15 May 2023

Orcadian Energy plc

(“Orcadian Energy”, “Orcadian” or the “Company”)

Orcadian announces that following extensive discussions with the North Sea Transition Authority (“NSTA”) that the NSTA has declined Orcadian’s request to extend Phase A of Licence P2320 (the “Licence” or “P2320”). As a consequence the Licence determined (expired) on 14 May 2023. In addition, the potential disposals of interests in sub-areas of the licence to Rapid Oil (see announcement dated 11 January 2023) and Carrick Resources (see announcement dated 3 August 2022) will not now proceed.

Orcadian has been in farm-out discussions with multiple counterparties regarding the drilling of an exploration well within the former P2320 licence area. A number of those companies have agreed non-compete arrangements with Orcadian which should ensure that any reapplication for a licence over the same area, by any of those companies, would be made in partnership with Orcadian.

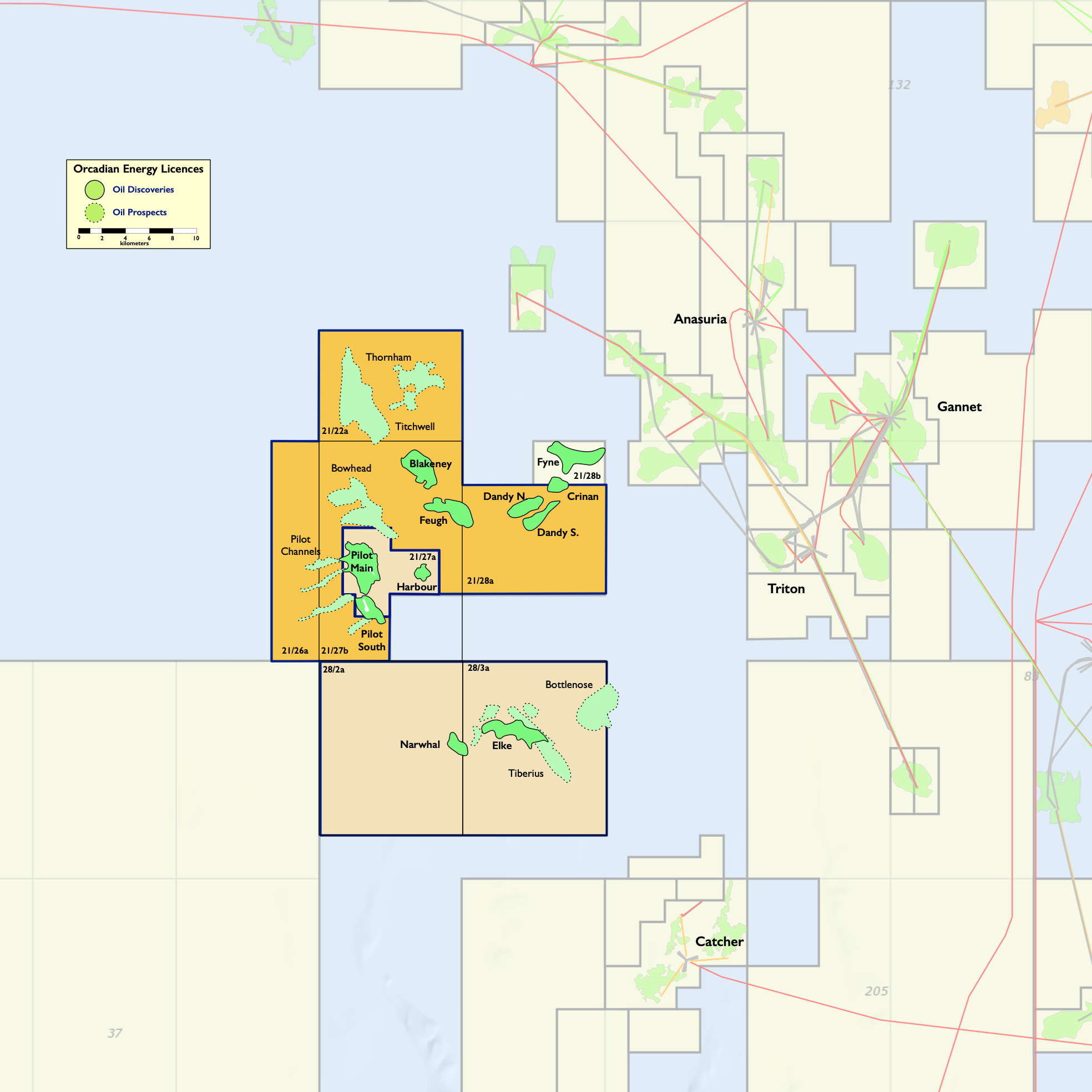

