THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY THE COMPANY TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER THE MARKET ABUSE REGULATION (EU) NO. 596/2014 AS IT FORMS PART OF UK DOMESTIC LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT 2018, AS AMENDED. UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO BE IN THE PUBLIC DOMAIN.

2 April 2024

Orcadian Energy plc

(“Orcadian Energy”, “Orcadian” or the “Company”)

Completion of Pilot Farm-out

Orcadian Energy (AIM: ORCA) is delighted to announce the completion of the previously announced farm-out of an 81.25% interest in licence P2244, which contains the Pilot field, to Ping Petroleum UK plc (“Ping”). Ping is focused on shallow water offshore production and development opportunities and has a significant acreage holding to the East of Pilot.

This means that Orcadian Energy retains an 18.75% interest in the Pilot field development, fully carried to the first offload of oil produced from the field. Orcadian has no requirement to fund the pre-production development project work programme.

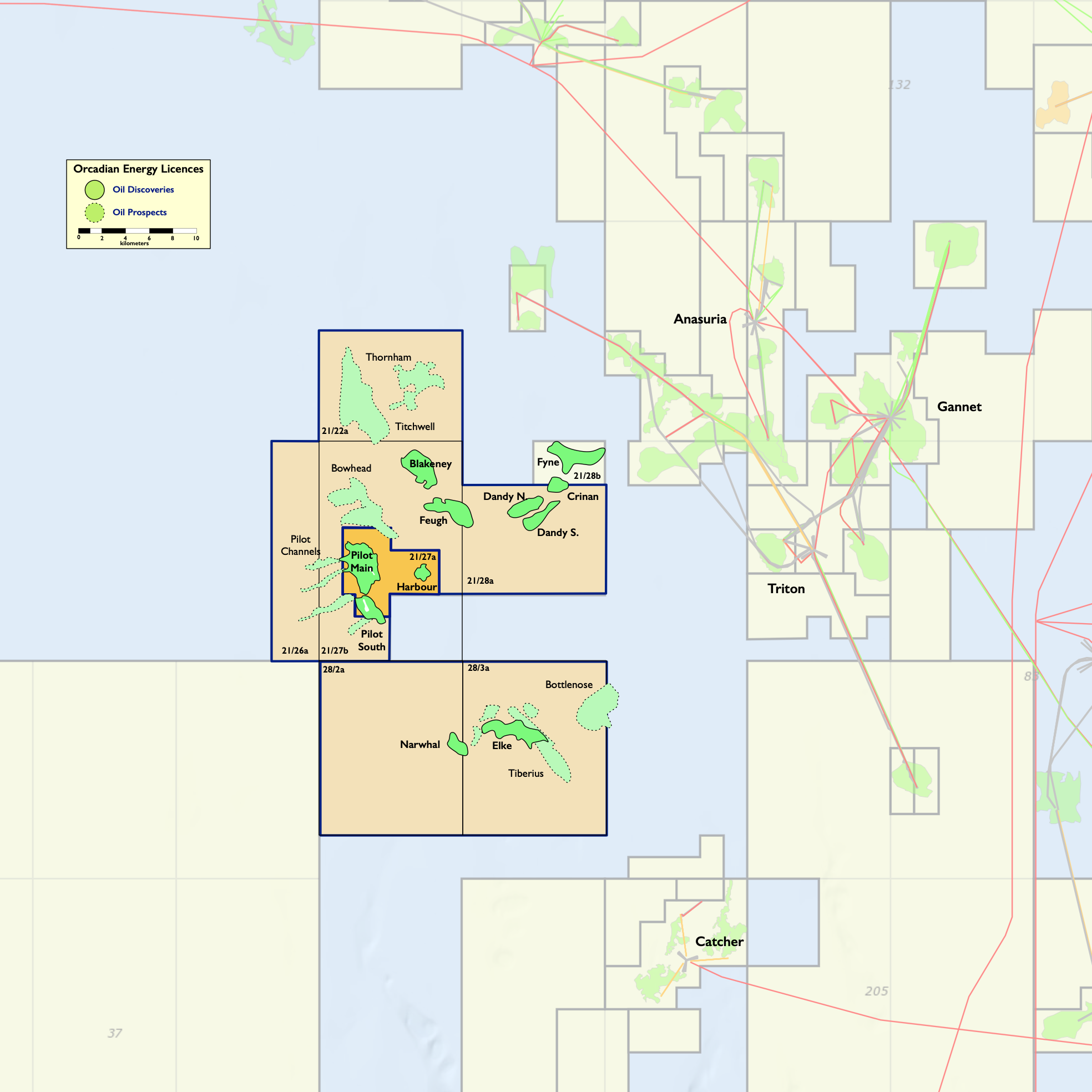

The Pilot project is intended to benefit from the application of polymer flooding technology which is enjoying consistent success on Ithaca’s Captain EOR project. For medium viscosity oils like Pilot, polymer flooding significantly reduces fluid handling, and hence energy requirements and materially boosts the recovery factor. Sproule audited the reserves on the Pilot field in 2021 and attributed gross 2P reserves of 78.8 MMbbl to a polymer flood scheme. To be consistent with Ping’s reserve classification scheme these volumes will be reclassified as 2C Contingent Resources (Development Pending) until the FDP is approved. Please see the updated resource estimates for the company at the end of this press release which include management and operator estimates of the resources associated with licences offered but not yet awarded.

The near-term focus of the Ping team will be to select a suitable FPSO and prepare a FDP for submission to the North Sea Transition Authority (“NSTA”). Orcadian will support the Ping team especially on the sub-surface aspects of a draft FDP which has already been reviewed by NSTA.

The commercial terms of the transaction are summarised below:

- Ping has acquired an 81.25% interest in licence P2244, which contains the Pilot field;

- Ping has been appointed operator of the licence;

- Orcadian will retain an 18.75% fully carried interest in the Licence;

