THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY THE COMPANY TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER THE MARKET ABUSE REGULATION (EU) NO. 596/2014 AS IT FORMS PART OF UK DOMESTIC LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT 2018, AS AMENDED. UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO BE IN THE PUBLIC DOMAIN.

22 May 2024

Orcadian Energy plc

(“Orcadian Energy”, “Orcadian” or the “Company”)

Potential Farm-in to the SNS Licence

Proposed Long Term Loan Agreement

Orcadian Energy (AIM:ORCA) is pleased to announce that it has agreed a non-binding Heads of Agreement (“HoA”) with a potential farm-in partner (the “Partner”) on its recently awarded SNS Licence:

Summary:

- Outlines a potential farm-in to Orcadian’s proposed SNS licence; which provides the partner with a period of commercial exclusivity – Orcadian announced the offer of award of the SNS Licence on 7 May 2024;

- Details the key terms of a proposed long-term loan of $1.4m, payable to Orcadian, from an affiliate of the Partner;

- Delineates further opportunities to work together to generate low carbon electricity for customers.

Farm-in Deal

- The SNS licence contains the Earlham discovery, with a P50 contingent resource of 114 bcf of sales gas, a potential redevelopment project to blow down the now decommissioned Orwell gas field, which Orcadian believes can deliver over 30 bcf of gas and the Clover prospect which has a P50 prospective resource of 153 bcf of gas.

- The Partner will acquire an interest in all, or part of, the SNS licence; Orcadian will remain operator of the licence until the assessment phase for the Earlham project is complete at which point the Partner is expected to become operator to prepare the Field Development Plan (“FDP”) and to deliver the project.

- On completion of the transaction the Partner will pay Orcadian a, to be agreed, fee and will fund all the Earlham and Orwell development costs, the SNS Licence work programme and other licence costs until first gas production.

- Orcadian has granted the Partner a commercial exclusivity period until 31 December 2024, for both parties to complete definitive documentation for the overall deal.

- This is a provisional agreement and there can be no guarantee that the transaction will complete. Any deal is subject to, amongst other matters, execution of licence documentation, completion of due diligence, negotiation of documentation, and various regulatory consents as well as Board approvals of the Partner and Orcadian.

Long Term Loan

An affiliate of the Partner has agreed in principle to loan Orcadian $1.4m for a period of up to two years. The loan is intended to be settled from the completion payment due under the proposed farm-in arrangement. There would be no fees or interest payable in the event that the farm-in deal completes.

In the event that the farm-in deal does not complete, for whatever reason, including a notice by the Partner that it no longer wishes to complete the farm-in to the SNS licence, interest will be payable at a rate of 6% and Orcadian will provide the Partner with a security over its 18.75% interest in the Pilot field.

It is intended to complete the loan documentation so that drawdown can occur before 13 June 2024. The purpose of the loan is to enable Orcadian to repay the outstanding loan to Shell, pay certain corporate liabilities and meet general and administrative costs.

Steve Brown, Orcadian’s CEO, said:

“We have been approached by a partner that shares our vision of developing Earlham. We have been very impressed with the maturity of our potential partner’s concept and are keen to explore this and other opportunities to work with them.”

“We are delighted that the partner also intends to provide a loan facility as part of this overall deal and it is our intention to use the proceeds of that loan to settle our outstanding debt to Shell.”

For further information on the Company please visit the Company’s website: https://orcadian.energy

Contact:

|

Orcadian Energy plc |

+ 44 20 7920 3150 |

|

Steve Brown, CEO Alan Hume, CFO |

|

|

Zeus (Nomad and Joint Broker) |

+44 20 3829 5000 |

|

Dan Bate / Alex Campbell-Harris (Investment Banking) Simon Johnson (Corporate Broking) |

|

|

Novum (Joint Broker) |

+44 207 399 9425 |

|

Colin Rowbury / Jon Belliss |

|

|

Tavistock (PR) |

+ 44 20 7920 3150 |

|

Nick Elwes / Simon Hudson |

Qualified Person’s Statement

Pursuant to the requirements of the AIM Rules and in particular, the AIM Note for Mining and Oil and Gas Companies, Maurice Bamford has reviewed and approved the technical information and resource reporting contained in this announcement.

Maurice has more than 33 years’ experience in the oil & gas industry and 3 years in academia. He holds a BSc in Geology from Queens University Belfast and a PhD in Geology from the National University of Ireland. Maurice is a Fellow of the Geological Society, London, and a member of the Geoscience Energy Society of Great Britain. He is Exploration and Geoscience Manager at Orcadian Energy.