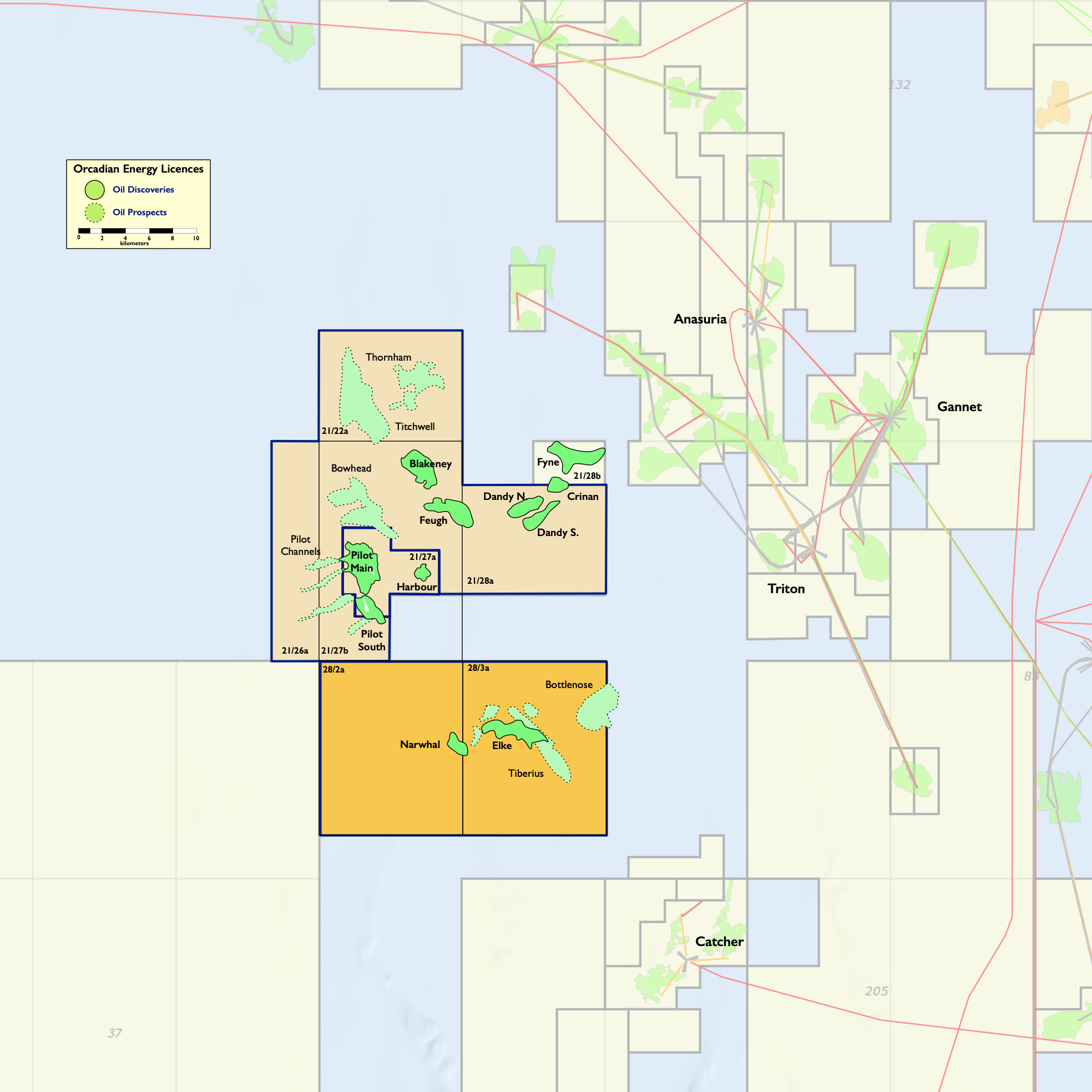

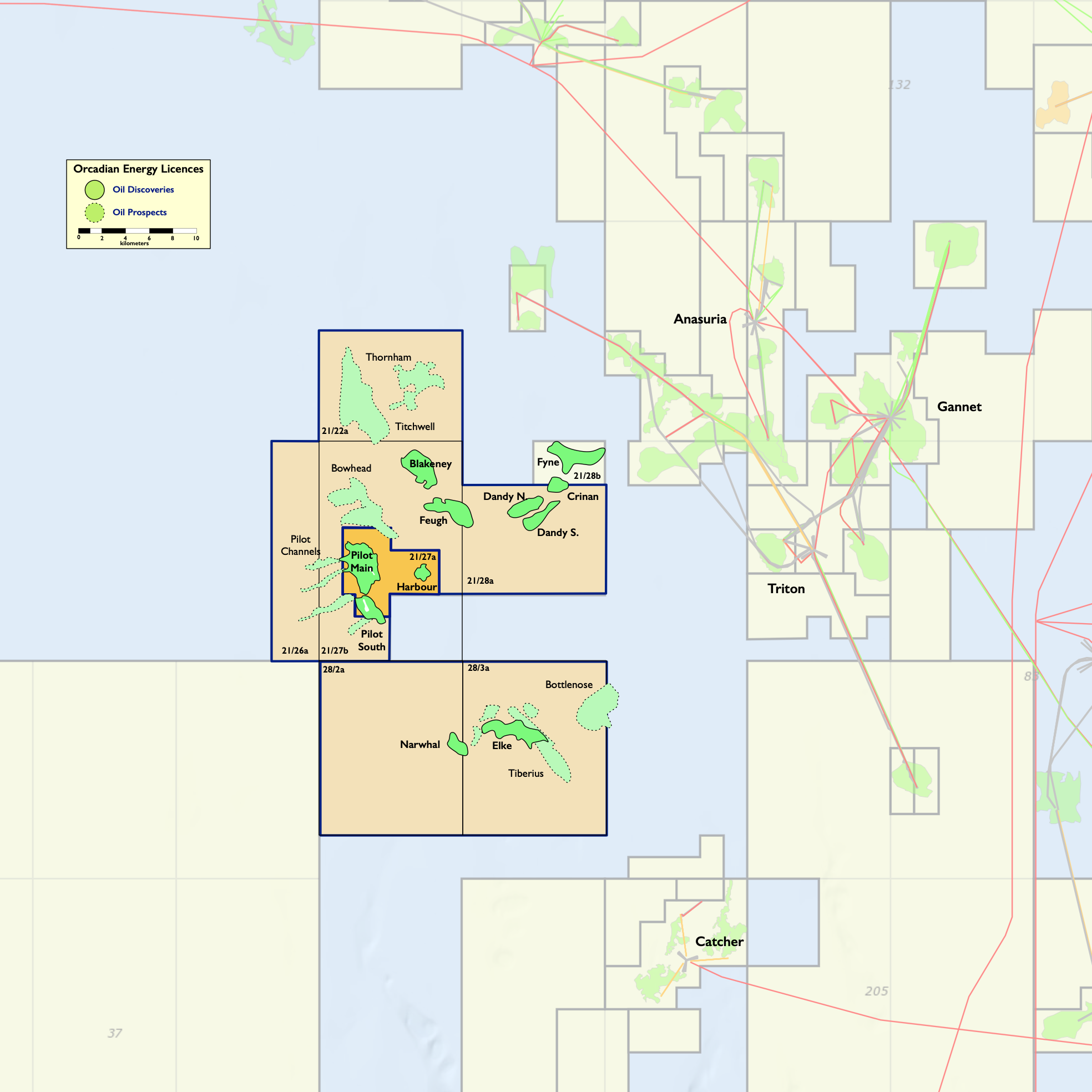

The P2320 licence contained the Blakeney discovery which had 2C Resources of 25 MMbbl and which represented only about 0.5% of the combined Pilot, Elke, Narwhal and Blakeney development project NPV evaluated in the Competent Person’s Report (set out in the Company’s Admission Document), assuming a $60/bbl oil price. The Licence also contained the Feugh, Dandy and Crinan discoveries, and the Bowhead and Carra prospects.

