The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulations (EU) No. 596/2014 (MAR). Upon the publication of this announcement via Regulatory Information Service (RIS), this inside information is now considered to be in the public domain.

15 July 2021

Orcadian Energy plc

(“Orcadian Energy”, “Orcadian” or the “Company”

and with its subsidiary the “Group”)

Concept Selection Update

Issue of shares

Orcadian Energy (AIM: ORCA), the North Sea focused, oil and gas development company, announces the following general update and an issue of new shares.

Concept Selection Update

The Company confirms today that it has now filed an addendum to the Pilot field Concept Select Report (“CSR”) with the Oil and Gas Authority (“OGA”). This followed the execution of an agreed work programme which included polymer core flood tests and work to reduce the carbon dioxide emissions from the project. The selected concept has now been revised to include a significant improvement in process heat management and power generation efficiency. To further improve emissions performance Orcadian has also chosen to include a floating wind turbine in the development concept. Following a review by Crondall Energy Limited, these initiatives combined have the potential to reduce expected Scope 1 emissions from the development by over 80%, to 2.6 kgCO2e/bbl (see the Company’s Admission Document for more information).

Issue of Shares

Following the completion of the placing and the Company’s Admission to AIM, Alisanos Geoscience Ltd, which has provided the services of geoscience consultant Maurice Bamford to the Company, has agreed to take £50,000 of £71,422 owed to it by Orcadian in ordinary shares in the Company at the Admission price of 40p per share. As a result of this Alisanos Geoscience Ltd (or other parties as it so directs) will today be issued with 125,000 ordinary shares in the Company (“New Shares”).

Application will be made to admit the New Shares to trading on AIM (“New Shares Admission“). Admission is expected to become effective, and dealings in the New Shares will commence on 21 July 2021. The New Shares will rank pari passu in all respects with the Company’s existing ordinary shares in issue.

For the purposes of the Financial Conduct Authority’s Disclosure Guidance and Transparency Rules (“DTRs”), the issued ordinary share capital of the Company following the New Shares Admission will consist of 63,755,174 ordinary shares with voting rights attached (one vote per ordinary share). There are no ordinary shares held in treasury. This total voting rights figure may be used by shareholders as the denominator for the calculations by which they will determine whether they are required to notify their interests in, or a change to their interest in, the Company under the DTRs.

For further information on the Company please visit the Company’s website: https://orcadian.energy

Contact:

| Orcadian Energy plc | + 44 20 7920 3150 |

|

Steve Brown, CEO Alan Hume, CFO |

|

| WH Ireland (Nomad and Sole Broker) | +44 20 7220 1666 |

|

Harry Ansell / Fraser Marshall (Corporate Broking) Katy Mitchell / James Sinclair-Ford / Lydia Zychowska (Nomad) |

