The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulations (EU) No. 596/2014 (MAR). Upon the publication of this announcement via Regulatory Information Service (RIS), this inside information is now considered to be in the public domain.

30 March 2023

Orcadian Energy plc

(“Orcadian Energy”, “Orcadian” or the “Company”)

Results for the half year ended 31 December 2022

Orcadian Energy (AIM: ORCA), the low-emissions North Sea focused oil and gas development company, is pleased to announce its unaudited results for the six months ended 31 December 2022.

Activity Focus:

- To improve the technical and commercial definition of the Pilot development project

- To seek partners and finance for the Pilot development project

- To maximise the value in our satellite discoveries and prospects

- To prepare applications for new opportunities in the 33rd Round, now submitted

Highlights:

- Secured a one-year extension to the P2244 licence, which includes the Pilot project

- Completed a revision of the technical resources on Pilot which resulted in a 18.4% upgrade to the P50 case (management estimates)

- Entered into a Memorandum of Understanding with SLB (formerly Schlumberger) for the exclusive provision of drilling and completion services and equipment for the Pilot project

- Progressed the reprocessing of the Catcher North seismic survey with TGS and started quantitative interpretation work

- Prepared 33rd Round applications (submitted 12 January 2023) which included a 114 bcf gas discovery and a 153 bcf near drill-ready prospect.

- Identified two new low-risk exploration prospects with P50 prospective resources of 120 MMbbl and 70 MMbbl (management estimates, after the reporting period)

- Since the end of the period under review, initial agreement reached with Rapid for the disposal of the Crinan and Dandy discoveries; and

- Raised £500k before expenses on February 1 2023

Steve Brown, Orcadian’s CEO, commented:

“The second half of 2022 was dominated by political and fiscal turmoil. We all hope for calmer waters in 2023. Our absolute focus is to find a farm-in partner or a new owner for Pilot and our intention is to elicit offers during 2Q and 3Q of 2023 so that a new operator can take the project forward; a project which will help deliver a secure transition for the UKCS.

“We are in active discussions with potential new investors as Orcadian needs additional working capital to secure the best deal for shareholders on Pilot.

“Those discussions have been buoyed by the identification of two new prospects on our licences which have been illuminated by the quantitative interpretation work done for us by TGS. These prospects are likely to contain a lighter oil than seen on Pilot and have a very high chance of success as well as a relatively low cost to drill. We will update shareholders on these discussions as soon as possible.”

For further information on the Company please visit the Company’s website: https://orcadian.energy

Contact:

|

Orcadian Energy plc |

+ 44 20 7920 3150 |

|

Steve Brown, CEO Alan Hume, CFO |

|

| WH Ireland (Nomad and Joint Broker) | +44 20 7220 1666 |

|

Katy Mitchell / Andrew de Andrade (Nomad) Harry Ansell / Fraser Marshall (Corporate Broking)

|

|

| Tavistock (PR) | + 44 20 7920 3150 |

| Nick Elwes / Simon Hudson | [email protected] |

Qualified Person’s Statement

Pursuant to the requirements of the AIM Rules and in particular, the AIM Note for Mining and Oil and Gas Companies, Maurice Bamford has reviewed and approved the technical information and resource reporting contained in this announcement. Maurice has more than 33 years’ experience in the oil & gas industry and 3 years in academia. He holds a BSc in Geology from Queens University Belfast and a PhD in Geology from the National University of Ireland. Maurice is a Fellow of the Geological Society, London, and a member of the Petroleum Exploration Society of Great Britain. He is Exploration and Geoscience Manager at Orcadian Energy.

About Orcadian Energy

Orcadian is a North Sea focused, low emissions, oil and gas development company. In planning its Pilot development, Orcadian has selected wind power to transform oil production into a cleaner and greener process. The Pilot project is on a timeline for approval and we anticipate it will be amongst the lowest carbon emitting oil production facilities in the world, despite being a viscous crude. Orcadian may be a small operator, but it is also nimble, and the Directors believe it has grasped opportunities that have eluded some of the much bigger companies. As we strike a balance between Net Zero and a sustainable energy supply, Orcadian intends to play its part to minimise the cost of Net Zero and to deliver reliable organic energy.

