10 March 2025

Orcadian Energy plc

(“Orcadian” or the “Company”)

Results for the half year ended 31 December 2024

Orcadian Energy (AIM: ORCA), the North Sea focused oil and gas development company, is pleased to announce its unaudited results for the six months ended 31 December 2024.

Highlights:

- Completed the acquisition of HALO Offshore UK Ltd (“HALO”) and agreed the sale of a 50% interest in HALO to The Independent Power Corporation PLC (“IPC”)

- Agreed the terms for a disposal of a 50% interest in licence P2680, which includes the Earlham project, to The Marine Low Carbon Power Company Ltd (“MLCP”)

- Upon completion, all costs associated with the remaining 50% interest in Earlham to be carried by MLCP until first production from Earlham

- These agreements cement the important and consequential relationship the Company has developed with IPC and MLCP

Post period Highlights:

- Completed the sale of a 50% interest in HALO to IPC and entered into a shareholders’ agreement and a financing agreement

Activity Focus:

- To identify and negotiate producing asset acquisition opportunities for HALO

- To support Ping and MLCP in the development of Pilot and Earlham respectively

- To pursue out-of-round licence applications for the former P2320 licence over Blakeney, Feugh and Thornham; and an extension of the P2634 licence to include the area of former licence P2516

Steve Brown, Orcadian’s CEO, commented:

“The second half of 2024 has been an important period in the development of Orcadian. We have handed over responsibility for the Pilot project to Ping Petroleum and we are pleased with the progress they are making. We have developed a strong working relationship with the MLCP and IPC teams, and we believe that these relationships can deliver on the Government’s Clean Power initiative as well as being extraordinarily fruitful for Orcadian.

“Having closed the acquisition of HALO in December we are delighted to have brought IPC in as a 50% partner in HALO which we intend to grow into a gas producing company just as quickly as we can. We believe that 2025 will see us well on the road to being a production company and graduating from our current pre-development status.”

For further information on the Company please visit the Company’s website: https://orcadian.energy

Contact:

|

Orcadian Energy plc |

+ 44 20 7920 3150 |

|

Steve Brown, CEO Alan Hume, CFO |

|

|

Zeus (Nomad and Joint Broker) |

+44 20 3829 5000 |

|

Dan Bate / Alex Campbell-Harris (Investment Banking) Simon Johnson (Corporate Broking) |

|

|

Novum (Joint Broker) |

+44 207 399 9425 |

|

Colin Rowbury / Jon Belliss |

|

|

Tavistock (PR) |

+ 44 20 7920 3150 |

|

Nick Elwes / Simon Hudson |

About Orcadian Energy

Orcadian is a North Sea focused, low emissions, oil and gas exploration and development company. Orcadian may be a small operator, but it is also nimble, and the Directors believe it has grasped opportunities that have eluded some of the much bigger companies. As we strike a balance between Net Zero and a sustainable energy supply, Orcadian intends to play its part to minimise the cost of Net Zero and to deliver reliable energy to the UK.

