01 February 2024

Orcadian Energy plc

(“Orcadian Energy”, “Orcadian” or the “Company”)

33rd Licensing Round Offer of Awards

Highlights

Orcadian Energy is delighted to report that NSTA has announced the offer of a further tranche of licence awards in the 33rd Round.

NSTA has confirmed, in an announcement dated 31 January 2024, that Orcadian Energy will be offered two licences in the Central North Sea (“CNS”) one in partnership with Parkmead Group, and the other in partnership with Triangle Energy. Orcadian anticipates that these licences will be formally issued within the next three months.

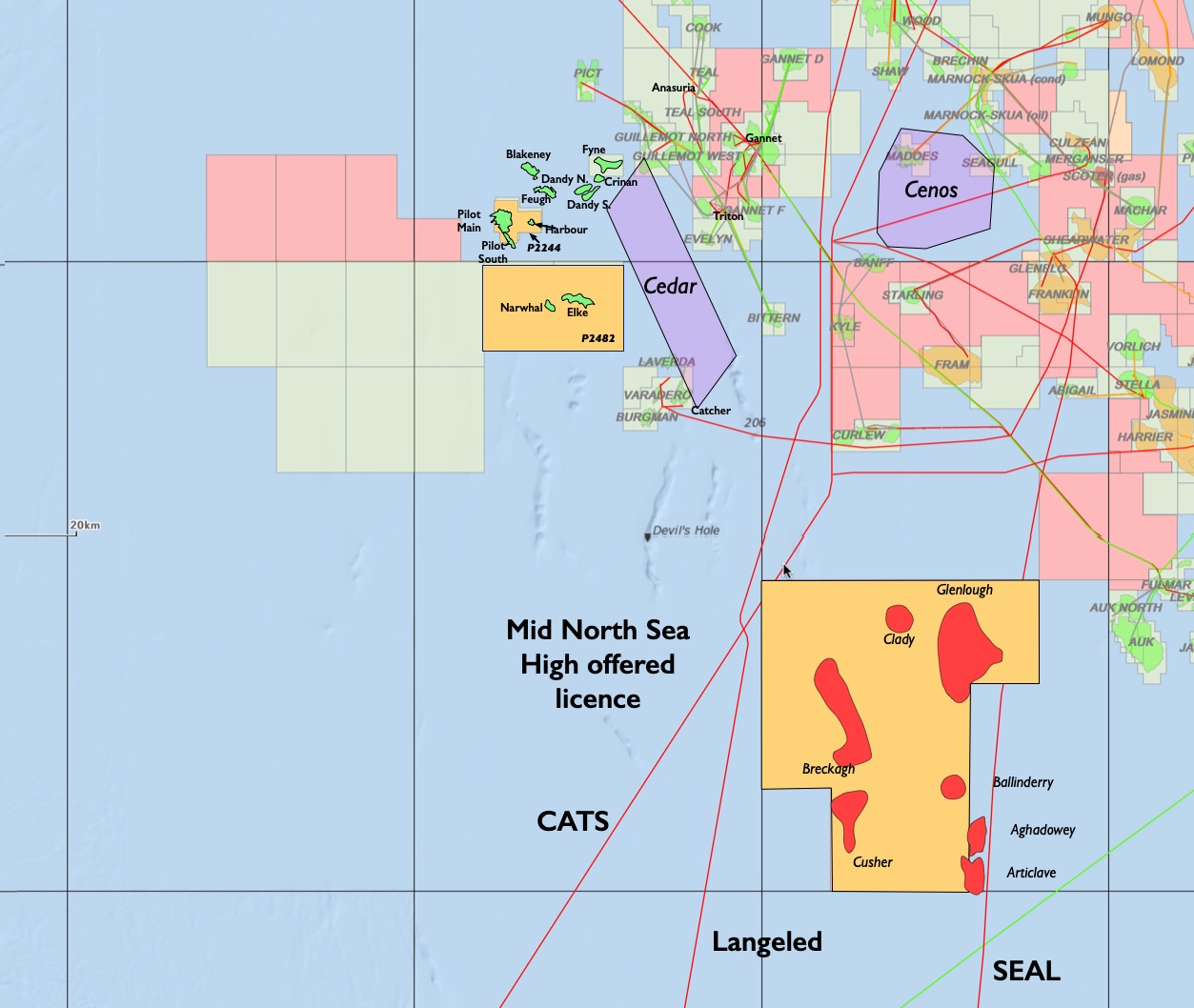

Mid-North Sea High Licence

The Mid-North Sea High (“MNSH”) licence contains shallow gas prospects and leads which contain up to 336 bcf of gross prospective recoverable resource on a P50 basis, this estimate is an Orcadian management estimate, which is provided for guidance only, and was submitted in the licence application. The two largest prospects – Glenlough and Breckagh – are estimated to account for about 80% of the identified resource potential. Orcadian applied in partnership with Triangle Energy, an Australian listed energy company. Orcadian would be licence administrator and would hold 50% of the offered licence.

The Mid-North Sea licence covers blocks 29/16, 29/17, 29/18, 29/19, 29/21, 29/22, 29/23, 29/27 and 29/28.