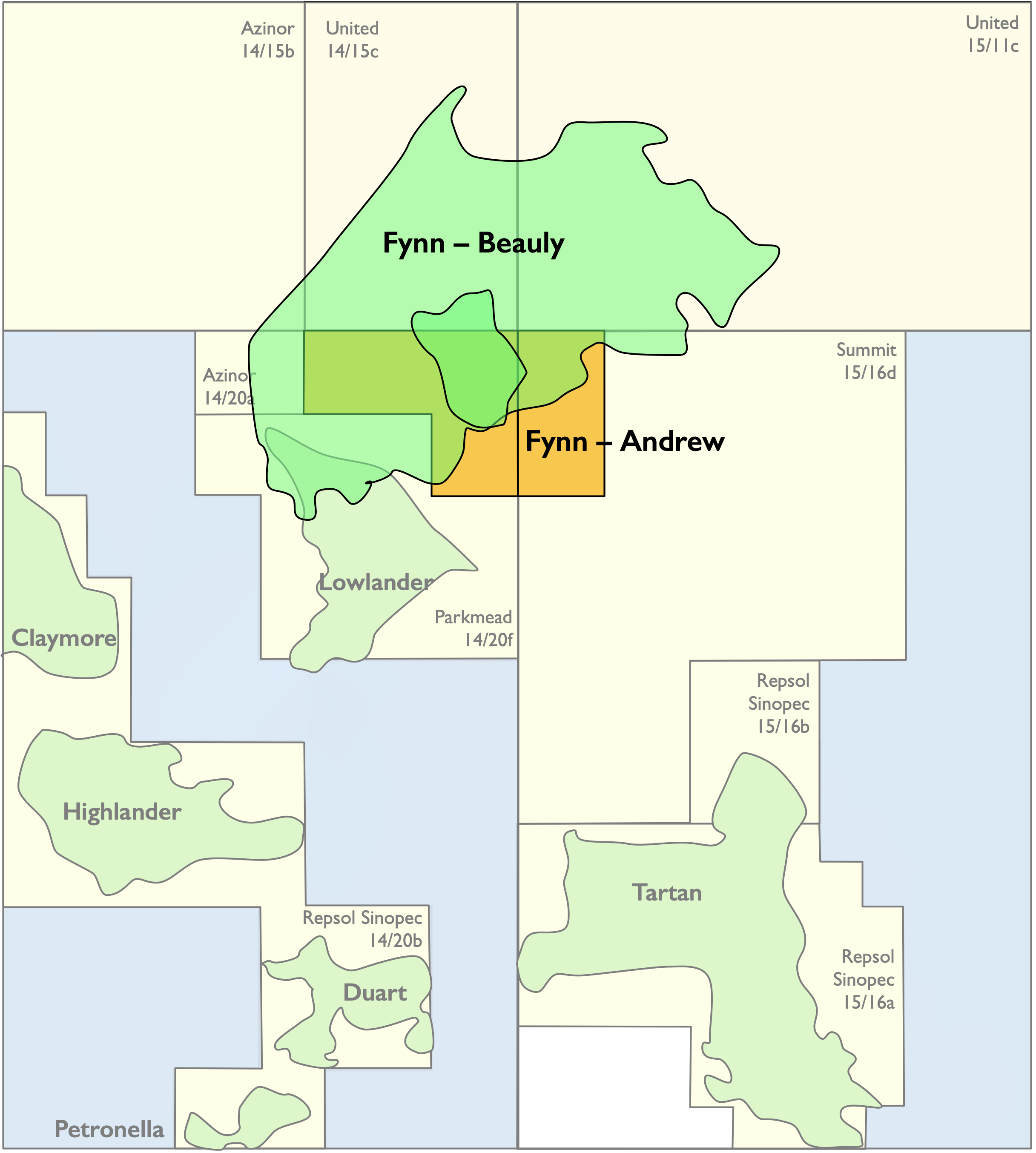

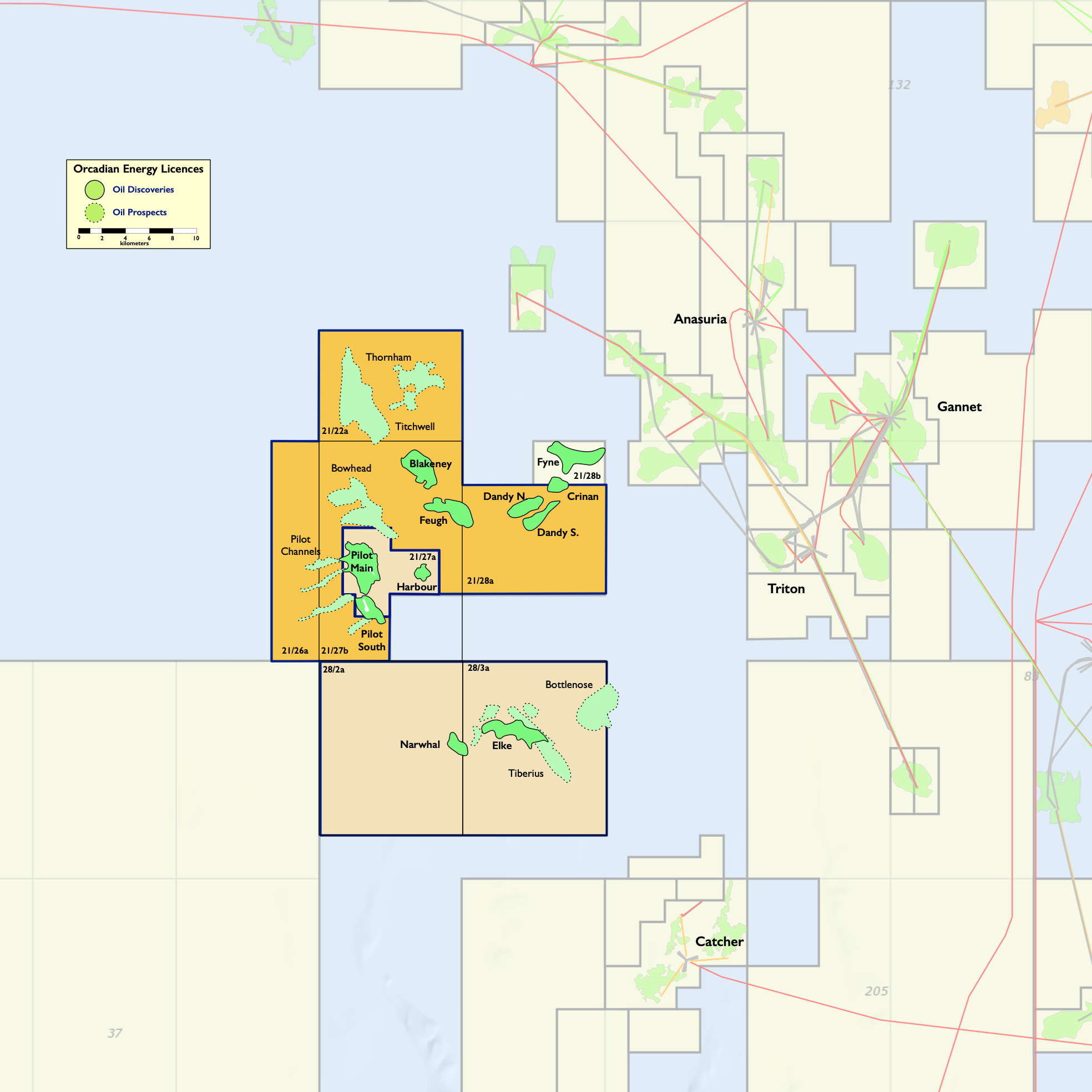

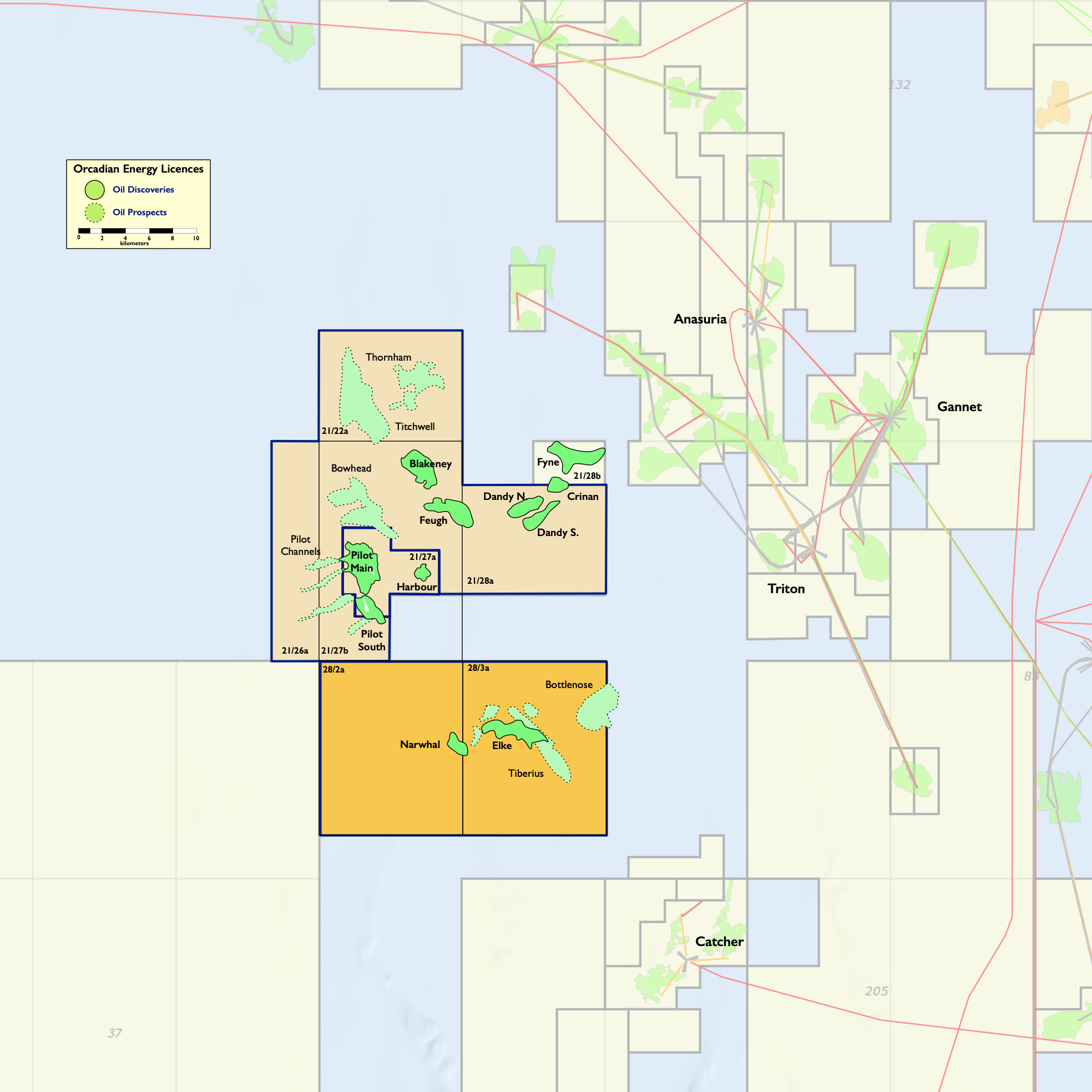

Orcadian Energy (CNS) Ltd (“CNS”), Orcadian’s operating subsidiary, was founded in 2014 and is the sole licensee of P2244, which contains 78.8 MMbbl of 2P Reserves in the Pilot discovery, and of P2320 and P2482, which contain a further 77.8 MMbbl of 2C Contingent Resources in the Elke, Narwhal and Blakeney discoveries (as audited by Sproule, see the CPR in the Company’s Admission Document for more details). Within these licences there are also 191 MMbbl of unrisked Prospective Resources. These licences are in blocks 21/27, 21/28, 28/2 and 28/3, and lie 150 kms due East of Aberdeen. The Company also has a 50% working interest in P2516, which contains the Fynn discoveries. P2516 is administered by the Parkmead Group and covers blocks 14/20g and 15/16g, which lie midway between the Piper and Claymore fields, 180 kms due East of Wick.

Pilot, which is the largest oilfield in Orcadian’s portfolio, was discovered by Fina in 1989 and has been well appraised. In total five wells and two sidetracks were drilled on Pilot, including a relatively short horizontal well which produced over 1,800 bbls/day on test. Orcadian’s proposed low emissions, field development plan for Pilot is based upon a Floating Production Storage and Offloading vessel (FPSO), with over thirty wells to be drilled by a Jack-up rig through a pair of well head platforms and provision of power from a floating wind turbine.

Emissions per barrel produced are expected to be about an eighth of the 2020 North Sea average, and less than half of the lowest emitting oil facility currently operating on the UKCS. On a global basis this places the Pilot field emissions at the low end of the lowest 5% of global oil production.