- The carry will apply to all pre-first offload expenditure up to a cap which will be based upon the field development plan budget, as submitted to NSTA, inclusive of contingencies and will be repaid by a combination of a reduced revenue interest of 10% and any cash tax benefits enjoyed by Ping related to the carry expenditure;

- On repayment of the carry the revenue interest will revert to 18.75%

- Orcadian will now receive a $100,000 cash payment and reimbursement of certain past costs capped at £250,000;

- Orcadian will also receive a $3m payment on FDP approval.

The net result of the carry arrangements is that Orcadian will enjoy a net present value (NPV) which is marginally greater than its equity share in the NPV of the overall project, but without having to raise capital to fund the project capex.

Facility Agreement

Under the terms of the facility agreement, Shell International Trading and Shipping Company Limited (“STASCO”) has given its consent for the farm-out of 81.25% of the P2244 license to Ping.

To secure the consent Stephen Brown has given a personal guarantee to STASCO for the loan amount. STASCO also requires that Stephen Brown procures a share charge over the ordinary shares held by him and his wife in Orcadian and until such time as this can be arranged Stephen Brown has undertaken that he will not dispose of nor create security over the shares.

Steve Brown, Orcadian’s CEO, said:

“The Pilot development is a fantastic opportunity for our new partners, Ping, the UK oil and gas industry more widely, and of course for Orcadian. I am very excited by the prospects for the development and as the major shareholder have facilitated the farm-out by providing a personal guarantee further demonstrating my commitment to Orcadian.

“Heavy, viscous oils make up a high proportion of the UK’s undeveloped discovered resources and we believe that in a post-transition world we will still need hydrocarbons, specifically heavy oils and gas. Heavy oils can supply the lubricants, asphalt, and anode grade petroleum coke markets which will continue to grow even as gasoline and diesel demand falls.

“Application of well proven polymer flooding technology early in a viscous oil development can significantly reduce emissions associated with the production process. Ping has been at the forefront of planning field developments that take advantage of renewable power, and we are confident that Ping can put together a very low emissions development scheme for Pilot.

“We are delighted to be working with the Ping team to bring this project to fruition. They are commercially and technically innovative and have built a team here in the UK which is not just a replication of a big company structure, but one which is capable of delivering a really innovative and cost-focussed project for us all.”

