16 December 2021

Orcadian Energy plc

(“Orcadian Energy”, “Orcadian” or the “Company”)

Results for the year ended 30 June 2021

Orcadian Energy (AIM: ORCA), the North Sea focused oil and gas development company, is delighted to announce its audited results for the twelve months ended 30 June 2021.

Highlights:

- Primary activity was preparing for the Company’s admission to trading on AIM.

- Following the end of the period under review:

- Orcadian admitted to AIM in July 2021 raising gross proceeds of £3 million

- Receipt of Letter of no objection from the Oil and Gas Authority (“OGA”) and entry into the authorisation phase of development planning for the Pilot Field

- Received three expressions of interest for the provision of an FPSO for the Pilot Development

- Entered into a non-binding Heads of Terms with Carrick Resources Limited (“Carrick”) in respect of a sub-area of Licence P2320 which covers the Carra prospect (“Carra”)

- Cash position as at 15th December 2021 of over £1.5 million

- Selected by the OGA to evaluate an approach to the electrification of North Sea oil and gas platforms which will dramatically cut carbon emissions.

Steve Brown, Orcadian’s CEO, said:

“The last financial year has been transformational for the Company.

“Whilst these results record our position at the end of June 2021, the rest of this year has seen the Company make significant progress in delivering its strategy.

“We were admitted to trading on AIM, a market of the London Stock Exchange. On Admission we raised gross proceeds of £3m and since then we have finalised the Concept Select process and moved to the ‘authorisation phase’ for our flagship Pilot development, whilst earlier this month we surpassed twenty-six other companies, or consortia, to win funding of £466,667 in the OGA Electrification Competition.

“The publishing of results is often a time for reflection, but from our perspective time spent resting on laurels is time wasted. Our focus for 2022 will be to seek to secure the financing for the Pilot project and to secure a customer for the platform electrification solution we will design in the coming months.

“We are determined to show the industry and the world that it is possible to produce the oil and gas, that regular customers need, in a cost effective way and with much, much lower emissions. We will do this on Pilot and we believe our electrification system will offer an opportunity for other operators on the UKCS to reduce emissions as rapidly as possible.

“North Sea businesses can show the world how to produce oil and gas with much lower emissions, helping to drive out high cost and high emissions production elsewhere in the world. We are proud of the role we are playing in this.

“We look forward to 2022 with optimism and energy and look forward to a sea change in attitudes to responsible oil and gas development projects and to the market continuing to recognise the significant value in our projects.”

Report and Accounts and Annual General Meeting

A copy of the annual report and accounts for the year ended 30 June 2021 is available on the Company’s website (https://orcadian.energy) with effect from today. A further announcement will be made when the Company posts its annual report and accounts and notice of Annual General Meeting to its shareholders.

For further information on the Company please visit the Company’s website: https://orcadian.energy

MAR Statement

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulations (EU) No. 596/2014 (MAR). Upon the publication of this announcement via Regulatory Information Service (RIS), this inside information is now considered to be in the public domain.

Contact:

| Orcadian Energy plc | + 44 20 7920 3150 |

|

Steve Brown, CEO Alan Hume, CFO |

|

| WH Ireland (Nomad and Joint Broker) | +44 20 7220 1666 |

|

Harry Ansell / Fraser Marshall (Corporate Broking) Katy Mitchell / Andrew de Andrade (Nomad) |

|

| Shore Capital (Joint Broker) | +44 20 7408 4090 |

|

Toby Gibbs / James O’Neill (Advisory) |

| Tavistock (PR) | + 44 20 7920 3150 |

|

Nick Elwes Simon Hudson Matthew Taylor |

[email protected] |

| Charlesbye (PR) | + 44 7403 050525 |

|

Lee Cain / Lucia Hodgson |

About Orcadian Energy

Orcadian is a North Sea oil and gas operator with a difference. In planning its Pilot development, Orcadian has selected wind power to transform oil production into a cleaner and greener process. The Pilot project is moving towards approval and will be amongst the lowest carbon emitting oil production facilities in the world, despite being a viscous crude. Orcadian may be a small operator, but it is also nimble, and it has grasped opportunities that have eluded some of the much bigger companies. As we strike a balance between Net Zero and a sustainable energy supply, Orcadian intends to play its part to minimise the cost of Net Zero and deliver reliable organic energy.

