12 December 2024

Orcadian Energy plc

(“Orcadian” or the “Company”)

Farm-out of Earlham and Orwell

Assignment of Shell Loan

Highlights

- Agreement of commercial terms for the sale of a 50% interest in Earlham and Orwell to MLCP and a carry arrangement to bring Earlham and Orwell into production

- Shell loan assigned to IPCNWE and loan terms restructured

- IPCNWE loans to be paid in full upon completion of assignment of Earlham and Orwell to MLCP

- Orcadian retains a 50% carried interest in the Earlham and Orwell projects

Orcadian (AIM:ORCA) is delighted to announce that the Company has agreed to sell a 50% interest in a sub-area of Licence P2680 to The Marine Low Carbon Power Company Ltd (“MLCP”). MLCP plan to develop Earlham and Orwell to supply the first of MLCP’s Mobile Offshore Generating Units (“MOGU”), which will in turn supply carbon free energy to MLCP customers and to IPC New World Energy Ltd’s (“IPCNWE”) battery projects.

MLCP is a joint venture company owned by IPCNWE and Richmond Offshore Energy Ltd. IPCNWE is part of the Independent Power Corporation PLC (“IPC”) group and is the largest developer of consented battery projects in the UK with 5.5 GW of capacity under development. MLCP has designed, in conjunction with GE Vernova and Capsol Technologies of Norway, a 300 MW offshore power facility with integrated carbon dioxide capture and distributed carbon dioxide storage offshore in a reservoir, most likely within the Licence P2680 sub-area.

Shell Loan

As part of the overall arrangements IPC has acquired the loan advanced by Shell International Trading and Shipping Company Limited (“Shell”) to Orcadian Energy (CNS) Ltd in August 2019. The amount owed to IPC and IPCNWE is US $1.5 million. IPCNWE has agreed to convert US $1.4 million of this into funding part of the consideration for MLCP to acquire its 50 per cent stake in Earlham and Orwell. The balance of US $100,000 will be exchanged for an Orcadian loan note, dated 30 June 2026, and convertible into approximately 312,500 Ordinary shares in Orcadian at a conversion price of 25 pence per share, Orcadian may require conversion of the loan note into Ordinary shares if Orcadian’s volume weighted average share price (“VWAP”) in each of five consecutive trading days is 35p or above.

Farm-out Terms

Orcadian has agreed the key terms of a farm-out agreement for a sub-area of Licence P2680 with MLCP. The principal terms of the agreements have been documented in a non-binding Heads of Agreement which defines the entire suite of agreements that need to be finalised.

It is intended that the farm-out will be implemented as follows:

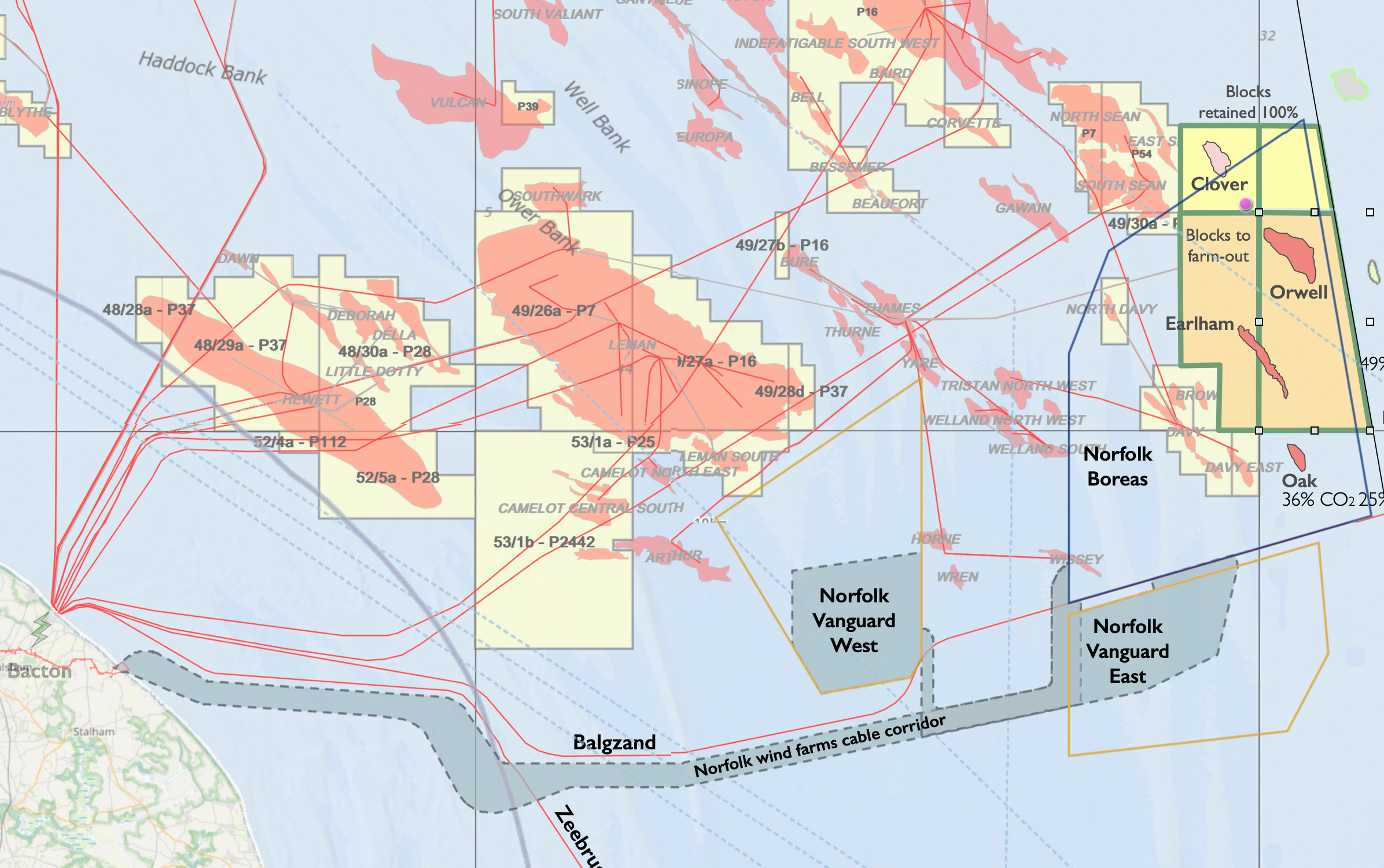

- MLCP will acquire from Orcadian a 50% interest in the Earlham discovery and Orwell field redevelopment by acquiring a 50% interest in a sub-area of Licence P2680, comprising blocks 50/26 and 49/30b.

- Orcadian will act as Licence Administrator through the Assessment Phase and MLCP will become Licence Administrator for the Authorisation phase which includes the preparation and submission of the Field Development Plan (“FDP”) and the Environmental Statement.

- It is intended, subject to approval from the North Sea Transition Authority (“NSTA approval”), that on FDP approval MLCP will become Licence Operator for the project execution and operating phases of the project.

- This transaction is subject to NSTA approval and will be documented in a fully termed Sale and Purchase Agreement and a Joint Operating Agreement;

- The purchase price of 50% of the sub-area of Licence P2680 has been agreed to be US $2.2m, with US $1.4m payable on completion and two tranches of US $400,000 payable on achieving fuel gas quality production rates in excess of 50 MMscf/day for a 48 hour period, both 30 days after first gas and 120 days after first gas.

- Together with the convertible loan arrangements noted above, the payment upon completion will offset in full the amounts owed by Orcadian to IPC and IPCNWE;

- MLCP will carry Orcadian’s share of expenditure through to first gas on the development of Earlham and Orwell;

- The carry will be repayable through MLCP having an enhanced revenue interest of 80% until the carry is fully repaid;

As a consequence of these arrangements, Orcadian will retain a 50% carried interest in the development of Earlham and the redevelopment of Orwell, and its debts to Shell and IPCNWE will be paid in full.

