Last reviewed on 21 February 2024

Governance

Corporate Governance Statement

The London Stock Exchange’s AIM rules require all AIM listed companies to adopt and comply with a recognised corporate governance code. The Board recognises the importance of good corporate governance in the management of the Company and in achieving its strategic goals. Accordingly, the Company has adopted Corporate Governance Code for Small and Mid-Size Quoted Companies from the Quoted Companies Alliance (“the QCA Code”).

The Board will annually assess its compliance with the QCA Code and will consider, as part of that review, whether the QCA Code continues to remain the most appropriate code for the Company to adopt. The Corporate Governance statement has been approved by the Company’s Board of directors (the “Board”) in accordance with the recommendations of the Code.

My principal role as Chairman of Orcadian Energy plc, is to manage and to provide leadership to the Board of Directors of the Company. My role is to lead the Company, ensuring sound corporate governance and establishing a strong and sustainable corporate culture of respect, integrity, honesty and transparency.

The Chairman is responsible for ensuring that the Board is effective in determining and implementing the Company’s vision and strategy as well as defining the Company’s culture. The Chairman is accountable to the Board of Directors (the “Board”) and is responsible for providing strong leadership and enabling the Board to operate effectively. The Chairman is not responsible for executive matters regarding the Group’s business.

The Chairman must demonstrate ethical leadership and promote the highest standards of integrity, probity and corporate governance throughout the Group and at Board level.

This statement explains how the ten principles of the Code are applied by the Company, and where the Company departs from the Code, an explanation of the reasons for doing so is provided.

Joseph Darby

Non-Executive Chairman

Principle 1 – Strategy

Establish a strategy and business model which promotes long-term value for shareholders

