THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY THE COMPANY TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER THE MARKET ABUSE REGULATION (EU) NO. 596/2014 AS IT FORMS PART OF UK DOMESTIC LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT 2018, AS AMENDED. UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO BE IN THE PUBLIC DOMAIN.

18 December 2023

Orcadian Energy plc

(“Orcadian Energy”, “Orcadian” or the “Company”)

£500,000 equity financing

Total Voting Rights

Orcadian is pleased to announce that it has today raised gross proceeds of £500,000 through the issue of 3,571,429 new ordinary shares of the Company (the “New Ordinary Shares“) at a price per New Ordinary Share of £0.14. These funds are raised as part of a direct subscription with the Company with existing investors. The subscription price represents a discount of approximately 15% to the closing mid-price of an ordinary share in the Company of 16.5p on 15December 2023, being the latest practicable day prior to the publication of this announcement.

The investors will also receive one warrant for every one New Ordinary Share subscribed for. Each warrant entitles the holder to subscribe, at any time for the next five-years, for one ordinary share in the Company at a price of 25p per ordinary share (the “Warrants”). In the event that, Orcadian’s volume weighted average share price (“VWAP”) in each of five consecutive trading days is 35p or above, investors will be required to exercise or forfeit the Warrants.

The New Ordinary Shares and 25% of the Warrants are being issued under the Company’s pre-existing share capital authorities with the balance of the Warrants to be issued subject to shareholders passing the necessary resolutions to authorise the issue, at the Company’s upcoming Annual General Meeting.

The proceeds of this fundraising will be applied to ongoing short term working capital and the costs involved in the progression of the Sale and Purchase agreement with Ping Petroleum UK plc (“Ping”) announced on 7 December 2023.

Application will be made to the London Stock Exchange for the New Ordinary Shares to be admitted to trading on AIM, and it is expected that dealings in the New Ordinary Shares will commence on or around 5 January 2024. The New Ordinary Shares will be issued fully paid and will rank pari passu to the Company’s existing ordinary shares.

Immediately following Admission, the Company’s issued share capital will be 79,000,412 Ordinary Shares, with each share carrying the right to one vote. The Company does not hold any Ordinary Shares in treasury. The total voting rights figure immediately following Admission, of 79,000,412 may be used by shareholders (and others with notification obligations) as the denominator for the calculations by which they will determine whether they are required to notify their interest in, or a change to their interest in, the Company under the Disclosure Guidance and Transparency Rules.

Steve Brown, Orcadian’s CEO, said:

“We are delighted to have support from our existing investors as we continue to progress what we believe is a truly exciting time for the Company.”

For further information on the Company please visit the Company’s website: https://orcadian.energy

Contact:

|

Orcadian Energy plc |

+ 44 20 7920 3150 |

|

Steve Brown, CEO Alan Hume, CFO |

|

| WH Ireland (Nomad and Joint Broker) | +44 20 7220 1666 |

|

Katy Mitchell / Andrew de Andrade (Nomad) Harry Ansell / Fraser Marshall (Corporate Broking)

|

|

| Tavistock (PR) | + 44 20 7920 3150 |

| Nick Elwes / Simon Hudson | [email protected] |

About Orcadian Energy

Orcadian is a North Sea focused, low emissions, oil and gas development company. In planning its Pilot development, Orcadian has selected wind power to transform oil production into a cleaner and greener process. The Pilot project is moving towards approval and will be amongst the lowest carbon emitting oil production facilities in the world, despite being a viscous crude. Orcadian may be a small operator, but it is also nimble, and the Directors believe it has grasped opportunities that have eluded some of the much bigger companies. As we strike a balance between Net Zero and a sustainable energy supply, Orcadian intends to play its part to minimise the cost of Net Zero and to deliver reliable energy to the UK.