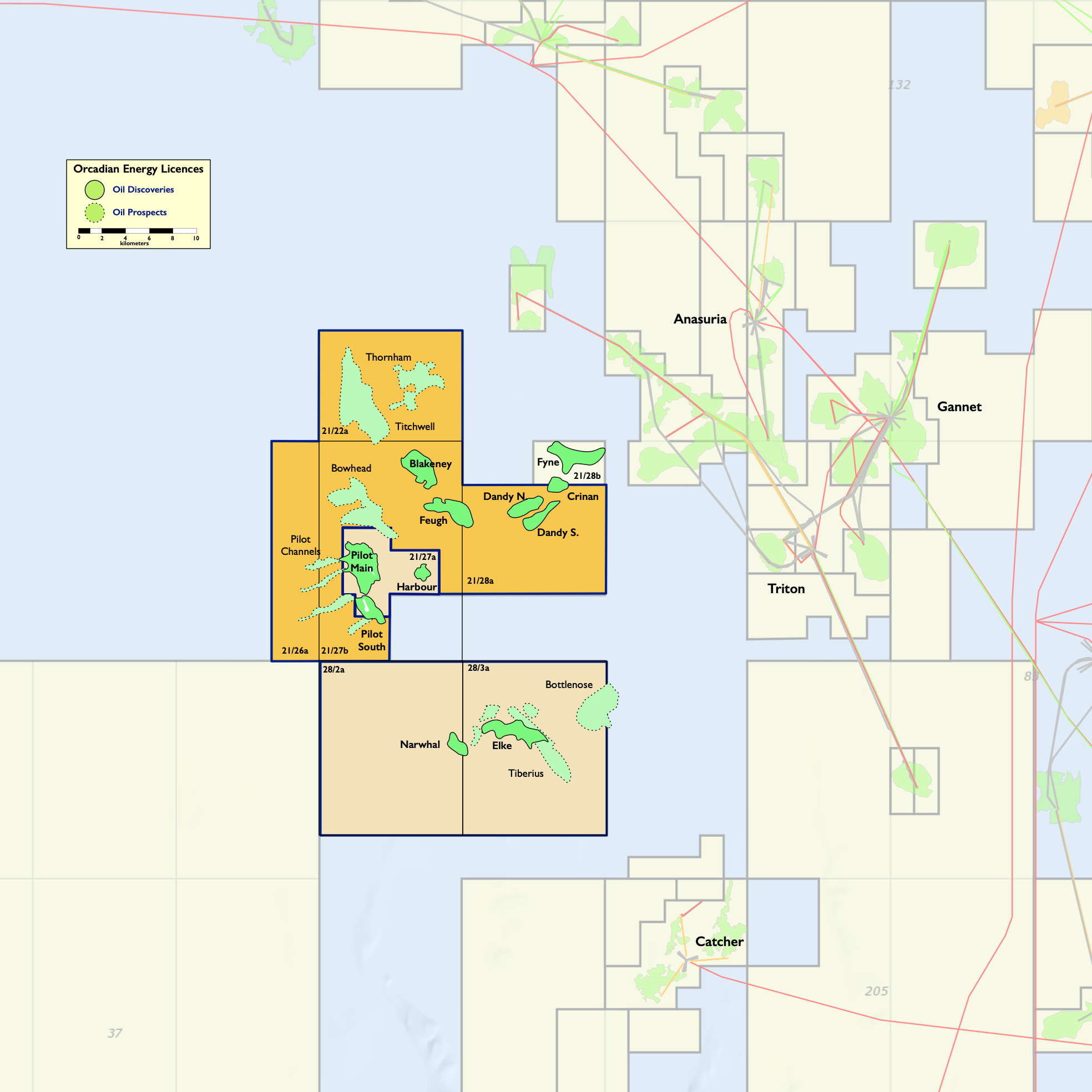

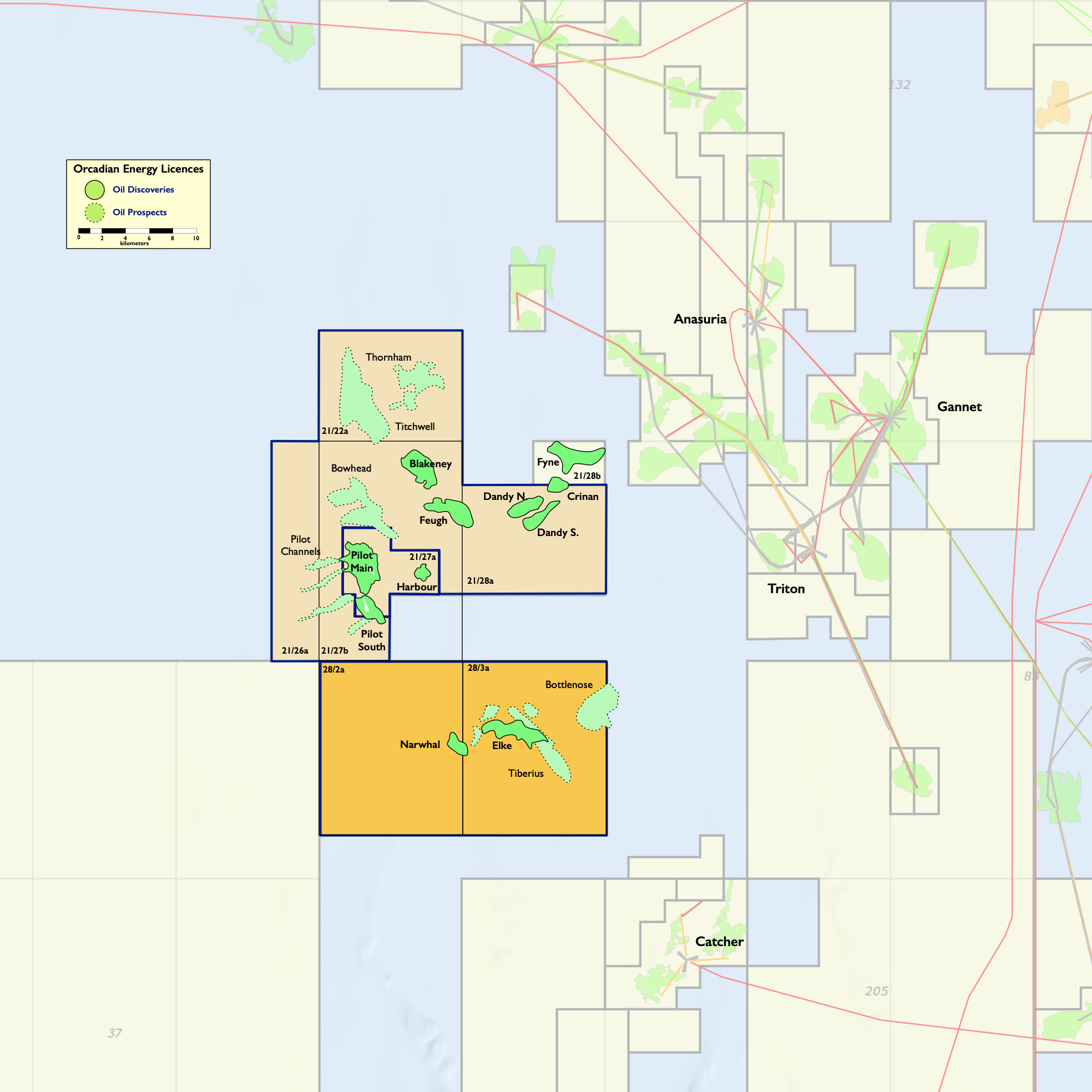

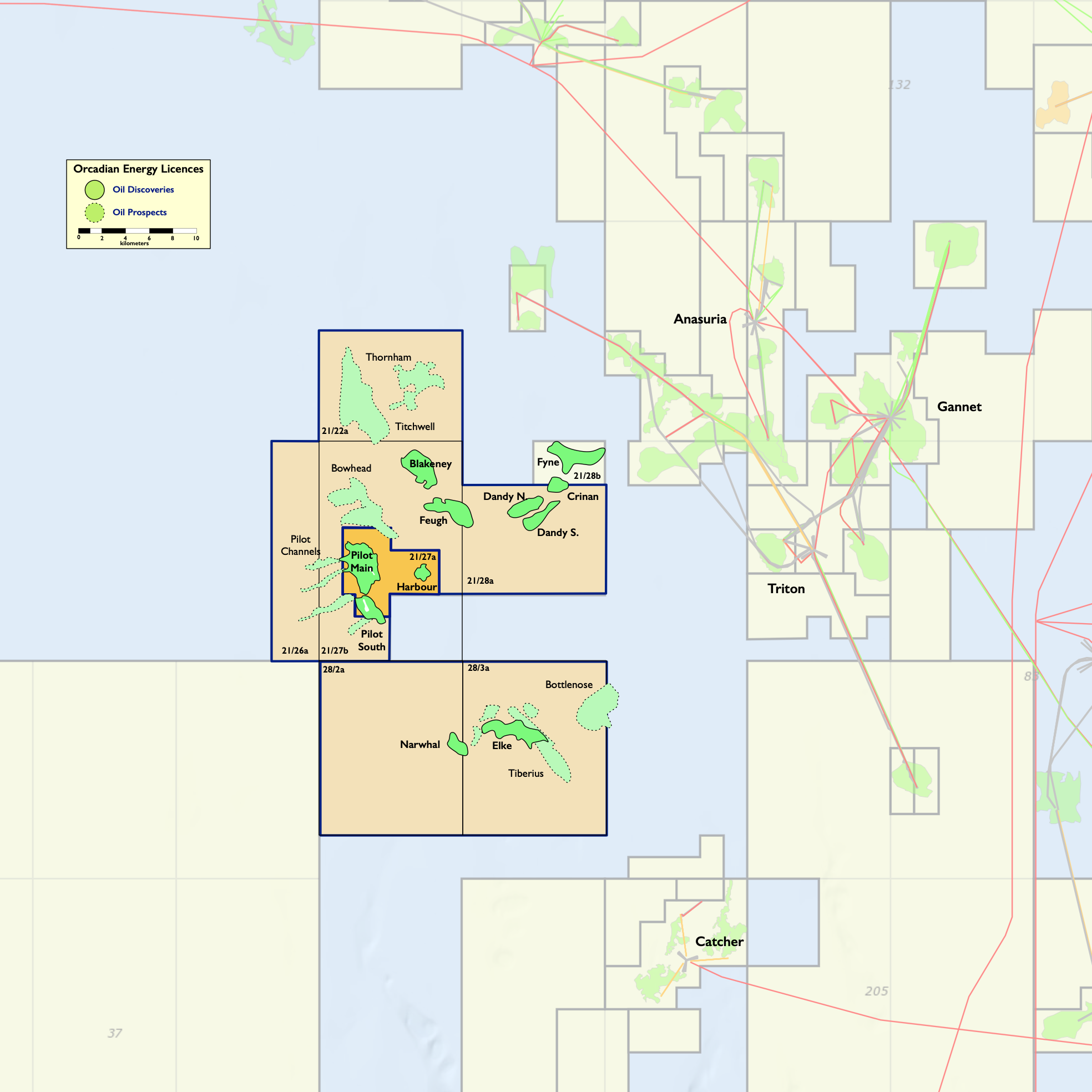

Orcadian’s key asset is the Pilot oilfield, Pilot was discovered by PetroFina in 1989 and has been well appraised. The field has excellent quality reservoir and contains 263MMbbl of a viscous oil ranging in gravity from 17º API in the South of the reservoir to 12º API in the North. In planning the Pilot development, Orcadian has selected polymer flooding and wind power to transform the production of viscous oil into a cleaner and greener process. Polymer significantly reduces fluid handling requirements and hence energy consumption as well as boosting recovery. Ithaca Energy, operator of the Captain field in the Inner Moray Firth, has enjoyed consistent success in applying polymer flood to the highly analogous Captain field. Following the recent farm-down of Pilot, the project is now under the stewardship of Ping Petroleum UK PLC (“Ping”) and is intended to be amongst the lowest carbon emitting oil production facilities in the world.

Ping is progressing a low-emissions, phased, field development plan for Pilot based upon a polymer flood of the reservoir, a Floating Production Storage and Offloading vessel (FPSO) and provision of power from a floating wind turbine or a local wind farm.