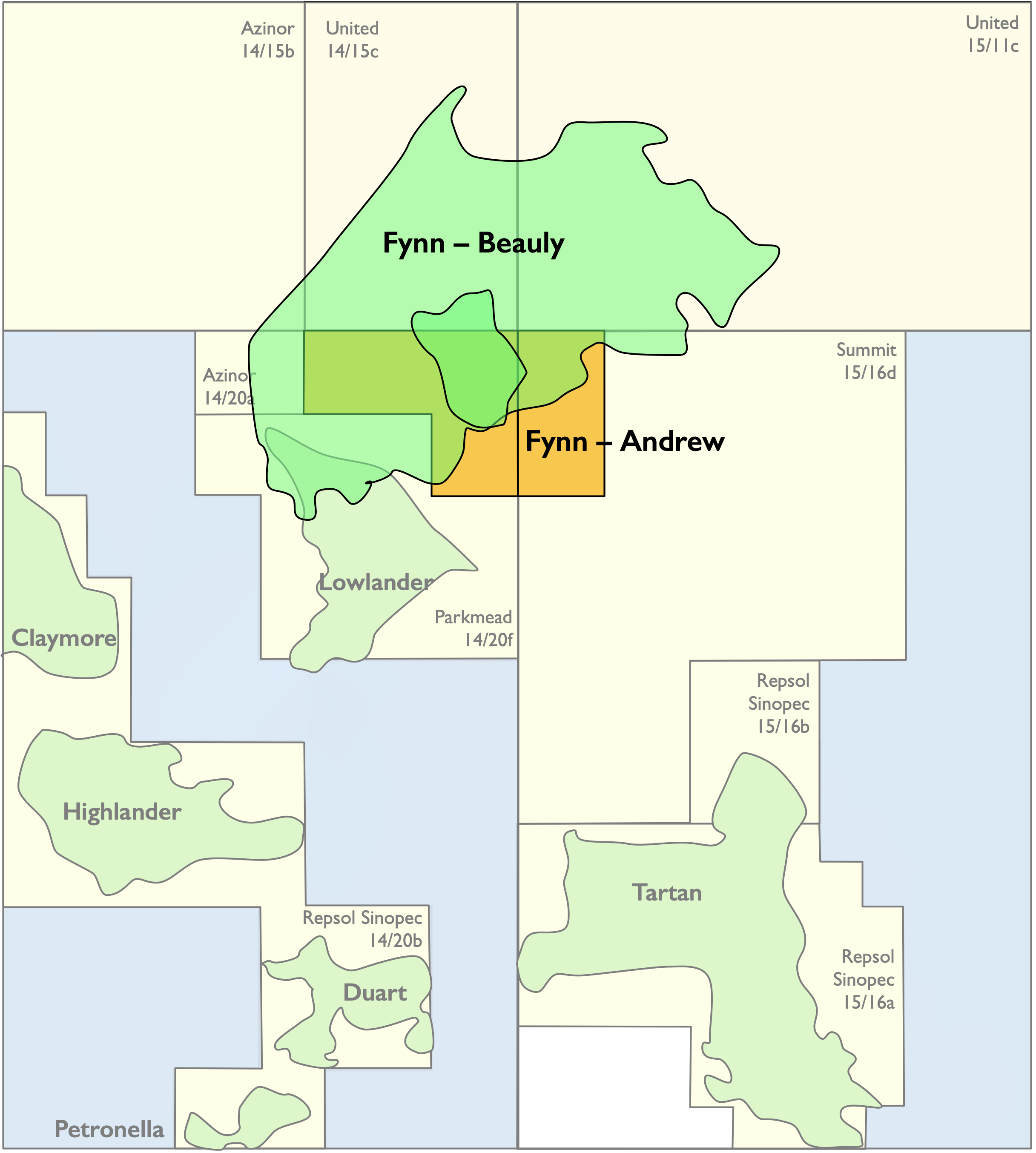

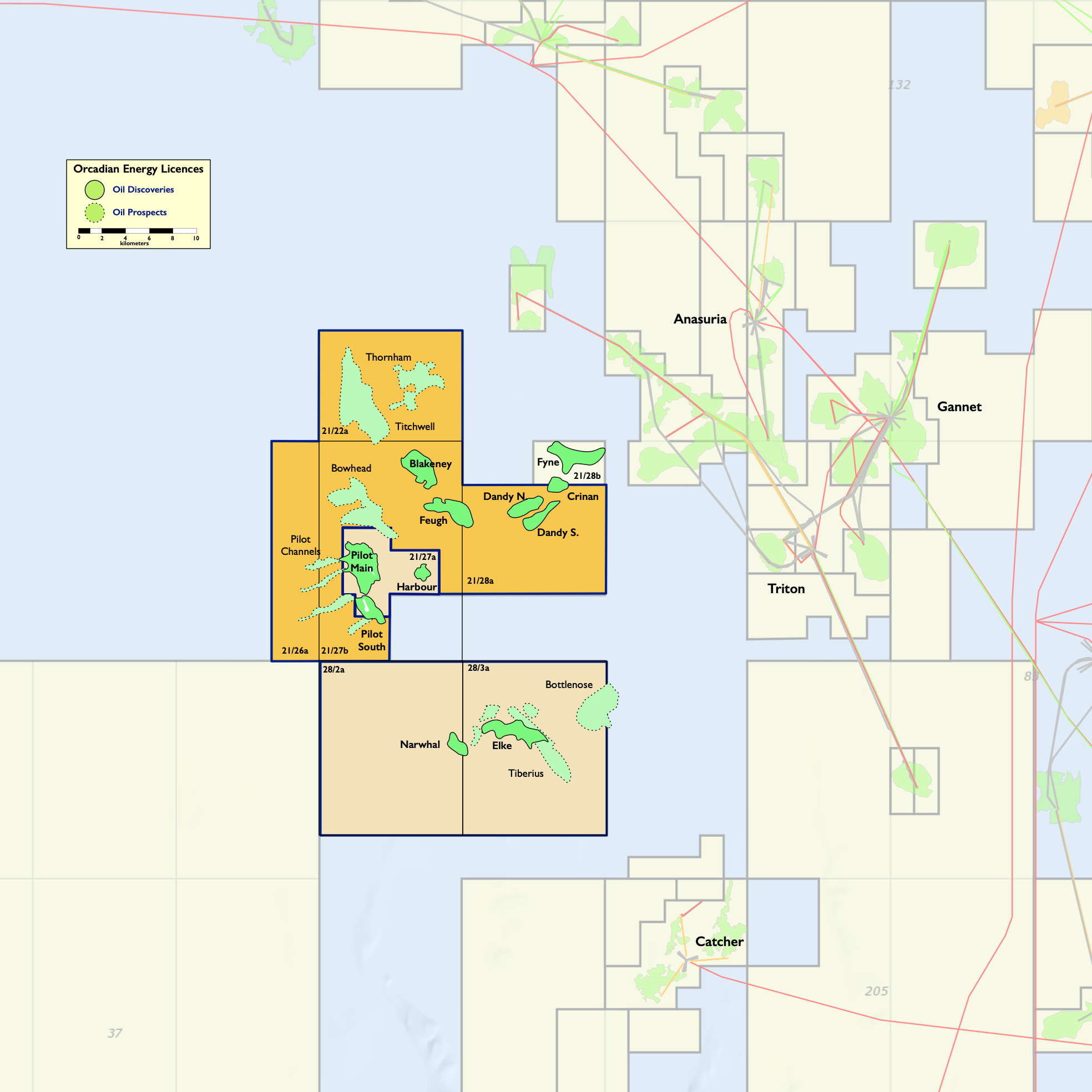

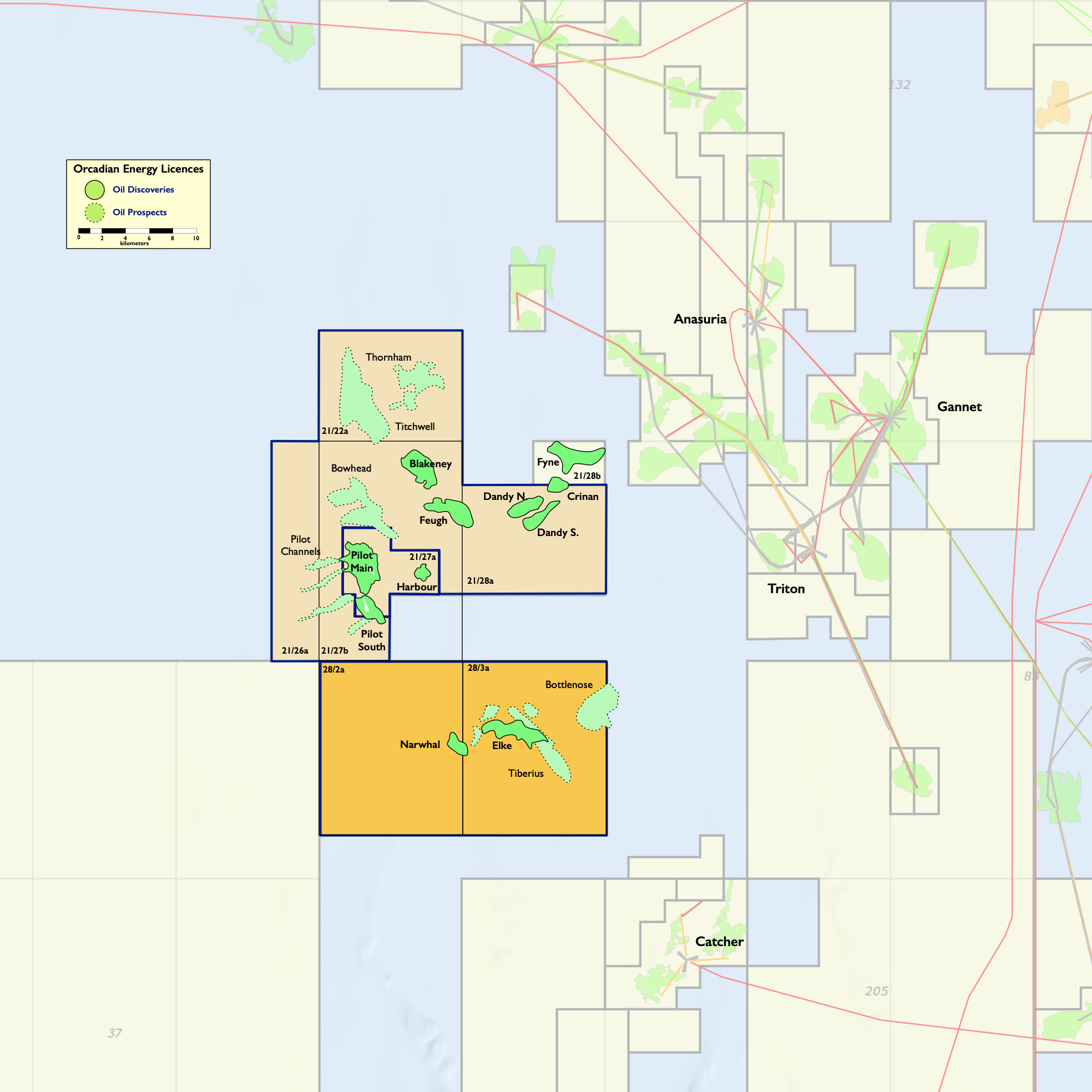

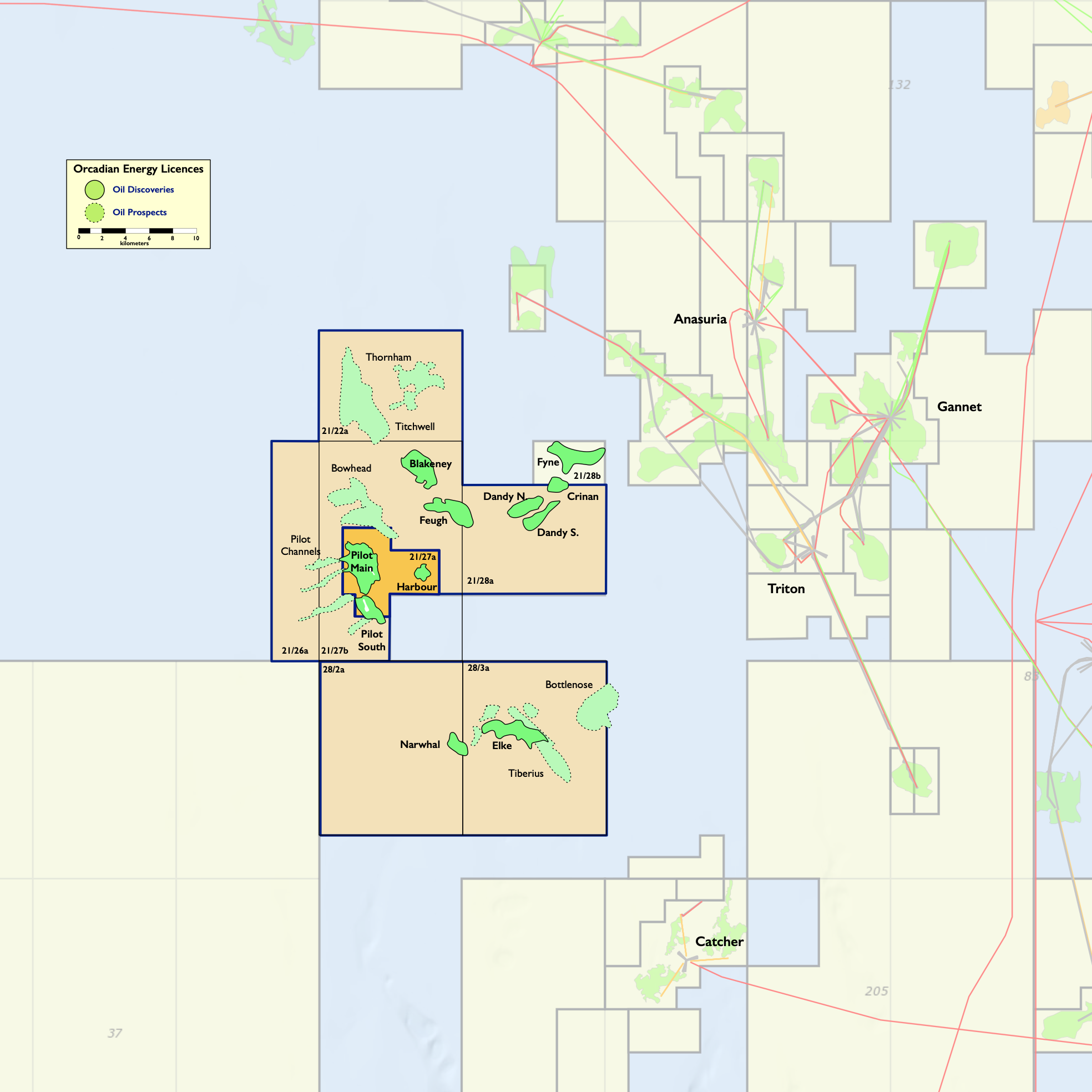

The Group’s strategy is to identify discovered resources, preferably well appraised and most likely on the UKCS; to secure access to those resources; and to create a profitable field development plan which attracts finance either from oil industry partners or financial investors. Since Orcadian Energy (CNS) Limited was founded in March 2014 the company has been awarded and currently holds a 100% interest in licences P2244 and P2482. The P2244 licence contains a shallow viscous oil discovery known as the Pilot field which has audited 2P reserves of 79 MMbbl.

