Orcadian Energy, the North Sea focused, oil and gas development company, is delighted to announce its intention to seek admission of its shares to trading on the AIM market of the London Stock Exchange (“Admission”). Orcadian is also seeking to raise gross proceeds of c. £5 million to progress its assets.

Key highlights:

- Orcadian is seeking Admission to support progress towards the commercialisation of its viscous oil assets located in the UK North Sea.

- The Company’s key asset is the 100% interest in the Pilot oilfield, with audited proven and probable reserves of 78.8 million barrels (audited by Sproule BV).

- The Directors believe that no other company has undertaken an IPO on AIM with more proven and probable reserves since 2006, and that when ranked by 2P reserves this will be the largest, UK focused oil and gas IPO on AIM since the market was launched in 1995.

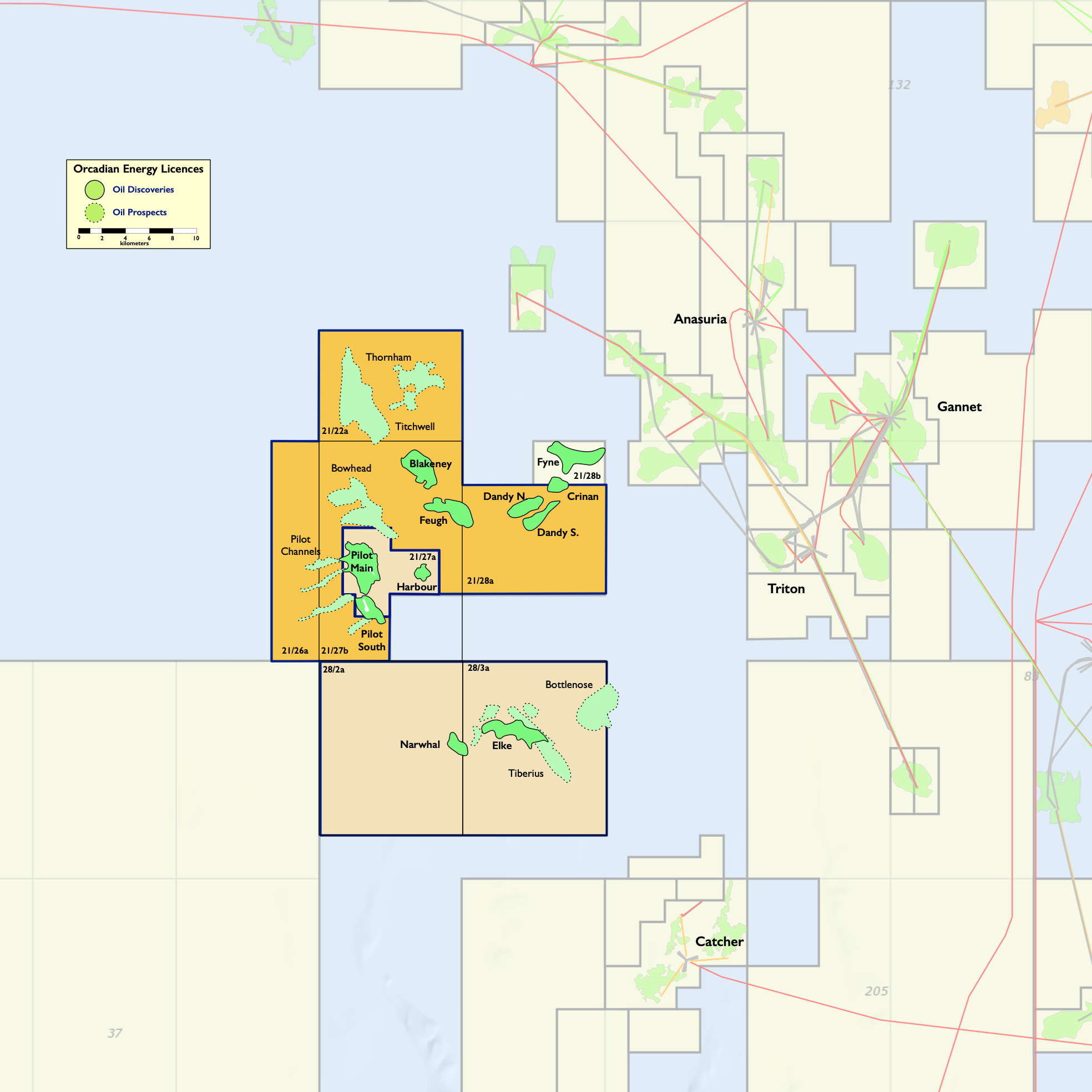

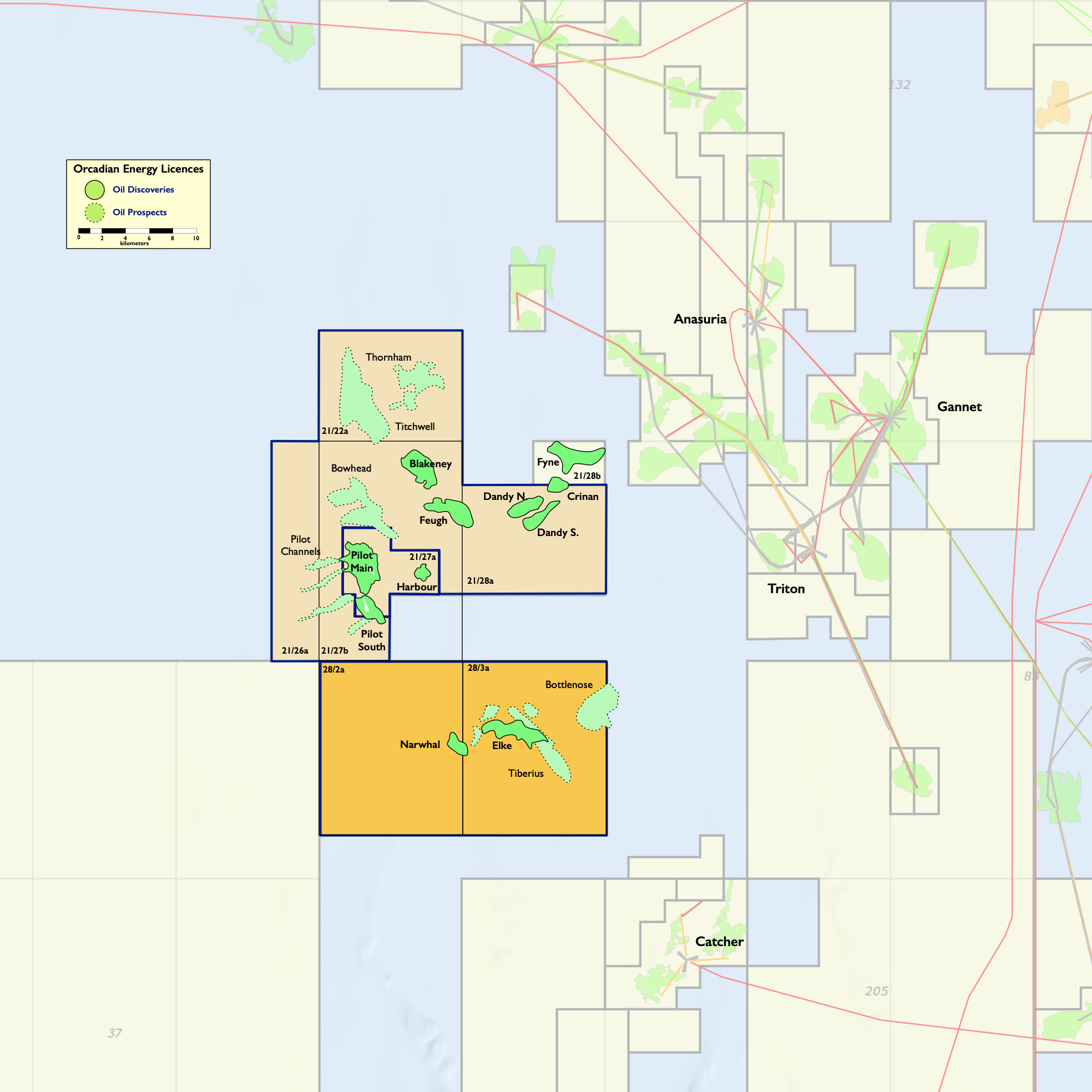

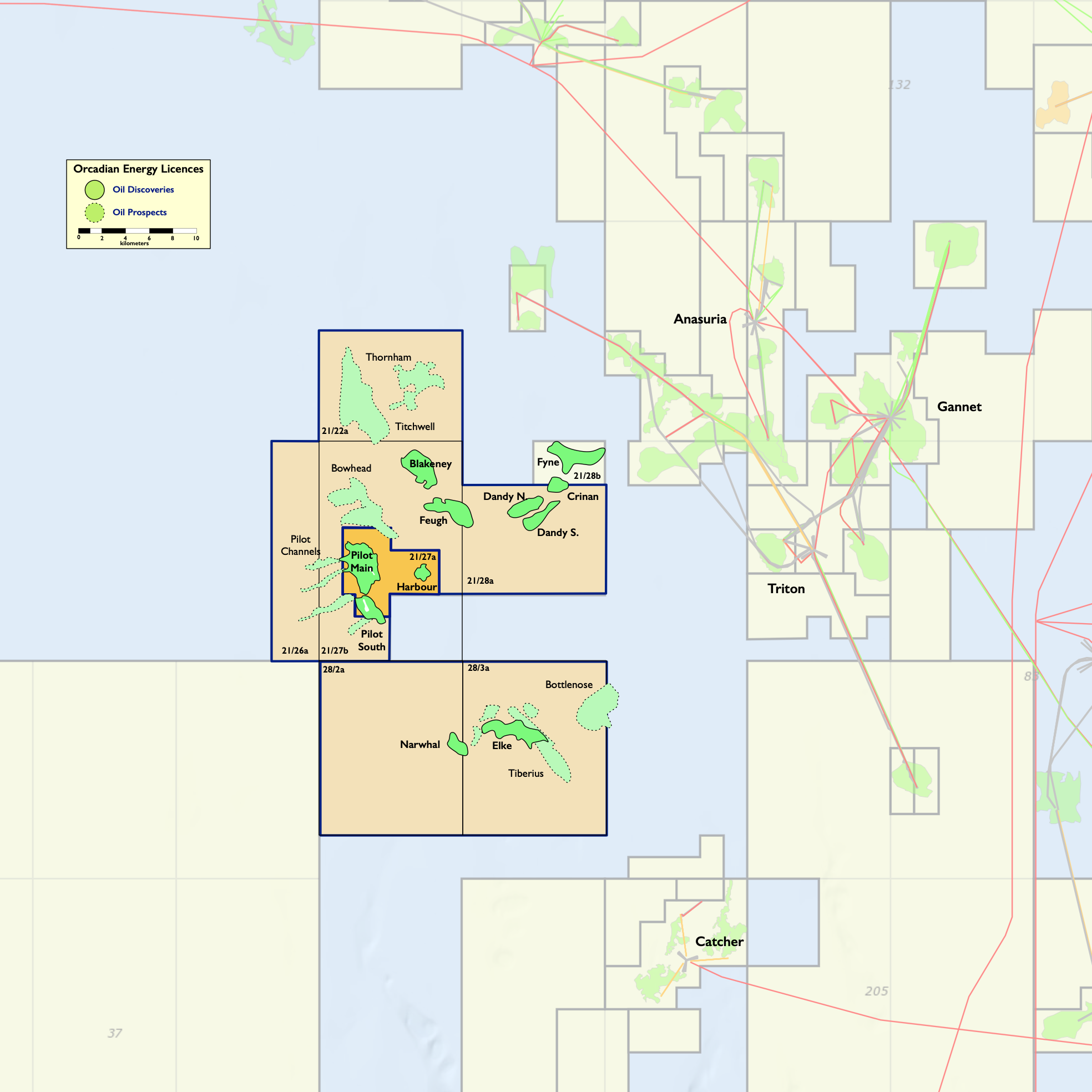

- The Company plans to develop, in phases, the Pilot Oilfield (comprising Pilot Main and Pilot South) and its other key discoveries Elke, Narwhal and Blakeney, using a polymer flood approach. There is also potential for