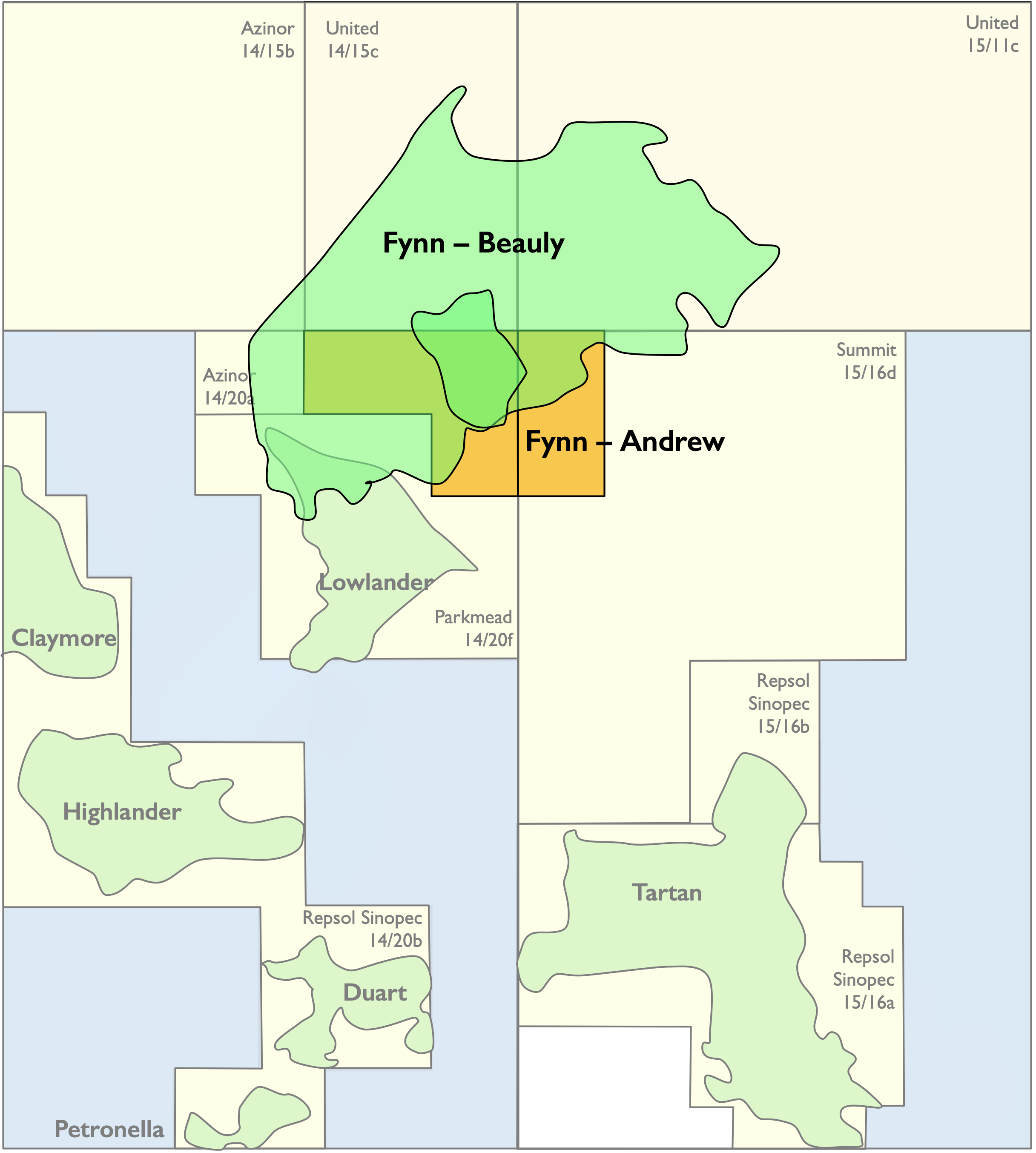

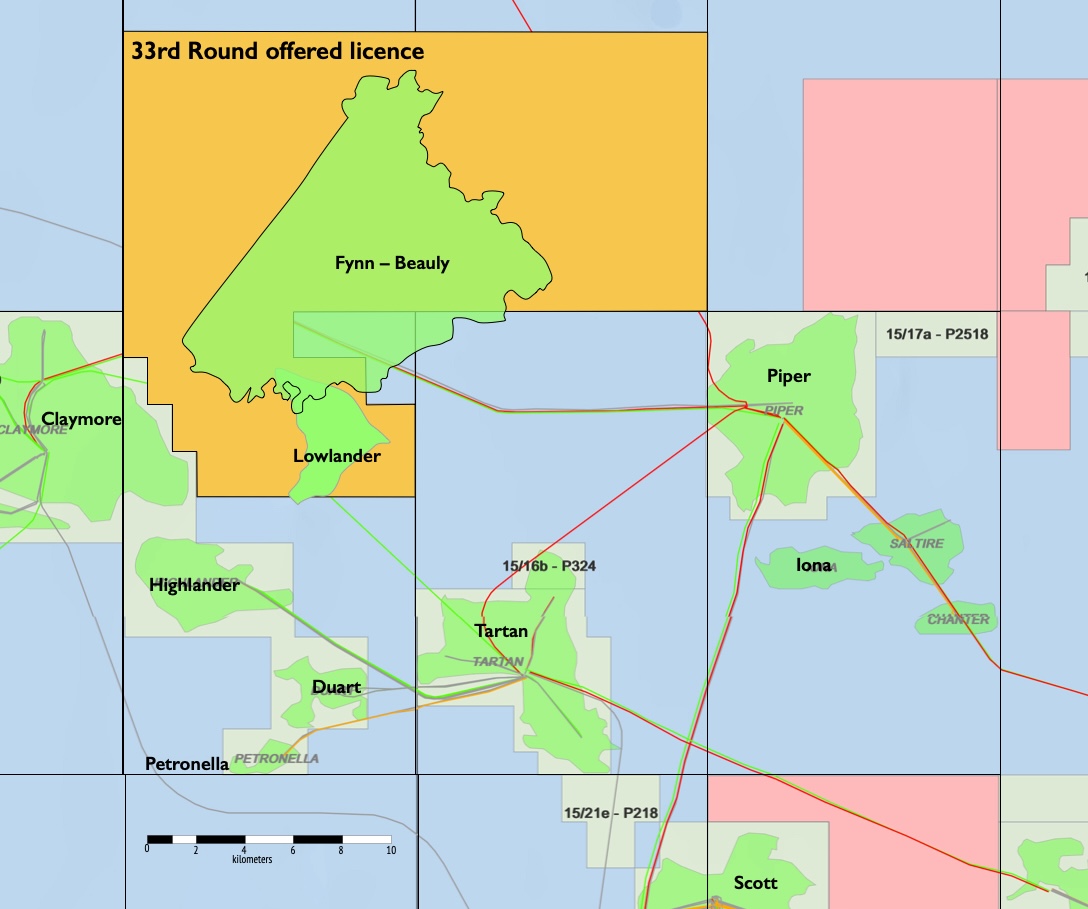

Fynn Licence

The Fynn licence contains a very substantial heavy oil discovery which has a gross P50 contingent recoverable resource of 292 MMbbl, based upon the latest internal estimates as presented to NSTA by Parkmead (E&P) Limited, the proposed operator. About 88% of the resource on a best technical case is estimated to lie within the area of the offered licence.