Chairman & CEO’s Statement

The second half of 2022 was an extraordinary time in British politics. The turbulence caused by the unseating of Boris Johnson, followed rapidly by the defenestration of Liz Truss, and the installation of Rishi Sunak had an immense impact on the energy industry. In short, that political and fiscal turmoil ensured that 2022 was a year in which many oil companies chose not to commit to new projects.

We are optimistic that 2023 will be different, and will be the year that the UK government, and opposition alike, realise the vital role that the UK’s oil and gas industry has to play in delivering a secure transition. The UK government’s and Climate Change Committee’s forecasts of oil and gas demand rely on the UK importing that energy from overseas. Exporting emissions and stifling the development of low-carbon production technologies seems entirely counterproductive to rational climate goals. The Company’s flagship project Pilot has the potential to be a leading-edge, low-carbon development and we estimate emissions can be as low as 2.6 kgCO2e/bbl , against a North Sea average of 25 kgCO2e/bbl.

The UK oil and gas industry can lead a transformation in how offshore oil and gas is produced so that global emissions from the production process are driven down. the people in the oil and gas sector have the skills, energy, and enthusiasm to do this and to make the UK a leader in using wind power to power the North Sea. The establishment of the Department for Energy Security and Net Zero will, we hope, deliver the right focus on a secure transition that will actually reduce, rather than displace, global emissions, boost domestic energy production and deliver good jobs.