This is a provisional agreement and there can be no guarantee that the transactions will all complete. Any deal is subject to, amongst other matters, completion of due diligence, negotiation of detailed documentation, and various regulatory consents as well as the Board approvals of MLCP and Orcadian. The parties hope to complete the transaction during 1Q 2025.

Earlham and Orwell

Earlham has a methane resource of 114 bcf and the Company believes Orwell could deliver a further 31 bcf.

The Earlham discovery is a high-quality Leman sand accumulation with high net to gross (c. 95%), porosity of 18% and permeability of c. 250 mD. The field was discovered in 1995 by Talisman and in 1996 BP drilled a high angle appraisal, and intended development, well with a 1,559m section in the gas pay zone. In line with our strategy this is a field with high quality reservoir rocks. BP curtailed the well test and abandoned the well because of the high CO2 content in the gas.

Development and production of the gas in Earlham is relatively straightforward given the high-quality reservoir, as no well stimulation will be required. Locating the MOGU offshore at the Earlham site dispenses with both a CO2 disposal pipeline from shore and a natural gas pipeline, the wells being located on an adjacent bridge-linked wellhead structure.

To enable this, Earlham gas will utilise a MOGU based pre-combustion CO2 removal system to reduce the CO2 content to a level which is acceptable for combustion within the LM-6000 gas turbines selected by MLCP. The captured pre-combustion CO2 will then be combined with the post-combustion captured CO2 using the Capsol Technologies’ system. The combined CO2 stream will then be reinjected into either Earlham, Orwell or a nearby licensed CO2 reservoir.

It is intended that the Earlham and Orwell developments provide the gas supply and the carbon storage reservoirs for the MOGU development, subject to NSTA approval. MLCP is exploring opportunities to share offshore cable and grid connections with nearby wind farms.

Steve Brown, Orcadian CEO, said:

“The development of Earlham is intended to be the first of a number of MLCP led zero carbon energy projects which will integrate gas-to-wire and carbon capture and storage technologies to provide zero carbon balancing power which is desperately needed if the United Kingdom is to meet its net zero obligations.

“These projects are designed to proceed without requiring any government subsidy since MLCP will sell power directly to customers who value reliable, carbon free electricity which is available when renewable energy is not available or in short supply. There is no need to create a business model for CO2 storage nor to rely on government to sanction financial support for the project. This should enable an early commitment to the Earlham development.

“Earlham will be the first gas field on the UKCS to be dedicated to a facility that will capture practically all the emitted carbon dioxide for storage underground. Scope 3 emissions will be less than 5% of a conventional gas development which supplies an unabated power station. This project is one which we believe supports the government’s vision of a clean UK power system in 2030 whilst crucially also delivering on the government’s energy security goals.”

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY THE COMPANY TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER THE MARKET ABUSE REGULATION (EU) NO. 596/2014 AS IT FORMS PART OF UK DOMESTIC LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT 2018, AS AMENDED. UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO BE IN THE PUBLIC DOMAIN.

For further information on the Company please visit the Company’s website: https://orcadian.energy

Contact:

|

Orcadian Energy plc |

+ 44 20 7920 3150 |

|

Steve Brown, CEO Alan Hume, CFO |

|

|

Zeus (Nomad and Joint Broker) |

+44 20 3829 5000 |

|

Dan Bate / Alex Campbell-Harris (Investment Banking) Simon Johnson (Corporate Broking) |

|

|

Novum (Joint Broker) |

+44 207 399 9425 |

|

Colin Rowbury / Jon Belliss |

|

|

Tavistock (PR) |

+ 44 20 7920 3150 |

|

Nick Elwes / Simon Hudson |

Qualified Person’s Statement

Pursuant to the requirements of the AIM Rules and in particular, the AIM Note for Mining and Oil and Gas Companies, Maurice Bamford has reviewed and approved the technical information and resource reporting contained in this announcement.