Orcadian has been offered a 50% working interest in the Fynn licence to be operated by the Parkmead Group. The Fynn licence covers blocks 14/15a, 14/20d and 15/11a.

As announced on 19 January 2023, the Company made three licence applications, two of which are described above. The third area applied for, which was in the Southern North Sea, has not been offered for award in this tranche but it is anticipated it will be considered in a future tranche, and further announcements will be made as appropriate.

Resource Update

As a result of the above licence awards and based upon the assumption that the planned disposal of an 81.25% interest in P2244 completes before 31 March 2024, Orcadian management’s latest view of the Company’s resources is set out below.

Resource estimates comprise the current Sproule CPR for Pilot, Elke, Narwhal and the Elke satellites; and for the remainder the estimates are management or operator estimates as submitted to NSTA in the licence applications. Prospective resources are only included for the high-graded leads and prospects: Clover, Breckagh, Glenlough and QI (quantitative interpretation) geophysically supported Elke satellites.

- Orcadian’s Current Resource Estimate (adjusted for the proposed disposal of Pilot and the TGS royalty).

| Gross | Net Attributable | |||||||||

| Licence | Operator | Key Discoveries or Prospects | Gross 2P Reserves MMboe |

Gross 2C Contingent Resources (On hold)

MMboe |

Gross 2C Contingent Resources (Technical)

MMboe |

Gross 2U Prospective Resources (Unrisked)

MMboe |

Net 2P Reserves MMboe |

Net 2C Contingent Resources (On hold)

MMboe |

Net 2C Contingent Resources (Technical)

MMboe |

Net 2U Prospective Resources (Unrisked)

MMboe |

| Oil & Liquids reserves per asset | ||||||||||

| P2244 | Ping | Pilot Main and Pilot South | 78.8 | – | 13.0 | – |

14.6* |

– |

2.4* |

– |

| P2482

|

Orcadian | Narwhal, Elke, & selected Elke satellites | – | 52.7 | 2.0 | 52.6 | – | 52.2 | 2.0 | 52.1 |

| Total for Oil and Liquids | 78.8 | 52.7 | 15.0 | 52.6 | 14.6 | 52.2 | 4.4 | 52.1 | ||

Source: Sproule

*assuming completion of the proposed disposal of the Pilot project so that Orcadian’s interest is reduced to 18.75%.

- Management Internal Estimates of resources contained in the new licences offered for award by the NSTA today

The below is compiled using the estimates submitted to the NSTA, but the numbers have not been independently audited and accordingly are provided for guidance purposes only and should not be relied upon.

| Gross (On blocks) | Net Attributable | |||||||||

| Licence | Operator | Key Discoveries or Prospects | Gross 2P Reserves MMboe |

Gross 2C Contingent Resources (On hold)

MMboe |

Gross 2C Contingent Resources (Technical)

MMboe |

Gross 2U Prospective Resources (Unrisked)

MMboe |

Net 2P Reserves MMboe |

Net 2C Contingent Resources (On hold)

MMboe |

Net 2C Contingent Resources (Technical)

MMboe |

Net 2U Prospective Resources (Unrisked)

MMboe |

| Oil & Liquids resources per asset | ||||||||||

| Fynn | Parkmead | Fynn (Beauly) | – | – | 257.2 | – |

– |

– |

128.6 |

– |

| Total for Oil and Liquids | – | – | 257.2 | – | – | 128.6 | – | |||

| Gas resources per asset (each bcf of gas is converted to MMboe by dividing by 6) | ||||||||||

| MNSH | Orcadian | Glenlough & Breckagh | – | – | 44.8 | – | – | – | 22.4 | |

| Total | – | – | 257.2 | 44.8 | – | – | 128.6 | 22.4 | ||

Source: Estimates. Not independently audited.