About Orcadian Energy

Orcadian is a North Sea focused, low emissions, oil and gas exploration and development company. Orcadian may be a small operator, but it is also nimble, and the Directors believe it has grasped opportunities that have eluded some of the much bigger companies. As we strike a balance between Net Zero and a sustainable energy supply, Orcadian intends to play its part to minimise the cost of Net Zero and to deliver reliable energy to the UK.

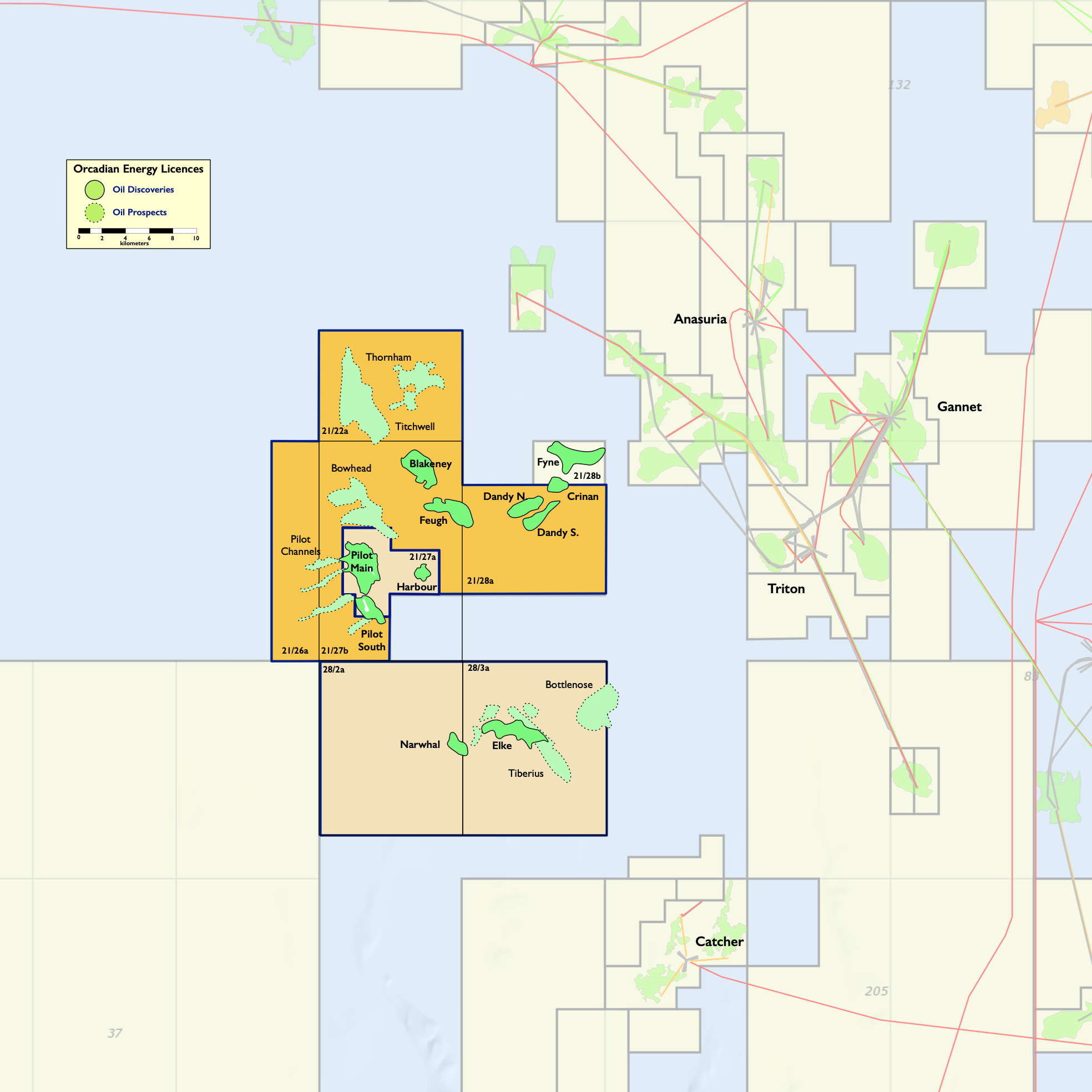

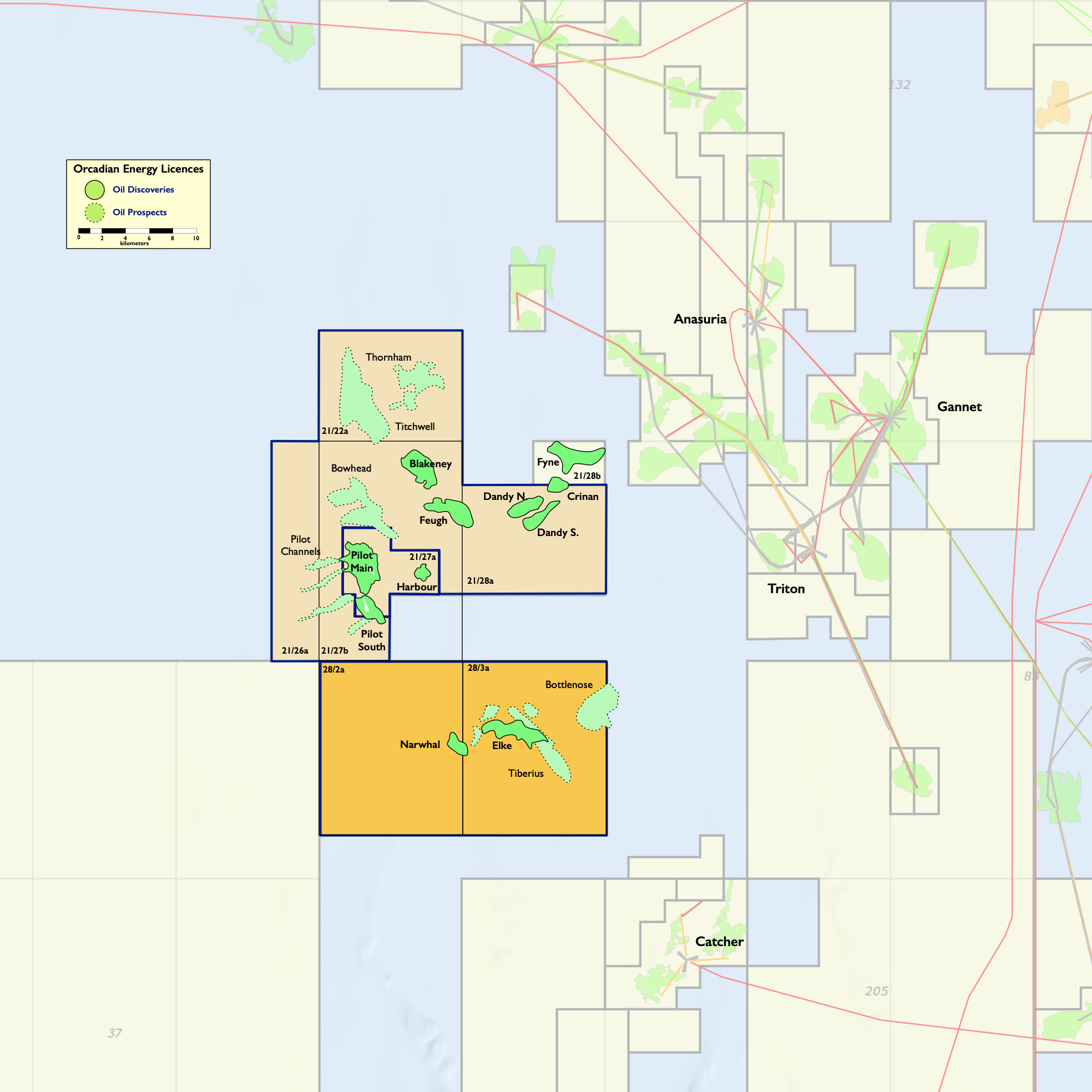

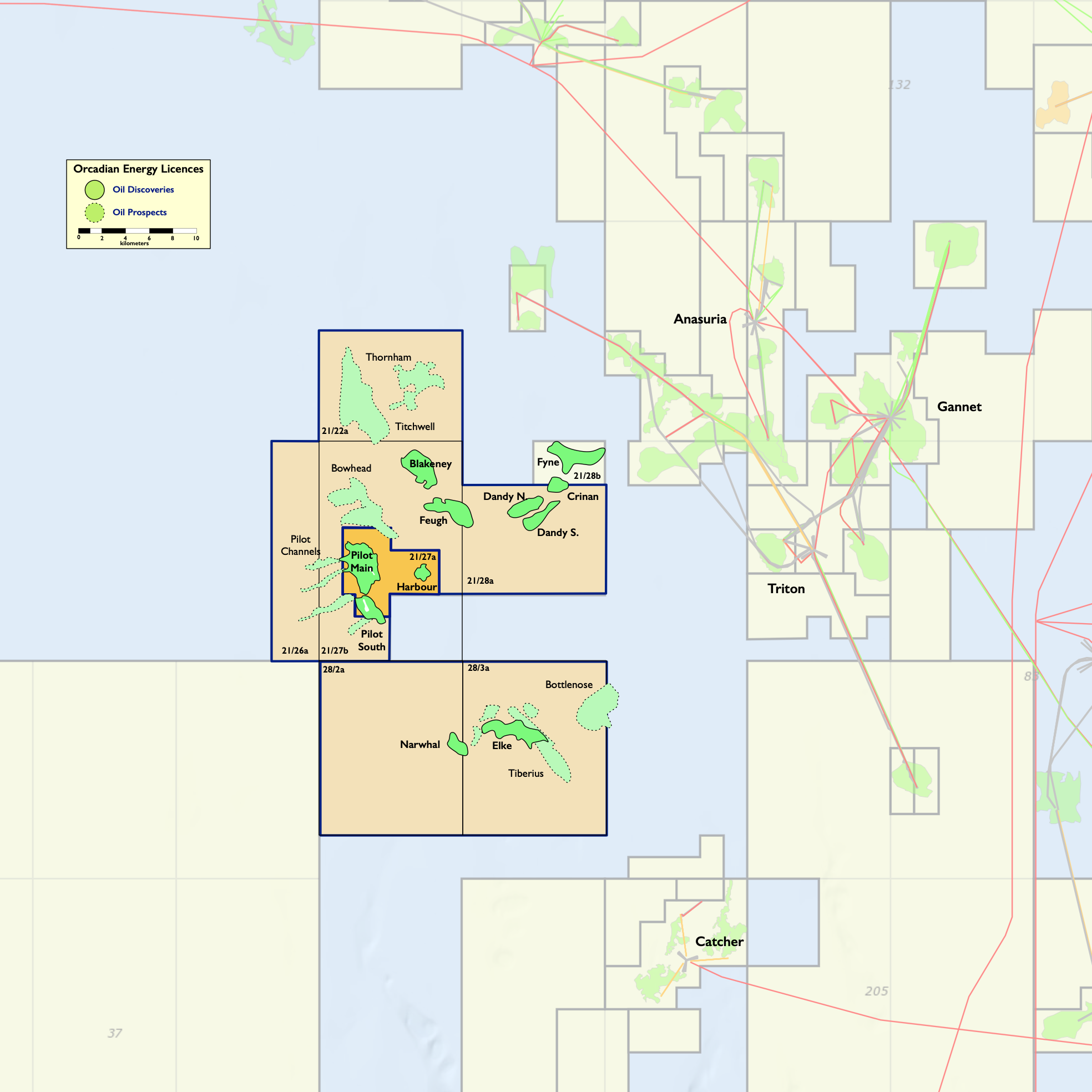

Orcadian’s key asset is the Pilot oilfield, Pilot was discovered by PetroFina in 1989 and has been well appraised. The field has excellent quality reservoir and contains 263MMbbl of a viscous oil ranging in gravity from 17º API in the South