|

| Tavistock (PR) | + 44 20 7920 3150 |

|

Nick Elwes Simon Hudson Matthew Taylor |

[email protected] |

About Orcadian Energy

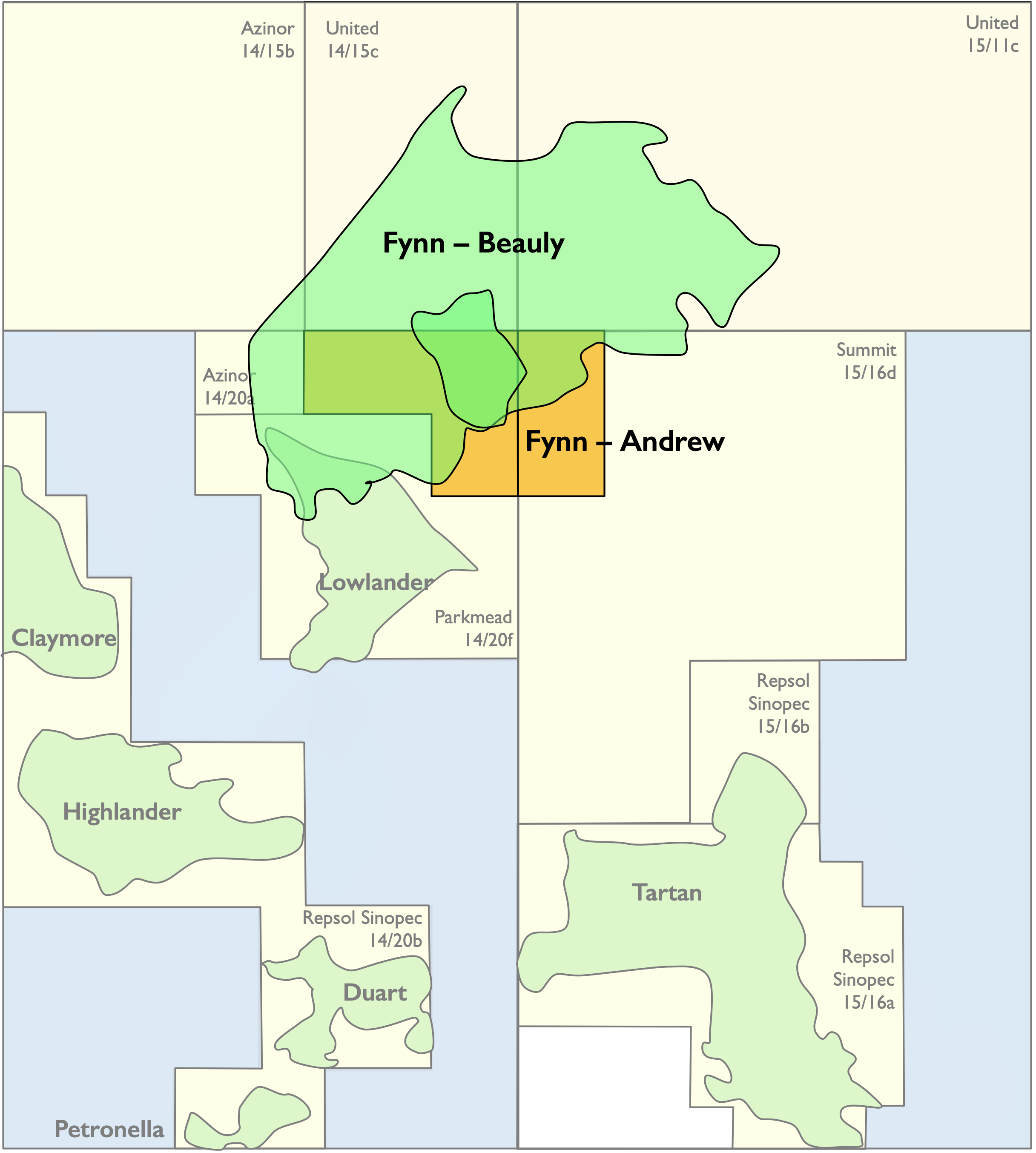

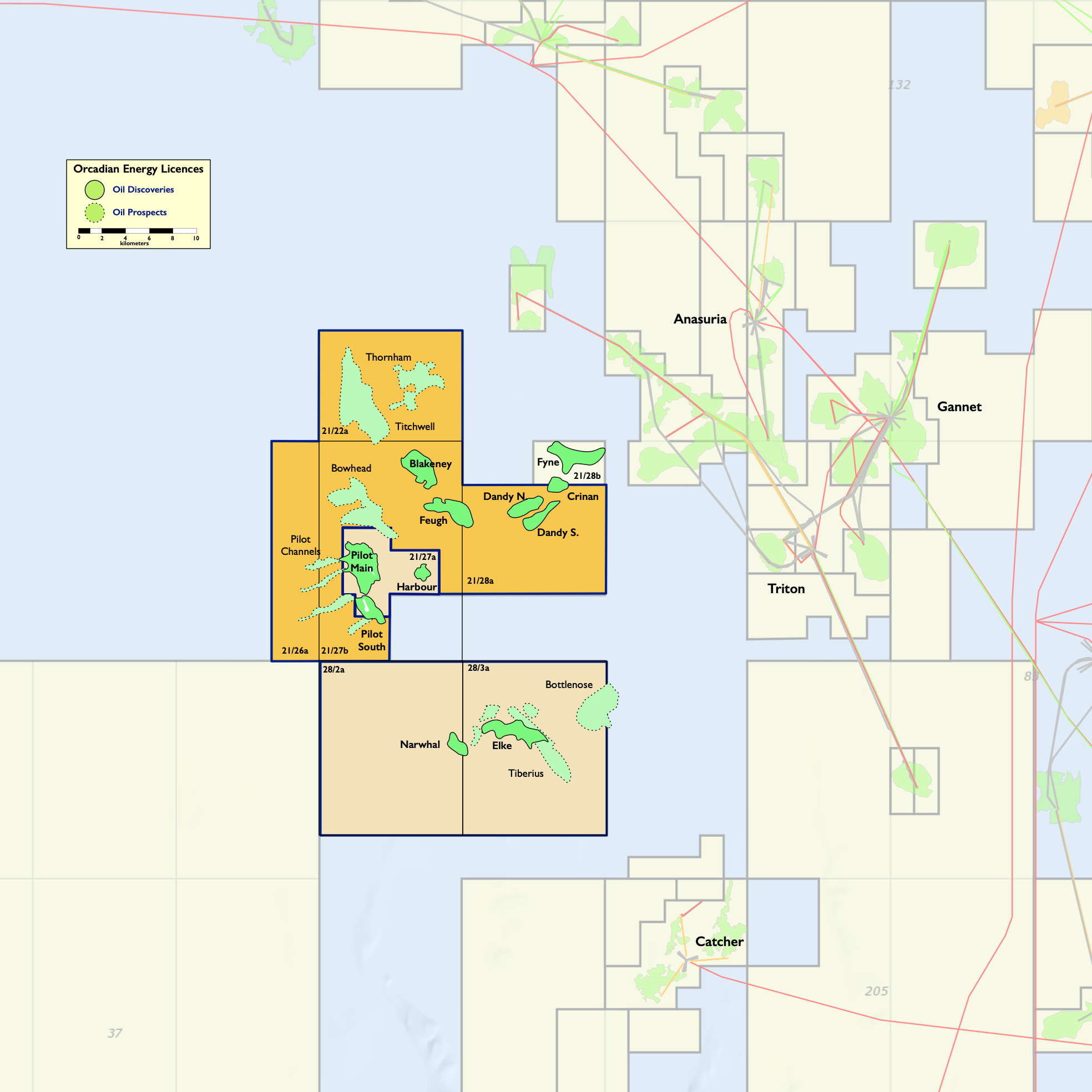

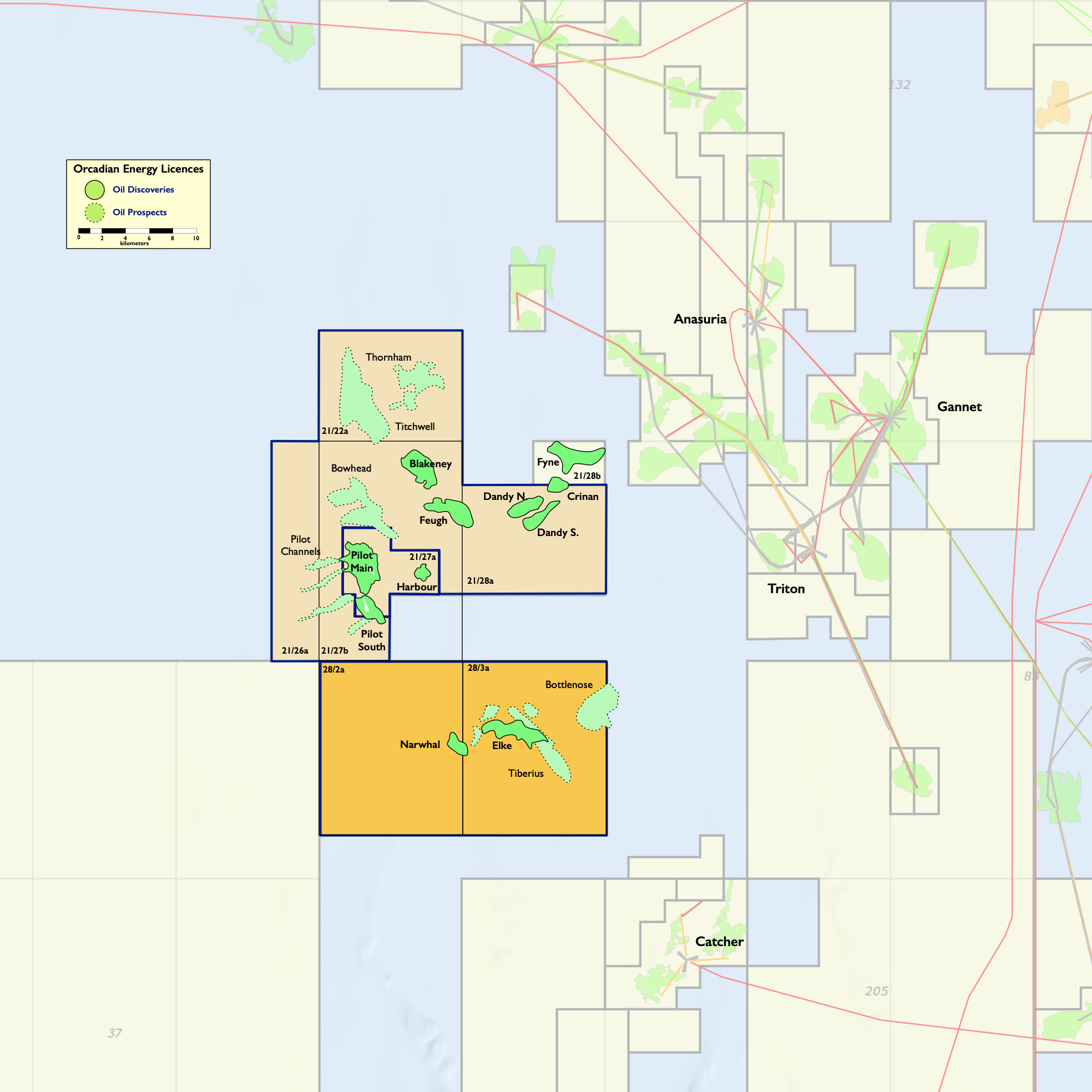

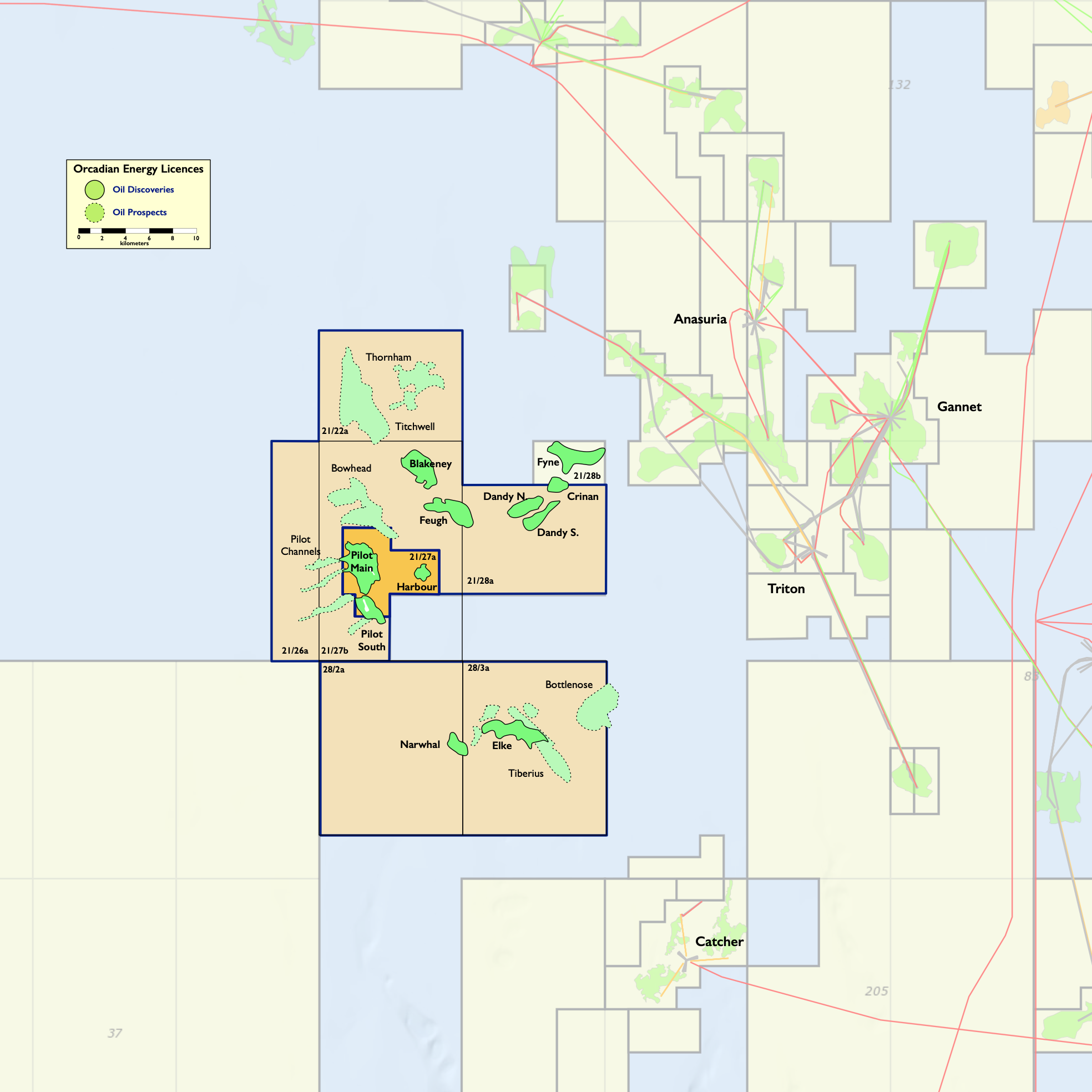

Orcadian Energy (CNS) Ltd (“CNS”), Orcadian’s operating subsidiary, was founded in 2014 and is the sole licensee of P2244, which contains 78.8 MMbbl of 2P reserves in the Pilot discovery, and of P2320 and P2482, which contain a further 77.8 MMbbl of 2C contingent resources in the Elke, Narwhal and Blakeney discoveries (as audited by Sproule, see the CPR in the Company’s Admission Document for more details). Within these licences there are also 191 MMbbl of unrisked prospective resources. These licences are in blocks 21/27, 21/28, 28/2 and 28/3, and lie 150 kms due East of Aberdeen. The Company also has a 50% working interest in P2516, which contains the Fynn discoveries. P2516 is administered by the Parkmead Group and covers blocks 14/20g and 15/16g, which lie midway between the Piper and Claymore fields, 180 kms due East of Wick.

Pilot, which is the largest oilfield in Orcadian’s portfolio was discovered by Fina in 1989 and has been appraised by five wells with seven separate formation reservoir penetrations, including a relatively short horizontal well which produced over 1,800 bbls/day on test.