Steve Brown, Orcadian’s CEO, said:

“We are delighted that NSTA has announced these offers of licence awards. Our strategy has been to licence or acquire discoveries and compelling prospects, and then to farm-out an interest in the licence to finance exploration drilling or, best of all, development. We will build upon that strategy which has been validated by the signing of a sale and purchase agreement for the Pilot field with Ping Petroleum, a deal which we are on track to complete by the end of March 2024*.

“We are excited to work with our partners Parkmead and Triangle. With Parkmead, our focus will be on designing a work programme to unlock the potentially very significant resource base in Fynn; and with Triangle we will be working to transform the leads on the Mid North Sea High licence into prospects which can be drilled, likely at a relatively low cost as the gas prospects are so shallow.”

* completion is subject to satisfaction of the conditions precedent set out in the announcement dated 7 December 2023

For further information on the Company please visit the Company’s website: https://orcadian.energy

Qualified Person’s Statement

Pursuant to the requirements of the AIM Rules and in particular, the AIM Note for Mining and Oil and Gas Companies, Maurice Bamford has reviewed and approved the technical information and resource reporting contained in this announcement. Maurice has more than 33 years’ experience in the oil & gas industry and 3 years in academia. He holds a BSc in Geology from Queens University Belfast and a PhD in Geology from the National University of Ireland. Maurice is a Fellow of the Geological Society, London, and a member of the Geoscience Energy Society of Great Britain. He is Exploration and Geoscience Manager at Orcadian Energy.

Contact:

|

Orcadian Energy plc |

+ 44 20 7920 3150 |

|

Steve Brown, CEO Alan Hume, CFO |

|

| WH Ireland (Nomad and Joint Broker) | +44 20 7220 1666 |

|

Katy Mitchell / Andrew de Andrade (Nomad) Harry Ansell / Fraser Marshall (Corporate Broking)

|

|

| Tavistock (PR) | + 44 20 7920 3150 |

| Nick Elwes / Simon Hudson | [email protected] |

About Orcadian Energy

Orcadian is a North Sea focused, low emissions, oil and gas development company. In planning its Pilot development, Orcadian has selected wind power to transform oil production into a cleaner and greener process. The Pilot project is moving towards approval and will be amongst the lowest carbon emitting oil production facilities in the world, despite being a viscous crude. Orcadian may be a small operator, but it is also nimble, and the Directors believe it has grasped opportunities that have eluded some of the much bigger companies. As we strike a balance between Net Zero and a sustainable energy supply, Orcadian intends to play its part to minimise the cost of Net Zero and to deliver reliable energy to the UK.