For further information on the Company please visit the Company’s website: https://orcadian.energy

Contact:

|

Orcadian Energy plc |

+ 44 20 7920 3150 |

|

Steve Brown, CEO Alan Hume, CFO |

|

|

Zeus (Nomad and Joint Broker) |

+44 20 3829 5000 |

|

Dan Bate / Alex Campbell-Harris (Investment Banking) Simon Johnson (Corporate Broking) |

|

|

Novum (Joint Broker) |

+44 207 399 9425 |

|

Colin Rowbury / Jon Belliss |

|

|

Tavistock (PR) |

+ 44 20 7920 3150 |

|

Nick Elwes / Simon Hudson |

Qualified Person’s Statement

Pursuant to the requirements of the AIM Rules and in particular, the AIM Note for Mining and Oil and Gas Companies, Maurice Bamford has reviewed and approved the technical information and resource reporting contained in this announcement.

Maurice has more than 33 years’ experience in the oil & gas industry and 3 years in academia. He holds a BSc in Geology from Queens University Belfast and a PhD in Geology from the National University of Ireland. Maurice is a Fellow of the Geological Society, London, and a member of the Geoscience Energy Society of Great Britain. He is Exploration and Geoscience Manager at Orcadian Energy.

About Orcadian Energy

Orcadian is a North Sea focused, low emissions, oil and gas exploration and development company. Orcadian may be a small operator, but it is also nimble, and the Directors believe it has grasped opportunities that have eluded some of the much bigger companies. As we strike a balance between Net Zero and a sustainable energy supply, Orcadian intends to play its part to minimise the cost of Net Zero and to deliver reliable energy to the UK.

Orcadian’s key asset is the Pilot oilfield, Pilot was discovered by PetroFina in 1989 and has been well appraised. The field has excellent quality reservoir and contains 263MMbbl of a viscous oil ranging in gravity from 12º API in the South of the reservoir to 17º API in the North. In planning the Pilot development, Orcadian has selected polymer flooding and wind power to transform the production of viscous oil into a cleaner and greener process. Polymer significantly reduces fluid handling requirements and hence energy consumption as well as boosting recovery. Ithaca Energy, operator of the Captain field in the Inner Moray Firth, has enjoyed consistent success in applying polymer flood to the highly analogous Captain field. The Pilot project is now under the stewardship of Ping Petroleum UK PLC (“Ping”) and is intended to be amongst the lowest carbon emitting oil production facilities in the world.

Ping is progressing a low-emissions, phased, field development plan for Pilot based upon a polymer flood of the reservoir, a Floating Production Storage and Offloading vessel (FPSO) and provision of power from a floating wind turbine or a local wind farm.