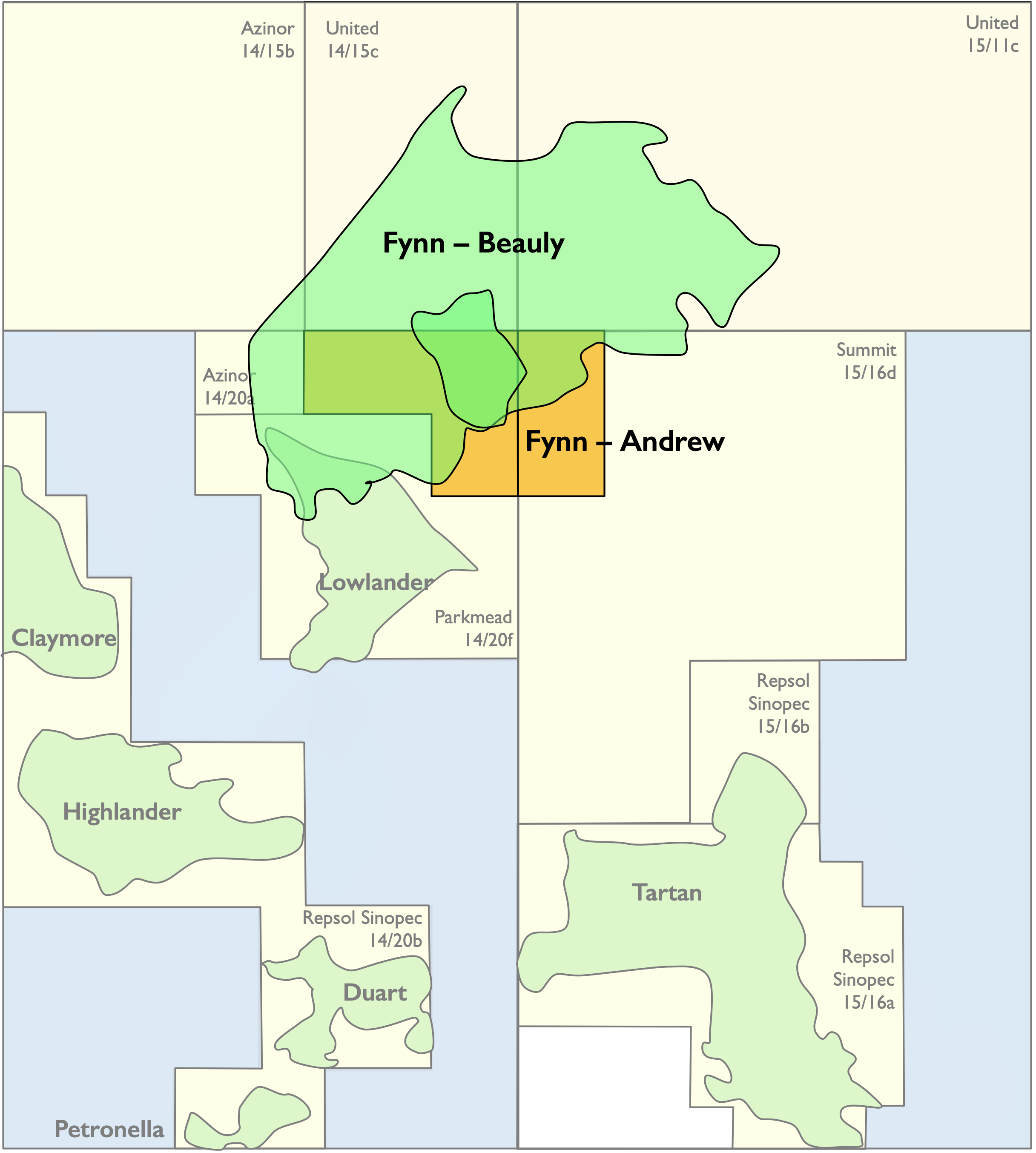

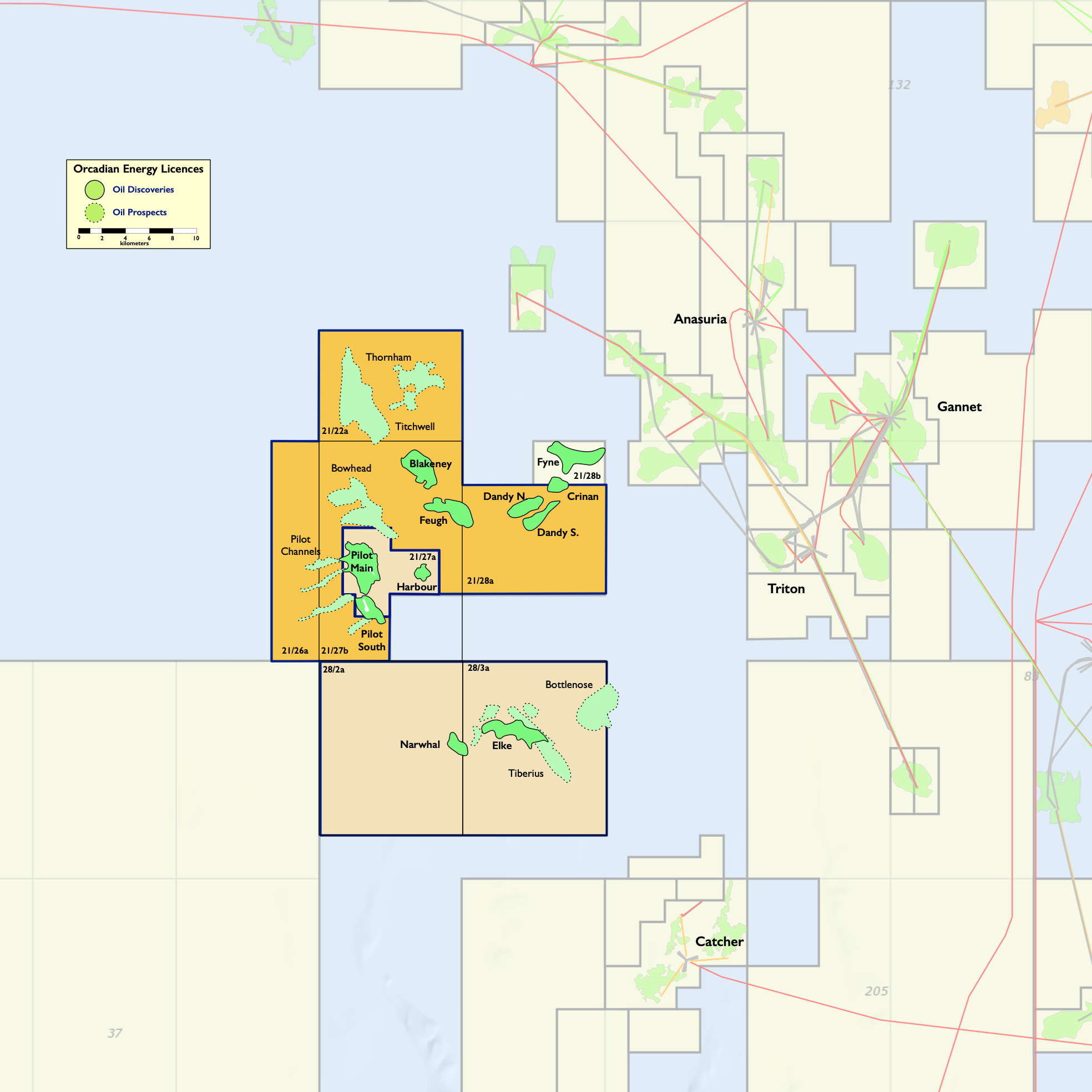

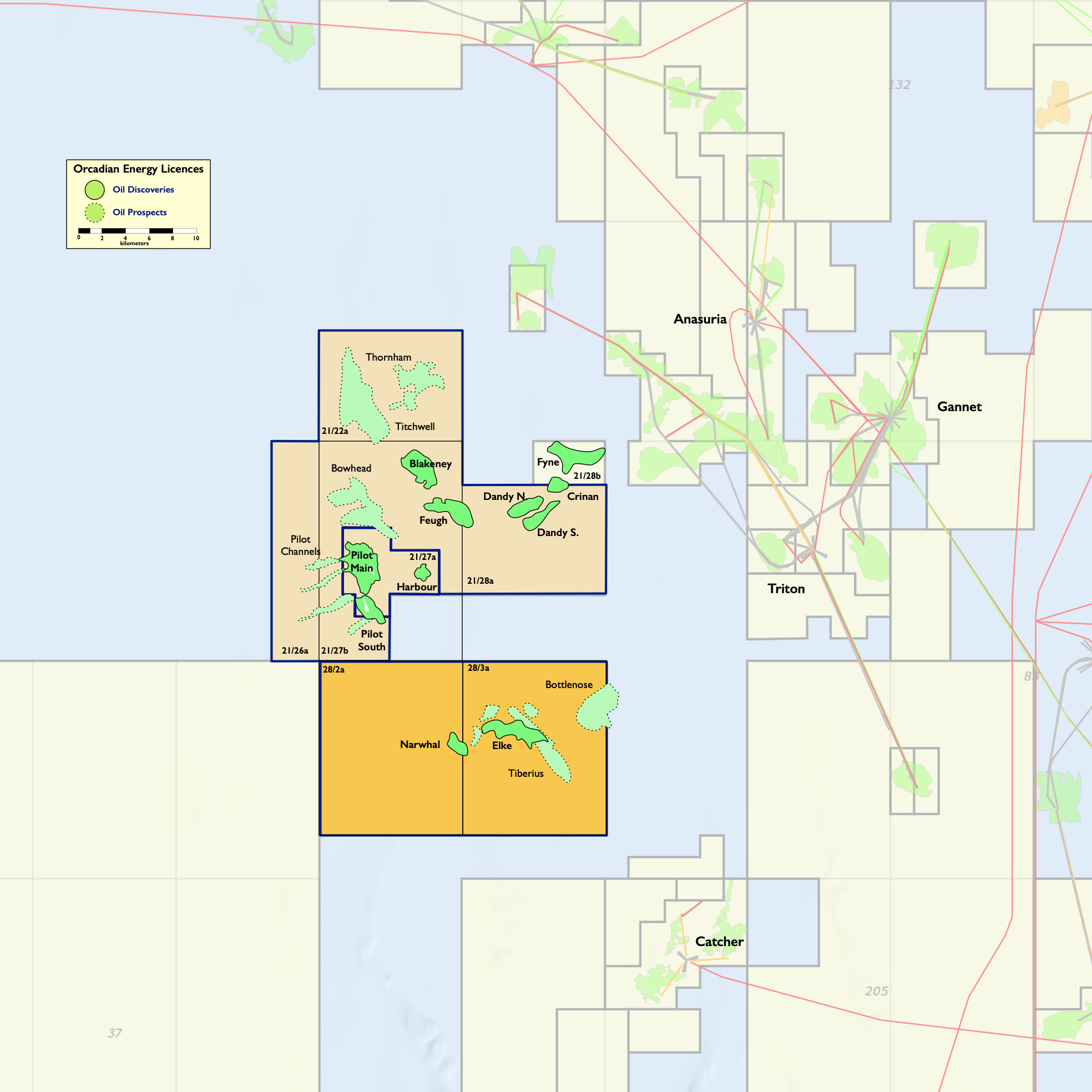

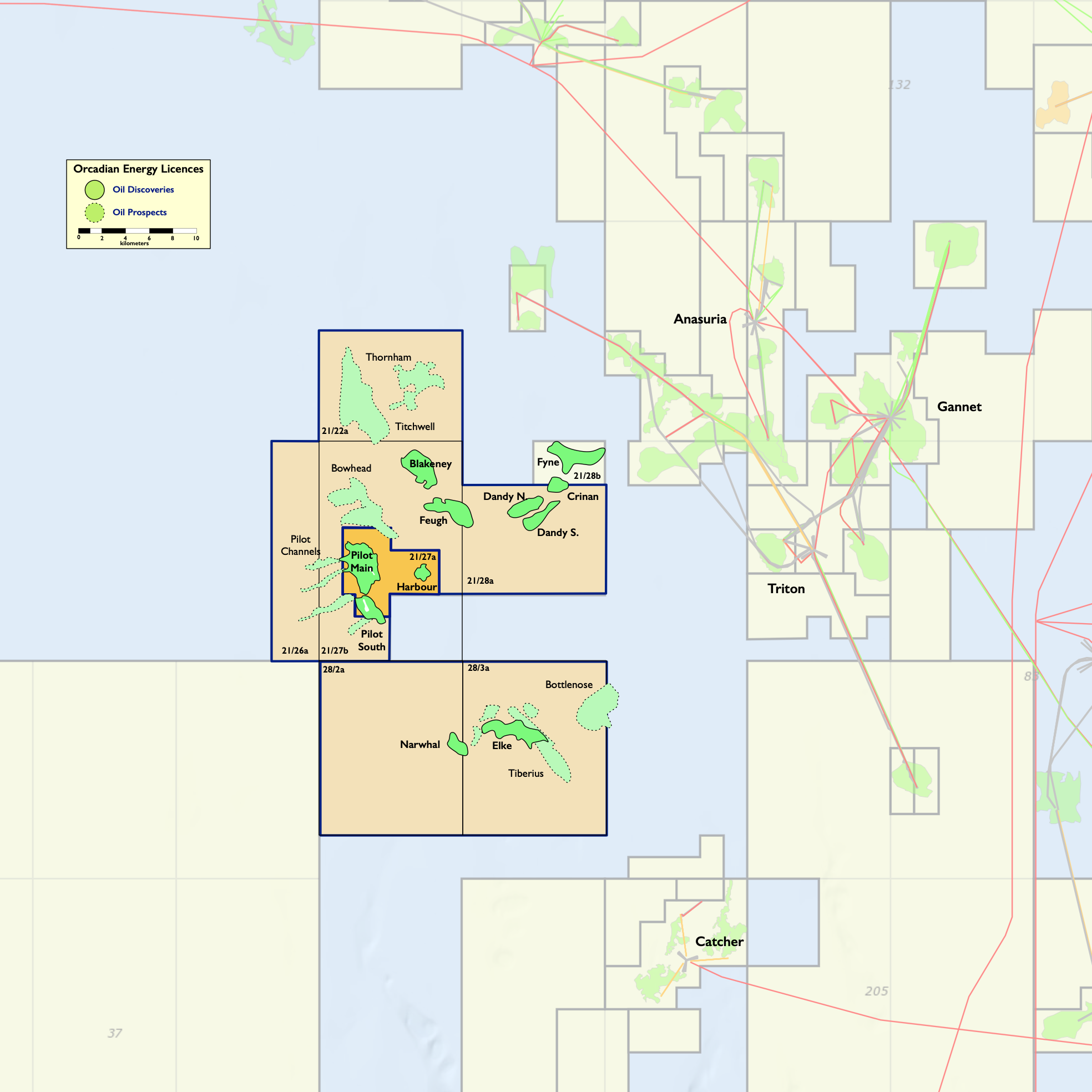

Orcadian Energy (CNS) Ltd (“CNS”), Orcadian’s operating subsidiary, was founded in 2014 and is the sole licensee of P2244, which contains 78.8 MMbbl of 2P Reserves in the Pilot discovery, and of P2320 and P2482, which contain a further 77.8 MMbbl of 2C Contingent Resources in the Elke, Narwhal and Blakeney discoveries (as audited by Sproule, see the CPR in the Company’s Admission Document for more details). Within these licences there are also 191 MMbbl of unrisked Prospective Resources. These licences are in blocks 21/27, 21/28, 28/2 and 28/3, and lie 150 kms due East of Aberdeen. The Company also has a 50% working interest in P2516, which contains the Fynn discoveries. P2516 is administered by the Parkmead Group and covers blocks 14/20g and 15/16g, which lie midway between the Piper and Claymore fields, 180 kms due East of Wick.