Orcadian has an 18.75% fully carried interest in licence P2244 (block 21/27a) and a 100% interest in licence P2482 (blocks 28/2a and 28/3a). Ping is operator of P2244 and the Pilot development project.

Orcadian was awarded three licences in the 33rd round. The Mid-North Sea High licence, P2650, contains shallow gas leads. Orcadian applied in partnership with Triangle Energy, an Australian listed energy company. Orcadian is licence administrator and holds 50% of the offered licence. The Mid-North Sea High licence covers blocks 29/16, 29/17, 29/18, 29/19, 29/21, 29/22, 29/23, 29/27 and 29/28.

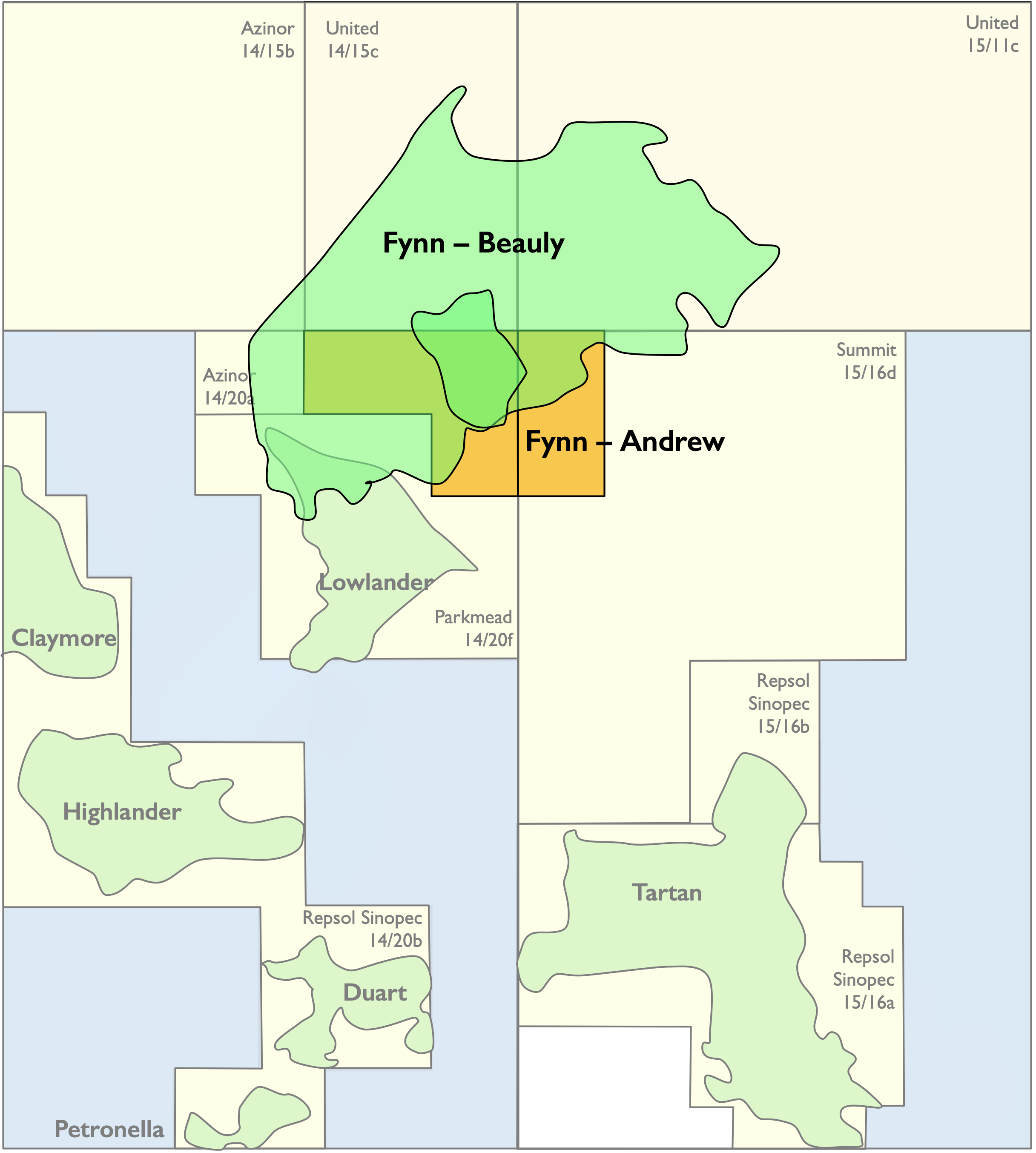

The Fynn licence, P2634, contains a very substantial heavy oil discovery. About 88% of the resource on a best technical case is estimated to lie within the area of the offered licence. Orcadian has a 50% working interest in the Fynn licence which is operated by the Parkmead Group. The Fynn licence covers blocks 14/15a, 14/20d and 15/11a.

The SNS licence, P2680, 50% Orcadian on completion of a proposed transaction, contains the Earlham discovery, a low-calorie gas discovery with 114bcf of methane resources on a P50 basis, the Clover prospect which has P50 prospective resources of 153bcf, and the decommissioned Orwell field which has redevelopment potential, alongside a number of smaller prospects. The Marine Low Carbon Power Company Ltd, an affiliate of IPC is intended to own the other 50% of P2680 and will carry Orcadian to first gas.