Orcadian intends to make an out-of-round application for a new licence covering the extensions of the Pilot field into the P2320 area, the Blakeney and Feugh discoveries, and the prospects identified using the TGS seismic data and Quantitative Interpretation products. Further updates on this will be provided in due course, but it is anticipated that this process could take up to six months.

Licence P2244 (the Pilot field) remains the Company’s key asset and key focus; and the Company’s interest in this licence is unaffected by the NSTA decision on Licence P2320.

As previously announced to the market, the Company needs to raise new funds in the short term for working capital and to repay the loan facility with Shell of c. £1m. However, the Company has initiated a series of cost cutting measures and is continuing positive discussions with potential investors in the Company. Further updates will be provided in due course.

Steve Brown, Orcadian’s CEO, commented:

“Whilst we obviously would have preferred that NSTA had extended Phase A of P2320, we are pleased to have progressed discussions on the prospects we had identified in the area with multiple potential partners, who have been willing to agree non-compete arrangements with us. We are determined to catalyse the drilling of the prospects we have identified and to deliver on our Central Obligation to Maximise Economic Recovery from the UKCS whilst continuing to minimise the potential emissions from any future development.”

For further information on the Company please visit the Company’s website: https://orcadian.energy

Contact:

|

Orcadian Energy plc |

+ 44 20 7920 3150 |

|

Steve Brown, CEO Alan Hume, CFO |

|

| WH Ireland (Nomad and Joint Broker) | +44 20 7220 1666 |

|

Katy Mitchell / Andrew de Andrade (Nomad) Harry Ansell / Fraser Marshall (Corporate Broking)

|

|

| Tavistock (PR) | + 44 20 7920 3150 |

| Nick Elwes / Simon Hudson | [email protected] |

About Orcadian Energy

Orcadian is a North Sea focused, low emissions, oil and gas development company. In planning its Pilot development, Orcadian has selected wind power to transform oil production into a cleaner and greener process. The Pilot project is moving towards approval and will be amongst the lowest carbon emitting oil production facilities in the world, despite being a viscous crude. Orcadian may be a small operator, but it is also nimble, and the Directors believe it has grasped opportunities that have eluded some of the much bigger companies. As we strike a balance between Net Zero and a sustainable energy supply, Orcadian intends to play its part to minimise the cost of Net Zero and to deliver reliable organic energy.