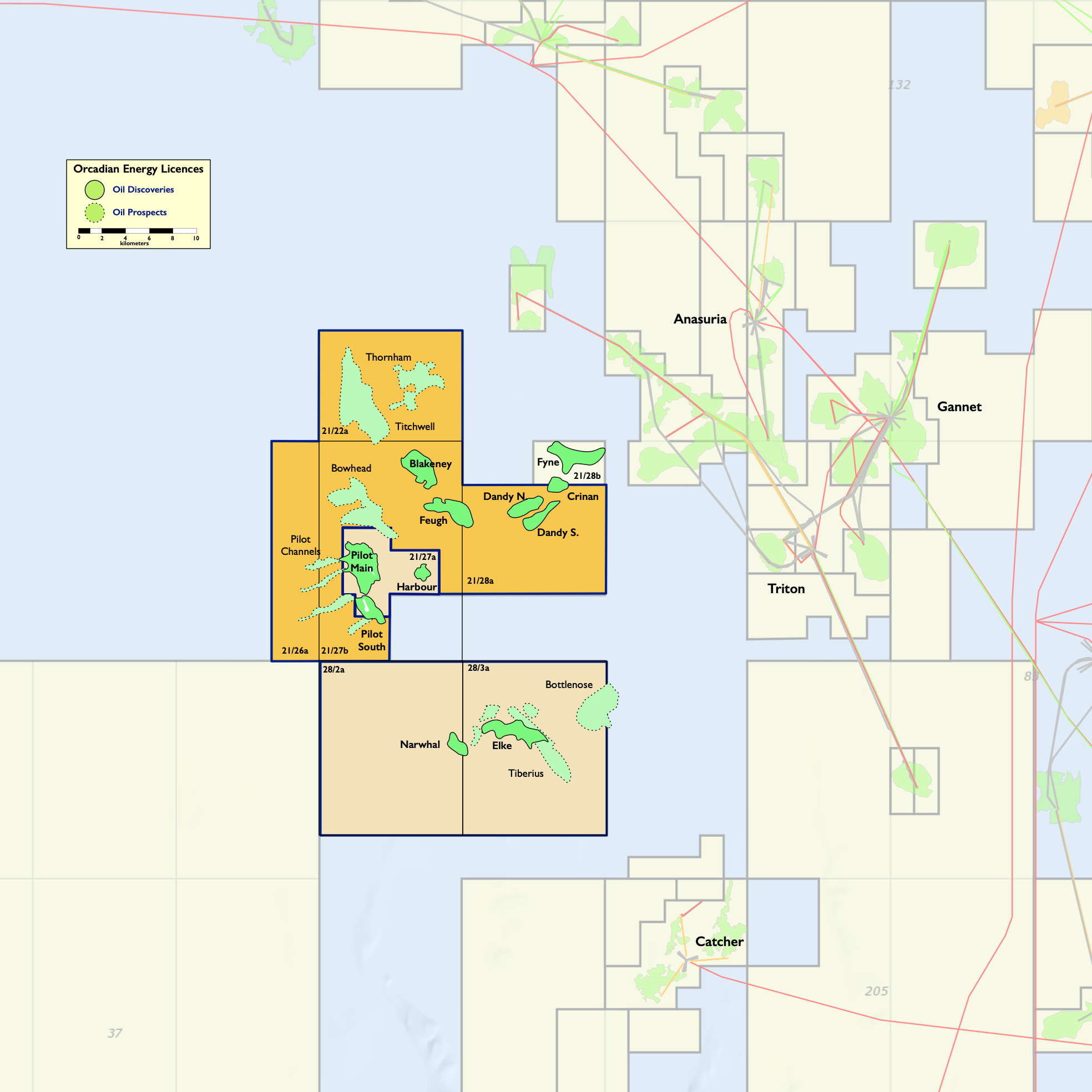

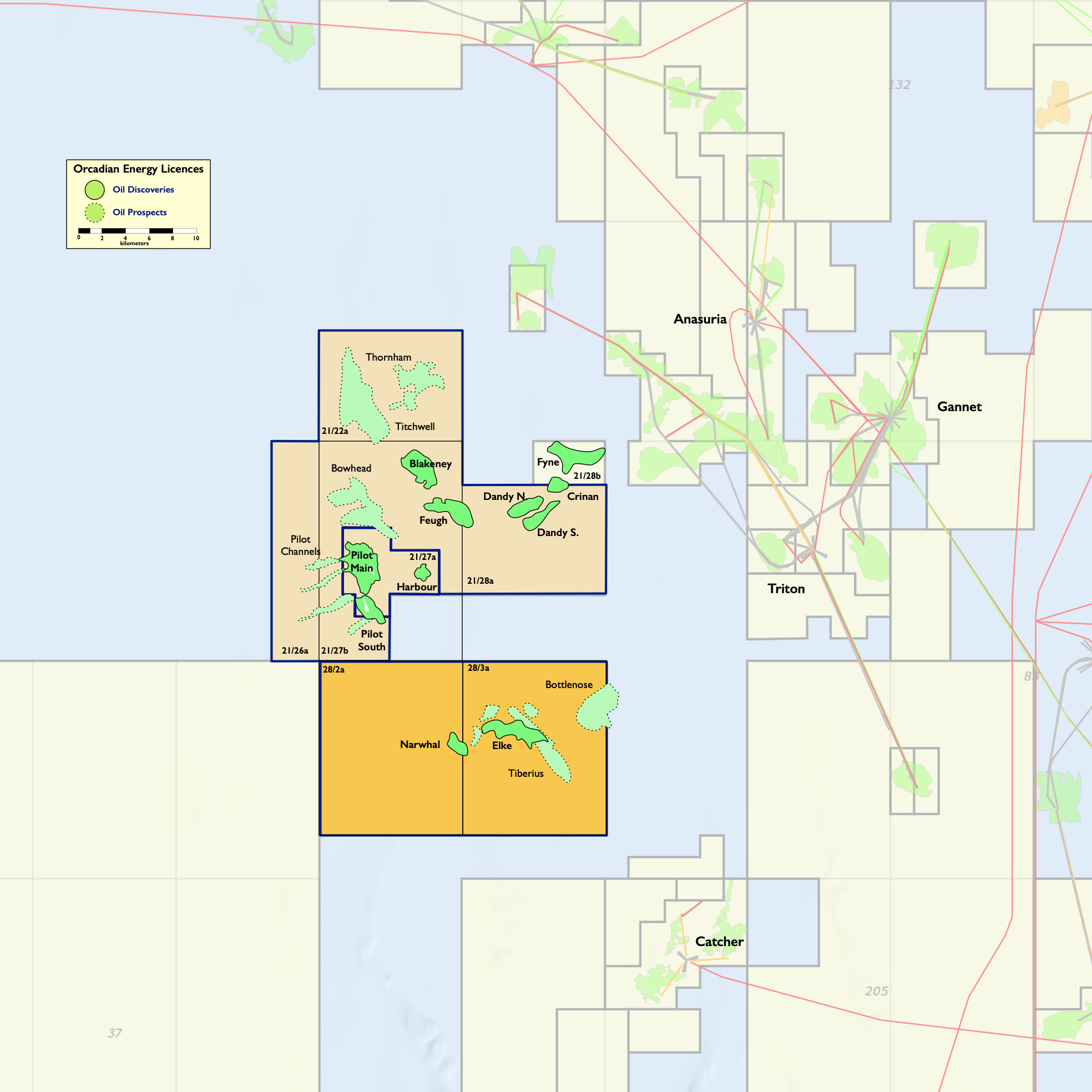

Orcadian has an 18.75% fully carried interest in licence P2244 (block 21/27a) and a 100% interest in licence P2482 (blocks 28/2a and 28/3a). Ping is operator of P2244 and the Pilot development project.

Orcadian has also been offered two licences in the 33rd licensing process and expects formal issues of these licences in due course.

The Mid-North Sea High licence contains shallow gas leads Orcadian applied in partnership with Triangle Energy, an Australian listed energy company. Orcadian would be licence administrator and would hold 50% of the offered licence. The Mid-North Sea High licence covers blocks 29/16, 29/17, 29/18, 29/19, 29/21, 29/22, 29/23, 29/27 and 29/28.