Chairman & CEO’s Statement

During the second half of 2024 we have built on our success in the 33rd Licensing Round and developed an important and consequential relationship with IPC and MLCP.

IPC has an impressive track record as a developer of electrical power projects and has been instrumental in establishing MLCP which has developed a design for an offshore power station capable of delivering nearly 300MW of clean power. The power is clean because the design includes integrated carbon capture facilities and a facility like this is capable of delivering dispatchable near-zero emissions electricity.

Folk may not have noticed, but this is the Holy Grail. Wind and solar, for all their green credentials, are at the mercy of the weather. The weather dictates when, and how much, power is generated. That means sometimes virtually no power is generated and sometimes bill-payers have to hand over cash to wind farm operators to shut down, as too much power is being generated. Batteries can help a little but their role on the grid is mostly to help with frequency stability.

As Sir Chris Llewellyn Smith FRS noted in the Royal Society’s report on large-scale electricity storage: “Wind supply can vary over time scales of decades and tens of TeraWatt hours of very long-duration storage will be needed. The scale is over 1,000 times that currently provided by pumped hydro in the UK, and far more than could conceivably be provided by conventional batteries.” The report assured us that “the leading candidate is storage of hydrogen in solution-mined salt caverns.”

This is not a low-cost approach, and in our opinion, hydrogen will ultimately prove to be a costly thermodynamic dead-end.

Thankfully, it’s not our role to find the best solution at national scale, our job and strategy is to find projects that deliver energy and mitigate carbon dioxide emissions for the lowest cost possible. Pursuing projects with a low carbon mitigation cost is how the UK can claim climate leadership. If we mitigate emissions at unbearable cost no-one will follow us. If the UK is to blaze a trail for climate policy, we have to slash the cost of mitigating emissions. We believe that the approach that MLCP has adopted can deliver energy security and drive down the cost of reducing carbon dioxide emissions as the design is replicated across the UKCS.

We are delighted that the Earlham field has the potential to be among the first of these developments.

The relationship we have developed with IPC has resulted in us jointly owning HALO. This company participated in exploration wells on the Andromeda (2019) and Pegasus (2014) gas fields which are now licensed by INEOS. As a result, HALO has incurred around £50 million of pre-trading capital expenditures which we expect will generate, on commencement of a ring-fence trade, tax allowances in the region of £115 million when Ring Fence Expenditure Supplement is applied. We intend to use this company as a vehicle for production acquisitions and our focus will be on non-operated producing gas fields.

We have great plans, but of course any deal requires a willing seller as well as a keen buyer so we are not about to forecast when a deal might be ready to announce. However, shareholders can rest assured that such acquisitions will be our prime focus in 2025.

The development of Earlham which has estimated 2C resources of 114 bcf of methane is potentially one of the first opportunities to deploy an offshore power station. We have been, and will be, working to support MLCP in preparing a Field Development Plan for Earlham and exploring opportunities to share planned nearby infrastructure. We have agreed the terms for a farm-in which will result in Orcadian retaining a 50% carried interest in this development.

IPC has also acquired from Shell the loan we took out in 2019 before we listed. The loan will be largely repaid from the proceeds of the Earlham farm-out deal. We see this as clear evidence of how much both IPC and MLCP value our relationship and the assets we have within our portfolio.

Our Pilot licence remains a core asset and we are pleased with the quiet progress Ping Petroleum UK plc (“Ping”) has made since they took over operatorship. The whole industry has been waiting for consultations on future licensing, the successor tax regime to EPL and environmental regulations following the Finch verdict. Hopefully the Government will swing behind the industry as domestic energy production is essential both to reduce emissions and to deliver on national security.

We also look forward to Serica joining us on Licence P2634 which contains the Fynn oilfield. Fynn is one of the largest undeveloped discoveries in the North Sea and the crude appears to be very well suited to the production of anode grade petroleum coke, a pre-cursor to the synthetic graphite used in the anodes of electric vehicle batteries.

Finally, we would like to thank, and greatly appreciate the support that, shareholders have shown us in 2024, and we aim to deliver real value for you all in 2025.

| Joe Darby | Steve Brown |

| Chairman | CEO |

| 10 March 2025 | 10 March 2025 |

CONSOLIDATED STATEMENT OF COMPREHENSIVE LOSS

FOR THE SIX MONTHS ENDED 31 DECEMBER 2024

| Unaudited

6 Month Period Ended 31 December 2024 |

Unaudited

6 Month Period Ended 31 December 2023 |

Audited

12 Month Period Ended 30 June 2024 |

||

| Note | £ | £ | £ | |

| Administrative expenses | (397,979) | (260,180) | (610,940) | |

| Exploration and evaluation recharges | 145,031 | – | – | |

| Exploration and evaluation expenses | (131,410) | – | – | |

| Pre-acquisition licence expenses | (30,163) | (2,513) | (40,071) | |

| Impairment of intangible assets | 5 | – | (173,567) | (186,158) |

| Operating Loss | (414,521) | (436,260) | (837,169) | |

| Net Finance costs | (34,494) | (51,865) | (101,302) | |

| Loss before tax | (449,015) | (488,125) | (938,471) | |

| Taxation | – | – | – | |

| Loss for the period | (449,015) | (488,125) | (938,471) | |

| Other comprehensive income: | ||||

| Items that will or may be reclassified to profit or loss: | ||||

| Other comprehensive income | – | – | – | |

| Total comprehensive income | (449,015) | (488,125) | (938,471) | |

| Basic and Diluted Earnings per share | 3 | (0.60p) | (0.66p) | (1.26p) |

All operations are continuing.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2024