Pilot, which is the largest oilfield in Orcadian’s portfolio was discovered by Fina in 1989 and has been well appraised. In total five wells and two sidetracks were drilled on Pilot, including a relatively short horizontal well which produced over 1,800 bbls/day on test. Orcadian’s proposed development plan for Pilot is based upon a Floating Production Storage and Offloading vessel, with over thirty wells to be drilled by a Jack-up rig through a pair of well head platforms and will include a floating wind turbine to provide much of the energy used in the production process. Emissions per barrel produced are expected to be about an eighth of the 2020 North Sea average and to lie in the lowest 5% of global oil production.

ANNUAL RESULTS FOR THE TWELVE MONTHS ENDED 30 JUNE 2021

Chairman’s Statement

The year ended 30 June 2021 has been a watershed year for the Orcadian Energy plc and its subsidiary (the “Group”). At the start of the year the Group was a single private company, then called Pharis Energy Ltd, now called Orcadian Energy (CNS) Ltd; by the end of the year that company had been acquired by the newly formed Orcadian Energy PLC (the “Company”), which was well on the road to being admitted to the AIM market, an event which occurred on 15 July 2021.

Operationally, the Group has made very substantial progress with the process of preparing the Pilot oilfield, the Group’s principal asset, for development. During the year £530,818 was spent on intangible assets. This has occurred during a period when the Government has raised the bar for emissions performance for the oil and gas industry. The Oil and Gas Authority (the “OGA”) had already started to focus on emissions performance as we were preparing a Concept Select Report (“CSR”) for the Pilot field development which we submitted in September 2020. A revised Strategy for the Oil & Gas Authority which placed a range of new net zero obligations on the UK oil and gas industry, on a par with the existing central obligation to maximise economic recovery, was laid before Parliament in December 2020 and came into force in February 2021.

The adoption of a polymer flooding strategy, an outcome of our concept select work, had already substantially reduced expected emissions from the Pilot development project, actually well below the North Sea average, but the OGA asked us to do better, and we responded positively to that challenge. The result is that expected Scope 1 emissions from the Pilot development are just 2.6 kgCO2e/bbl, a performance which places the Pilot development at the low end of the lowest 5% of global oil production (further details of which are set out in the Company’s Admission Document). Following the end of the period under review, an addendum to the CSR was submitted to the OGA on the 1st of July 2021 and the OGA confirmed on the 29th November 2021 that they were content with our proposal and that the project can move from the Assessment phase into the Authorisation phase of the OGA’s field development plan process.

The financial results of the Group largely reflect the investment in progressing the Pilot field and the costs of preparing the Group for admission to AIM, a costly but necessary process to position the Group for success. Since Orcadian Energy (CNS) Ltd was established to apply for the Pilot licence in 2014 much has been achieved with few resources, indeed the admission to AIM of Orcadian, when measured by the metric of proven plus probable reserves, was the largest ever UKCS focussed admission of an oil and gas company to the AIM market. Being quoted gives the Group access to capital and multiplies the options the Group has to progress the development of Pilot.

Finally, also following the end of the period under review, on the 6th December 2021 the OGA announced that Orcadian had been awarded £466,667 in the OGA Electrification Competition. In return, we will evaluate a new concept for the electrification of key producing oil and gas fields, initially focussing on Central Graben area fields, which are owned and controlled by third parties (see announcement dated 6 December 2021 for more information).

Our concept would use renewable energy, generated from local wind farms, for the bulk of the electricity required; with back-up power generated from gas or net zero fuels, supported by batteries for a fast response. We will be working with Crondall Energy, Enertechnos, Petrofac, North Sea Midstream Partners (“NSMP”) and Wärtsilä to deliver a report to the OGA and Central Graben Operators by the end of March 2022. The OGA funding covers all our external costs in doing this work.

We have also formed a partnership with North Sea Midstream Partners to make a commercial proposal for the delivery of electrical power to Central Graben and Central North Sea Operators. It remains to be seen whether this opportunity can be developed into a new business, but we remain committed to making the best of every opportunity to create value for shareholders.

In any event, the Company is now well positioned to make the best of its assets and to deliver real value for shareholders from the very substantial reserve base the Group holds.

Financial Results

The Group incurred a loss for the year to 30 June 2021 of £296,338 (30 June 2020 – loss of £230,519). The 2020 comparative numbers are that of wholly owned subsidiary Orcadian Energy (CNS) Ltd. Refer to note 2.2 for further detail.

In the year to 30 June 2021 the loss mainly arose from expenses in connection to the transaction, costs associated with the admission process including Advisory and Consultancy Fees, salaries, consulting and professional fees along with general administration expenses. These expenses have been met from the proceeds of the issue of shares.

Cash flow and cash position

Cash used in operations totalled £312,189 (30 June 2020 – £141,254)

As at 30 June 2021, the Group had a cash balance of £179,556 (30 June 2020 – £31,318). Following the end of the financial period under review the Company raised gross proceeds of £3m as part of its Admission to AIM.

Oil Price Outlook

When the Company’s shares were admitted to trading on AIM, we stated in the Admission Document that, based on an internal assessment of the supply and demand outlook, the Directors believed that we were entering a period of relative scarcity of oil, which we also believed was supportive of a higher oil price. We believe that is now the consensus view, with demand above 100 million barrels per day, politicians calling for OPEC to increase supply and Brent oil prices having exceeded $80/bbl, before falling back to the low $70s/bbl.

We also stated that the Directors expected that governments around the world would continue their efforts to reduce carbon dioxide emissions, obviously that could temper demand in the future, but we also noted that under-investment in the upstream oil industry could well counteract that pressure.

We still believe that oil prices will always be volatile, but we also believe it is not unreasonable to plan the Group’s projects on the assumption that there is a robust outlook for oil; and the Directors believe the Group’s flagship project should be economically robust as the NPV breakeven price for the Pilot development scheme is approximately US$39/bbl. (see the Company’s Admission Document for details of the assumption behind that NPV) and since January 2015 the oil price has been above US$39/bbl 94% of the time.

UK Oil and Gas Sector

On 24 March 2021, the Government announced the North Sea Transition Deal demonstrating the Government’s commitment to the UKCS oil and gas sector. Through this deal the UK’s oil and gas sector and the government will work together to deliver the skills, innovation and new infrastructure required to decarbonise North Sea oil and gas production. The Group is a part of these discussions and with the support of the OGA will be making a proposal to supply clean reliable energy to Platform Operators. The Directors are confident that the Government will continue to support the oil and gas industry, especially those companies and projects which can demonstrate their contribution to delivering a Net Zero basin.

Business Outlook

The key challenge for the Group is the financing of the Pilot project. The Directors are pursuing two parallel and complementary paths to achieve this aim. The reserves have been established, and with the receipt of a “Letter of no objection” from the OGA the development plan is clear. We are working to attract oil companies and contractors as partners in the development and we will continue to do that through 2022. We are confident that, as the mist clears after COP26, that companies will once again recognise that the UKCS is a great place to invest and that appetite for well-designed development opportunities which have substantial proven reserves will re-emerge.