Maurice has more than 35 years’ experience in the oil & gas industry and 3 years in academia. He holds a BSc in Geology from Queens University Belfast and a PhD in Geology from the National University of Ireland. Maurice is a Fellow of the Geological Society, London, and a member of the Geoscience Energy Society of Great Britain. He is Exploration and Geoscience Manager at Orcadian Energy.

About Orcadian Energy

Orcadian is a North Sea focused, low emissions, oil and gas exploration and development company. Orcadian may be a small operator, but it is also nimble, and the Directors believe it has grasped opportunities that have eluded some of the much bigger companies. As we strike a balance between Net Zero and a sustainable energy supply, Orcadian intends to play its part to minimise the cost of Net Zero and to deliver reliable energy to the UK.

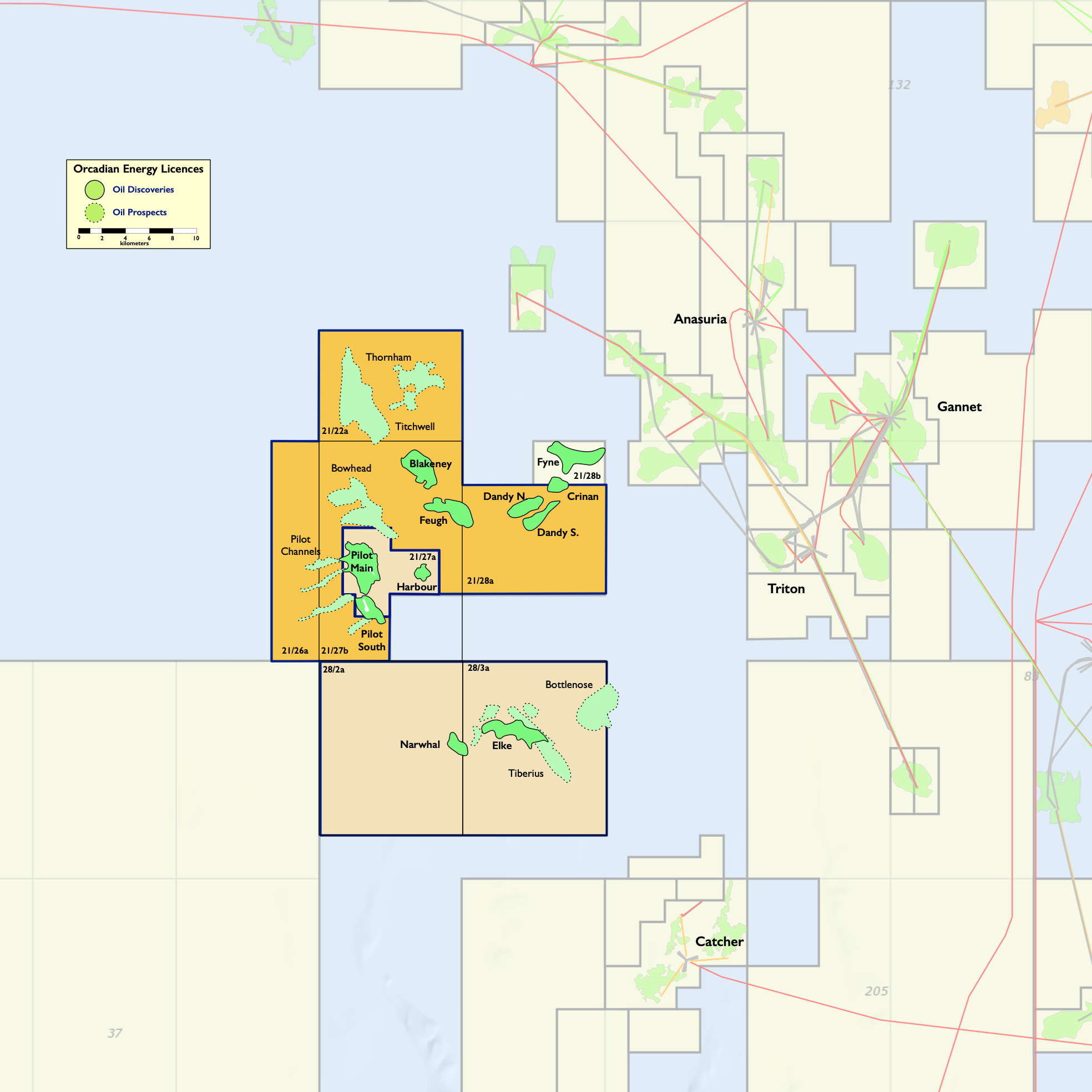

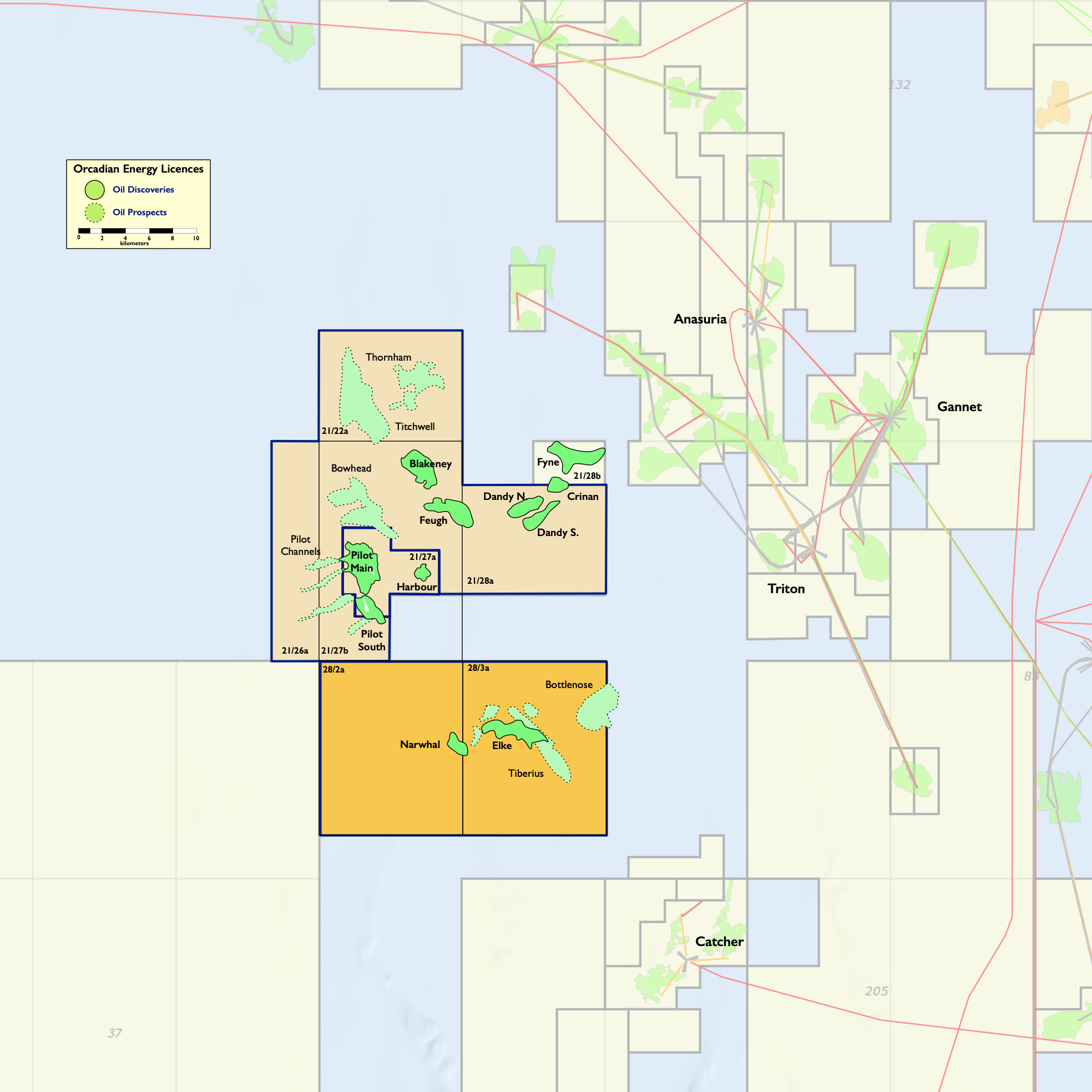

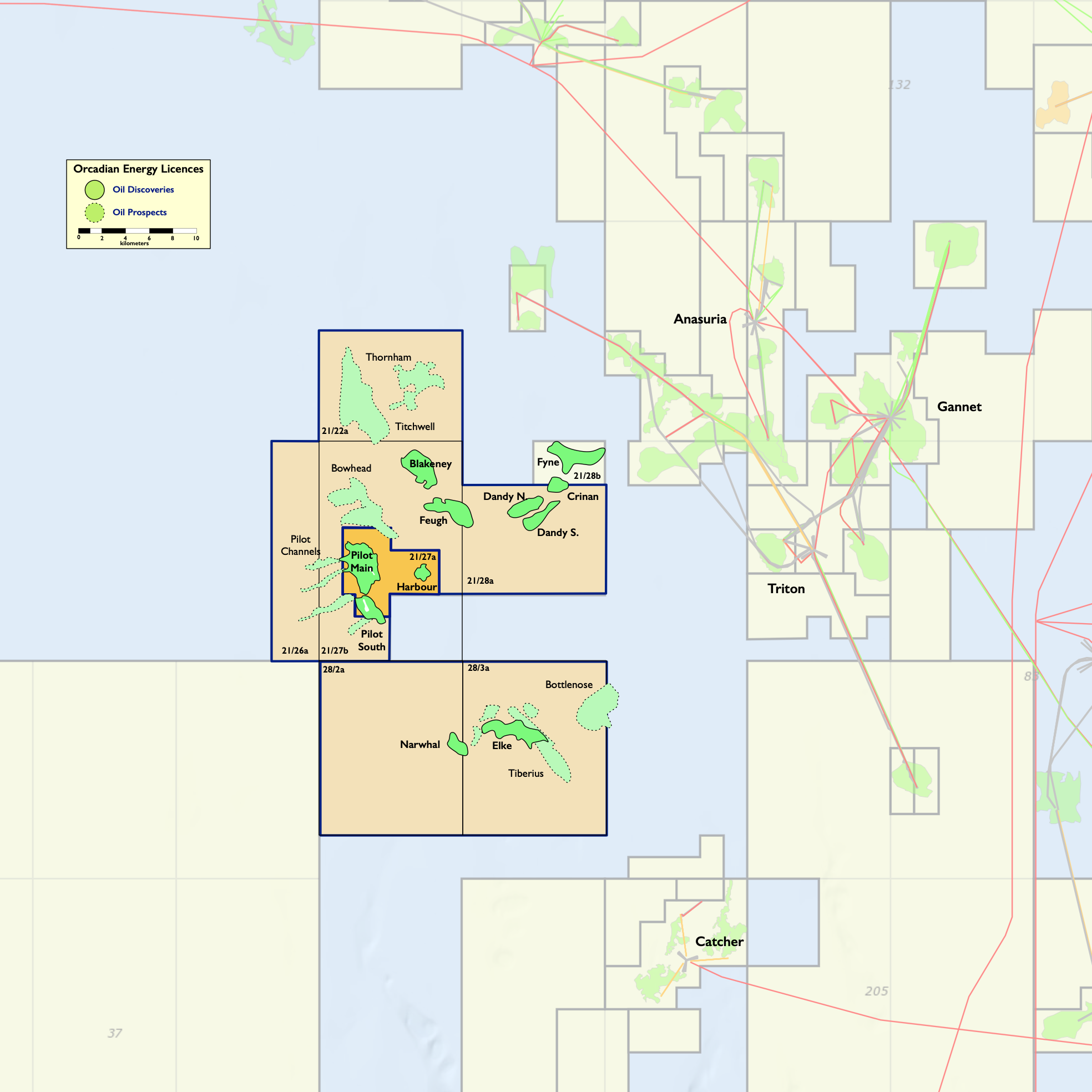

Orcadian’s key asset is the Pilot oilfield, Pilot was discovered by PetroFina in 1989 and has been well appraised. The field has excellent quality reservoir and contains 263MMbbl of a viscous oil ranging in gravity from 17º API in the South of the reservoir to 12º API in the North. In planning the Pilot development, Orcadian has selected polymer flooding and wind power to transform the production of viscous