The company has submitted a Concept Select report for the development of Pilot to the NSTA, which was approved in November 2021. Key to the company’s success and a prime strategic objective was to secure the finance necessary to develop Pilot either through farm-out or creation of a contractor alliance to develop the field. In December 2023 Orcadian Energy (CNS) Limited signed a farm-out agreement with Ping Petroleum UK plc which will result in Orcadian retaining an 18.75% interest in P2244 with all costs carried too first oil.

The Group will also seek to mature its portfolio of prospective and contingent resources into reserves.

Principle 2 – Shareholder's needs and expectation

Seek to understand and meet shareholders' needs and expectations

The Company supports an open and transparent dialogue with shareholders with the aim of ensuring shareholders views on the performance of the Company are heard and shareholders needs and objectives are understood.

The AGM is a key part of the Company’s investor relations strategy and shareholders are encouraged to participate, particularly private investors who have the opportunity to ask questions and raise issues, either formally during the meeting or informally with directors following conclusion of business.

Direct communication with shareholders is achieved primarily through the timely release of regulatory news, via a regulatory information service, which can be accessed through various channels, including the London Stock Exchange website and the Company website.

https://www.londonstockexchange.com

The Company has an on-going investor relations programme which includes individual meetings with institutional shareholders and analysts following the preliminary and half-year results including presentations to institutions as well as face to face, or virtual, briefings to for groups of shareholders. Ongoing shareholder communication is also conducted regularly throughout the year on an ad hoc basis. We will aim to answer as many questions as possible in these session.

If you wish to contact the Company, contact details are on our website at https://orcadian.energy/contacts details of the Company and the Company’s advisors are included in all announcements released via RNS should shareholders wish to communicate with the Board. The Chairman and/or the Executive Director typically respond to shareholder queries directly (whilst maintaining diligence on Market Abuse Regulations restrictions on insider information and within the requirements of the AIM Rules for Companies) or through our Investor Relations advisers Tavistock Communications.

The Company’s Articles of Association can be found here

Principle 3 – Social responsibility

Take into account wider stakeholder and social responsibilities and their implications for long-term success

The Board is very aware of its corporate, environmental and social responsibilities. In pursuing its business objectives Orcadian Energy plc is committed to delivering lasting benefit to the local communities and environments where we work as well as to our shareholders, employees and contractors.

Principle 4 – Risk management

Embed effective risk management, considering both opportunities and threats, throughout the organisation

The Board and the Risk Committee is responsible for setting the risk framework within which the Company operates and ensuring that suitable risk-management controls and reporting structures are in place throughout the Group.

The management of the business and the execution of the Company’s strategy are subject to a number of risks. The Board ensures risks are mitigated as far as reasonably practicable by performing a detailed review of the issues pertaining to each significant decision. Significant decisions are reviewed by the Board having consulted the Company’s professional third-party advisers (be they legal, financial or technical). The Board convenes on a regular basis, either by telephone or in person on a formal basis to discuss risk management.

The nature of the Group’s operations will have particular risk management challenges, including, in particular, maintaining the health and safety of all staff and contractors working on site and ensuring that all drilling and related operations are carried out in an environmentally sound and safe manner. All health and safety measures are formalized, described in detailed manuals and explained in person to all people associated with the Group’s operational activities. In addition, the Company will have appropriate insurances in place before commencing any of its planned technical work.

Principle 5 – Board functioning

Maintain the Board as a well functioning, balanced team led by the Chairman

The Board meets formally in person and by telephone multiple times throughout the year and at least six times per year. The Board also holds regular informal project appraisal and strategy discussions, to examine operations, opportunities and assess risks.