Joseph Darby

Chairman and Non-Executive Director

15 December 2021

CONSOLIDATED STATEMENT OF COMPREHENSIVE LOSS

FOR THE YEAR ENDED 30 JUNE 2021

| Year ended 30 June 2021

|

Year ended 30 June 2020

|

||||

| Note | £ | £ | |||

| Revenue | – | – | |||

| Administrative expenses | 5 | (258,909) | (200,225) | ||

| Operating Loss | (258,909) | (200,225) | |||

| Finance costs | 9 | (44,349) | (40,294) | ||

| Other income | 7 | 3,000 | 10,000 | ||

| Listing costs | (76,500) | – | |||

| Loss before tax | (376,758) | (230,519) | |||

| Taxation | 10 | 80,420 | – | ||

| Loss for the year | (296,338) | (230,519) | |||

| Other comprehensive income: | |||||

| Items that will or may be reclassified to profit or loss: | |||||

| Other comprehensive income | – | – | |||

| Total comprehensive income | (296,338) | (230,519) | |||

| Earnings per share | 11 | (1.34) | (1.32p) | ||

All operations are continuing.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2021

| 30 June 2021

|

30 June 2020

|

||

| Note | £ | £ | |

| Non-current assets | |||

| Property, plant and equipment | 12 | 1,842 | 107 |

| Intangible assets | 13 | 1,814,615 | 1,283,797 |

| 1,816,457 | 1,283,904 | ||

| Current assets | |||

| Trade and Other Receivables | 14 | 88,548 | 78,138 |

| Cash and cash equivalents | 15 | 179,556 | 31,318 |

| 268,104 | 109,456 | ||

| Total assets | 2,084,561 | 1,393,360 | |

| Non-current liabilities | |||

| Borrowings | 17 | (762,686) | (953,152) |

| (762,686) | (953,152) | ||

| Current liabilities | |||

| Trade and other payables | 18 | (328,601) | (250,596) |

| Borrowings | 17 | (1,100,000) | – |

| (1,428,601) | (250,596) | ||

| Total liabilities | (2,191,287) | (1,203,748) | |

| Net (liabilities) / assets | (106,726) | 189,612 | |

|

Equity Ordinary share capital |

19 | 52,202 | 17,401 |

| Share premium | 19 | – | 563,561 |

| Reverse acquisition reserve | 4 | (38,848) | – |

| Retained earnings | (120,080) | (391,350) | |

| Total equity | (106,726) | 189,612 |

The consolidated Financial Statements of Orcadian Energy PLC were approved by the Board of Directors and authorised for issue on 15 December 2021.

Signed on behalf of the Board of Directors by:

Alan Hume

Director

COMPANY STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE 2021

|

|

30 June 2021

|

||

| Note | £ | ||

| Non-current assets | |||

| Investment in subsidiary | 16 | 52,202 | |

| 52,202 | |||

| Current assets | |||

| Trade and Other Receivables | 14 | – | |

| Cash and cash equivalents | 15 | – | |

| – | |||

| Total assets | 52,202 | ||

| Non-current liabilities | |||

| Borrowings | 17 | – | |

| – | |||

| Current liabilities | |||

| Trade and other payables | 18 | – | |

| – | |||

| Total liabilities | – | ||

| Net assets | 52,202 | ||

|

Equity Ordinary share capital |

19 | 52,202 | |

| Retained earnings | – | ||

| Total equity | 52,202 |

Orcadian Energy PLC, company number 13298968, has used the exemption granted under s408 of the Companies Act 2006 that allows for the non-disclosure of the Income Statement of the parent company. The after-tax loss attributable to Orcadian Energy PLC for the three months to 30 June 2021 was £nil .

The Financial Statements were approved by the Board of Directors and authorised for issue on 15 December 2021.

Signed on behalf of the Board of Directors by:

Alan Hume

Director

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE PERIOD ENDED 30 JUNE 2021

| Ordinary Share capital | Share premium | Reverse acquisition reserve | Retained earnings | Total | ||

| Note | £ | £ | £ | £ | £ | |

| Balance as at 1 July 2019 | 17,346 | 492,215 | – | (160,831) | 348,730 | |

| Loss for the year and total comprehensive income | – | – | – | (230,519) | (230,519) | |

| Proceeds of share issues (net of costs) | 19 | 55 | 71,346 | – | – | 71,401 |

| Balance as at 30 June 2020 | 17,401 | 563,561 | – | (391,350) | 189,612 | |

| Balance as at 1 July 2020 | 17,401 | 563,561 | – | (391,350) | 189,612 | |

| Loss for the year and total comprehensive income | – | – |

– |

(296,338) | (296,338) | |

| Bonus issue of shares | 19 | 34,801 | (34,801) | – | – | – |

| Issue of shares | 19 | 52,202 | – | (52,202) | – | – |

| Transfer to reverse acquisition reserve | 4 | (52,202) | (528,760) | 13,354 | 567,608 | – |

| Balance as at 30 June 2021 | 52,202 | – | (38,848) | (120,080) | (106,726) |

The following describes the nature and purpose of each reserve within equity:

| Reserve | Description and purpose |

| Ordinary share capital | Represents the nominal value of shares issued |

| Share premium account | Amount subscribed for share capital in excess of nominal value |

| Reverse acquisition reserve

Retained earnings |

Reserve created in accordance with the acquisition of Orcadian Energy (CNS) Ltd on 11 May, 2021 (Refer to Note 4)

Cumulative net gains and losses recognised in the Consolidated Statement of Comprehensive Income |

COMPANY STATEMENT OF CHANGES IN EQUITY FOR THE PERIOD ENDED 30 JUNE 2021

| Ordinary Share capital | Retained earnings | Total | |||

| Note | £ | £ | £ | ||

| Balance as at Incorporation 29 March 2021 | – | – | – | ||

| Loss for the period and total comprehensive income | – | – | – | ||

| Issue of shares upon acquisition of subsidiary | 19 | 52,202 | – | 52,202 | |

| Balance as at 30 June 2021 | 52,202 | – | 52,202 |

The following describes the nature and purpose of each reserve within equity:

| Reserve | Description and purpose |

| Ordinary share capital | Represents the nominal value of shares issued |

| Retained earnings | Cumulative net gains and losses recognised in the Consolidated Statement of Comprehensive Income |

CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE PERIOD ENDED 30 JUNE 2021

| Year ended 30 June 2021

|

Year ended 30 June 2020

|

||

| Note | £ | £ | |

| Cash flows from operating activities | |||

| Loss before tax for the year | (376,758) | (230,519) | |

| Adjustments for: | |||

| Depreciation | 12 | 217 | 694 |

| Unrealised foreign exchange (gain) | 5 | (129,511) | – |

| (Increase) / decrease trade and other receivables | 14 | (10,409) | 4,435 |

| (Decrease) / Increase in trade and other payables | 18 | 79,504 | 43,842 |

| Finance costs in the year | 9 | 44,349 | 40,294 |

| Cash generated from operations | (392,608) | (141,254) | |

| Income taxes paid | 80,420 | – | |

| Net cash flows from operating activities | (312,188) | (141,254) | |

| Investing activities | |||

| Purchases of property, plant and equipment | 14 | (1,952) | – |

| Purchases of exploration and evaluation assets | 13 | (530,818) | (750,799) |

| Net cash used in investing activities | (532,770) | (750,799) | |

| Financing activities | |||

| Borrowings from Directors and Officers | 21 | – | (882) |

| Proceeds from issue of convertible loan notes | 17 | 1,100,000 | 100,000 |

| Repayment of convertible loan notes | 17 | (100,000) | – |

| Proceeds from loans obtained | 17 | – | 814,260 |

| Interest paid | (6,804) | – | |

| Proceeds from issue of ordinary share capital | 19 | – | – |

| Net cash used in financing activities | 993,196 | 913,378 | |

| Net increase in cash and cash equivalents | 148,238 | 21,325 | |

| Cash and cash equivalents at beginning of period | 15 | 31,318 | 9,993 |

| Cash and cash equivalents and end of period | 15 | 179,556 | 31,318 |

There were no significant non-cash transactions in the year to 30 June 2021.

COMPANY STATEMENT OF CASH FLOWS FOR THE PERIOD ENDED 30 JUNE 2021

| 30 June 2021

|

|||

| Note | £ | ||

| Cash flows from operating activities | |||

| Loss for the year | – | ||

| Adjustments for: | |||

| Depreciation | 12 | – | |

| Decrease in trade and other receivables | 4 | – | |

| Increase in trade and other payables | 18 | – | |

| Finance costs in the year | – | ||

| Cash generated from operations | – | ||

| Income taxes paid | – | ||

| Net cash flows from operating activities | – | ||

| Investing activities | |||

| Purchases of property, plant and equipment | 12 | – | |

| Purchases of exploration and evaluation assets | 13 | – | |

| Net cash used in investing activities | – | ||

| Financing activities | |||

| Borrowings from Directors and Officers | 21 | – | |

| Proceeds from issue of ordinary share capital | 19 | – | |

| Net cash used in financing activities | – | ||

| Net increase in cash and cash equivalents | – | ||

| Cash and cash equivalents at beginning of period | 15 | – | |

| Cash and cash equivalents and end of period | 15 | – |

No cash was held by the Company during the period to 30 June 2021

NOTES TO THE FINANCIAL STATEMENTS

1. General Information

Orcadian Energy PLC (the “company”) is a public limited company which is domiciled and incorporated in England and Wales under the Companies Act 2006 with the registered number 13298968. The Company’s registered office is 6th floor, 60 Gracechurch Street, London, EC3V 0HR, and its ordinary shares are admitted to trading on AIM, a market of the London Stock Exchange.

The principal activity of the Group is managing oil and gas assets and it holds a 100% interest in, and is administrator for, UKCS Seaward Licences P2244, which contains the Pilot and Harbour heavy oil discoveries, and P2320, which contains the Blakeney, Feugh, Dandy & Crinan discoveries.

The financial statements presented for Group are for the year ended 30 June 2021 and these have are shown alongside figures for the year ended 30 June 2020 for comparative purposes.

2. Summary of significant accounting policies

The principal accounting principles applied in the preparation of these financial statements are set out below. These principles have been consistently applied to all years presented, unless otherwise stated.

2.1 Basis of preparation

The financial statements have been prepared in accordance with International Financial Reporting Standards (IFRS) and IFRS Interpretations Committee (IFRIC) and the Companies Act 2006 applicable to companies reporting under IFRS.

The financial statements have been prepared under the historical cost convention.