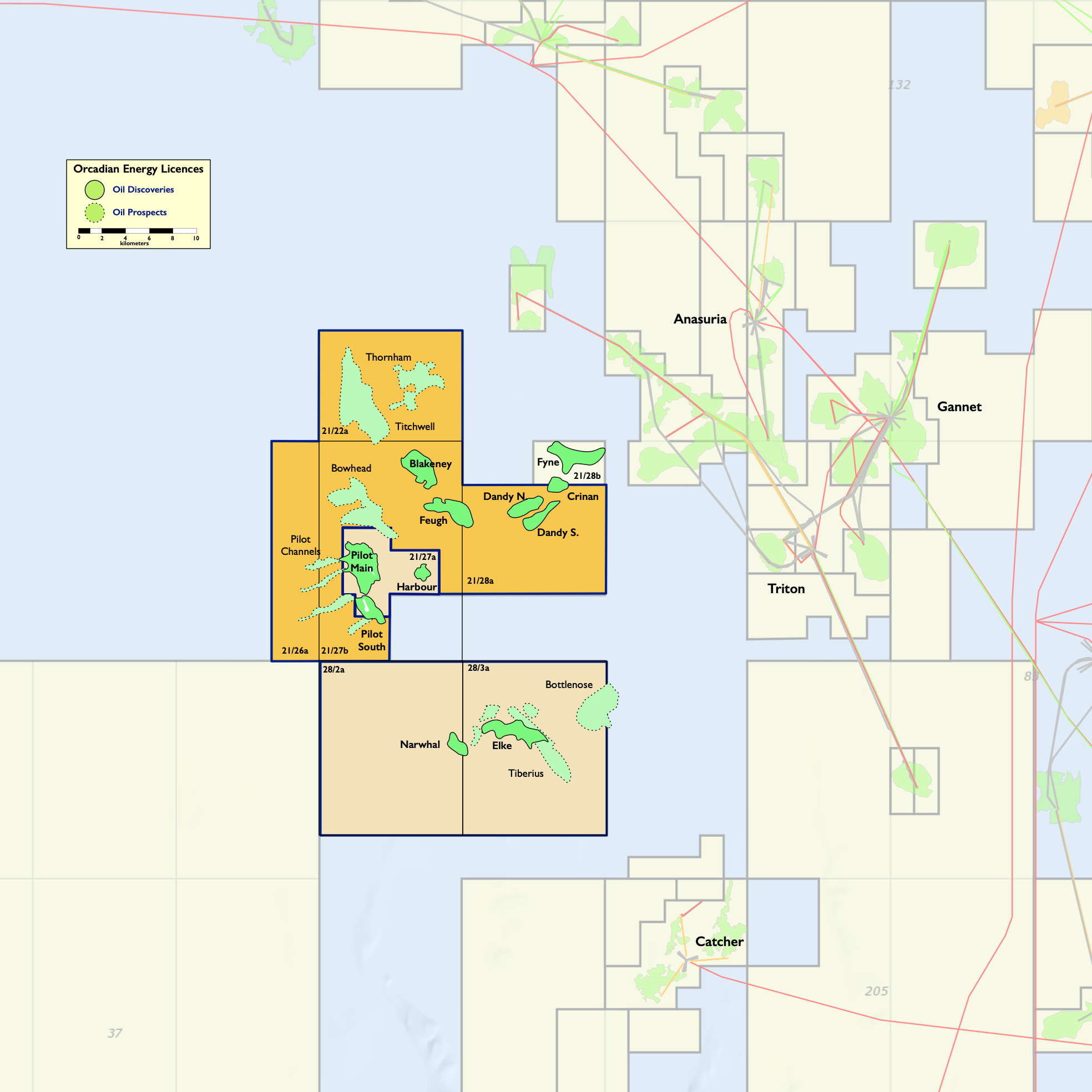

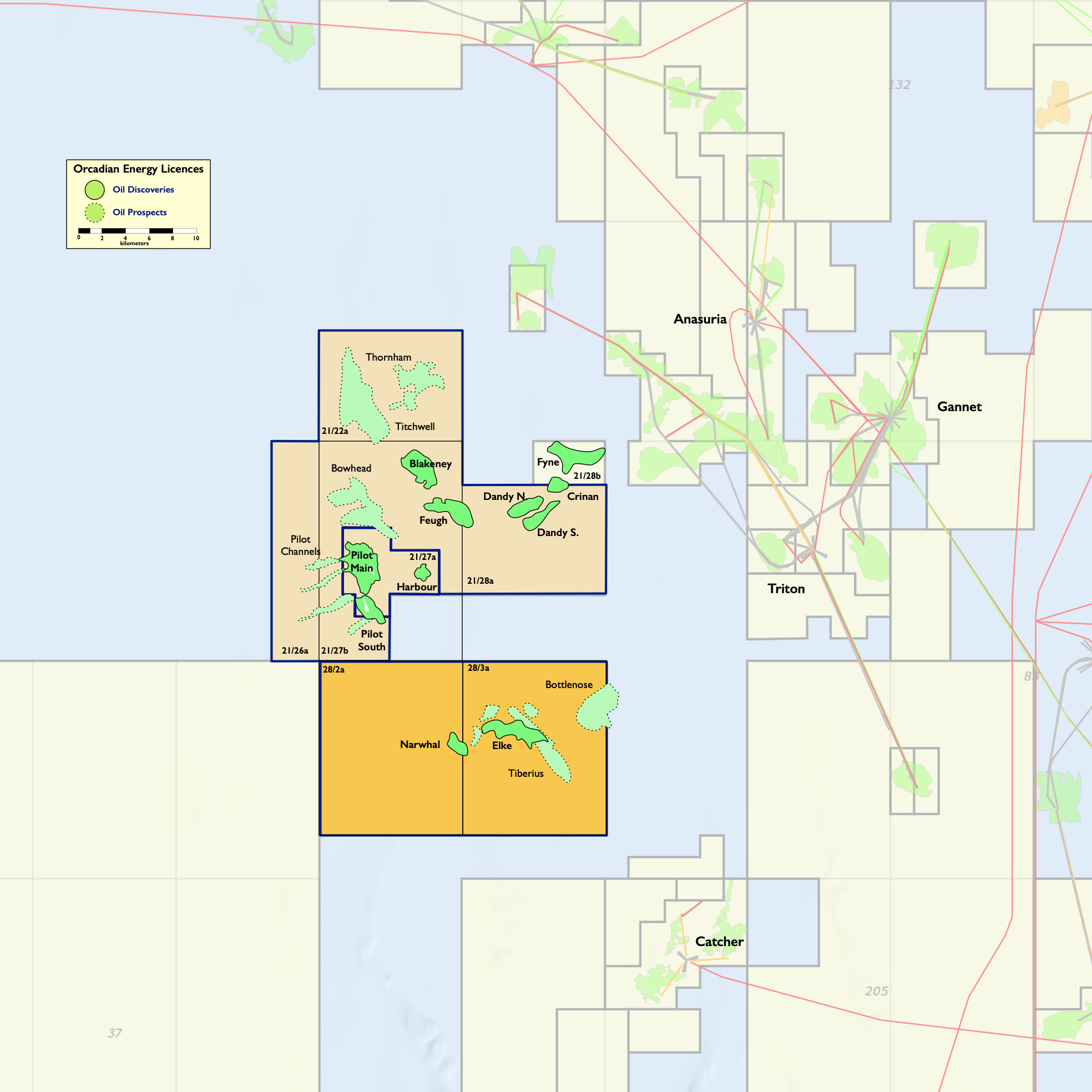

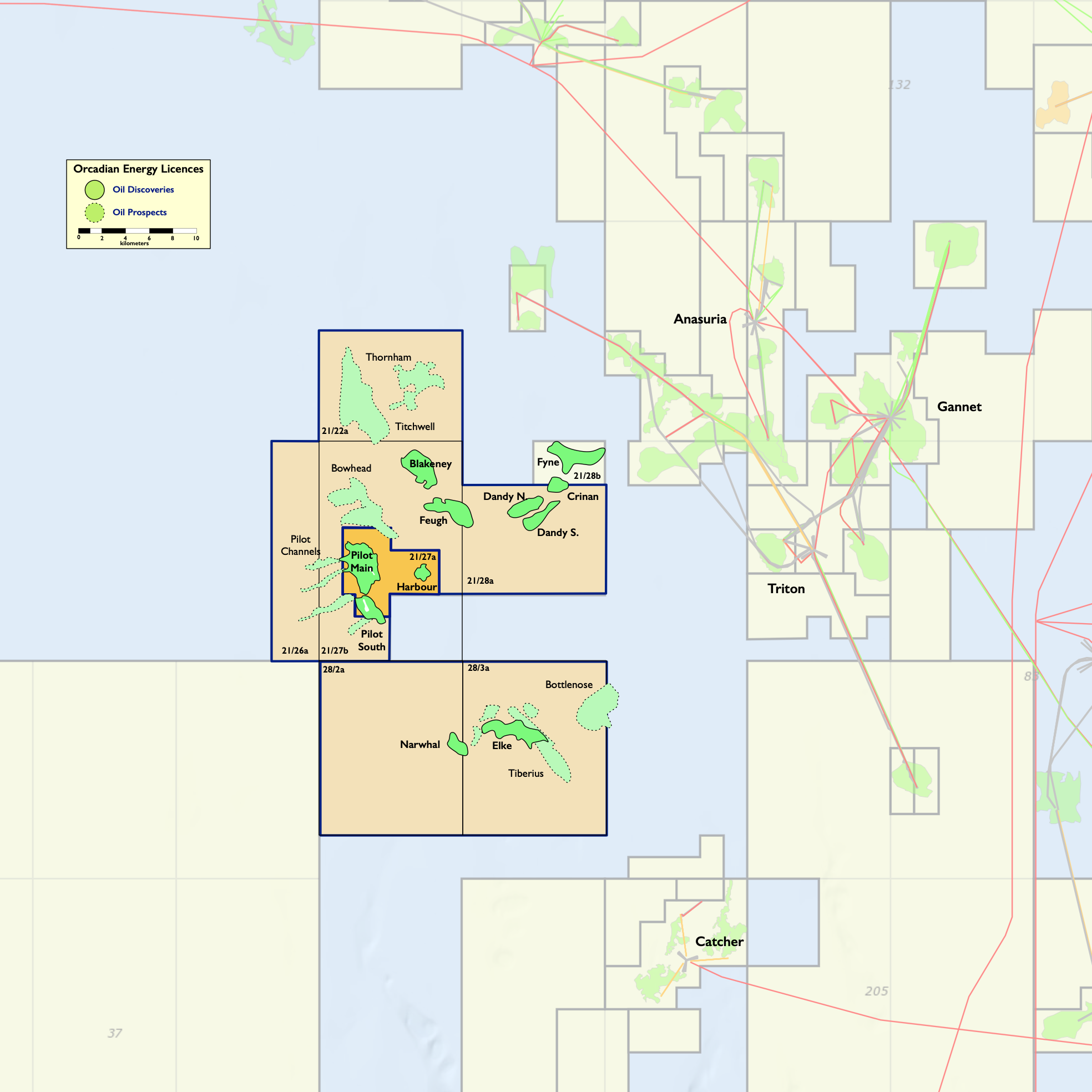

Orcadian Energy (CNS) Ltd, Orcadian’s operating subsidiary, was founded in 2014 and is the sole licensee of P2244, which contains 78.0 MMbbl of 2P Reserves in the Pilot discovery, and of P2482, which contain a further 52.2 MMbbl of 2C Contingent Resources in the Elke and Narwhal discoveries (as audited by Sproule, with both numbers modified to take into account the TGS royalty, see the CPR in the Company’s Admission Document for more details). Within these licences there are also 118 MMbbl of unrisked Prospective Resources (modified for TGS royalty). These licences are in blocks 21/27a, 28/2a and 28/3a, and lie 150 kms due East of Aberdeen.

Pilot, which is the field with the largest reserves in Orcadian’s portfolio, was discovered by PetroFina in 1989 and has been well appraised. In total five wells and two sidetracks were drilled on Pilot, including a relatively short horizontal well which produced over 1,800 bbls/day on test. Orcadian’s proposed low emissions, field development plan for Pilot is based upon a Floating Production Storage and Offloading vessel (FPSO), with over thirty wells to be drilled by a Jack-up rig and provision of power from a floating wind turbine.

Orcadian has entered into a conditional sale and purchase agreement with Ping Petroleum UK plc (“Ping”) which details the terms under which Ping will farm-in to the Pilot development project. Upon conclusion of this deal Orcadian would have an 18.75% stake in the Pilot development with all pre-first oil development costs paid by Ping.

Emissions per barrel produced are expected to be about a tenth of the 2021 North Sea average, and less than half of the lowest emitting oil facility currently operating on the UKCS. On a global basis this places the Pilot field emissions at the low end of the lowest 5% of global oil production.