oil into a cleaner and greener process. Polymer significantly reduces fluid handling requirements and hence energy consumption as well as boosting recovery. Ithaca Energy, operator of the Captain field in the Inner Moray Firth, has enjoyed consistent success in applying polymer flood to the highly analogous Captain field. Following the recent farm-down of Pilot, the project is now under the stewardship of Ping Petroleum UK PLC (“Ping”) and is intended to be amongst the lowest carbon emitting oil production facilities in the world.

Ping is progressing a low-emissions, phased, field development plan for Pilot based upon a polymer flood of the reservoir, a Floating Production Storage and Offloading vessel (FPSO) and provision of power from a floating wind turbine or a local wind farm.

Orcadian has an 18.75% fully carried interest in licence P2244 (block 21/27a) and a 100% interest in licence P2482 (blocks 28/2a and 28/3a). Ping is operator of P2244 and the Pilot development project.

Orcadian was awarded three licences in the 33rd round. The Mid-North Sea High licence, P2650, contains shallow gas leads. Orcadian applied in partnership with Triangle Energy, an Australian listed energy company. Orcadian is licence administrator and holds 50% of the offered licence. The Mid-North Sea High licence covers blocks 29/16, 29/17, 29/18, 29/19, 29/21, 29/22, 29/23, 29/27 and 29/28.