2.2 Consolidation and acquisitions

The financial statements consolidate the financial information of the Group and companies controlled by the Group (its subsidiaries) at each reporting date. Control is achieved where the Company has the power to govern the financial and operating policies of an investee entity, has the rights to variable returns from its involvement with the investee and has the ability to use its power to affect its returns. The results of subsidiaries acquired or sold are included in the financial information from the effective date of acquisition or up to the effective date of disposal, as appropriate. Where necessary, adjustments are made to the results of acquired subsidiaries to bring their accounting policies into line with those used by the Group. All intra-Group transactions, balances, income and expenses are eliminated on consolidation. The financial statements of all Group companies are adjusted, where necessary, to ensure the use of consistent accounting policies.

The Company’s shares were admitted to trading on AIM, a market operated by the London Stock Exchange, on 15 July 2021. These financial statements are the Company’s first subsequent to its admission to AIM. In connection with the admission to AIM, the Group undertook a Group reorganisation of its corporate structure which resulted in the Company becoming the ultimate holding company of the Group. Prior to the reorganisation there was no ultimate holding company as Orcadian Energy (CNS) Ltd (“CNS”) was a standalone entity. The transaction was accounted for as a capital reorganisation rather than a reverse acquisition since it did not meet the definition of a business combination under IFRS 3. In a capital reorganisation, the consolidated financial statements of the Group reflect the predecessor carrying amounts of CNS with comparative information of CNS presented for all periods since no substantive economic changes have occurred. The difference arising on acquisition has been accounted for with the recognition of a merger reserve on the balance sheet following the reorganisation of the share capital of the Group at the point of completion of the transaction.

2.3 Going concern

The financial statements have been prepared on a going concern basis. The Group is not yet revenue generating and an operating loss has been reported. The Directors have reviewed a detailed forecast based on the funds raised, and including all required spend to meet licence requirements. This forecast has been stress tested by management in reaching their going concern conclusion. Having made due and careful enquiry, the Directors are of the opinion that the Group has adequate working capital to execute its operations over the next 12 months. The Directors, therefore, have made an informed judgement, at the time of approving financial statements, that there is a reasonable expectation that the Company has adequate resources to continue in operational existence for the foreseeable future.

The Directors acknowledge that COVID-19 has had and may continue to have significant adverse impacts on the global economy and capital markets. However, the Company has been able to raise funds during this time and are of the opinion that COVID-19 does not pose a risk sufficient to call in to question the Group’s ability to operate as a Going Concern. The Directors are of the opinion that the Group has adequate working capital to be able to meet its obligations as they fall due over the next 12 months

As a result, the Directors have continued to adopt the going concern basis of accounting in preparing the annual financial statements for the year ended 30 June 2021.

2.4 Changes in accounting policies

2.4.1 New standards, amendments to standards and interpretations

i) New and amended standards adopted by the Group

During the financial year, the Group has adopted the following new IFRSs (including amendments thereto) and IFRIC interpretations that became effective for the first time.

| Standard | Impact on initial application | Effective date |

| IFRS 3 (amendments)

IFRS standards (amendments) |

Definition of a Business

References to the Conceptual Framework |

01 January 2020

01 January 2020 |

| IAS 1 (amendments) | Definition of Material | 01 January 2020 |

| IAS 8 (amendments) | Definition of Material | 01 January 2020 |

| IFRS 9, IAS 39 and IFRS 7 (amendments) | Interest Rate Benchmark Reform | 01 January 2020 |

| IFRS 3 (amendments)

IFRS standards (amendments) |

Definition of a Business

References to the Conceptual Framework |

01 January 2020

01 January 2020 |

| IFRS 3 (amendments)

IFRS standards (amendments) |

Definition of a Business

References to the Conceptual Framework |

01 January 2020

01 January 2020 |

| IAS 1 (amendments) | Definition of Material | 01 January 2020 |

| IAS 8 (amendments) | Definition of Material | 01 January 2020 |

None of the standards or interpretations that came into effect for the first time for the financial year beginning 1 July 2020 had a material impact on the Group.

2.4.2 New standards and amended standards and interpretations issued but not yet effective for the financial year beginning 1 July 2021

At the date of approval of these financial statements, the following standards and interpretations which have not been applied in these financial statements were in issue but not yet effective (and in some cases had not been adopted by the UK):

| Standard | Impact on initial application | Effective date |

| IFRS standards (amendments) | Interest rate benchmark reform | 01 January 2021 |

| IFRS 3 (amendments) | Business combinations | 01 January 2022 |

| IAS 37 (amendments) | Onerous contracts | 01 January 2022 |

| IFRS standards (amendments) | 2018-2020 annual improvement cycle | 01 January 2022 |

| IAS 16 (amendments) | Proceeds before intended use | 01 January 2022 |

| IFRS 17 | Insurance Contracts | 01 January 2023 |

| IFRS 17 (amendments) | Insurance contracts | 01 January 2023 |

| IAS 1 (amendments) | Reclassification of liabilities as current or non-current | 01 January 2023 |

The new and amended Standards and Interpretations which are in issue but not yet mandatorily effective is not expected to be material.

2.5 Foreign currency

2.5.1 Functional and presentation currency

Items in the company’s financial statements are measured in the currency of the primary economic environment in which the entity operates (functional currency). Τhe functional currency of the Company is Pounds sterling (£).

Monetary amounts in these financial statements are rounded to the nearest £.

2.5.2.Transactions and balances

Foreign currency transactions are translated into the functional currency using the exchange rates prevailing at the dates of the transactions or valuation where items are re-measured. Foreign exchange gains and losses resulting from the settlement of such transactions and from the translation at year-end exchange rates of monetary assets and liabilities denominated in foreign currencies are recognised in the income statement, except when deferred in other comprehensive income as qualifying cash flow hedges and qualifying net investment hedges. Foreign exchange gains and losses that relate to borrowings and cash and cash equivalents are presented in the income statement within ‘finance income or costs.’ All other foreign exchange gains and losses are presented in the income statement within ‘Other (losses)/gains.’

Translation differences on non-monetary financial assets and liabilities such as equities held at fair value through profit or loss are recognised in profit or loss as part of the fair value gain or loss. Translation differences on non-monetary financial assets measure at fair value are included in other comprehensive income.

2.6 Government grants

The Group recognises an unconditional government grant in profit or loss as other income when the grant becomes receivable.

2.7 Taxation

Tax is recognised in the Statement of Comprehensive Income, except to the extent that it relates to items recognised in other comprehensive income or directly in equity. In this case, the tax is also recognised in other comprehensive income or directly in equity respectively.

R&D tax credits are recognised through the Consolidated Statement of Comprehensive Loss upon receipt of funds.

2.8 Leases

The Group assesses whether a contract is or contains a lease at the inception of the contract. The Group recognises a right-of-use asset and a corresponding lease liability with respect to all lease arrangements in which it is the lessee, except for short-term leases (defined as leases with a lease term of 12 months or less) and leases of low value assets (such as tablets and personal computers, small items of office furniture and telephones). For these leases, the Group recognises the lease payments as an administrative expense on a straight-line basis over the term of the lease unless another systematic basis is more representative of the time pattern in which economic benefits from the leased assets are consumed.

2.9 Intangible assets

Exploration and evaluation expenditures (E&E)

The Group applies the successful efforts method of accounting for oil and gas assets, having regard to the requirements of IFRS 6 ‘Exploration for and Evaluation of Mineral Resources’. Costs incurred prior to obtaining the legal rights to explore an area are expensed immediately to the Statement of Comprehensive Income.

All licence acquisitions, exploration and evaluation costs are capitalised, a share of administration costs is capitalised insofar as they relate to exploration, evaluation and development activities. These costs are written off unless commercial reserves have been established or the determination process has not been completed and there are no indications of impairment. If a project is deemed commercial all of the attributable costs are transferred into Property, Plant and Equipment. These costs are then depreciated from the commencement of production on a unit of production basis.

2.10 Impairment of non-financial assets

The Group assesses at each reporting date whether there is an indication that an asset may be impaired. This includes consideration of the IFRS 6 impairment indicators for any intangible exploration and evaluation assets capitalised as intangible costs. If any such indication exists, or when annual impairment testing for an asset is required, the Group makes an estimate of the asset’s recoverable amount.

An asset’s recoverable amount is the higher of its fair value less costs to sell and its value in use. This is determined for an individual asset, unless the asset does not generate cash inflows that are largely independent of those from other assets or Groups of assets, and the asset’s value in use cannot be estimated to be close to its fair value. In such cases, the asset is tested for impairment as part of the cash-generating unit to which it belongs. When the carrying amount of an asset or cash-generating unit exceeds its recoverable amount, it is considered impaired and is written down to its recoverable amount.

In assessing value in use, estimated future cash flows are discounted to their present value using a pre-tax discount rate that reflects current market assessments of the time value of money and the risks specific to the asset. Impairment losses relating to continuing operations are recognised in those expense categories consistent with the function of the impaired asset, unless the asset is carried at revalued amount (in which case the impairment loss is treated as a revaluation decrease). An assessment is also made at each reporting date as to whether there is any indication that previously recognised impairment losses may no longer exist or may have decreased. If such indication exists, the recoverable amount is estimated.

A previously recognised impairment loss is reversed only if there has been a change in the estimates used to determine the asset’s recoverable amount since the last impairment loss was recognised. If that is the case, the carrying amount of the asset is increased to its recoverable amount. That increased amount cannot exceed the carrying amount that would have been determined, net of depreciation, had no impairment loss been recognised for the asset in prior years. Such reversal is recognised in the Statement of Comprehensive Income unless the asset is carried at revalued amount, in which case the reversal is treated as a revaluation increase. After such a reversal, the depreciation charge is adjusted in future periods to allocate the asset’s revised carrying amount, less any residual value, on a systematic basis over its remaining useful life.