of the reservoir to 12º API in the North. In planning the Pilot development, Orcadian has selected polymer flooding and wind power to transform the production of viscous oil into a cleaner and greener process. Polymer significantly reduces fluid handling requirements and hence energy consumption as well as boosting recovery. Ithaca Energy, operator of the Captain field in the Inner Moray Firth, has enjoyed consistent success in applying polymer flood to the highly analogous Captain field. Following the recent farm-down of Pilot, the project is now under the stewardship of Ping Petroleum UK PLC (“Ping”) and is intended to be amongst the lowest carbon emitting oil production facilities in the world.

Ping is progressing a low-emissions, phased, field development plan for Pilot based upon a polymer flood of the reservoir, a Floating Production Storage and Offloading vessel (FPSO) and provision of power from a floating wind turbine or a local wind farm.

Orcadian has an 18.75% fully carried interest in licence P2244 (block 21/27a) and a 100% interest in licence P2482 (blocks 28/2a and 28/3a). Ping is operator of P2244 and the Pilot development project. As noted above Orcadian has also been offered three licences in the 33rd licensing process and expects formal issues of these licences in due course.

The Mid-North Sea High licence contains shallow gas leads. Orcadian applied in partnership with Triangle Energy, an Australian listed energy company. Orcadian would be licence administrator and would hold 50% of the offered licence. The Mid-North Sea High licence covers blocks 29/16, 29/17, 29/18, 29/19, 29/21, 29/22, 29/23, 29/27 and 29/28.