other prospects within the Group’s licence areas to be developed using the same method (such as Bowhead and the Elke satellites) if future drilling successfully confirms their suitability.

- Polymer flooding is an established development technique for viscous oil assets which has been proven offshore on the Captain field in the Central North Sea by Chevron and Ithaca.

- The Company expects to pursue in parallel, potential development farm-out and contractor alliances as options for financing the development of its assets.

- The Company has a low emission development plan (see ESG section below), which the Directors’ believe is in line with the OGA’s Net Zero goals, and which is projected by Crondall to deliver an emissions performance which lies in the lowest 5% of the world’s oilfields.

- Previous initial funding was received by Orcadian from Shell Trading International Limited in 2019.

- The Company’s strategy is to identify discovered resources, preferably well appraised and most likely on the UKCS; to secure access to those resources; and to create a profitable field development plan which attracts finance either from oil industry partners or financial investors.

Steve Brown, CEO of Orcadian commented:

“Orcadian was founded in 2014 to find the best way to develop the Pilot discovery. Since then, we have added to our resource base, but most importantly we have created a technically mature, feasible development plan for Pilot, based upon the injection of polymerised water right from the start of production.

“Polymer flooding is well proven and, when implemented early in field life, can significantly reduce emissions from viscous oilfields. In addition, we have identified further opportunities to reduce emissions to remarkably low levels. Admission to AIM will give the Company access to some of the capital we need to transform our plans into actionable projects. We look forward to welcoming new investors as we progress this next phase of development of our North Sea oilfields.”

For further information please visit the Company’s website: https://orcadian.energy/

Contact:

Orcadian Energy plc

Steve Brown, CEO

Alan Hume, CFO

+ 44 20 7920 3150

WH Ireland (Nomad and Sole Broker)

Harry Ansell / Fraser Marshall (Corporate Broking)

Katy Mitchell / James Sinclair-Ford / Lydia Zychowska (Corporate Finance)

+44 20 7220 1666

Tavistock (PR)

Nick Elwes / Simon Hudson / Matthew Taylor

+ 44 20 7920 3150

[email protected]