2.11 Property, plant and equipment

Property, plant and equipment is stated at cost less accumulated depreciation and any accumulated impairment losses. Depreciation is provided on all property, plant and equipment to write off the cost less estimated residual value of each asset over its expected useful economic life on a straight-line basis at the following annual rates:

- Property, plant and equipment – 3 years straight line.

All assets are subject to annual impairment reviews.

2.12 Financial Instruments

2.12.1 Initial recognition

A financial asset or financial liability is recognised in the statement of financial position of the Group when it arises or when the Groupbecomes part of the contractual terms of the financial instrument.

2.12.2 Classification

Financial assets at amortised cost

The Group measures financial assets at amortised cost if both of the following conditions are met:

- the asset is held within a business model whose objective is to collect contractual cash flows; and

- the contractual terms of the financial asset generating cash flows at specified dates only pertain to capital and interest payments on the balance of the initial capital.

Financial assets which are measured at amortised cost, are measured using the Effective Interest Rate Method (EIR) and are subject to impairment. Gains and losses are recognised in profit or loss when the asset is derecognised, modified or impaired.

Financial liabilities at amortised cost

Financial liabilities measured at amortised cost using the effective interest rate method include current borrowings and trade and other payables that are short term in nature. Financial liabilities are derecognised if the Group’s obligations specified in the contract expire or are discharged or cancelled.

Amortised cost is calculated by taking into account any discount or premium on acquisition and fees or costs that are an integral part of the effective interest rate (“EIR”). The EIR amortisation is included as finance costs in profit or loss. Trade payables other payables are non-interest bearing and are stated at amortised cost using the effective interest method.

Financial liabilities at fair value through profit or loss

Financial liabilities at fair value through profit or loss include financial liabilities held for trading and financial liabilities designated upon initial recognition as at fair value through profit or loss. Financial liabilities are classified as held for trading if they are incurred for the purpose of repurchasing in the near term. Gains or losses on liabilities held for trading are recognised in the statement of profit or loss and other comprehensive income.

2.12.3. Derecognition

A financial asset is derecognised when:

- the rights to receive cash flows from the asset have expired, or

- the Group has transferred its rights to receive cash flows from the asset or has undertaken the commitment to fully pay the cash flows received without significant delay to a third party under an arrangement and has either (a) transferred substantially all the risks and the assets of the asset or (b) has neither transferred nor held substantially all the risks and estimates of the asset but has transferred the control of the asset.

2.12.4 Impairment

The Group recognises a provision for impairment for expected credit losses regarding all financial assets. Expected credit losses are based on the balance between all the payable contractual cash flows and all discounted cash flows that the Group expects to receive. Regarding trade receivables, the Group applies the IFRS 9 simplified approach in order to calculate expected credit losses. Therefore, at every reporting date, provision for losses regarding a financial instrument is measured at an amount equal to the expected credit losses over its lifetime without monitoring changes in credit risk. To measure expected credit losses, trade receivables and contract assets have been Grouped based on shared risk characteristics.

2.13 Trade and other receivables

Trade and other receivables are initially recognised at fair value when related amounts are invoiced then carried at this amount less any allowances for doubtful debts or provision made for impairment of these receivables.

2.14 Cash and cash equivalents

Cash and cash equivalents comprise cash at bank and in hand and are subject to an insignificant risk of changes in value.

2.15 Share capital

Ordinary shares are classified as equity. Incremental costs directly attributable to the issue of new shares or options are shown in equity as a deduction, net of tax, from the proceeds.

2.16 Share premium

Share premium account represents the excess of the issue price over the par value on shares issued. Incremental costs directly attributable to the issue of new ordinary shares or options are shown in equity as a deduction, net of tax, from the proceeds.

2.17 Trade payables

These financial liabilities are all non-interest bearing and are initially recognised at the fair value of the consideration payable.

2.18 Convertible loan notes and borrowings

Convertible loan notes classified as financial liabilities and borrowings are recognised initially at fair value, net of transaction costs incurred. After initial recognition, loans are measured at the amortised cost using the effective interest rate method. Any difference between the proceeds (net of transaction costs) and the redemption value is recognised in the income statement over the period of the borrowings using the effective interest rate method.

2.19 Finance income and finance costs

Finance income comprises interest income on bank funds. Interest income is recognised as it accrues in profit or loss, using the effective interest method. Finance costs comprise interest expense on borrowings. Borrowing costs are recognised in profit or loss in the period in which they are incurred.

2.20 Earnings per share

Basic Earnings per share is calculated as profit attributable to equity holders of the parent for the period, adjusted to exclude any costs of servicing equity (other than dividends), divided by the weighted average number of ordinary shares, adjusted for any bonus element.

2.21 Operating segments

The Chief Operating Decision Maker (CODM) is considered to be the Board of Directors. They consider that the Group operates in a single segment, that of oil and gas exploration, appraisal and development, in a single geographical location, the North Sea of the United Kingdom. As a result, the financial information of the single segment is the same as set out in the statement of comprehensive income, statement of financial position, statement of Changes in Equity and Statement of Cashflows.

2.22 Investment in Subsidiaries

The consolidated financial statements incorporate the financial statements of the company and entities controlled by the Group (its subsidiaries). Control is achieved where the Group has the power to govern the financial and operating policies of an entity so as to obtain benefits from its activities.

The results of subsidiaries acquired or disposed of during the year are included in total comprehensive income from the effective date of acquisition and up to the effective date of disposal, as appropriate using accounting policies consistent with those of the parent. All intra-group transactions, balances, income and expenses are eliminated in full on consolidation.

Investments in subsidiaries are accounted for at cost less impairment in the individual financial statements.

2.23 Research and development

Research and development expenditure is charged to the Consolidate Statement of Comprehensive Income in the year in which the claim is submitted and recovered as prior to this the recovery of the income is not deemed to be probable.

3. Significant accounting estimates and judgements, estimates and assumptions

The preparation of financial statements using accounting policies consistent with IFRS requires the Directors to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities and the reported amounts of income and expenses. The preparation of financial statements also requires the Directors to exercise judgement in the process of applying the accounting policies. Changes in estimates, assumptions and judgements can have a significant impact on the financial statements.

Recoverable value of intangible assets

As at 30 June 2021, the Group held oil and gas exploration and evaluation intangible assets of £1,814,615 (2020: £1,283,797). The carrying values of intangible assets are assessed for indications of impairment, as set out in IFRS 6, on an annual basis. As part of this impairment assessment, the recoverable value of the intangible assets is required to be estimated.

When estimating the recoverable value of the intangibles Management consider the proved, probably and potential resources per the latest CPR, likely production costs and the forecasted oil prices.

As a result of the budget exploration costs, the licenses being valid and the assessed recoverable value of the intangibles being in excess of the carrying value, Management do not consider that any intangible assets are impaired as at 30 June 2021.

These estimates and assumptions are subject to risk and uncertainty and therefore a possibility that changes in circumstances will impact the assessment of impairment indicators.

There was only one critical judgement identified, apart from those involving estimations (which are dealt with separately above) that the Directors have made in the process of applying the Group’s accounting policies and that have the most significant effect on the amounts recognised in the financial statements.

The acquisition of Orcadian Energy (CNS) Ltd during the year via a share for share agreement, as detailed in note 4, falls outside of the scope of IFRS 3 as Orcadian Energy Plc at the time of the transaction did not meet the definition of a business. The acquisition constituted a group reorganisation since the two entities were under common control at the date of acquisition.

As such, the Directors were required to apply judgement in deciding the most appropriate way to account for this acquisition. The Directors decided to adopt the predecessor value approach which requires the assets and liabilities acquired being accounted for using their carrying values at the date of acquisition and the difference between the cost of the acquisition and the net assets of the legal subsidiary at the date of acquisition being taken to the merger reserve.

Furthermore, the Consolidated Statement of Comprehensive Loss, Consolidated Statement of Financial Position, Consolidate Statement of Changes in Equity and the Consolidated Statement of Cashflows have been presented to show the group as if it were in existence since the beginning of the comparative period.

4. Group reorganisation under common control

The acquisition met the definition of a group reorganisation due to the Company and the subsidiary being under common control at the date of acquisition. As a result, and since Orcadian Energy Plc did not meet the definition of a business per IFRS 3, the acquisition fell outside of the scope of IFRS 3 and the predecessor value method was used to account for the acquisition.

These consolidated financial statements represent a continuation of the consolidated financial statements of Orcadian Energy (CNS) Ltd and include:

- The assets and liabilities of Orcadian Energy (CNS) Ltd at their pre-acquisition carrying amounts and the results for both periods; and

- The assets and liabilities of the Company as at 11 May 2021 and it’s results from 11 May to 30 June 2021.

On 11 May 2021, the Company issued 52,201,601 shares entire issued share capital of Orcadian Energy (CNS) Ltd.