The directors encourage a collaborative Board culture to ensure that each decision reached is always in the Company’s and its shareholders’ best interests and that any one individual opinion never dominates the decision making process. The Board seeks, so far as possible, to achieve decisions by consensus and all directors are encouraged to use their independent judgement and to challenge all matters whether strategic or operational.

The Board will maintain a balance of executives and non-executive directors. Currently there are two non-executives: the Non Executive Chairman Joseph Darby and one Independent Non-Executive Tim Feather. There are no mandatory hours for directors to be available for Company business although the CEO is required to commit 100% of his working time (based on a 40 hour working week) to the Company. The non-executive directors are available for any Company business when it may arise.

The Board delegates certain decisions to an Audit Committee, the Remuneration Committee the Risk Committee and the Reserves Committee, details of these committees are included in Principles 7 and 9.

Principle 6 – Board capabilities

Ensure that between them the directors have the necessary up-to-date experience, skills and capabilities

The Board currently consists of two Executive and two Non-executive directors. The Board has an appropriate balance of skills and expertise across the areas of resources, operations, finances and public markets. The Board membership will be reviewed periodically as the needs of the Group evolve.

The Directors biographical details can be found here.

Each director takes his continued professional and technical development seriously.

The Board ensures it is well advised and supported by utilising a range of external experts in various fields, and employs accountants, legal counsel, a Company Secretary, a Nominated Adviser and a broker, in accordance with the AIM rules.

Principle 7 – Code and committees

Evaluate Board performance based on clear and relevant objectives, seeking continuous improvement

The Company is required under the AIM Rules to comply with a recognised corporate governance code to be chosen by the Board. The Board recognises the importance of sound corporate governance and intends that the Company will comply with the provisions of the QCA Code. The Company shall disclose on its website how it complies with the QCA Code and, where it departs from the QCA Code, will explain the reasons for doing so.

The Board is comprised of two executive directors and two non-executive directors (all of whom are considered by the Board to be independent).

The Board is responsible for formulating, reviewing and approving the Company’s strategy, budgets and corporate actions. The Company has established properly constituted audit and AIM compliance, Audit, Risk, Reserve and Remuneration committees of the Board with formally delegated duties and responsibilities.

Audit Committee

The Audit Committee has primary responsibility for monitoring the quality of internal controls, ensuring that the financial performance of the Company is properly measured and reported on and ensuring compliance with the AIM Rules for Companies. It will receive and review reports from the Company’s management and auditors relating to the interim and annual accounts and the accounting and internal control systems in use throughout the Company. The Audit Committee will meet no less than three times each year and will have unrestricted access to the Company’s auditors. The Audit Committee comprises a minimum of two directors, both of whom are independent Non-Executive Directors, and a minimum of one member shall have with recent and relevant financial experience. The members of the Audit Committee are Mr. Feather (Chairman) and Mr. Darby.

Remuneration Committee

The Remuneration Committee reviews the performance of executive directors and makes recommendations to the Board on matters relating to their remuneration and terms of employment. The committee also makes recommendations to the Board on proposals for the granting of share options and other equity incentives pursuant to any share option scheme or equity incentive scheme in operation from time to time. The Remuneration Committee will meet at least twice each year. The Remuneration Committee comprises a minimum of two directors all of whom shall be independent Non-Executive Directors. The members of the Remuneration and Nomination Committee shall be Mr. Darby (Chairman) and Mr. Feather.

AIM Rule 31 Compliance Policy and MAR Handbook

The Company has also adopted an MAR Handbook and an AIM Rule 31 compliance policy to ensure that they have in place sufficient procedures for ensuring compliance with the AIM Rules for Companies. In addition, the Company has established an AIM and MAR Compliance Committee that reviews the adherence to these policies and makes recommendations to the Board on matters relating to their compliance with the AIM rules and the MAR. The AIM and MAR Compliance Committee will meet at least twice each year. The AIM and MAR Compliance Committee comprises a minimum of three directors including, at least, two independent Non-Executive Directors and one member with recent and relevant financial experience. The members of the AIM and MAR Compliance Committee are Mr. Feather (Chairman), Mr. Darby and Mr. Hume.

Reserves Committee

The Company has established a Reserves Committee that reviews the company’s reported reserves and resources figures and which is responsible for appointing the company’s reserves auditors. The Reserves Committee will meet at least once each year and will have unfettered access to the company’s reserve auditors. The Reserves Committee comprises a minimum of two directors including, at least, one independent Non-Executive Directors and one member with recent and relevant technical experience. The members of the Reserves Committee are Mr. Darby (Chairman) and Mr. Brown.