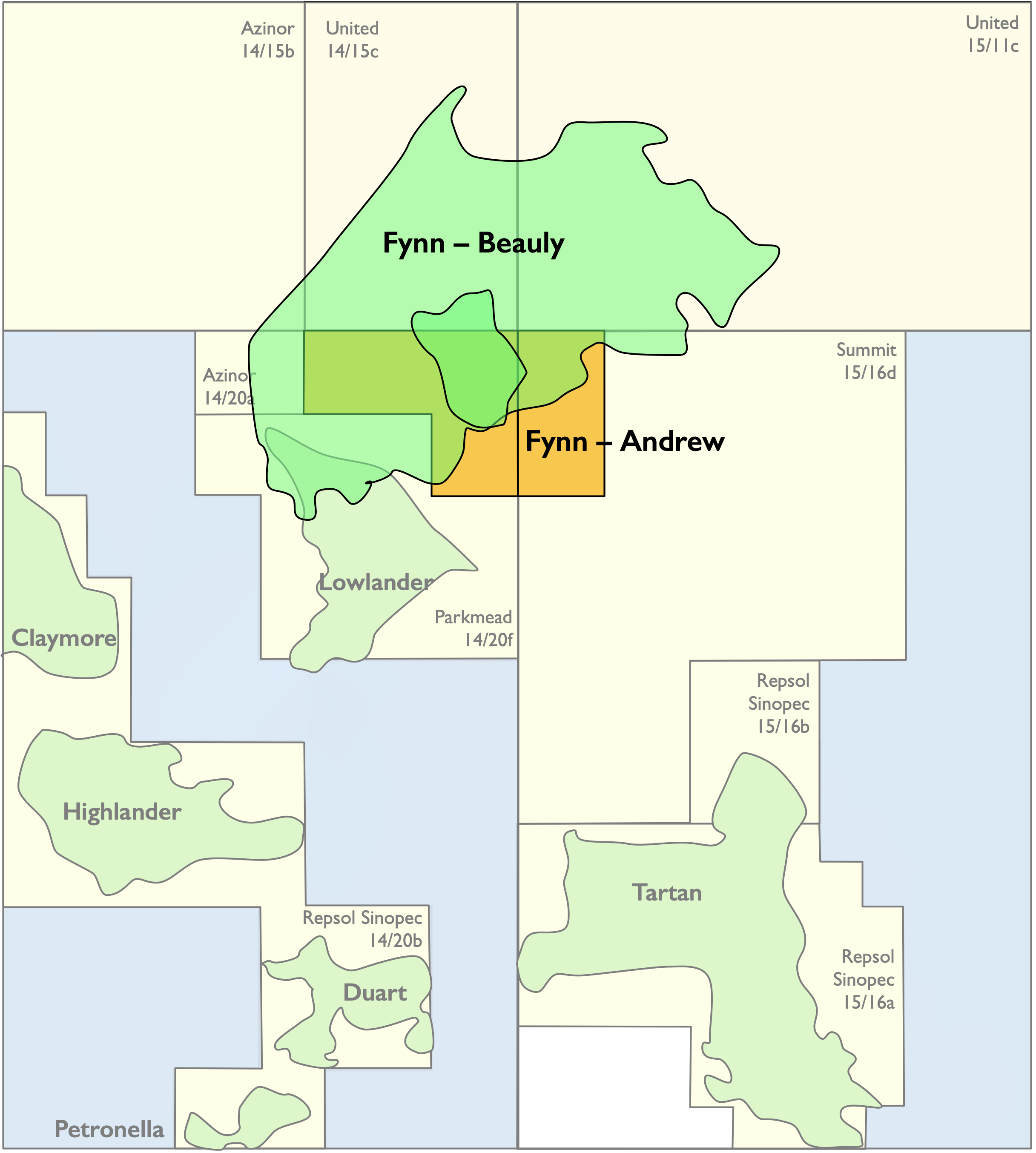

The Fynn licence contains a very substantial heavy oil discovery. About 88% of the resource on a best technical case is estimated to lie within the area of the offered licence. Orcadian has been offered a 50% working interest in the Fynn licence to be operated by the Parkmead Group. The Fynn licence covers blocks 14/15a, 14/20d and 15/11a.

The SNS licence, 100% Orcadian, contains the Earlham discovery, a low-calorie gas discovery with 114bcf of methane resources on a P50 basis, the Clover prospect which has P50 prospective resources of 153bcf, and the decommissioned Orwell field which has redevelopment potential, alongside a number of smaller prospects.