The net assets of Orcadian Energy (CNS) Ltd at the date of acquisition was as follows:

| £ | ||

| Property Plant & Equipment | 1,357 | |

| Intangible Assets | 1,719,292 | |

| Current Assets | 447,425 | |

| Current Liabilities | (284,745) | |

| Non-Current Liabilities | (1,869,975) | |

| Net assets | 13,354 | |

The reserve that arose from the acquisition is made up as follows:

| Year ended 30 June 2021 | |

| £ | |

| As at start of year | – |

| Cost of the investment in Orcadian Energy (CNS) Ltd | 52,202 |

| Less: net assets of Orcadian Energy (CNS) Ltd at acquisition | (13,354) |

| As at end of year | 38,848 |

5. Administrative expenses

| 2021 | 2020 | |

| £ | £ | |

| Office costs, rates and services | 18,672 | 18,649 |

| Wages and salaries | 128,125 | 60,000 |

| Consultants and advisers | 56,113 | 11,335 |

| Audit fees (note 18) | 38,090 | 8,000 |

| Pre-award licence costs | – | 17,821 |

| Insurance | 44,466 | 4,603 |

| Other expenses | 65,234 | 28,991 |

| National Insurance | 35,594 | 16,310 |

| Foreign Exchange | (127,603) | 33,822 |

| Depreciation | 217 | 694 |

| 258,909 | 200,225 |

6. Auditor’s Remuneration

During the year, the Company obtained the following services from the Company’s auditors and its associates:

| 2021 | 2020 | |

| £ | £ | |

| Audit of the financial statements | 25,000 | 8,000 |

| Transaction services | 5,000 | – |

| 30,000 | 8,000 |

7. Other Income

| 2021 | 2020 | |

| £ | £ | |

| Consulting fees | 3,000 | – |

| Coronavirus support grant | – | 10,000 |

| Other Income | 3,000 | 10,000 |

The Company undertook a minor consulting role during the year for which it billed £3,000.

As part of the Government’s support for small businesses during the Coronavirus crisis a non-repayable Coronavirus support grant of £10,000 was provided to any business whose premises were eligible for Small Business Rate Relief as of 11 March 2020, having a rateable value up to £15,000. The Company qualified for this support and applied for and received the grant.

8. Staff numbers and costs

| Group | Group | ||

| 2021 | 2020 | ||

| Staff costs (including directors) | £ | £ | |

| Wages and salaries | 128,125 | 138,133 | |

| Social security costs | 35,594 | 16,309 | |

| 163,719 | 154,442 |

No pension benefits are provided for any Directors (2020: £nil).

The average number of persons (including directors) employed by the Company during the year was:

| Group and Company | 2021 | 2020 |

| Management and Administration | 5 | 6 |

| 5 | 6 |

9. Finance costs

| 2021 | 2020 | |

| £ | £ | |

| Interest paid | 44,349 | 40,293 |

| 44,349 | 40,293 |

10. Taxation

Analysis of charge for the year:

| 2021

£ |

2020

£ |

|

| Current income tax charge | – | – |

| R&D tax credits | 80,420 | – |

| Deferred tax charge | – | – |

| Total taxation credit/(charge) | 80,420 | – |

Taxation reconciliation

The below table reconciles the tax charge for the year to the theoretical charge based on the result for the year and the corporation tax rate.

| 2021

£ |

2020 £ |

|

| Loss before income tax | (296,338) | (230,519) |

| Tax at the applicable rate of 19% (2020: 19%) | (56,304) | (43,799) |

| Effects of: | ||

| R&D tax credits | 80,420 | – |

| Expenses not deducted for tax purposes | – | 1,661 |

| Unutilised tax losses | 56,304 | 42,138 |

| Total income tax credit / (expense) | 80,420 | – |

Due to the nature of the expenditure incurred by the Company on the Offshore Steam Flood during the periods ending 30 June 2019 and 30 June 2020 claims were made under the SME R&D tax rebate provisions which resulted in refunds totalling £80,420.

As at 30 June 2021, the Group had unused tax losses of £139,767 (2020: £83,463) for which no deferred tax asset has been recognised. This is due to uncertainty over the availability of future taxable profits to offset these losses against.

11. Earnings per share

The calculation of the basic and diluted earnings per share is calculated by dividing the loss for the year for continuing operations for the Company by the weighted average number of ordinary shares in issue during the year.

There is no difference between the basic and diluted earnings per share as there were no securities on issue as at 30 June 2021 that would have a dilutive effect on earnings per share.

| 2021

£ |

2020 £ |

|

| Loss for the purposes of basic earnings per share being net loss attributable to the owners | (296,338) | (230,519) |

| Weighted average number of Ordinary Shares | 22,167,804 | 17,362,614 |

| Loss per share | (1.34p) | (1.32p) |

The weighted average number of shares is adjusted for the impact of the acquisition as follows:

– Prior to the acquisition, the number of shares is based on Orcadian Energy (CNS) Ltd, adjusted using the share exchange ratio arising on the acquisition; and

– From the date of the acquisition, the number of shares is based on the Company.

12. Property, plant and equipment

| IT hardware & software | Office equipment | Total | |

| £ | £ | £ | |

| Cost | |||

| As at 30 June 2019 | 2,842 | 202 | 3,044 |

| Additions | – | – | – |

| As at 30 June 2020 | 2,842 | 202 | 3,044 |

| Additions | 1,952 | – | 1,952 |

| As at 30 June 2021 | 4,794 | 202 | 4,996 |

| IT hardware & software | Office equipment | Total | |

| £ | £ | £ | |

| Depreciation | |||

| As at 30 June 2019 | 2,092 | 151 | 2,243 |

| Charged in the year | 643 | 51 | 694 |

| As at 30 June 2020 | 2,735 | 202 | 2,937 |

| Charged in the year | 217 | – | 217 |

| As at 30 June 2021 | 2,952 | 202 | 3,154 |

| Net book value as at 30 June 2021 | 1,842 | – | 1,842 |

| Net book value as at 30 June 2020 | 107 | – | 107 |

The depreciation expense is recognised in administrative expenses as set out in note 6.

13. Intangible assets

| Oil and gas exploration assets | |

| £ | |

| Cost | |

| As at 30 June 2019 | 532,998 |

| Additions | 750,799 |

| As at 30 June 2020 | 1,283,797 |

| Additions | 530,818 |

| As at 30 June 2021 | 1,814,615 |

No general office expenses incurred during the year were capitalised (2020: £nil).

The carrying value of the prospecting and exploration rights is supported by the estimated resource and current market values as contained in the Competent Person’s Report date 1 April 2021 which was prepared by Sproule B.V.

14. Trade and other receivables

| Group | 2021 | 2020 |

| £ | £ | |

| VAT receivable | 50,925 | 5,914 |

| Prepayments relating to the issue of equity | 13,500 | – |

| Prepayments other | 24,123 | – |

| Amounts due from related parties | – | 72,224 |

| 88,548 | 78,138 |

Amounts due from related parties were unsecured, interest free and had no fixed repayment date.

The fair value of other receivables is the same as their carrying values as stated above.

The maximum exposure to credit risk at the reporting date is the carrying value of each class of receivable mentioned above. The Company does not hold any collateral as security.

15. Cash and cash equivalents

| Group | 2021 | 2020 |

| £ | £ | |

| Cash at bank and in hand | 179,556 | 31,318 |

| 179,556 | 31,318 |

16. Investment in subsidiary

| Name | Address of the registered office | Nature of business | Proportion of ordinary shares held directly by parent (%) |

| Orcadian Energy (CNS) Ltd | 6th floor, 60 Gracechurch Street, London, EC3V 0HR | Managing oil and gas assets | 100 |

The acquisition of Orcadian Energy (CNS) Ltd took place on 11 May 2021. Refer to note 4 for further details.

17. Borrowings

| 2021 | ||||

| Convertible loan note 2020

£ |

STASCO Loan £ |

Convertible loan note 2021

£ |

Total £ |

|

| As at 30 June 2020 | 100,000 | 853,152 | – | 953,152 |

| Convertible loan note issues | 380,000 | – | 720,000 | 1,100,000 |

| Convertible loan note repayments | (100,000) | – | – | (100,000) |

| Interest accrued | – | 39,045 | – | 39,045 |

| Effect of foreign exchange | – | (129,511) | – | (129,511) |

| As at 30 June 2021 | 380,000 | 762,686 | 720,000 | 1,862,686 |

Between July and December 2020 the Company issued £380,000 of convertible loan notes. In January 2021 £100,000 of convertible loan notes were repaid in cash and a further CLN for £100,000 was issued to a further lender. The term for these CLN’s was three years with an interest rate of 12% per annum if they were redeemed. If conversion to Ordinary Shares no interest is applied.

In March 2021 the Company issued £705,000 of convertible loan notes, and in June 2021 the Company issued £15,000 of convertible loan notes. These CLN’s had a term of one year and a zero interest rate.

Subsequent to reporting date on 15 July 2021, all CLNs were converted in to ordinary shares at a price of 28 pence each, which was a 30% discount to the fundraise price. In total 3,928,572 ordinary shares were issued in full discharge of the CLNs. No interest was paid on the CLNs as they were converted in to ordinary shares.

| 2020 | ||||

| Convertible loan note 2018

£ |

STASCO Loan £ |

Convertible loan note 2020

£ |

Total £ |

|

| As at 30 June 2019 | 70,000 | – | – | 70,000 |

| Convertible loan note issues | – | – | 100,000 | 100,000 |

| Convertible loan notes redeemed for shares |

(70,000) |

– |

– |

(70,000) |

| Loan drawdowns | – | 814,260 | 814,260 | |

| Interest accrued | – | 38,892 | – | 38,892 |

| As at 30 June 2020 | – | 853,152 | 100,000 | 953,152 |

Convertible loan notes were exercised in the year leading to shares being issued for a total value of £71,400. No cash was received in consideration for these shares.

The STASCO loan was drawn down on 23 August 2019. The loan is repayable by 23 August 2023 and is subject to an interest rate at LIBOR plus 5% with interest accruing on a compounding basis.