We were initially encouraged by the structure of the Energy Profits Levy (“EPL”) as it had clearly, and cleverly, been designed to be both temporary and to encourage upstream investments. The second incarnation of EPL has continued that encouragement to invest and the inclusion of a decarbonisation allowance is very supportive of our plans to deploy a floating wind turbine to provide the bulk of the electrical power the Pilot development needs.

The structure of the windfall tax is significantly advantageous to companies that are already producing and paying taxes in the UK Continental Shelf. For example, a producing company’s financial exposure is just 25% of the capital cost to first oil on a new prospect or development, whilst for a non-producing company the exposure is 100% of the capital cost[1]. The impact on Orcadian is clear, we will focus on attracting UK producing and tax paying companies as partners in, or new owners for, the Pilot development. We do have another approach to financing the development, which is to find investors willing to furnish the required facilities in return for a tariff or day rate. This infrastructure financing arrangement could create a very attractive project for investors, and we are now preparing to engage with specific funding and contracting parties based in the Middle East.

We are working hard on both strategies. We are committed to seeing the Pilot project developed and we will do everything in our power to chart a path forward for the very significant resource we have under licence.

Management’s estimated resource for the Pilot reservoir grew by over 18% in the reporting period. This was largely down to an increase in the mapped oil-in-place which emerged as we interpreted the newly reprocessed seismic which we had licensed from TGS in June 2022. Part of the resource upgrade was also founded upon the reservoir modelling work we did which has given us an excellent understanding of how polymer flood works on a field like Pilot. However, we do not rely solely upon reservoir models, we are constantly reviewing the performance of analogue fields and we have been massively encouraged by the success enjoyed by Ithaca on Captain in the North Sea, Hilcorp on the Milne Point project in Alaska and CNRL on the Britnell/Pelican Lake project in Alberta. Every projection we make for production performance is benchmarked against the performance of these projects. Our production forecasts are typically more conservative than the actual results from these analogues.

The Captain reservoir, operated by Ithaca, is the field most like Pilot. Both are offshore, lying about 3000’ below the sea, are cool at 31ºC, have excellent and similar porosity, permeability and net to gross characteristics. The Pilot oil is somewhat more viscous than Captain, but the projects at Milne Point and Pelican Lake are successful with oil viscosities both similar to and substantially higher than we see in Pilot. The Captain polymer flood project has blazed a trail for the Pilot development. Ithaca, and Chevron before them, have solved the technical and logistical challenges of implementing an offshore polymer flood and we follow everything they report avidly.

In February 2023 we attended and presented at a polymer conference hosted by SNF in Aberdeen and we were delighted to hear that Ithaca were enjoying “consistent success across the Captain reservoir development”. We remain convinced that polymer flooding is the right solution for developing viscous oil on the UKCS, and we believe it is one of few opportunities for the industry to maintain production given that about 8 billion barrels of discovered viscous oil in place remains undeveloped. Encouraging polymer floods of these viscous oil discoveries should be a key plank of the UK government’s energy security strategy.

The prize on the Pilot development has been confirmed and enhanced by the technical work we did in 2022. 2023 is the year we need to deliver this project into new tax advantaged hands.