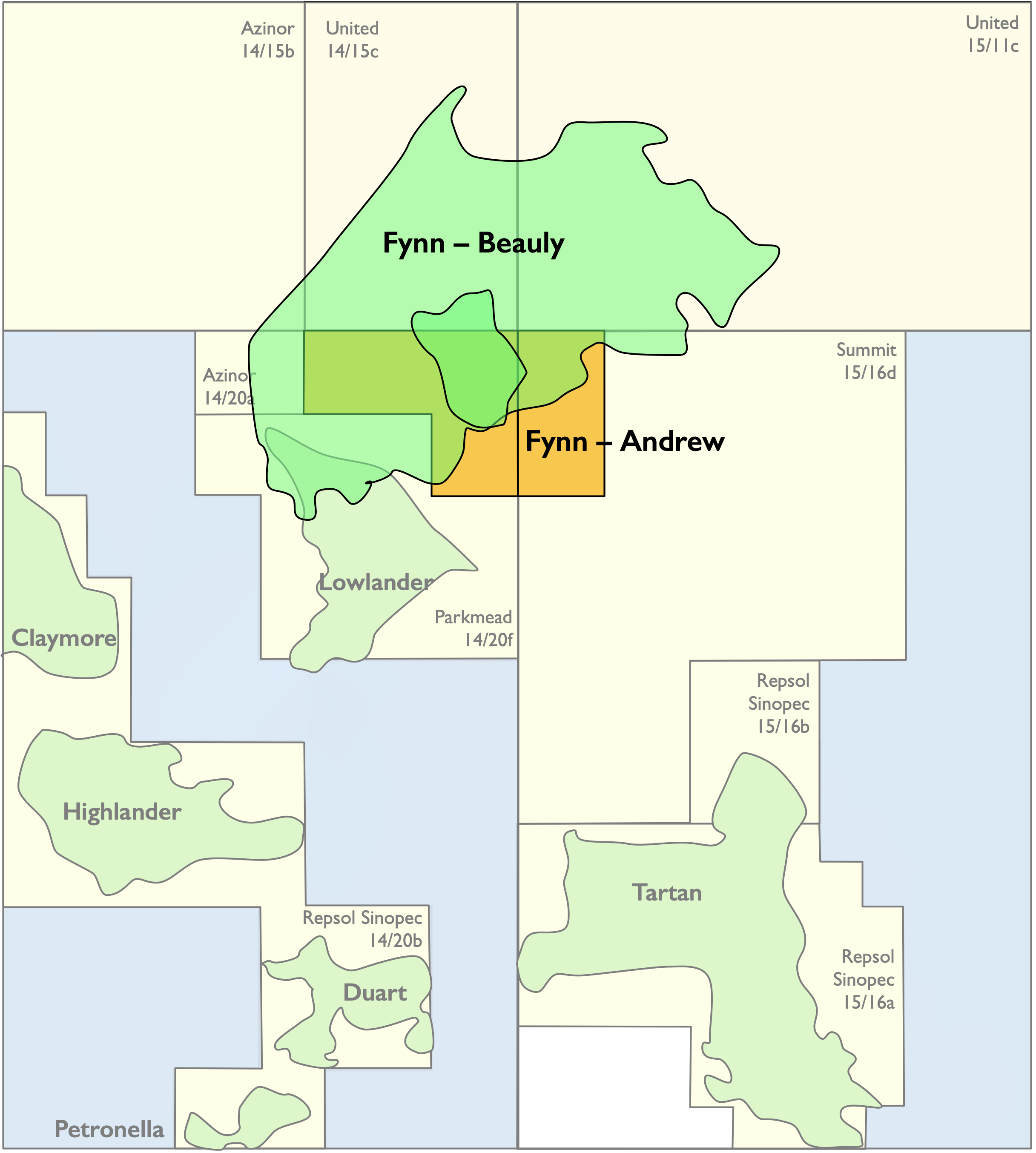

The Fynn licence, P2634, contains a very substantial heavy oil discovery. About 88% of the resource on a best technical case is estimated to lie within the area of the offered licence. Orcadian has a 50% working interest in the Fynn licence which is operated by the Parkmead Group. The Fynn licence covers blocks 14/15a, 14/20d and 15/11a.

The SNS licence, P2680 100% Orcadian, contains the Earlham discovery, a low-calorie gas discovery with 114bcf of methane resources on a P50 basis, the Clover prospect which has P50 prospective resources of 153bcf, and the decommissioned Orwell field which has redevelopment potential, alongside a number of smaller prospects.

About IPC New World Energy Limited

IPC New World Energy Ltd is a subsidiary of Independent Power Corporation PLC (“IPC”) which since 1995 has been a developer, owner and operator of power plants on five continents across the globe. IPC has developed, owned or operated around 10,000 MW of conventional power capacity across a wide range of project types including gas, diesel, wind, biofuels and hydroelectric plants. Thermal plants have included combined cycle gas turbine (CCGT) power plants (including the first in country in Bolivia and South Africa) as well as combined heat and power (CHP) projects and emissions reduction projects in CIS countries. In recent years, IPC has developed projects in Azerbaijan, Chile, Ghana and the United Kingdom as an independent developer, sponsor and operator of power plants. Its IPCNWE subsidiary has in excess of 7.5 GW of offshore wind and BESS battery storage projects in the United Kingdom and Europe.

About the Marine Low Carbon Power Company Limited

MLCP was formed in 2020 to generate low carbon balancing power in UK territorial waters using offshore gas reserves. The energy can be generated flexibly to provide carbon free energy when wind and solar energy sources are unavailable, therefore supporting and complementing UK renewable energy – unlike CCGT baseload gas fired power plants which compete with renewables and which do not have the operational ability to stop and start at short notice.

MLCP is a joint venture between IPC New World Energy Ltd and Richmond Offshore Energy Ltd.