On 20 March 2020 and 28 May 2020 the Company issued £50,000 of convertible loan notes on each of those dates.

18. Trade and other payables – due within one year

| 2021 | 2020 | |

| £ | £ | |

| Trade payables | 35,443 | 8,003 |

| Accruals | 276,133 | 242,593 |

| Other creditor | 17,025 | – |

| 328,601 | 250,596 |

The carrying values of trade and other payables are considered to be a reasonable approximation of the fair value and are considered by the Directors as payable within one year.

19. Ordinary share capital and share premium

| Group | |||

| Issued | Number of shares | Ordinary share capital

£ |

Share

premium £ |

| As at 30 June 2019 | 17,345,610 | 17,346 | 492,215 |

| Issue of shares | 54,924 | 55 | 71,346 |

| As at 30 June 2020 | 17,400,534 | 17,401 | 563,561 |

| Transfer between reserves | – | 34,801 | (34,801) |

| Issued capital of Company at acquisition | 1 | – | – |

| Issue of shares upon acquisition of subsidiary | 52,201,601 | 52,202 | – |

| Transfer of Ltd paid up capital to reverse acquisition reserve |

(17,400,534) |

(52,202) |

(528,760) |

| As at 30 June 2021 | 52,201,601 | 52,202 | – |

The issued capital of the Group for the period 1 July 2020 to 11 May 2021 is that of Orcadian Energy (CNS) Ltd. Upon completion of the acquisition the share capital of Orcadian Energy (CNS) Ltd was transferred to the Acquisition reserve (Refer to note 4) and the share capital of Orcadian Energy PLC was brought to account.

The ordinary shares confer the right to vote at general meetings of the Company, to a repayment of capital in the event of liquidation or winding up and certain other rights as set out in the Company’s articles of association.

| Company | |||

| Issued | Number of shares | Share capital

£ |

Share

premium £ |

| Balance as at Incorporation 29 March 2021 | 1 | – | – |

| Issue of shares upon acquisition of subsidiary | 52,201,601 | 52,202 | – |

| As at 30 June 2021 | 52,202,602 | 52,202 | – |

On 29 March 2021, the Company issued one new ordinary shares of £0.001 upon incorporation.

On 11 May 2021, the Company issued 52,202,601 new ordinary shares of £0.001 each at nominal value for the acquisition of 100% of the issued capital of Orcadian Energy (CNS) Ltd pursuant to a share swap arrangement (Refer to Note 4).

20. Related parties

20.1 Transactions with related parties

The Company had the following related party transactions:

- The Company makes use of an office at 70 Claremont Road which is currently provided to the Company by Mrs Julia Cane-Honeysett and Mr Stephen Brown at a rental of £1,000 per calendar month. The company pays for the services and business rates associated with the property.

20.2 Loans to/from related parties

During the year, several Directors and shareholders provided funds to the Company as a working capital injection.

The following balances are outstanding at the end of the reporting period in relation to these transactions:

| Amount due (to)/from related parties | |

| £ | |

| As at 30 June 2020 | 72,224 |

| Funds advanced to the Company | (135,000) |

| Loan amounts settlement by the Related Party | 72,224 |

| As at 30 June 2021 | (135,000) |

As at 30 June 2021 the Company had issued convertible loan notes (CLNs”) from Company Directors Alan Hume totalling £135,000. These CLNs were converted in to 482,142 ordinary shares post year end on 15 July 2021 at 28 pence per share.

20.3. Key management personnel

Directors of the Company are considered to be key management personnel. The remuneration of the Directors has been set out in note 8.

21. Ultimate controlling party

The Directors consider Stephen Brown and Julia Cane-Honeysett to be the ultimate controlling parties given their combined holding of 55.87% of the issued capital of the Company.

22. Financial instruments

The Company holds the following financial instruments:

Financial assets

| 2021 | 2020 | |

| Financial assets at amortised cost: | £ | £ |

| Trade receivables | ||

| Other financial assets at amortised cost | – | 72,224 |

| Cash and cash equivalents | 179,556 | 31,318 |

| 179,556 | 103,542 |

The maximum exposure to credit risk at the end of the reporting period is the carrying amount of each class of financial assets mentioned above.

Financial liabilities

| 2021 | 2020 | |

| Financial liabilities at amortised cost: | £ | £ |

| Trade payables | 35,443 | 8,003 |

| Borrowings | 762,686 | 853,152 |

| 798,129 | 861,155 |

| 2021 | 2020 | |

| Financial liabilities at fair value through profit and loss |

£ |

£ |

| Borrowings | 1,100,000 | 100,000 |

| 1,100,000 | 100,000 |

23. Financial risk management

23.1 Financial risk factors

The Company’s activities expose it to a variety of financial risks: market risk, credit risk and liquidity risk. The Company’s overall risk management programme focuses on the unpredictability of financial markets and seeks to minimise potential adverse effects on the Company’s financial performance.

Risk management is carried out by the executive management team.

a) Market risk

The Company is exposed to market risk, primarily relating to interest rate, foreign exchange and commodity prices. The Company does not hedge against market risks as the exposure is not deemed sufficient to enter into forward contracts. The Company has not sensitised the figures for fluctuations in interest rates, foreign exchange or commodity prices as the Directors are of the opinion that these fluctuations would not have a significant impact on the Financial Statements at the present time. The Directors will continue to assess the effect of movements in market risks on the Company’s financial operations and initiate suitable risk management measures where necessary.

b) Credit risk

Credit risk arises from cash and cash equivalents as well as outstanding receivables. To manage this risk, the Company periodically assesses the financial reliability of customers and counterparties.

The amount of exposure to any individual counter party is subject to a limit, which is assessed by the Board.

The Company considers the credit ratings of banks in which it holds funds in order to reduce exposure to credit risk. The Company will only keep its holdings of cash with institutions which have a minimum credit rating of ‘A’.

c) Liquidity risk

The Company’s continued future operations depend on the ability to raise sufficient working capital through the issue of equity share capital or debt. The Directors are reasonably confident that adequate funding will be forthcoming with which to finance operations. Controls over expenditure are carefully managed.

The following table summarizes the Company’s significant remaining contractual maturities for financial liabilities at 30 June 2021, and 30 June 2020.

| Contractual maturity analysis as at 30 June 2021

|

||||||

| Less than 12

Months £ |

1 – 5 Year £ |

Total £ |

||||

| Accounts payable | 35,443 | – | 35,443 | |||

| Accrued liabilities | 276,133 | – | 293,158 | |||

| Other creditor | 17,025 | – | 17,025 | |||

| STASCO Loan | – | 762,686 | 762,686 | |||

| 328,601 | 762,686 | 1,091,287 | ||||

|

Contractual maturity analysis as at 30 June 2020

|

||||||

| 1 – 5

Year £ |

Longer than

5 years £ |

Total £ |

||||

| Accounts payable | 8,003 | – | 8,003 | |||

| Accrued liabilities | 242,593 | – | 242,593 | |||

| STASCO Loan | – | 853,152 | 853,152 | |||

| 250,596 | 853,152 | 1,103,748 | ||||

23.2 Capital risk management

The Company’s objectives when managing capital are to safeguard the Company’s ability to continue as a going concern, in order to enable the Company to continue its exploration and development of oil and gas resources. In order to maintain or adjust the capital structure, the Company may adjust the issue of shares or sell assets to reduce debts.

The Company defines capital based on the total equity and reserves of the Company. The Company monitors its level of cash resources available against future planned operational activities and may issue new shares in order to raise further funds from time to time.

24. Commitments

The Company has entered into the following non-cancellable commitments in respect of exploration licences:

| 2021 | 2020 | |

| £ | £ | |

| Due within one year | 197,771 | 94,348 |

| Later than one year but not later than five years | 112,729 | 298,951 |

| Total commitments | 310,500 | 393,299 |

25. Events after the reporting period

The Company listed on the Alternative Investment Market (AIM) on the 15th July 2021. At the same time the Company placed 7,500,000 New Ordinary Shares to raise gross proceeds of £3,000,000.

On the 15th July 2021 the Company issued 125,000 new shares of 40p each to a supplier in part payment of an outstanding bill.

On 15th July all Convertible Loan Notes (“CLNs”) were converted in to ordinary shares at a price of 28 pence each. In total 3,928,572 ordinary shares were issued in full discharge of the CLNs.

On the 15th July the Company filed an addendum to the Pilot field Concept Select Report (“CSR”) with the Oil and Gas Authority (“OGA”). This followed the execution of an agreed work programme which included polymer core flood tests and work to reduce the carbon dioxide emissions from the project. The selected concept has now been revised to include a significant improvement in process heat management and power generation efficiency.

On the 29th November 2021 the Company received a “Letter of no objection” from the Oil and Gas Authority (“OGA”) in respect of the development concept for the Pilot field. This letter signals the finalisation of the “Assessment phase” and the entry into the “Authorisation phase” of development planning for the Pilot Field.

On 6th December 2021 the Company was awarded £466,667 by the OGA to evaluate a new concept for the electrification of key producing oil and gas fields initially focussing on Central Graben area fields owned and operated by others. Orcadian is working with Crondall Energy, Enertechnos, Petrofac, North Sea Midstream Partners (“NSMP”) and Wärtsilä; together the working group will undertake an evaluation of this concept and deliver a report to the OGA and Central Graben Operators by the end of March 2022. The evaluation will include a commercial proposal for the delivery of electrical power to Central Graben and Central North Sea Operators interested in rapidly implementing electrification of their platforms.