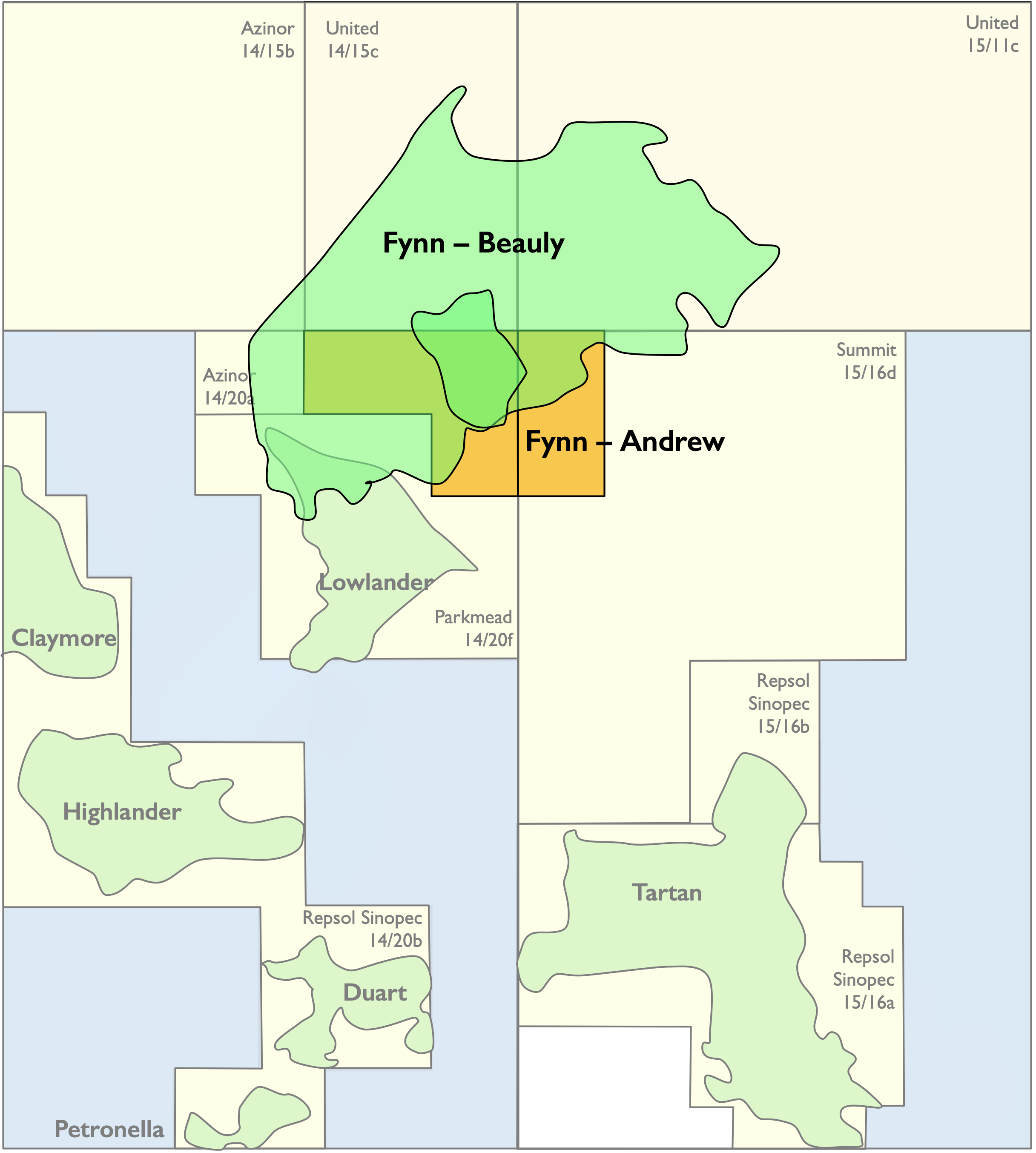

The Fynn licence contains a very substantial heavy oil discovery. About 88% of the resource on a best technical case is estimated to lie within the area of the offered licence. Orcadian has been offered a 50% working interest in the Fynn licence to be operated by the Parkmead Group. The Fynn licence covers blocks 14/15a, 14/20d and 15/11a.

Orcadian provides below a summary of resources across its licences and potential licences. For licences P2244 (Pilot) and P2482 (Elke, Narwhal and Elke satellites) the volumes are based upon the CPR prepared by Sproule in April 2021 net of TGS royalty and including an estimate of the allocation of production as detailed in the Pilot SPA and JOA. For the prospects on the potential licences, Fynn (Beauly), Lowlander & Midlander, Glenlough and Breckagh the volumes are either Orcadian management estimates or Operator management estimates prepared in accordance with the reserve definitions guidelines defined in the SPE Petroleum Resources Management System 2018.

| Asset | Gross | Net | PRMS sub-class | Phase & units | Commercial risk factor | Licence | ||||

| 1C | 2C | 3C | 1C | 2C | 3C | |||||

| Pilot* | 58.4 | 78.8 | 110.5 | 9.8 | 13.6 | 19.7 | Development pending | Oil, MMbbl | 100% | P2244 Source 2 |

| Pilot periphery | 5.9 | 9.8 | 17.6 | 1.1 | 1.8 | 3.3 | Development unclarified | Oil, MMbbl | 80% | P2244 Source 2 & 7 |

| Elke Main § | 26.0 | 45.5 | 94.9 | 25.7 | 45.0 | 94.0 | Development on hold | Oil, MMbbl | 79% | P2482 Source 3 |

| Narwhal | 4.3 | 9.2 | 17.6 | 4.2 | 9.1 | 17.4 | Development on hold | Oil, MMbbl | 79% | P2482 Source 1 |

| Fynn (Beauly)^ | 175.6 | 292.3 | 480.6 | 77.3 | 128.6 | 211.5 | Development unclarified | Oil, MMbbl | 25% | P2634^ Source 5 & 7 |

| Lowlander & Midlander^ | 17.5 | 11.6 | 31.9 | 8.8 | 5.8 | 16.0 | Development unclarified | Oil, MMbbl | 15% | P2634^ Source 6 & 7 |

| Total contingent resources | 204.0 | Oil, MMbbl | ||||||||

| Total contingent resources factored by commercial risk | 90.9 | Oil, MMbbl | ||||||||

| Asset | Gross | Net | PRMS sub-class | Phase & units | Geological risk factor | Licence | ||||