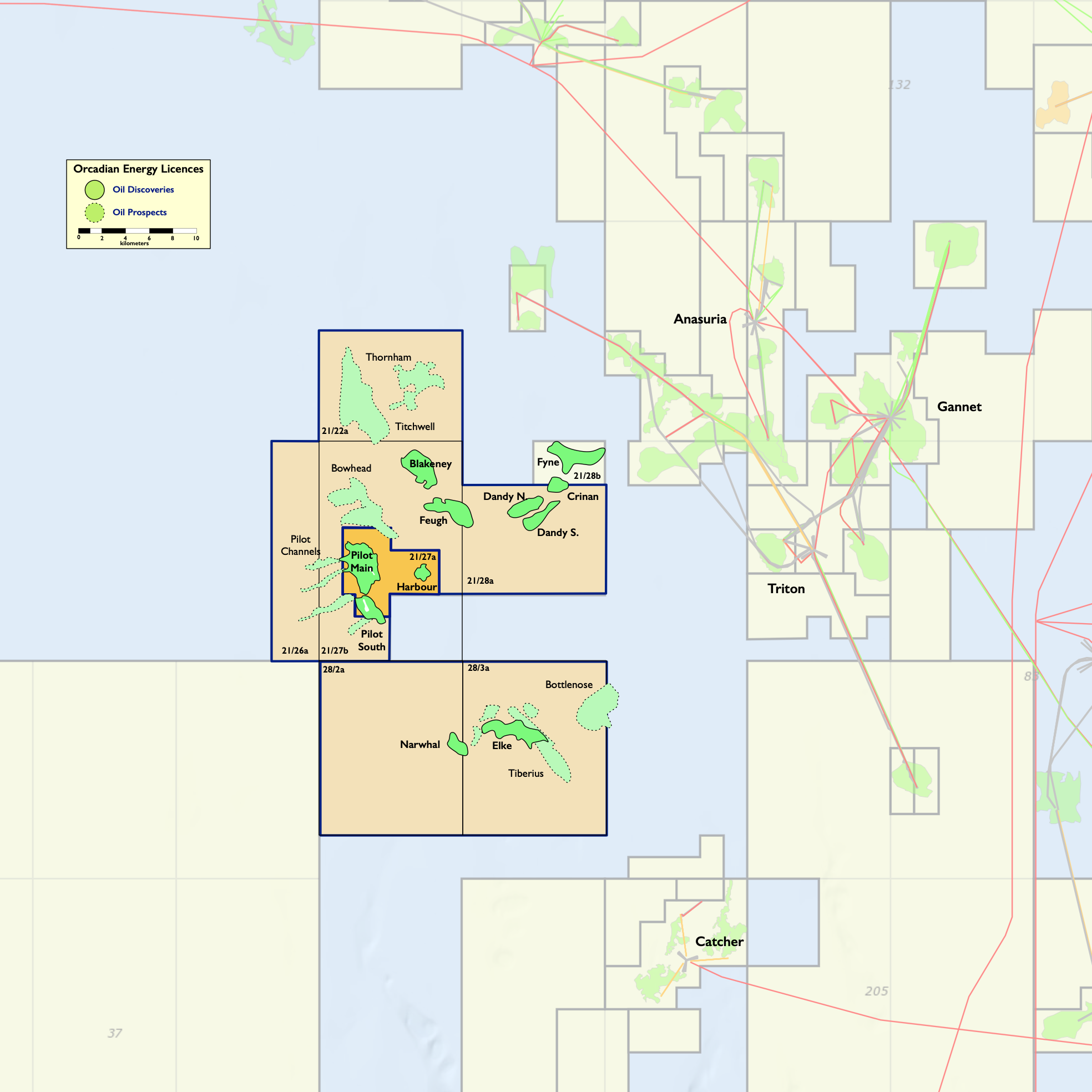

The work we have done with TGS has been revelatory and has far exceeded our internal expectations. When we licensed over 2,000 km2 of the best quality data available in the area, and asked TGS to reprocess both the Catcher North and Catcher surveys, we had high hopes that we would get encouragement that Carra and Bowhead would be drillable targets and that we could farm these prospects out.

TGS has employed a seismic attribute analysis, which they have been developing over recent years, that can distinguish lithology and fluid fill when certain conditions are met. Being able to identify fluid fill with a high degree of certainty is the Holy Grail of seismic interpretation. The TGS technique was originally designed for use in frontier basins that lack significant well coverage, since it did not require any local well information. In extensively drilled areas, such as on Orcadian’s Western Platform acreage, this is equally beneficial, but in a different way. Actual well results can be used to check the predictive ability of the technique and give statistically based guidance to the geological chance of success.

Where we have mapped the Tay play (the fairway that we are focussed on) with the new seismic attribute, twenty-seven out of twenty-seven reservoir penetrations were correctly predicted by the attribute, across changing geological conditions. We see this as highly significant especially since the technique was not conditioned with local well data.

Work is currently ongoing, but the results to date have completely reshaped and reinvigorated our exploration strategy for the area. We have now identified two exciting and deeper prospects, each likely to contain a significantly less viscous oil than in Pilot. Based on preliminary mapping, one has a P50 prospective resource of 120 MMbbl, the other 70 MMbbl. Additional geophysical modelling work has also explained why these prospects had not been high-graded with the previously used seismic attributes.

We have requested from NSTA, a further extension to Phase A of the P2320 licence, which contains Feugh and Bowhead, to provide additional time to secure a well commitment on the licence (see the Company’s announcement dated 22 March 2022 for more details on this licence).

The attribute that TGS has mapped for us over our Tay play fairway is called relative Extended Elastic Impedance, or rEEI for short. For the more technically minded of you we recommend the paper “Practical application of global siliciclastic rock property trends to AVA interpretation in frontier basins” by Dave Went, of TGS. (Link: https://www.tgs.com/articles/global-siliciclastic-rock-property-to-ava-interpretation)

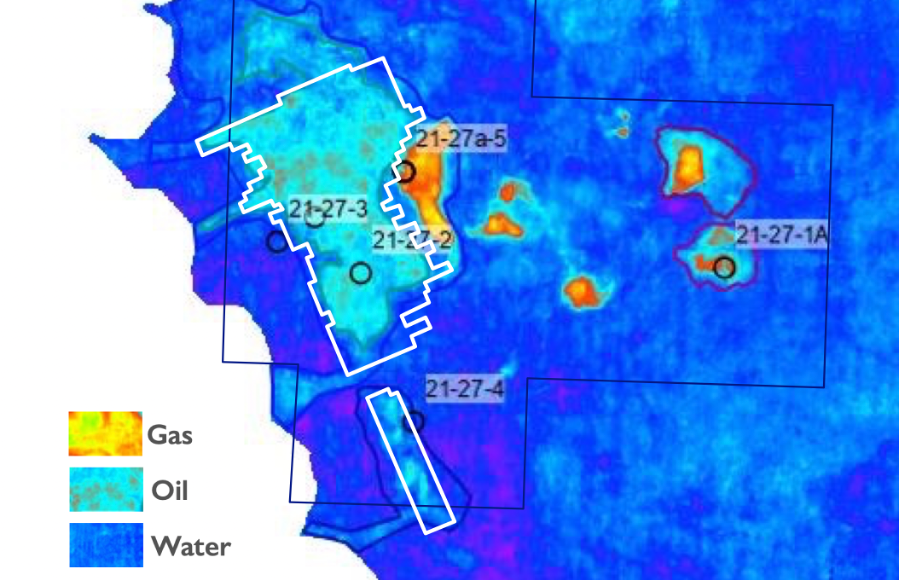

We illustrate the results we have seen with the map below. This is an image of the rEEI response over the Pilot reservoir with our proposed drilling envelope superimposed. This outline shows where we intend to place both production and injection wells and predated the rEEI attribute analysis.

Image reproduced with the kind permission of TGS

Gas caps are easy to spot; gas filled sand creates a high amplitude response and is obvious on virtually any seismic attribute. This is just as true for rEEI and the orange-red response clearly identifies the gas cap in the east of Pilot itself as well as a number of small four-way dip closed structures to the east of Pilot, including the Harbour discovery, well 21/27-1A.

Shales and brine filled sands both show up as dark blue on this display as they are difficult to distinguish, one from the other, with the rEEI technique at shallow depths. Oil filled sands show up as cyan with a brown/orange speckle. The conformity of the seismically predicted oil-bearing sands with our previous structurally based interpretation is extraordinary. The channels which feed sand into the Pilot field are crystal clear and the path taken by the channel which separates Pilot Main from Pilot South is consistent with the model we had developed to explain the almost 90 feet difference in oil water contacts between Pilot Main and Pilot South. Previously we could not image the cause of the barrier between the two pools.

We are of course committed to finding a development or financing partner for Pilot and success in farming out the Pilot project would be transformational for the Company, but to add to that we have uncovered a significant prospective resource with a very high geological chance of success right on our own doorstep.