| Unaudited

as at 31 December 2024 |

Unaudited

as at 31 December 2023 |

Audited

as at 30 June 2024 |

||

| Note | £ | £ | £ | |

| Non-current assets | ||||

| Property, plant and equipment | 1,718 | 1,671 | 1,718 | |

| Goodwill | 4 | 30,150 | – | – |

| Intangible assets | 5 | 4,488,967 | 4,610,093 | 4,412,453 |

| 4,520,835 | 4,611,764 | 4,414,171 | ||

| Current assets | ||||

| Trade and Other Receivables | 6 | 26,225 | 535,522 | 19,230 |

| Cash and cash equivalents | 62,461 | 72,934 | 214,977 | |

| 88,686 | 608,456 | 234,207 | ||

| Total assets | 4,609,521 | 5,220,220 | 4,648,378 | |

| Current liabilities | ||||

| Trade and Other Payables | 7 | (1,502,873) | (1,396,463) | (1,247,235) |

| Borrowings | 8 | (1,250,199) | (1,067,947) | (1,095,679) |

| (2,753,072) | (2,464,410) | (2,342,914) | ||

| Total liabilities | (2,753,072) | (2,464,410) | (2,342,914) | |

| Net assets | 1,856,449 | 2,755,810 | 2,305,464 | |

|

Equity Ordinary share capital |

9 | 79,000 | 75,429 | 79,000 |

| Share premium | 9 | 6,080,544 | 5,638,615 | 6,080,544 |

| Share warrants reserve | 9 | – | 15,000 | 15,000 |

| Shares to be issued | 10 | – | 445,500 | – |

| Reverse Acquisition Reserve | (38,848) | (38,848) | (38,848) | |

| Retained earnings | (4,264,247) | (3,379,886) | (3,830,232) | |

| Total equity | 1,856,449 | 2,755,810 | 2,305,464 |

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTH PERIOD ENDED 31 DECEMBER 2024

| Ordinary Share capital | Share premium | Share warrants reserve |

Shares to be issued |

Reverse Acquisition Reserve | Retained earnings | Total | ||

| Note | £ | £ | £ | £ | £ | £ | £ | |

| Balance as at 30 June 2023 (audited) | 72,512 | 5,316,532 |

15,000 |

– |

(38,848) |

(2,891,761) | 2,473,435 | |

| Loss for the period and total comprehensive income | – | – | – | – | – | (488,125) | (488,125) | |

| Issue of shares | 9 | 2,917 | 347,083 | – | – | – | – | 350,000 |

| Share issue costs | 9 | – | (25,000) | – | – | – | – | (25,000) |

| Shares to be issued – 18 December 2023 placing | 10 | – | – | – | 445,500 | – | – | 445,500 |

| Balance as at 31 December 2023 (unaudited) | 75,429 | 5,638,615 | 15,000 | 445,500 | (38,848) | (3,379,886) | 2,755,810 | |

| Loss for the period and total comprehensive income | – | – |

– |

– |

– |

(450,346) | (450,346) | |

| Issue of shares | 9 | 3,571 | 496,429 | – | (445,500) | – | – | 54,500 |

| Share issue costs | 9 | – | (54,500) | – | – | – | – | (54,500) |

| Balance as at 30 June 2024 (audited) | 79,000 | 6,080,544 | 15,000 | – | (38,848) | (3,830,232) | 2,305,464 | |

| Loss for the period and total comprehensive income | – | – | – | – | – | (449,015) | (449,015) | |

| Transfer between reserves | – | – | (15,000) | – | – | 15,000 | – | |

| Balance as at 31 December 2024 (unaudited) | 79,000 | 6,080,544 | – | – | (38,848) | (4,264,247) | 1,856,449 |

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTH PERIOD ENDED 31 DECEMBER 2024

| Unaudited

6 Month Period Ended 31 December 2024 |

Unaudited

6 Month Period Ended 31 December 2023 |

Audited

12 Month Period Ended 30 June 2024 |

||

| Note | £ | £ | £ | |

| Cash flows from operating activities | ||||

| Loss before tax for the year | (449,015) | (488,125) | (938,471) | |

| Adjustments for: | ||||

| Depreciation | – | 837 | 1,754 | |

| Unrealised foreign exchange loss (gain) | 63,212 | 24,692 | (780) | |

| Impairment of intangible assets | 5 | – | 173,567 | 186,158 |

| Interest received | (2,814) | (51) | (3,818) | |

| (Increase) / decrease in trade and other receivables | 6 | (6,995) | 13,305 | 29,598 |