| Low | Best | High | Low | Best | High | |||||

| Elke Main – West (3C outline §) |

13.0 | 22.8 | 47.5 | 12.9 | 22.5 | 47.0 | Prospect | Oil, MMbbl | 90% | P2482 Source 3 & 7 |

| Elke Updip | 5.5 | 17.5 | 39.0 | 5.4 | 17.3 | 38.6 | Prospect | Oil, MMbbl | 87% | P2482 Source 1 |

| Elke Area 2 | 4.2 | 12.3 | 25.4 | 4.2 | 12.2 | 25.1 | Prospect | Oil, MMbbl | 64% | P2482 Source 1 |

| Glenlough^ | 12.0 | 21.8 | 36.7 | 6.0 | 10.9 | 18.3 | Lead | Gas, MMboe | 31% | P2650^ Source 4 |

| 72.0 | 131.0 | 220.0 | 36.0 | 65.5 | 110.0 | Gas, bcf | ||||

| Upper Breckagh^ | 3.3 | 5.5 | 9.2 | 1.7 | 2.8 | 4.6 | Lead | Gas, MMboe | 55% | P2650^ Source 4 |

| 20.0 | 33.0 | 55.0 | 10.0 | 16.5 | 27.5 | Gas, bcf | ||||

| Lower Breckagh^ | 9.5 | 17.5 | 30.3 | 4.8 | 8.8 | 15.2 | Lead | Gas, MMboe | 20% | P2650^ Source 4 |

| 57.0 | 105.0 | 182.0 | 28.5 | 52.5 | 91.0 | Gas, bcf | ||||

| Total prospective resources | 74.4 | Oil & gas, MMboe | ||||||||

| Total risked prospective resources | 49.8 | Oil & gas, MMboe | ||||||||

| Source | ||||||||

| 1 | Sproule CPR 2021 | |||||||

| 2 | Sproule CPR 2021 – equity updated | |||||||

| 3 | Sproule CPR 2021 – management modified | |||||||

| 4 | Management estimate – Licence Application to NSTA | |||||||

| 5 | Operator estimate – as presented to NSTA | |||||||

| 6 | Operator – earlier Relinquishment Report & Licence Application – both for NSTA | |||||||

| 7 | Orcadian management estimate of risk factor | |||||||

| Notes | |||||||||

| * | Pilot field net resources include a reduced revenue interest of 10% until the carry is repaid | ||||||||

| § | Elke high case is limited to the 2C outline as we have reclassified the 3C extension as the Elke Main West prospect | ||||||||

| ^ | Resources are on a licence which has been offered for award but which has not yet been signed | ||||||||

About Ping UK

Ping Petroleum UK PLC (“Ping UK”) is the UK division of Ping Petroleum Limited. Ping UK is the joint owner and operator of the Anasuria Cluster and the Anasuria FPSO, both through the Anasuria Operating Company, a 50/50 joint venture with Anasuria Hibiscus UK, a subsidiary of Hibiscus Petroleum Berhad. Since 2021, Ping UK has also held a 100 per cent stake in Avalon, which lies in block 21/6b in the North Sea. Ping UK aims to become the first organisation to use floating offshore wind to power an FPSO in the UK, which would mark a significant step in the energy transition.

About Ping Petroleum Limited

Ping Petroleum Limited (“Ping”) is an independent oil and gas (“O&G”) upstream exploration and production company. The company focuses on shallow water offshore production and development opportunities and currently has four assets namely Anasuria and Avalon in the North Sea, United Kingdom (“UK”) and Meranti- and A-Clusters in Malaysia. The company is a subsidiary of Dagang NeXchange Berhad (“DNeX”), which is listed on the Main Market of Bursa Malaysia. For more information on the company, log on to www.pingpetroleum.com.

About Dagang NeXchange Berhad

Dagang NeXchange Berhad (“DNeX”) is a global technology company operating in three business divisions namely Technology, Energy, and Information Technology (“IT”). In Technology, the company is a leading semiconductor foundry while in Energy, the company is making its mark in upstream exploration and production as well as equipment supply and maintenance. In IT, the company is a leading provider of award-winning eServices for Trade Facilitation and has a wealth of knowledge, expertise and operational know-how in the provisioning of eServices for Trade Facilitation, Technology Consulting and Systems Integration, as well as Subsea Telecommunications. The company is listed on the Main Market of Bursa Malaysia. For more information on the company, log on to www.dnex.com.my.