Whilst the Company is considering all options at this stage, any disposal of Licence P2244 and the Pilot project would likely be a fundamental disposal pursuant to Rule 15 of the AIM Rules for companies. Such a disposal would therefore be conditional on the consent of shareholders; and require both an announcement and the publication of a shareholder circular detailing the potential disposal. Further announcements will be made in due course if this option is pursued by the Company.

Clearly, and as we noted when we completed a small fundraise at the beginning of February, the Company needs to raise additional funds in the near term for working capital and also to repay the loan facility with Shell of c. £1m which is due to be repaid in August 2023. We can confirm we are in active discussions with a number of financing counterparties in respect of that requirement, and the addition of this exciting exploration strategy will be very helpful to our success in those financing discussions. We will also update shareholders as these discussions progress.

Finally, I would also like to take this opportunity to thank all our shareholders for their continued support and look forward to providing further updates as appropriate on what we believe will be a key year for the Company and the development of Pilot.

| Joe Darby | Steve Brown |

| Chairman | CEO |

| 29 March 2023 | 29 March 2023 |

CONSOLIDATED STATEMENT OF COMPREHENSIVE LOSS

FOR THE SIX MONTHS ENDED 31 DECEMBER 2022

| Unaudited

6 Month Period Ended 31 December 2022 |

Unaudited

6 Month Period Ended 31 December 2021 |

Audited

12 Month Period Ended 30 June 2022 |

||

| Note | £ | £ | £ | |

| Administrative expenses | (455,196) | (519,650) | (1,694,576) | |

| Operating Loss | (455,196) | (519,650) | (1,694,576) | |

| Finance costs | (36,493) | (19,277) | (41,869) | |

| Other income | 2,187 | – | 466,667 | |

| Listing costs | – | (325,449) | (316,949) | |

| Loss before tax | (489,503) | (864,376) | (1,586,727) | |

| Taxation | – | – | – | |

| Loss for the period | (489,503) | (864,376) | (1,586,727) | |

| Other comprehensive income: | ||||

| Items that will or may be reclassified to profit or loss: | ||||

| Other comprehensive income | – | – | – | |

| Total comprehensive income | (489,503) | (864,376) | (1,586,727) | |

| Basic and Diluted Earnings per share | 4 | (0.74p) | (1.38p) | (2.51p) |

All operations are continuing.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2022

| Unaudited

as at 31 December 2022 |

Unaudited

as at 31 December 2021 |

Audited

as at 30 June 2021 |

||

| Note | £ | £ | £ | |

| Non-current assets | ||||

| Property, plant and equipment | 3,264 | 1,842 | 3,414 | |

| Intangible assets | 5 | 3,768,546 | 2,694,666 | 3,303,400 |

| 3,771,810 | 2,696,508 | 3,306,814 | ||

| Current assets | ||||

| Trade and Other Receivables | 6 | 58,689 | 63,217 | 1,055,829 |

| Cash and cash equivalents | 225,446 | 1,517,902 | 271,439 | |

| 284,135 | 1,581,119 | 1,327,268 | ||

| Total assets | 4,055,945 | 4,277,627 | 4,634,082 | |

| Non-current liabilities | ||||

| Borrowings | 7 | – | (815,185) | (956,184) |

| – | (815,185) | (956,184) | ||

| Current liabilities | ||||

| Trade and Other Payables | 8 | (428,381) | (516,902) | (553,509) |

| Borrowings | 7 | (992,678) | – | – |

| (1,421,059) | (516,902) | (553,509) | ||

| Total liabilities | (1,421,059) | (1,332,087) | (1,509,693) | |

| Net assets | 2,634,886 | 2,945,540 | 3,124,389 | |

|

Equity Ordinary share capital |

9 | 66,612 | 63,755 | 63,755 |

| Share premium | 9 | 4,788,432 | 3,890,089 | 3,890,089 |

| Share warrants reserve | 9 | 15,000 | 15,000 | 15,000 |

| Shares to be issued | 9 | – | – | 901,200 |

| Reverse Acquisition Reserve | 3 | (38,848) | (38,848) | (38,848) |

| Retained earnings | (2,196,310) | (984,456) | (1,706,807) | |

| Total equity | 2,634,886 | 2,945,540 | 3,124,389 |

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTH PERIOD ENDED 31 DECEMBER 2022

| Ordinary Share capital | Share premium | Share warrants reserve |

Shares to be issued |

Reverse Acquisition Reserve | Retained earnings | Total | ||

| Note | £ | £ | £ | £ | £ | £ | £ | |

| Balance as at 1 July 2021 (audited) | 52,202 | – |

– |

– |

(38,848) |

(120,080) | (106,726) | |

| Loss for the period and total comprehensive income | – | – | – | – | – | (864,376) | (864,376) | |

| Issue of shares | 9 | 7,625 | 3,042,375 | – | – | – | – | 3,050,000 |

| Share issue costs | 9 | – | (233,358) | – | – | – | – | (233,358) |

| Conversion of loans | 9 | 3,928 | 1,096,072 | – | – | – | – | 1,100,000 |

| Issue of warrants | 9 | – | (15,000) | 15,000 | – | – | – | – |

| Balance as at 31 December 2021 (unaudited) | 63,755 | 3,890,089 | 15,000 | – | (38,848) | (984,456) | 2,945,540 | |

| Loss for the period and total comprehensive income | – | – |

– |

– |

– |

(722,351) | (722,351) | |

| Shares to be issued | 9 | – | – | – | 901,200 | – | – | 901,200 |

| Balance as at 30 June 2022 (audited) | 63,755 | 3,890,089 |

15,000 |

901,200 |

(38,848) |

(1,706,807) | 3,124,389 | |

| Loss for the period and total comprehensive income | – | – | – | – | – | (489,503) | (489,503) | |

| Issue of shares | 9 | 2,857 | 997,143 | – | (1,000,000) | – | – | 1,000,000 |

| Share issue costs | 9 | – | (98,800) | – | 98,800 | – | – | – |

| Balance as at 31 December 2022 (unaudited) | 66,612 | 4,788,432 | 15,000 | – | (38,848) | (2,196,310) | 2,634,886 |