| Increase in trade and other payables | 7 | 217,455 | 98,320 | 130,652 |

| Finance costs in the period | 37,308 | 51,916 | 105,120 | |

| Net cash used in operating activities | (140,849) | (125,539) | (89,787) | |

| Investing activities | ||||

| Interest received | 2,814 | 51 | 3,818 | |

| Farm-out proceeds | 5 | – | 332,349 | |

| Acquisition of subsidiary | (30,150) | – | – | |

| Purchases of property, plant and equipment | – | – | (964) | |

| Purchases of exploration and evaluation assets | 5 | (38,331) | (236,283) | (510,644) |

| Net cash used in investing activities | (65,667) | (236,232) | (175,441) | |

| Financing activities | ||||

| Proceeds from issue of ordinary share capital | 9 | – | 350,000 | 850,000 |

| Share issue costs paid | 9 | – | (25,000) | (79,500) |

| Proceeds from borrowings | 8 | 209,128 | – | – |

| Repayment of borrowings | 8 | (155,128) | – | – |

| Net cash used in financing activities | 54,000 | 325,000 | 770,500 | |

| Net decrease in cash and cash equivalents | (152,516) | (36,771) | 105,272 | |

| Cash and cash equivalents at beginning of period | 214,977 | 109,705 | 109,705 | |

| Cash and cash equivalents and end of period | 62,461 | 72,934 | 214,977 |

There were no significant non-cash transactions during the period.

NOTES TO THE FINANCIAL STATEMENTS

-

General Information

Orcadian Energy PLC (the “Company”) is a public limited company which is domiciled and incorporated in England and Wales under the Companies Act 2006 with the registered number 13298968. The Company’s registered office is 6th floor, 60 Gracechurch Street, London, EC3V 0HR, and its ordinary shares are admitted to trading on AIM, a market of the London Stock Exchange.

The principal activity of Orcadian Energy Plc is managing oil and gas assets and through its subsidiary Orcadian Energy (CNS) Ltd the Group holds interests in UKCS Seaward Licences P2244, which contains the Pilot and Harbour heavy oil discoveries, P2482, which contains the Elke and Narwhal discoveries, P2634 which contains the Fynn heavy oil discovery, P2650 which contains shallow gas prospects and P2680 which contains the Earlham development project, the Orwell re-development project and the Clover gas prospect.

-

Summary of significant accounting policies

The principal accounting principles applied in the preparation of these financial statements are set out below. These principles have been consistently applied to all years presented, unless otherwise stated.

- Basis of preparation

The interim financial information set out above does not constitute statutory accounts within the meaning of the Companies Act 2006. It has been prepared on a going concern basis in accordance with UK-adopted international accounting standards. Statutory financial statements for the year ended 30 June 2024 were approved by the Board of Directors on 13 December 2024 and delivered to the Registrar of Companies. The report of the auditors on those financial statements was unqualified.

The interim financial information for the six months ended 31 December 2024 has not been reviewed or audited. The interim financial report has been approved by the Board on 5 March 2025.

- Going concern

The Directors, having made appropriate enquiries, consider that adequate resources exist for the Company to continue in operational existence for the foreseeable future and that, therefore, it is appropriate to adopt the going concern basis in preparing the interim financial statements for the period ended 31 December 2024.

- Risks and uncertainties

The Board continuously assesses and monitors the key risks of the business. The key risks that could affect the Company’s medium term performance and the factors that mitigate those risks have not substantially changed from those set out in the Company’s 2024 Annual Report and Financial Statements, a copy of which is available on the Company’s website: https://orcadian.energy. The key financial risks are securing finance for the Pilot project and an emerging cost inflation risk.

- Critical accounting estimates

The preparation of interim financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the end of the reporting period. Significant items subject to such estimates are set out in note 3 of the Company’s 2024 Annual Report and Financial Statements. The nature and amounts of such estimates have not changed significantly during the interim period.

The accounting policies applied are consistent with those of the annual financial statements for the year ended 30 June 2024, as described in those annual financial statements.

-

Earnings per share

The calculation of the basic and diluted earnings per share is calculated by dividing the loss for the year for continuing operations for the Company by the weighted average number of ordinary shares in issue during the year.

Dilutive loss per Ordinary Share equals basic loss per Ordinary Share as, due to the losses incurred in all three periods presented, there is no dilutive effect from the subsisting share warrants.

| Unaudited

6 Month Period Ended 31 December 2024 |

Unaudited

6 Month Period Ended 31 December 2023 |

Audited

12 Month Period Ended 30 June 2024 |

|

| £ | £ |

£ |

|

| Loss for the purposes of basic earnings per share being net loss attributable to the owners | (449,015) | (488,125) | (938,471) |

| Weighted average number of Ordinary Shares | 74,655,987 | 73,891,393 | 74,655,987 |

| Loss per share | (0.60p) | (0.66p) | (1.26p) |

-

Goodwill

On 2nd December 2024 the Company completed the acquisition of Halo Offshore UK Limited (“HALO”) through the purchase of 100% of the issued capital of Halo (“the Acquisition”). The Acquisition has been accounted for in accordance with IFRS 3, with the excess of consideration paid over net assets of £30,150 being recorded as Goodwill on the on the Consolidated Statement of Financial Position. In connection with the acquisition IPC made a loan to the Company of £54,000 (refer to note 8 for further detail).

