NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO OR FROM THE UNITED STATES, AUSTRALIA, CANADA, JAPAN OR SOUTH AFRICA OR ANY JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS ANNOUNCEMENT. FURTHER, THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND SHALL NOT CONSTITUTE AN OFFER TO SELL OR ISSUE OR THE SOLICITATION TO BUY, SUBSCRIBE FOR OR OTHERWISE ACQUIRE ANY ORDINARY SHARES OF ORCADIAN ENERGY PLC (THE “COMPANY”) IN ANY JURISDICTION IN WHICH ANY SUCH OFFER OR SOLICITATION WOULD BE UNLAWFUL.

15 July 2021

Orcadian Energy plc

(“Orcadian Energy”, “Orcadian” or the “Company”)

Admission to Trading on AIM and First Day of Dealings

Orcadian Energy (AIM: ORCA), the North Sea focused, oil and gas development company, announces the admission (“Admission”) of its entire issued and to be issued ordinary share capital to trading on the AIM Market of the London Stock Exchange (“AIM”). Admission will occur at 8.00 a.m. today, under the ticker “ORCA” and ISIN GB00BN0TY502.

Key Highlights:

- The Placing of the New Shares raised gross proceeds of £3 million for the Company

- Based on the Placing Price of 40p, the market capitalisation of the Company will be approximately £25.5 million at Admission

- The Company will have 63,630,174 Ordinary Shares in issue and a free float of approximately 34 per cent

- For the purposes of the Disclosure Guidance and Transparency Rules, the total number of ordinary shares with voting rights in the Company with effect from 15 July 2021 will be 63,630,174

- The proposed use of proceeds from Admission will be applied to:

- Progress the Pilot oilfield (100% Orcadian) towards Field Development Plan; including an FPSO market approach with Crondall;

- Purchase of recently reprocessed 3D seismic and interpretation thereof on the Bowhead Prospect;

- Ongoing licence fees for the licences held by the Group;

- To progress appraisal work on other licences held in the Group; and

- For working capital purposes.

- The Company’s ISIN isGB00BN0TY502 and its SEDOL is BN0TY50

- WH Ireland Limited (“WH Ireland”) is acting as Sole Broker and Nominated Adviser in relation to the Admission.

The Company’s Admission Document can be found here.

Investor Presentation

Orcadian is also pleased to announce that Steve Brown, CEO and Alan Hume, CFO will provide a live presentation via the Investor Meet Company platform on 21st July 2021 at 12:00pm BST.

The presentation is open to all existing and potential shareholders. Questions can be submitted pre-event via your Investor Meet Company dashboard up until 9am the day before the meeting or at any time during the live presentation.

Investors can sign up to Investor Meet Company for free and add to meet Orcadian Energy plc via:

https://www.investormeetcompany.com/orcadian-energy-plc/register-investor

Investors who already follow Orcadian Energy plc on the Investor Meet Company platform will automatically be invited.

Steve Brown, CEO of Orcadian commented:

“Our Admission to AIM is an important next step in Orcadian’s development. We look forward to welcoming our new shareholders and providing updates as our work programme advances.”

Contact:

| Orcadian Energy plc | + 44 20 3603 1941 |

|

Steve Brown, CEO Alan Hume, CFO |

|

| WH Ireland (Nomad and Sole Broker) | +44 20 7220 1666 |

|

Harry Ansell / Fraser Marshall (Corporate Broking) Katy Mitchell / James Sinclair-Ford / Lydia Zychowska (Nomad) |