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTH PERIOD ENDED 31 DECEMBER 2022

| Unaudited

6 Month Period Ended 31 December 2022 |

Unaudited

6 Month Period Ended 31 December 2021 |

Audited

12 Month Period Ended 30 June 2022 |

||

| Note | £ | £ | £ | |

| Cash flows from operating activities | ||||

| Loss before tax for the year | (489,503) | (864,376) | (1,586,727) | |

| Adjustments for: | ||||

| Depreciation | 150 | – | 674 | |

| Unrealised foreign exchange loss (gain) | – | 33,222 | 151,629 | |

| (Increase) / decrease) in trade and other receivables | 6 | (2,859) | 25,331 | 32,720 |

| (Decrease) / Increase in trade and other payables | 8 | (60,714) | (24,928) | 36,000 |

| Finance costs in the period | 36,493 | 19,277 | 41,869 | |

| Net cash flows from operating activities | (516,433) | (811,474) | (1,323,836) | |

| Investing activities | ||||

| Purchases of property, plant and equipment | – | – | (2,246) | |

| Purchases of exploration and evaluation assets | 5 | (430,760) | (666,822) | (1,348,677) |

| Net cash used in investing activities | (430,760) | (666,822) | (1,350,677) | |

| Financing activities | ||||

| Proceeds from issue of ordinary share capital | 9 | 1,000,000 | 3,000,000 | 3,000,000 |

| Share issue costs paid | 9 | (98,800) | (183,358) | (233,358) |

| Net cash used in financing activities | 901,200 | 2,816,642 | 2,766,642 | |

| Net (decrease) / increase in cash and cash equivalents | (45,993) | 1,338,346 | 91,883 | |

| Cash and cash equivalents at beginning of period | 271,439 | 179,556 | 179,556 | |

| Cash and cash equivalents and end of period | 225,446 | 1,517,902 | 271,439 |

Significant non-cash transactions:

There were no significant non-cash transactions during the period.

NOTES TO THE FINANCIAL STATEMENTS

- General Information

Orcadian Energy PLC (the “Company”) is a public limited company which is domiciled and incorporated in England and Wales under the Companies Act 2006 with the registered number 13298968. The Company’s registered office is 6th floor, 60 Gracechurch Street, London, EC3V 0HR, and it ordinary shares are admitted to trading on AIM, a market of the London Stock Exchange.

The principal activity of the Group is managing oil and gas assets and the Group holds a 100% interest in, and is licence administrator for, UKCS Seaward Licences P2244, which contains the Pilot and Harbour heavy oil discoveries, P2320, which contains the Blakeney, Feugh, Dandy & Crinan discoveries and P2482 which contains the Elke and Narwhal discoveries. The Group also has a 50% working interest in P2516, which contains the Fynn discoveries. P2516 is administered by the Parkmead Group and covers blocks 14/20g and 15/16g, which lie midway between the Piper and Claymore fields.

- Summary of significant accounting policies

The principal accounting principles applied in the preparation of these financial statements are set out below. These principles have been consistently applied to all years presented, unless otherwise stated.

- Basis of preparation

The interim financial information set out above does not constitute statutory accounts within the meaning of the Companies Act 2006. It has been prepared on a going concern basis in accordance with UK-adopted international accounting standards. Statutory financial statements for the year ended 30 June 2022 were approved by the Board of Directors on 15 December 2022 and delivered to the Registrar of Companies. The report of the auditors on those financial statements was unqualified.

The interim financial information for the six months ended 31 December 2022 has not been reviewed or audited. The interim financial report has been approved by the Board on 28 March 2023.

- Going concern

The financial statements have been prepared on a going concern basis. The Group is not yet revenue generating and an operating loss has been reported. The Group has historically been reliant on raising finance, both debt and equity, to enable it to meet its obligations as they fall due.

The Directors have reviewed a detailed forecast based on the funds expected to be raised and forecasted expenditure, including all required spend to meet licence requirements. This forecast has been stress tested by management in reaching their going concern conclusion. Having made due and careful enquiry, the Directors acknowledge that funds will need to be raised within the next 12 months to enable the Group to meets its obligations as they fall due, however, the Directors are confident that the required funds will successfully be raised through the equity market to funds its operations over the next 12 months.

The Directors, therefore, have made an informed judgement, at the time of approving financial statements, that the Group is a going concern but they acknowledge that the dependence on raising further funds during the next 12 months represents a material uncertainty.

- Risks and uncertainties

The Board continuously assesses and monitors the key risks of the business. The key risks that could affect the Company’s medium term performance and the factors that mitigate those risks have not substantially changed from those set out in the Company’s 2022 Annual Report and Financial Statements, a copy of which is available on the Company’s website: https://orcadian.energy. The key financial risks are securing finance for the Pilot project and an emerging cost inflation risk.

- Critical accounting estimates

The preparation of interim financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the end of the reporting period. Significant items subject to such estimates are set out in note 3 of the Company’s 2022 Annual Report and Financial Statements. The nature and amounts of such estimates have not changed significantly during the interim period.

The accounting policies applied are consistent with those of the annual financial statements for the year ended 30 June 2022, as described in those annual financial statements.

- Group reorganisation under common control

The acquisition in the year ended 30 June 2021 met the definition of a group reorganisation due to the Company and the subsidiary being under common control at the date of acquisition. As a result, and since Orcadian Energy Plc did not meet the definition of a business per IFRS 3, the acquisition fell outside of the scope of IFRS 3 and the predecessor value method was used to account for the acquisition.

These consolidated financial statements for the period ended 31 December 2022 are of the Company’s wholly owned subsidiary, Orcadian Energy (CNS) Ltd.

On 11 May 2021, the Company issued 52,201,601 shares to acquire the entire issued share capital of Orcadian Energy (CNS) Ltd.