-

Intangible assets

| Oil and gas exploration assets | |

| £ | |

| Cost | |

| As at 30 June 2023 (audited) | 3,871,362 |

| Additions | 912,298 |

| Impairment | (173,567) |

| As at 31 December 2023 (Unaudited) | 4,610,093 |

| Additions | 147,300 |

| Farm-out | (332,349) |

| Impairment | (12,591) |

| As at 30 June 2024 (audited) | 4,412,453 |

| Additions | 76,514 |

| As at 31 December 2024 (Unaudited) | 4,488,967 |

-

Trade and other receivables

| Group | Unaudited

as at 31 December 2024 |

Unaudited

as at 31 December 2023 |

Audited

as at 30 June 2024 |

| £ | £ | £ | |

| VAT receivable | 26,225 | 26,978 | 17,184 |

| Prepayments | – | 8,544 | – |

| Other receivables | – | 500,000 | 2,046 |

| 26,225 | 535,522 | 19,230 |

-

Trade and other payables – due within one year

| Unaudited

as at 31 December 2024 |

Unaudited

as at 31 December 2023 |

Audited

as at 30 June 2024 |

|

| £ | £ | £ | |

| Trade payables | 631,979 | 867,941 | 545,604 |

| Accruals | 870,894 | 528,522 | 701,631 |

| 1,502,873 | 1,396,463 | 1,247,235 |

-

Borrowings

| Unaudited

as at 31 December 2024 |

Unaudited

as at 31 December 2023 |

Audited

as at 30 June 2024 |

|

| £ | £ | £ | |

| STASCO Loan | – | 1,067,947 | 1,095,679 |

| IPC Loan (ex Shell) | 1,196,199 | ||

| IPC Loan (HALO) | 54,000 | – | – |

| 1,250,199 | 1,067,947 | 1,095,679 | |

| Current liabilities | 1,250,199 | 1,067,947 | 1,095,679 |

| Non-current liabilities | – | – | – |

During the period under review:

- On 1 August 2024, US$100,000 was received from IPC which was paid to Shell International Trading and Shipping Company Limited (“Shell”) in part settlement of the STASCO loan. IPC is a joint venture partner with Richmond Offshore Energy Ltd in their ownership of MLCP;

- On 3 September 2024, US$100,000 was received from IPC which was paid to Shell in part settlement of the STASCO loan;

- On 3 December 2024 the Company announced that it had acquired all of the ordinary shares of HALO On 12th December 2024, the Company agreed to sell a 50% interest in a sub-area of Licence P2680 to MLCP. As part of the overall arrangements IPC acquired the STASCO loan. The amount owed to IPC and IPC is US$1.5 million. IPC has agreed to convert US$1.4 million of this into funding part of the consideration for MLCP to acquire its 50 per cent stake in the Earlham and Orwell licences. The balance of US $100,000 will be exchanged for an Orcadian loan note, dated 30 June 2026, and convertible into approximately 312,500 Ordinary shares in Orcadian at a conversion price of 25 pence per share, Orcadian may require conversion of the loan note into Ordinary shares if Orcadian’s volume weighted average share price (“VWAP”) in each of five consecutive trading days is 35p or above;

- On 13 December 2024 the Company announced that it had agreed to sell 50% of the shares in HALO to IPC and that Peter Earl and Mark Preece would be joining the board.

-

Ordinary share capital and share premium

| Group | |||||

| Issued | Number of shares | Ordinary share capital

£ |

Share

premium £ |

Total share capital

£ |

|

| As at 30 June 2023 (audited) | 72,512,317 | 72,512 | 5,316,532 | 5,389,044 | |

| Issue of shares | 2,916,666 | 2,917 | 347,083 | 350,000 | |

| Share issue costs | – | – | (25,000) | (25,000) | |

| As at 31 December 2023 (unaudited) | 75,428,983 | 75,429 | 5,638,615 | 5,714,044 | |

| Issue of shares | 3,571,429 | 3,571 | 496,429 | 500,000 | |

| Share issue costs | – | – | (54,500) | (54,500) | |

| As at 30 June 2024 (audited) | 79,000,412 | 79,000 | 6,080,544 | 6,159,544 | |

| As at 31 December 2024 (unaudited) | 79,000,412 | 79,000 | 6,080,544 | 6,159,544 | |

The ordinary shares confer the right to vote at general meetings of the Company, to a repayment of capital in the event of liquidation or winding up and certain other rights as set out in the Company’s articles of association.

-

Shares to be issued

The Shares to be issued, in the prior period, represents the issue of 3,571,429 Ordinary shares (“the Shares”) at 14 pence each that completed after the prior period reporting date, on 8 January 2024. The value of the Shares to be issued reserve reflects the gross proceeds of the share placement of £500,000, less £54,500 of share issue costs were accrued for at 31 December 2023. Upon completion the value of Shares to be issued was re-allocated to Share capital and Share premium.

-

Events after the reporting period

On 4 March 2025 the Company announced the completion of the sale of 50% of the shares of HALO Offshore UK Ltd to IPC.