|

| Tavistock (PR) | + 44 20 7920 3150 |

|

Nick Elwes Simon Hudson Matthew Taylor |

[email protected] |

About Orcadian Energy

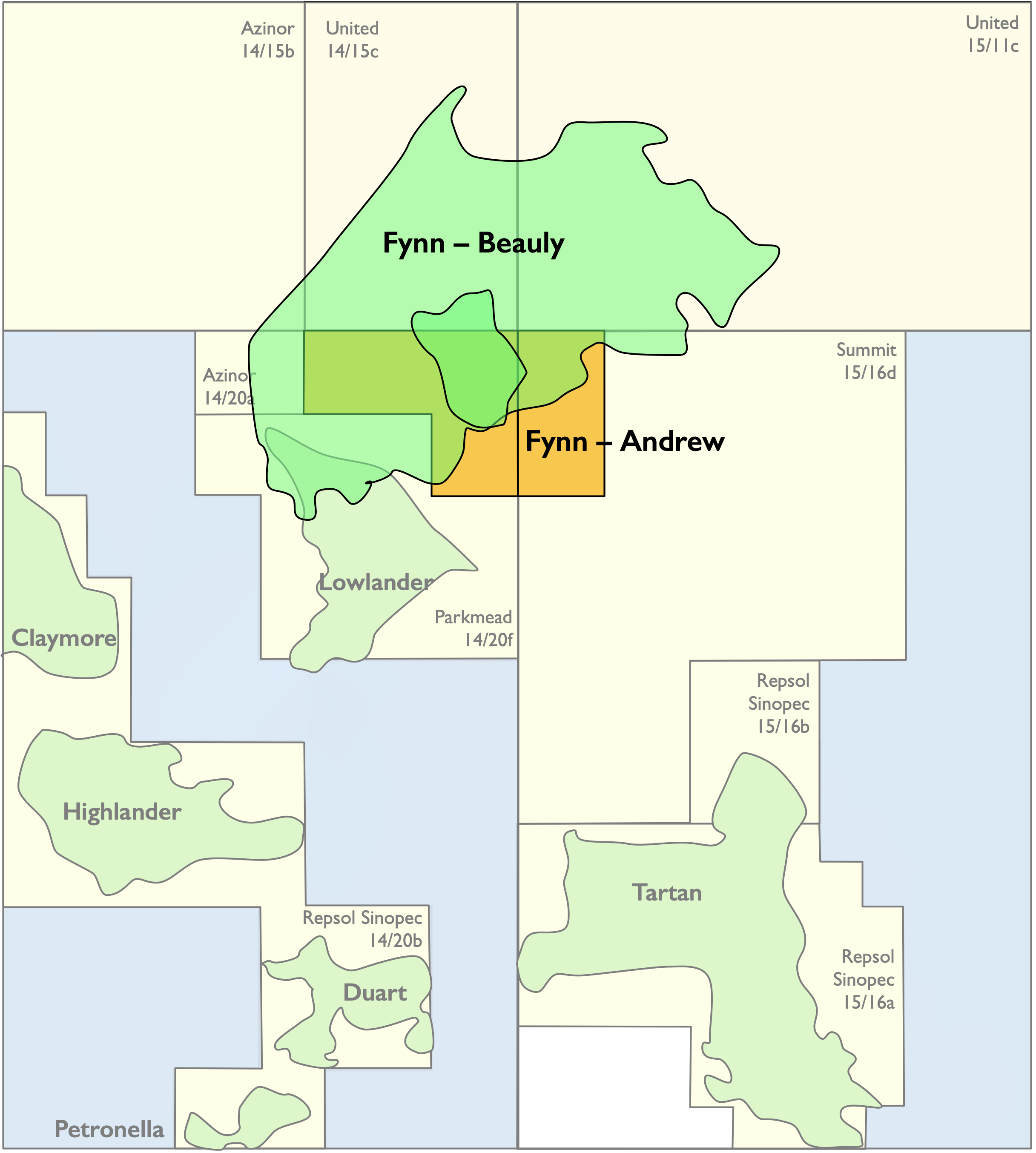

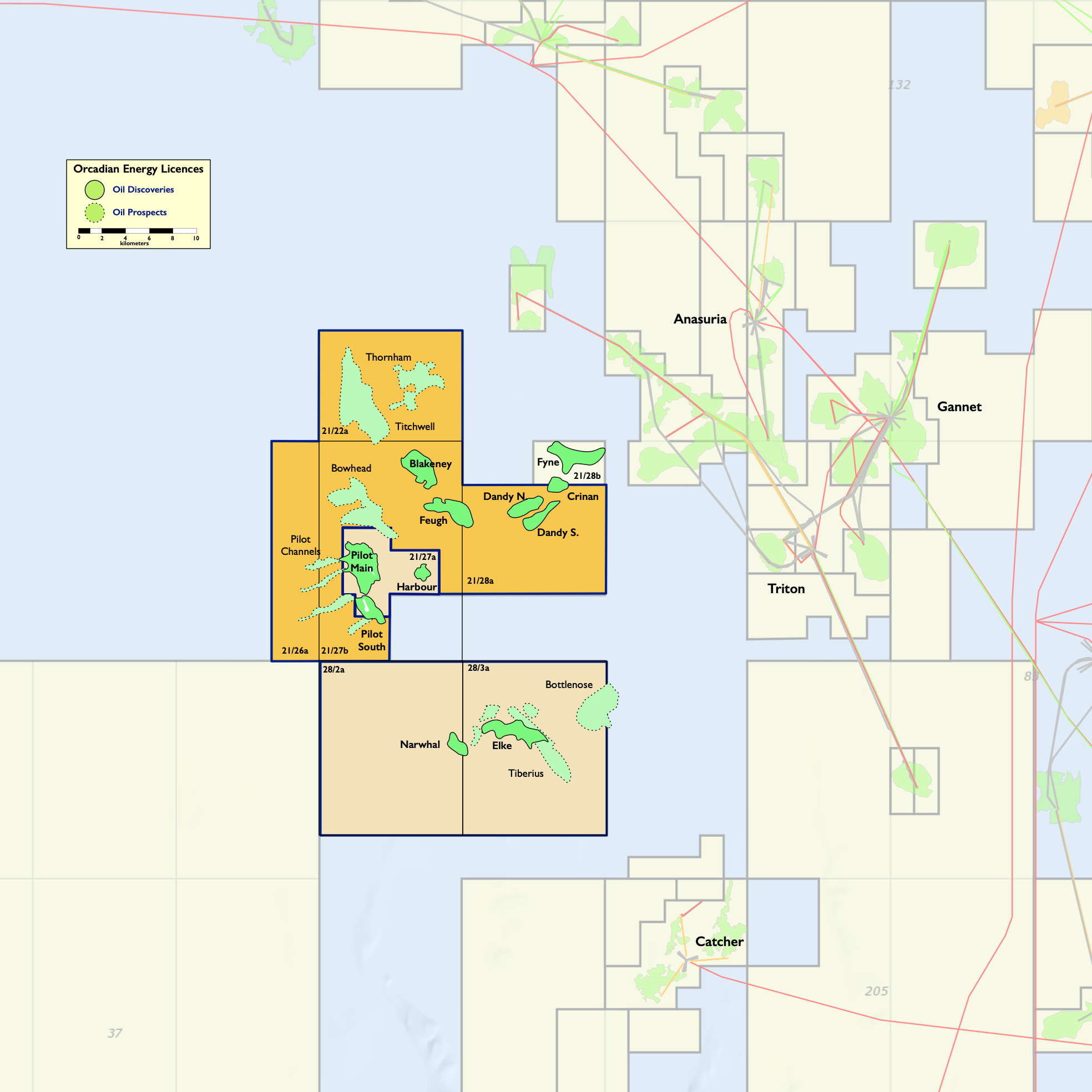

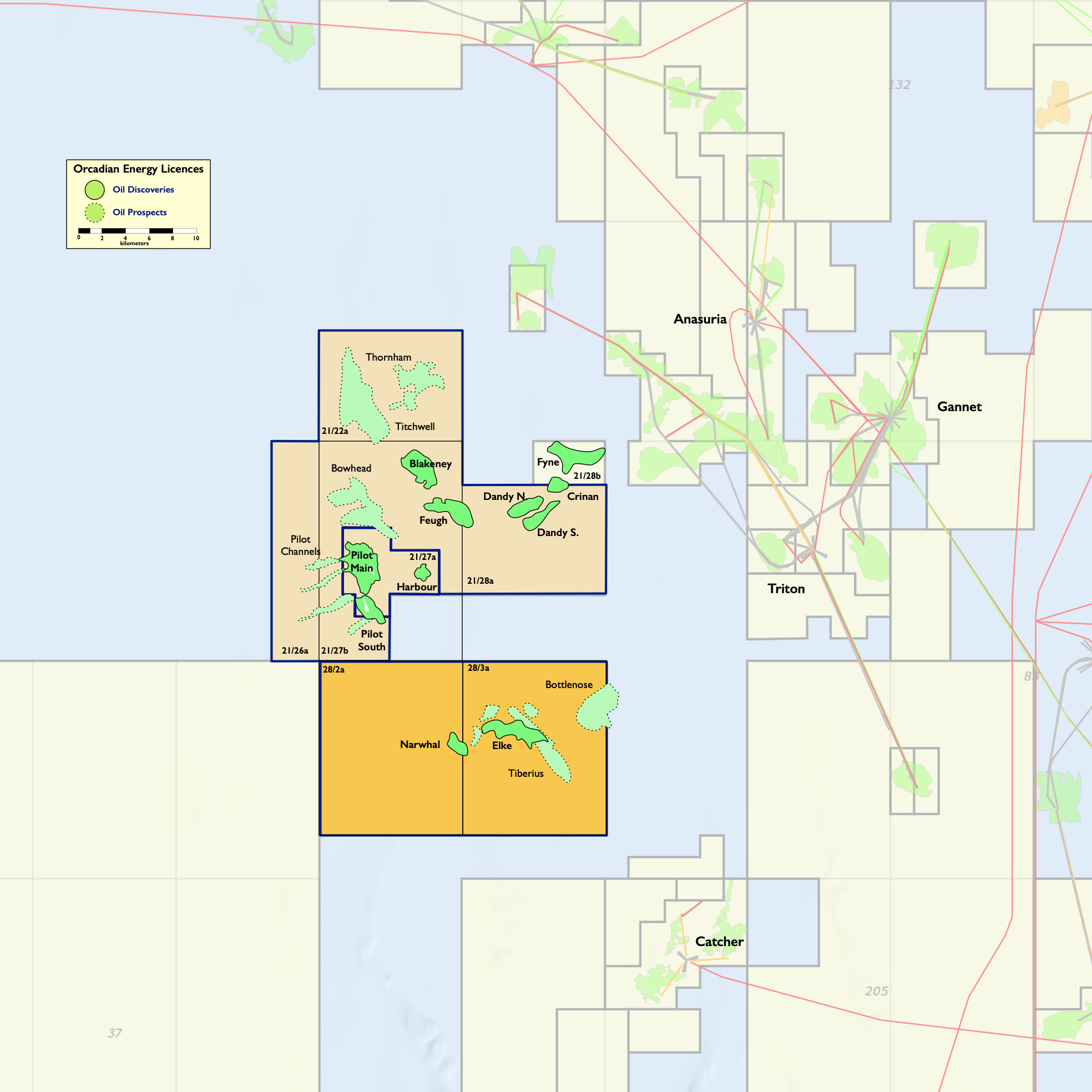

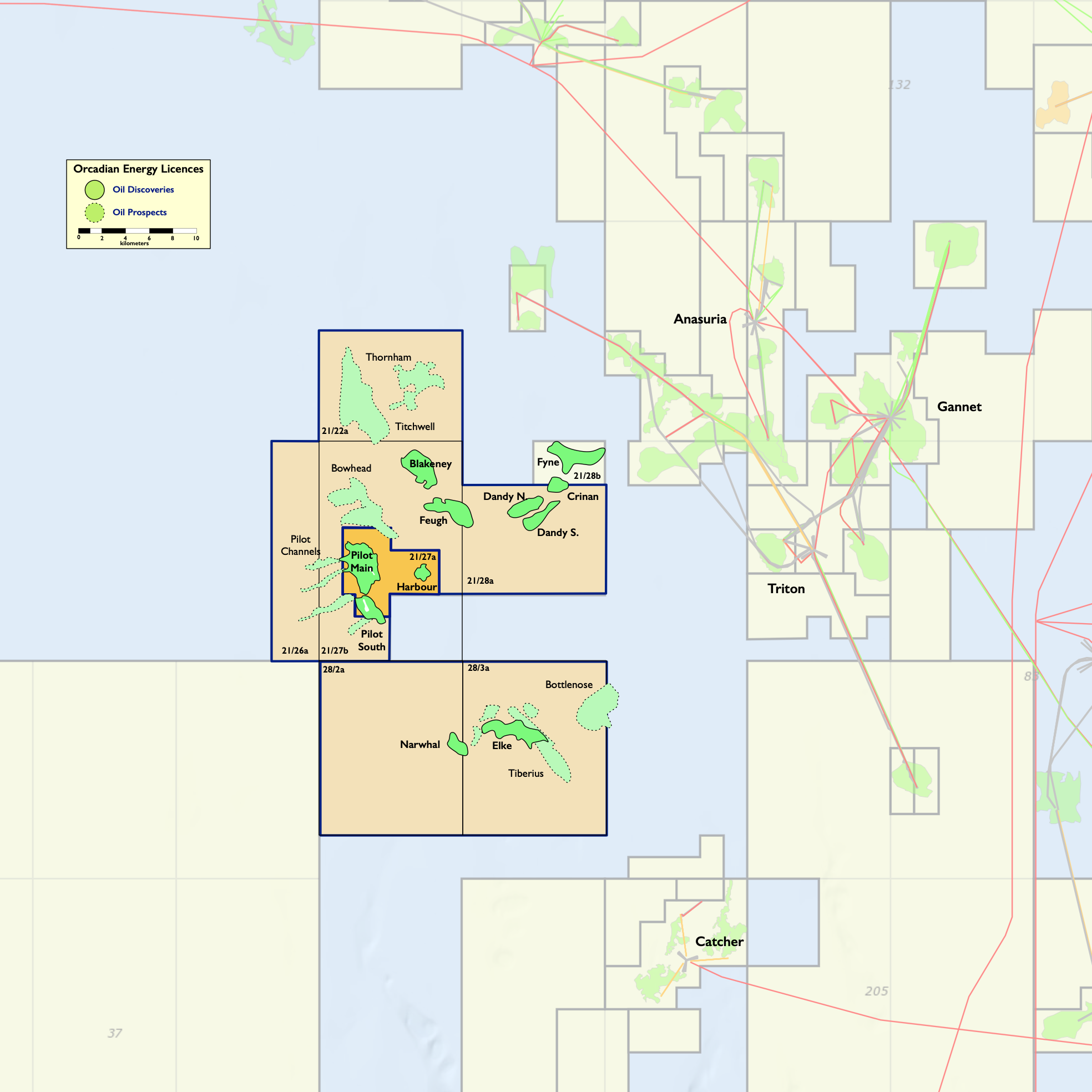

Orcadian Energy (CNS) Ltd (“CNS”), Orcadian’s operating subsidiary, was founded in 2014 and is the sole licensee of P2244, which contains 78.8 MMbbl of 2P reserves in the Pilot discovery, and of P2320 and P2482, which contain a further 77.8 MMbbl of 2C contingent resources in the Elke, Narwhal and Blakeney discoveries (as audited by Sproule, see the CPR in the Company’s Admission Document for more details). Within these licences there are also 191 MMbbl of unrisked prospective resources. These licences are in blocks 21/27, 21/28, 28/2 and 28/3, and lie 150 kms due East of Aberdeen. The Company