Risk Committee

The Company has established a Risk Committee that reviews the company’s assessment of risks and makes recommendations to the Board on actions to minimise or mitigate risk. The Risk Committee will meet at least once each year and will have full access to the company’s risk assessment. The Risk Committee comprises a minimum of two directors including, at least, two independent Non-Executive Directors and one member with recent and relevant technical experience. The members of the Risk Committee shall be Mr. Darby (Chairman) and Mr. Feather.

Principle 8 – Culture

Promote a corporate culture that is based on ethical values and behaviours

The Board strives to promote a corporate culture based on sound ethical values and behaviours.

To that end, the Company has adopted a strict anti-corruption and whistle-blowing policy but the directors are not aware of any event to date that might be considered to breach this policy. The executive directors ensure that external contractors are aware of, and comply with, this policy.

The Company has also adopted a code for directors’ and employees’ dealings in securities, which is appropriate for a company whose securities are traded on AIM. The code is in accordance with the requirements of the Market Abuse Regulation that came into effect in 2016.

The Board is also aware that the tone and culture that it sets will greatly impact all aspects of the Company and the way that employees behave, as well as the achievement of corporate objectives. A significant part of the Company’s activities is centred upon an open dialogue with shareholders, employees and other stakeholders. Therefore, the importance of sound ethical values and behaviours is crucial to the ability of the Company to successfully achieve its corporate objectives.

Principle 9 – Governance structure

Maintain governance structures and processes that are fit for purpose and support good decision-making by the Board

AIM quoted companies are required to state which recognised corporate governance code they will follow from Admission, how they comply with such code and to explain reasons for any non-compliance. The Directors recognise the value and importance of high standards of corporate governance and intend, given the Company’s size and the constitution of the Board, to comply with the recommendations set out in the QCA Code.

The Board

The Board will be responsible for the overall management of the Group including the formulation and approval of the Group’s long term objectives and strategy, the approval of budgets, the oversight of Group operations, the maintenance of sound internal control and risk management systems and the implementation of Group strategy, policies and plans. While the Board may delegate specific responsibilities, there will be a formal schedule of matters specifically reserved for decision by the Board. Such reserved matters will include, amongst other things, approval of significant capital expenditure, material business contracts and major corporate transactions. The Board will meet regularly to review performance.

The QCA Code recommends at least two members of the Board comprise non-executive directors determined by the Board to be independent. The Board is comprised of two executive directors and two non-executive directors, both of which are independent and, as such, the Company complies with the requirements of the QCA Code in this regard.

The QCA Code recommends that the Board should appoint one of its independent non-executive Directors to be the Senior Independent Director. However, given the size and maturity of the Company it has been decided to defer the appointment of a Senior Independent Director. If shareholders have concerns over an issue that the normal channels of communication (through the Chairman, the Chief Executive Officer or the Chief Financial Officer) have failed to resolve or for which such channels of communication are inappropriate, they are invited to contact either of the Independent non-executives.

The Board has created four committees – Audit, Risk, Reserves and Remuneration Committees– each with written terms of reference and formally delegated duties which are outlined above.

Principle 10 – Communication

Communicate how the Company is governed and is performing by maintaining a dialogue with shareholders and other relevant stakeholders

The Company ensures a printed Annual Report is delivered to each shareholder, and also made available on the Company’s website. All RNS announcements are released in a timely manner, while also ensuring all announcements are drafted in a clear and concise fashion. In addition, all shareholders are encouraged to attend the Company’s Annual General Meeting and virtual or in person briefing as and when they are arranged. The outcome of all shareholder votes are disclosed in a clear and transparent manner via a RNS.

The Company includes historical Annual Reports, Notices of General Meetings and RNS announcements since listing on its website. The Company also lists contact details on its website, should shareholders wish to communicate with the Board.

The Company intends to include, where relevant, in its Annual Report, any matters of note arising from the Audit or Remuneration Committees.

Given the size of the Company, the Board is of the opinion that no formal communication structures are required at this time.

The Company does however ensure continued disclosure of all items in conjunction with AIM Rule 26 on its website.