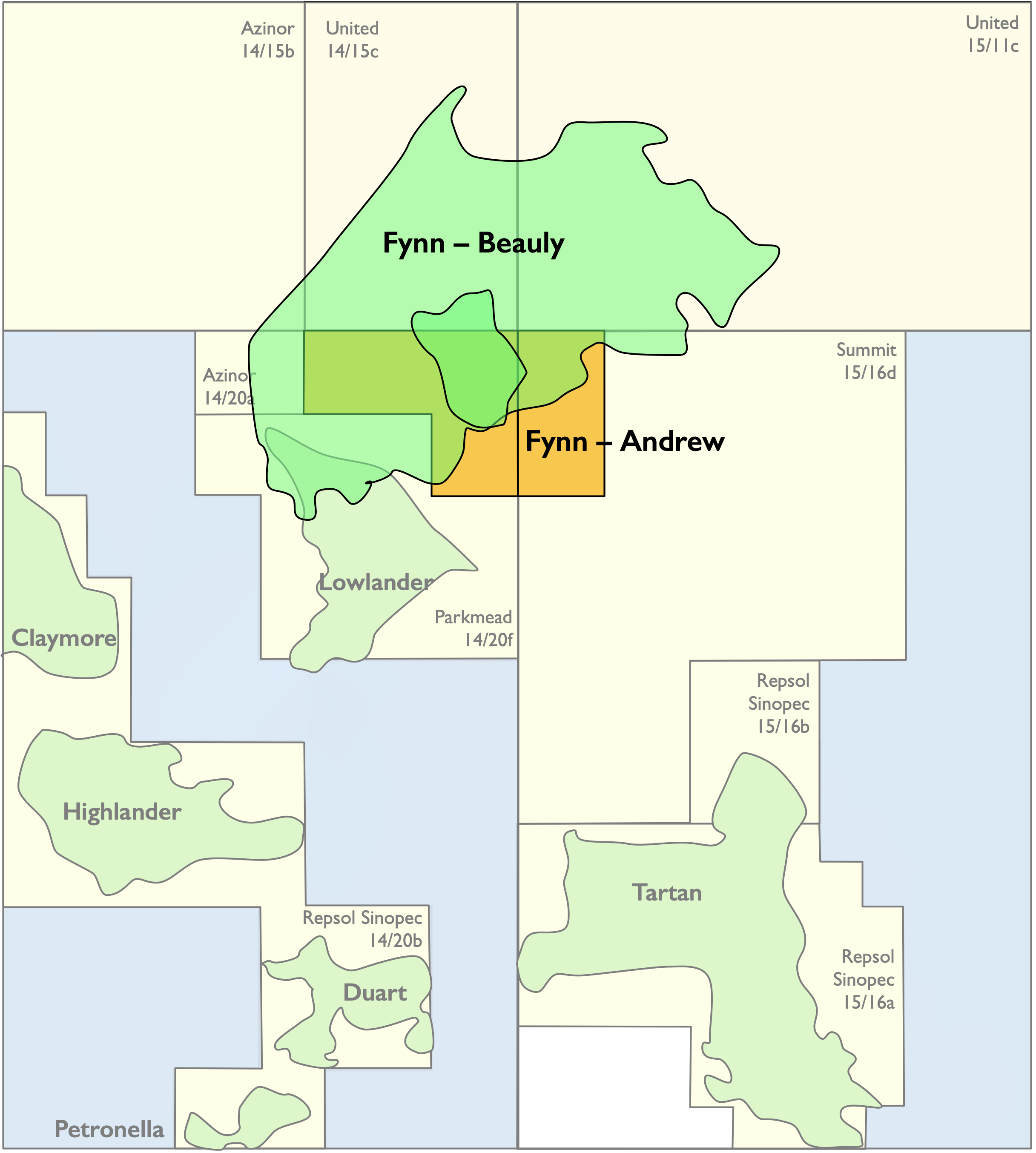

Orcadian Energy (CNS) Ltd (“CNS”), Orcadian’s operating subsidiary, was founded in 2014 and is the sole licensee of P2244, which contains 78.8 MMbbl of 2P Reserves in the Pilot discovery, and of P2482, which contain a further 52.7 MMbbl of 2C Contingent Resources in the Elke and Narwhal discoveries (as audited by Sproule, see the CPR in the Company’s Admission Document for more details). Within these licences there are also 119 MMbbl of unrisked Prospective Resources. These licences are in blocks 21/27a, 28/2a and 28/3a, and lie 150 kms due East of Aberdeen. The Company also has a 50% working interest in P2516, which contains the Fynn discoveries. P2516 is administered by the Parkmead Group and covers blocks 14/20g and 15/16g, which lie midway between the Piper and Claymore fields, 180 kms due East of Wick.

Pilot, which is the largest oilfield in Orcadian’s portfolio, was discovered by Fina in 1989 and has been well appraised. In total five wells and two sidetracks were drilled on Pilot, including a relatively short horizontal well which produced over 1,800 bbls/day on test. Orcadian’s proposed low emissions, field development plan for Pilot is based upon a Floating Production Storage and Offloading vessel (FPSO), with over thirty wells to be drilled by a Jack-up rig through a pair of well head platforms and provision of power from a floating wind turbine.

Emissions per barrel produced are expected to be about a tenth of the 2021 North Sea average, and less than half of the lowest emitting oil facility currently operating on the UKCS. On a global basis this places the Pilot field emissions at the low end of the lowest 5% of global oil production.