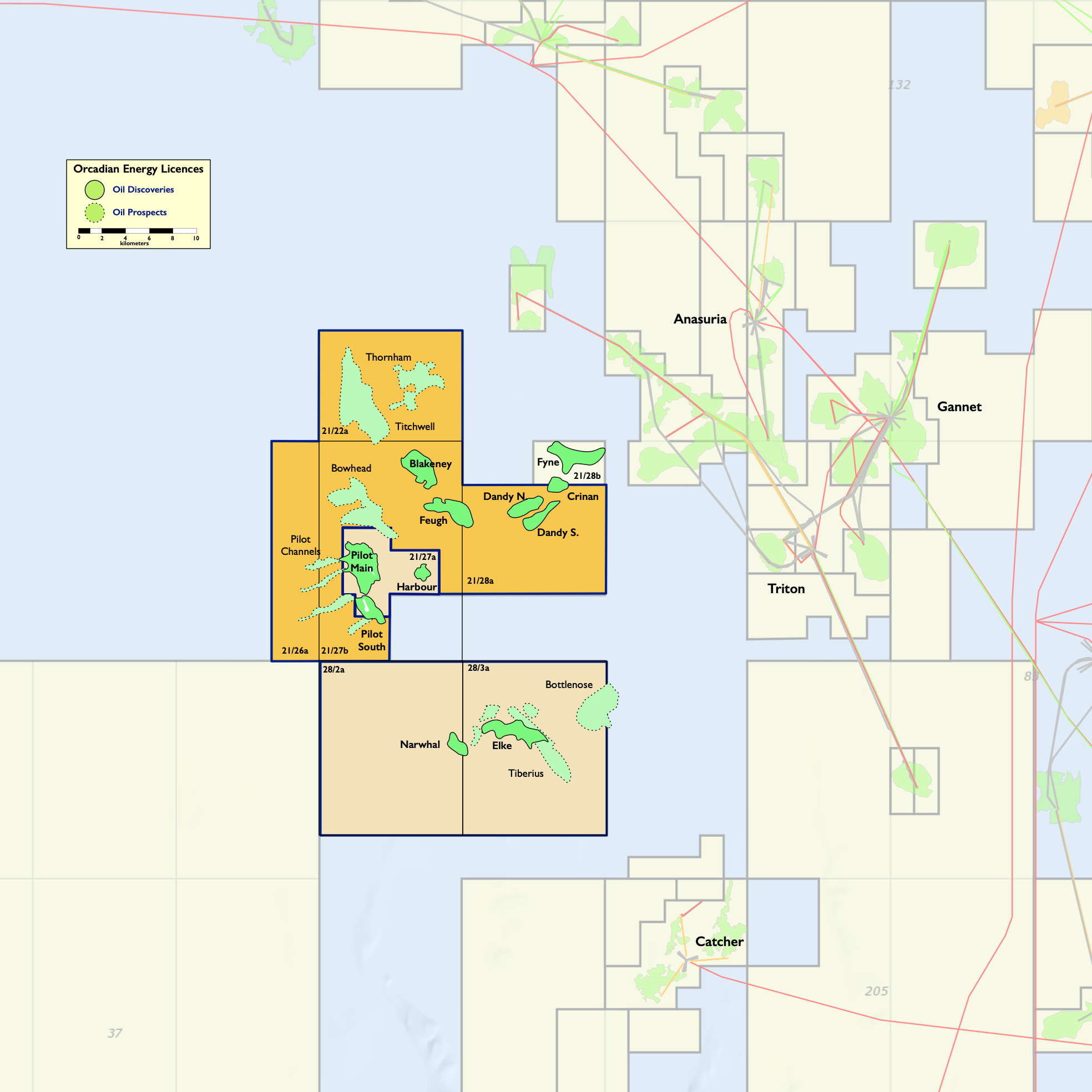

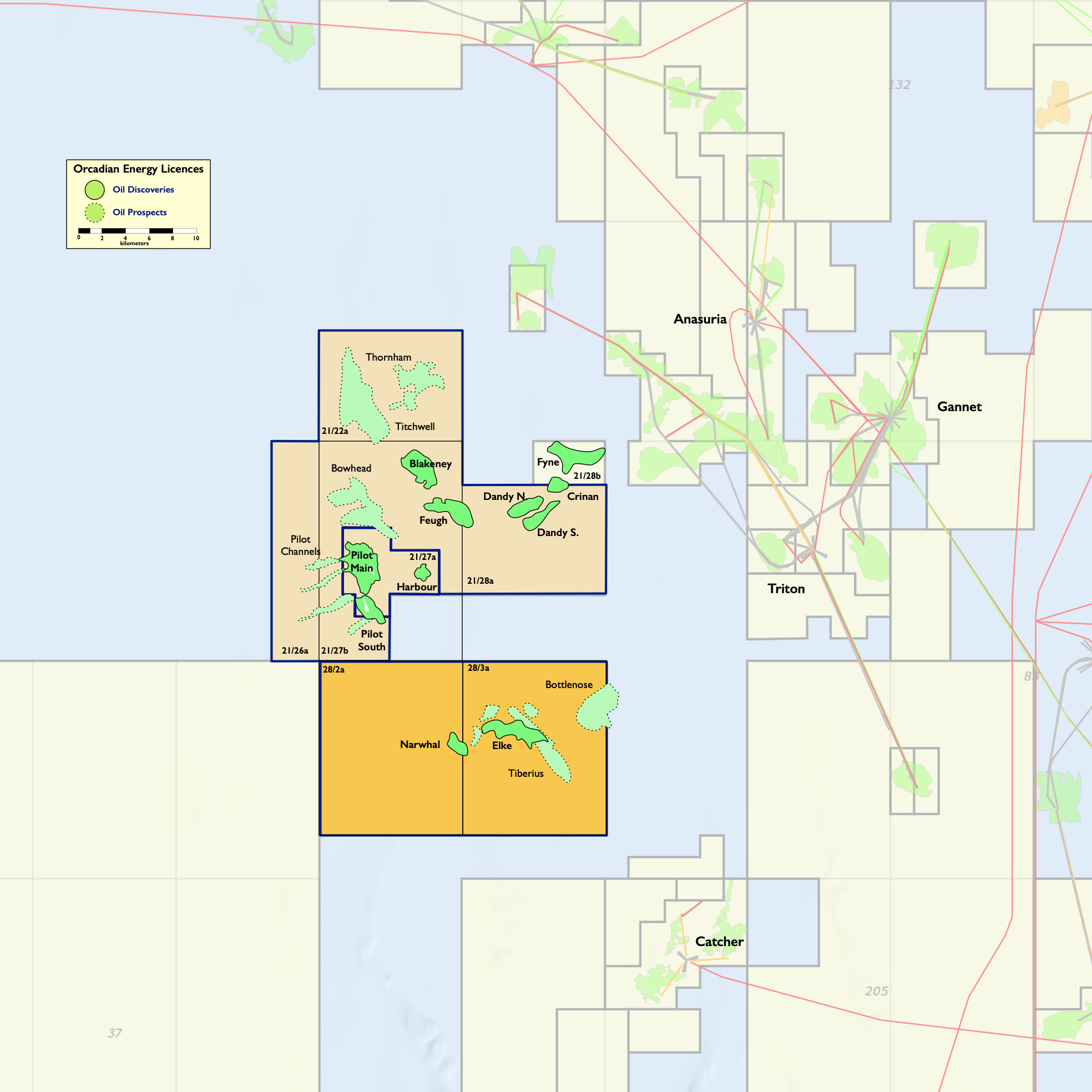

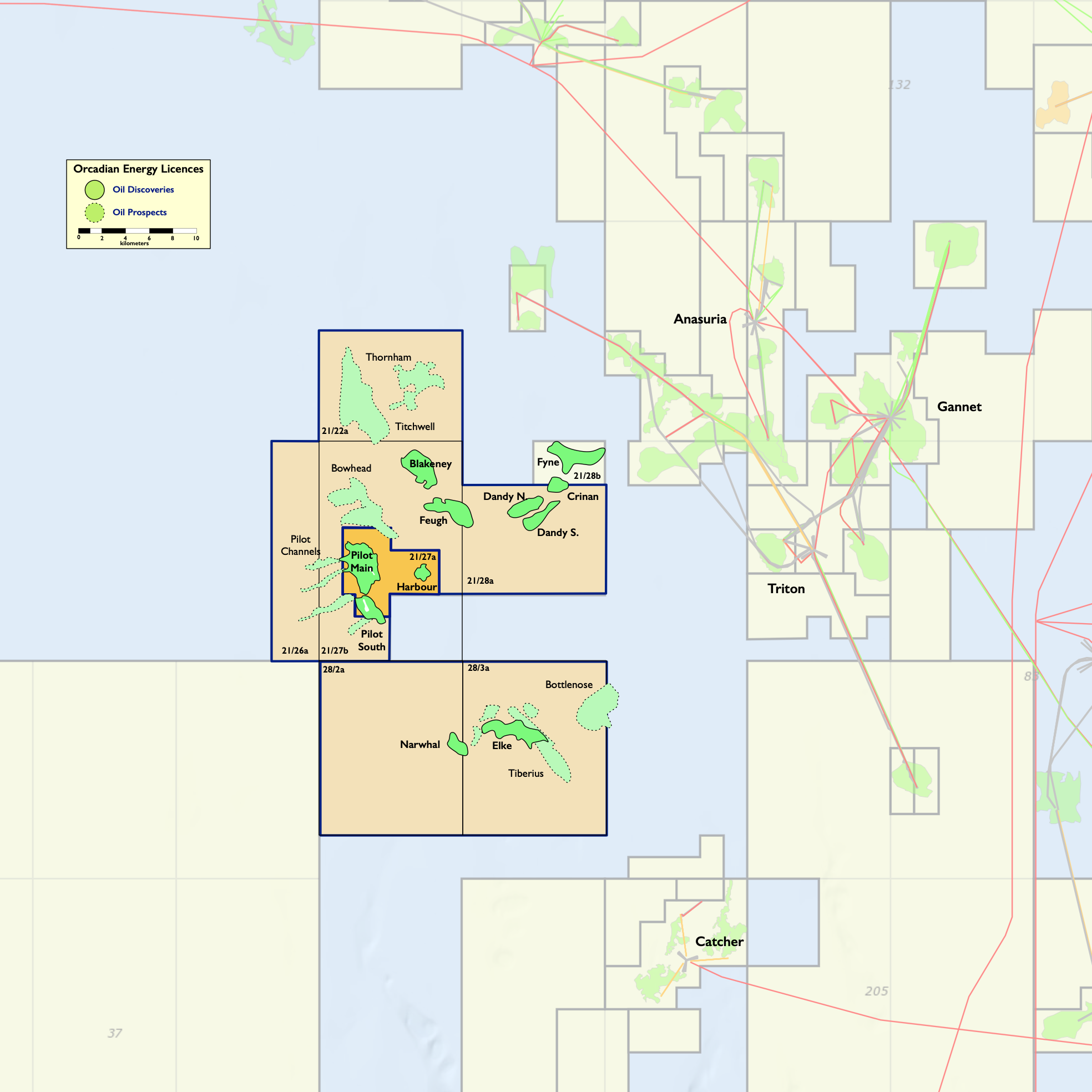

Orcadian Energy (CNS) Ltd, Orcadian’s operating subsidiary, was founded in 2014 and is the sole licensee of P2244, which contains 78.0 MMbbl of 2P Reserves in the Pilot discovery, and of P2482, which contain a further 52.2 MMbbl of 2C Contingent Resources in the Elke and Narwhal discoveries (as audited by Sproule, with both numbers modified to take into account the TGS royalty, see the CPR in the Company’s Admission Document for more details). Within these licences there are also 118 MMbbl of unrisked Prospective Resources (modified for TGS royalty). These licences are in blocks 21/27a, 28/2a and 28/3a, and lie 150 kms due East of Aberdeen.

Pilot, which is the field with the largest reserves in Orcadian’s portfolio, was discovered by PetroFina in 1989 and has been well appraised. In total five wells and two sidetracks were drilled on Pilot, including a relatively short horizontal well which produced over 1,800 bbls/day on test. Orcadian’s proposed low emissions, field development plan for Pilot is based upon a Floating Production Storage and Offloading vessel (FPSO), with over thirty wells to be drilled by a Jack-up rig and provision of power from a floating wind turbine.

Orcadian has entered into a conditional sale and purchase agreement with Ping Petroleum UK plc (“Ping”) which details the terms under which Ping will farm-in to the Pilot development project. Upon conclusion of this deal Orcadian would have an 18.75% stake in the Pilot development with all pre-first oil development costs paid by Ping.

Emissions per barrel produced are expected to be about a tenth of the 2021 North Sea average, and less than half of the lowest emitting oil facility currently operating on the UKCS. On a global basis this places the Pilot field emissions at the low end of the lowest 5% of global oil production.