The net assets of Orcadian Energy (CNS) Ltd at the date of acquisition was as follows:

| £ | |

| Property Plant & Equipment | 1,357 |

| Intangible Assets | 1,719,292 |

| Current Assets | 447,425 |

| Current Liabilities | (284,745) |

| Non-Current Liabilities | (1,869,975) |

| Net assets | 13,354 |

The reserve that arose from the acquisition is made up as follows:

| £ | |

| As at 31 December 2020 | – |

| Cost of the investment in Orcadian Energy (CNS) Ltd | 52,202 |

| Less: net assets of Orcadian Energy (CNS) Ltd at acquisition | (13,354) |

| As at 30 June 2021 (audited) and as at 31 December 2021 (unaudited) | 38,848 |

- Earnings per share

The calculation of the basic and diluted earnings per share is calculated by dividing the loss for the year for continuing operations for the Company by the weighted average number of ordinary shares in issue during the year.

Dilutive loss per Ordinary Share equals basic loss per Ordinary Share as, due to the losses incurred in all three periods presented, there is no dilutive effect from the subsisting share warrants.

| Unaudited

6 Month Period Ended 31 December 2022 |

Unaudited

6 Month Period Ended 31 December 2021 |

Audited

12 Month Period Ended 30 June 2021 |

|

| £ | £ |

£ |

|

| Loss for the purposes of basic earnings per share being net loss attributable to the owners | (489,503) | (864,376) | (1,586,727) |

| Weighted average number of Ordinary Shares | 66,519,149 | 62,809,231 | 63,278,315 |

| Loss per share | (0.74p) | (1.38p) | (2.51p) |

The weighted average number of shares is adjusted for the impact of the acquisition as follows:

- Intangible assets

| Oil and gas exploration assets | |

| £ | |

| Cost | |

| As at 30 June 2021 (audited) | 1,814,615 |

| Additions | 880,051 |

| As at 31 December 2021 (unaudited) | 2,694,666 |

| Additions | 608,734 |

| As at 30 June 2022 (audited) | 3,303,400 |

| Additions | 465,146 |

| As at 31 December 2022 (Unaudited) | 3,768,546 |

- Trade and other receivables

| Group | Unaudited

as at 31 December 2022 |

Unaudited

as at 31 December 2021 |

Audited

as at 30 June 2022 |

| £ | £ | £ | |

| VAT receivable | 55,188 | 63,217 | 55,829 |

| Other receivables | 3,500 | – | 1,000,000 |

| 58,688 | 63,217 | 1,055,829 |

- Borrowings

| Unaudited

as at 31 December 2022 |

Unaudited

as at 31 December 2021 |

Audited

as at 30 June 2022 |

|

| £ | £ | £ | |

| STASCO Loan | 992,678 | 815,185 | 956,184 |

| 992,678 | 815,185 | 956,184 | |

| Current liabilities | 992,678 | – | – |

| Non-current liabilities | – | 815,185 | 956,184 |

- Trade and other payables – due within one year

| Unaudited

as at 31 December 2022 |

Unaudited

as at 31 December 2021 |

Audited

as at 30 June 2022 |

|

| £ | £ | £ | |

| Trade payables | 177,849 | 294,918 | 184,636 |

| Accruals | 250,532 | 191,049 | 334,631 |

| Other creditor | – | 30,935 | 34,242 |

| 428,381 | 516,902 | 553,509 |

- Ordinary share capital and share premium

| Group | |||

| Issued | Number of shares | Ordinary share capital

£ |

Share

premium £ |

| As at 30 June 2021 (audited) | 52,201,602 | 52,202 | – |

| Issue of shares | 7,625,000 | 7,625 | 3,042,375 |

| Share issue costs | – | – | (233,358) |

| Conversion of loans | 3,928,572 | 3,928 | 1,096,072 |

| As at 31 December 2021 (unaudited) | 63,755,174 | 63,755 | 3,905,089 |

| As at 30 June 2022 (audited) | 63,755,174 | 63,755 | 3,890,089 |

| Issue of shares | 2,857,143 | 2,857 | 997,143 |

| Share issue costs | – | – | (98,800) |

| As at 31 December 2022 (unaudited) | 66,612,317 | 66,612 | 4,788,432 |

On 6 July 2022, the Company issued 2,857,143 ordinary shares of the Company at 35 pence each. At 30 June 2022, these shares were recorded on the statement of financial position as Shares to be issued. The value of the Shares to be issued reserve reflected the gross proceeds of the share placement of £1,000,000, less £98,800 of accrued share issue costs. Upon completion on 6 July 2022 the net value of Shares to be issued was re-allocated to Share capital and Share premium.

On 15 July 2021 the Company placed 7,500,000 New Ordinary Shares (“the Raise”) at 40p each to raise gross proceeds of £3,000,000, and also issued 125,000 new shares at 40p each to a supplier in part payment of an outstanding bill.

On 15 July 2021 all Convertible Loan Notes (“CLNs”) were converted in to ordinary shares at a price of 28 pence each. In total 3,928,572 ordinary shares were issued in full discharge of the CLNs.

The ordinary shares confer the right to vote at general meetings of the Company, to a repayment of capital in the event of liquidation or winding up and certain other rights as set out in the Company’s articles of association.

On 15 July 2021 the Company issued 75,000 warrants over ordinary shares of the Company at 40 pence each, exercisable at any time over a three year period from the date of issue. The warrants were valued using the Black-Scholes pricing model. The inputs into the Black-Scholes model are as follows:

| Grant date | 15 July 2021 |

| Exercise price | 40.00 pence |

| Expected life | 3 years |

| Expected volatility | 77.32% |

| Risk free rate of interest | 0.0242% |

| Dividend yield | Nil |

| Fair value of option | 20.00 pence |

Volatility has been estimated based on the historic volatility of a collection of comparable companies over a period equal to the expected term from the grant date.

- Events after the reporting period

Since 31 December 2022, the Company has been focussed on the following activities:

- Identification of two new prospects with P50 prospective resources of 120 MMbbl and 70 MMbbl (management estimates);

- Increase in P50 technically recoverable resources at the Pilot field to 97 MMbbl (management estimates);

- Signing of a non-binding heads of terms for the disposal of non-core projects Crinan and Dandy;

- Lodged three licence applications in the 33rd Offshore licencing round;

- Completion of share placement raising £500,000 before costs through the issue of 5 million ordinary shares at 10 pence per share.

[1] More information on the UK Government’s windfall tax scheme can be found here: https://www.gov.uk/government/publications/autumn-statement-2022-energy-taxes-factsheet/energy-taxes-factsheet