also has a 50% working interest in P2516, which contains the Fynn discoveries. P2516 is administered by the Parkmead Group and covers blocks 14/20g and 15/16g, which lie midway between the Piper and Claymore fields, 180 kms due East of Wick.

Pilot, which is the largest oilfield in Orcadian’s portfolio was discovered by Fina in 1989 and has been appraised by five wells with seven separate formation reservoir penetrations, including a relatively short horizontal well which produced over 1,800 bbls/day on test.

Forward-looking statements

This announcement includes statements that are, or may be deemed to be, ”forward-looking statements”. These forward-looking statements may be identified by the use of forward-looking terminology, including the terms ”believes”, ”estimates”, ”anticipates”, ”expects”, ”intends”, ”plans”, ”may”, ”will” or ”should” or, in each case, their negative or other variations thereon or comparable terminology. All statements other than statements of historical fact included in this announcement are forward-looking statements. They appear in a number of places throughout this announcement and include statements regarding the Directors’ or the Group’s intentions, beliefs or current expectations concerning, among other things, its operating results, financial condition, prospects, growth, expansion plans, strategies, the industry in which the Group operates and the general economic outlook.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future and therefore are based on current beliefs and expectations about future events. Forward-looking statements are not guarantees of future performance, and the Group’s actual operating results and financial condition, and the development of the industry in which it operates may differ materially from those made in or suggested by the forward-looking statements contained in this announcement. In addition, even if the Group’s operating results, financial condition and liquidity, and the development of the industry in which the Group operates are consistent with the forward- looking statements contained in this announcement, those results or developments may not be indicative of results or developments in subsequent periods. Accordingly, prospective investors should not rely on these forward-looking statements.

These forward-looking statements speak only as of the date of this announcement. The Company and W H Ireland expressly disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations with regard thereto, any new information or any change in events, conditions or circumstances on which any such statements are based, unless required to do so by law or any appropriate regulatory authority.