THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY THE COMPANY TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER THE MARKET ABUSE REGULATION (EU) NO. 596/2014 AS IT FORMS PART OF UK DOMESTIC LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT 2018, AS AMENDED. UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO BE IN THE PUBLIC DOMAIN.

1 December 2023

Orcadian Energy plc

(“Orcadian Energy”, “Orcadian” or the “Company”)

Pilot Farm-out Update

Further to the announcements of 18 September 2023 and 25 October 2023 the Company provides the following update on its potential farm-out of its flagship asset the Pilot development project (Licence P2244):

- The Company has today agreed with the potential operator (the “Operator”) a seven day extension, from 30 November 2023 until 7 December 2023 (the “New Deadline”) for the Operator to execute definitive documentation for an overall farm out deal.

- Notwithstanding this, the Company has yesterday submitted to the North Sea Transition Authority (“NSTA”) a request to:

- consent to an assignment under, and in accordance with, clause 40(1) of the Licence to the Operator; and

- approval of appointment of the Operator as operator under, and in accordance with, clause 24 of the P2244 Licence.

The Company has attached to this application the currently agreed Sale and Purchase Agreement (“SPA”), on the understanding that a fully executed SPA will be filed before 7 December 2023. The Company is in conversations with NSTA to confirm that this approach will satisfy the extension conditions for P2244, set out in the announcement of 25 October 2023. However, if it does not, and in any event if an SPA is not signed by the New Deadline, then Orcadian will withdraw the NSTA request and, unless NSTA agree otherwise, Orcadian’s interest in P2244 will automatically cease and determine on the 30 December 2023.

There can be no guarantee that the SPA with a potential operator will be signed by the New Deadline but the Directors have every confidence that it will be.

Further updates will be provided in due course.

For further information on the Company please visit the Company’s website: https://orcadian.energy

Contact:

|

Orcadian Energy plc |

+ 44 20 7920 3150 |

|

Steve Brown, CEO Alan Hume, CFO |

|

| WH Ireland (Nomad and Broker) | +44 20 7220 1666 |

|

Katy Mitchell / Andrew de Andrade (Nomad) Harry Ansell / Fraser Marshall (Corporate Broking)

|

|

| Tavistock (PR) | + 44 20 7920 3150 |

| Nick Elwes / Simon Hudson | [email protected] |

About Orcadian Energy

Orcadian is a North Sea focused, low emissions, oil and gas development company. In planning its Pilot development, Orcadian has selected wind power to transform oil production into a cleaner and greener process. The Pilot project is moving towards approval and will be amongst the lowest carbon emitting oil production facilities in the world, despite being a viscous crude. Orcadian may be a small operator, but it is also nimble, and the Directors believe it has grasped opportunities that have eluded some of the much bigger companies. As we strike a balance between Net Zero and a sustainable energy supply, Orcadian intends to play its part to minimise the cost of Net Zero and to deliver reliable energy to the UK.

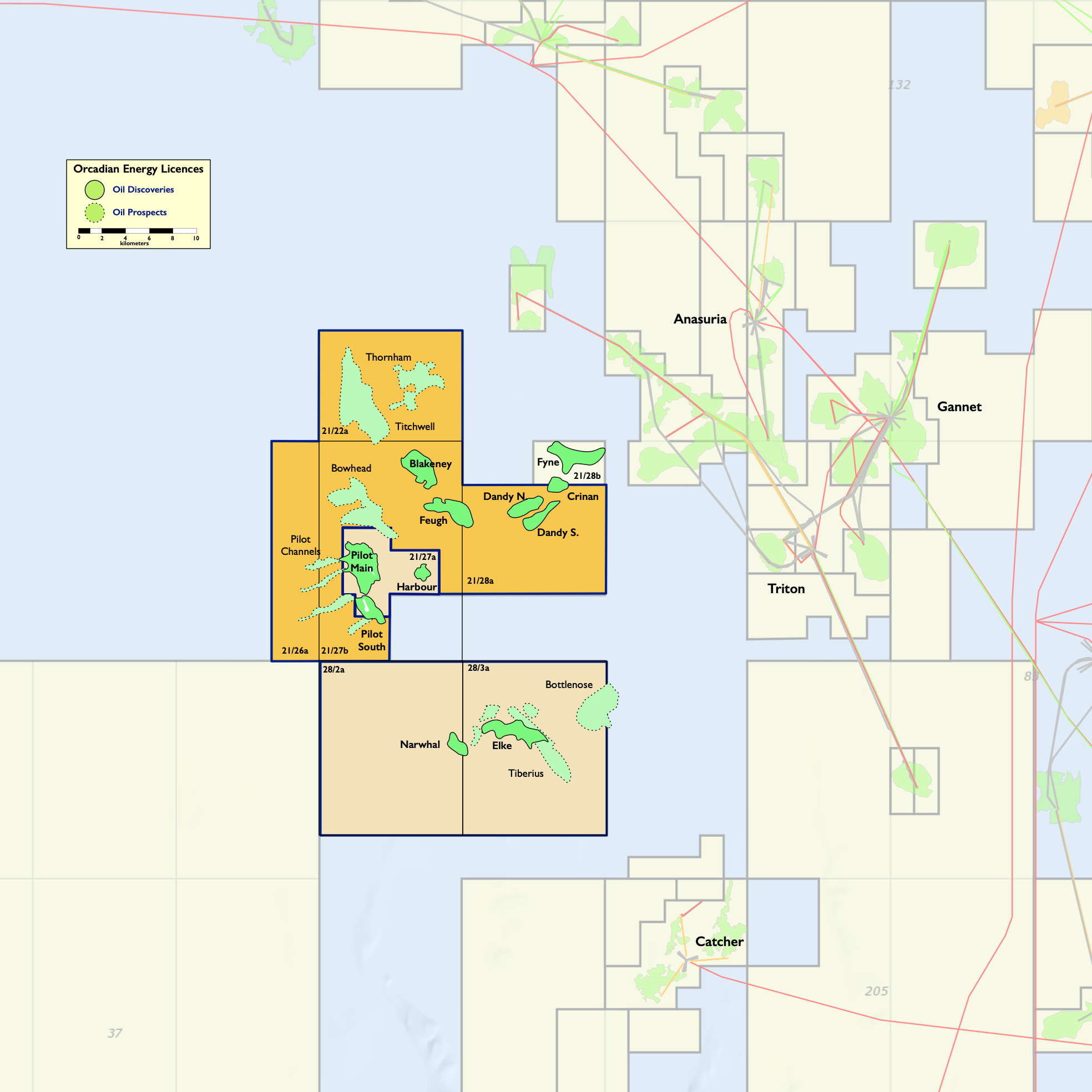

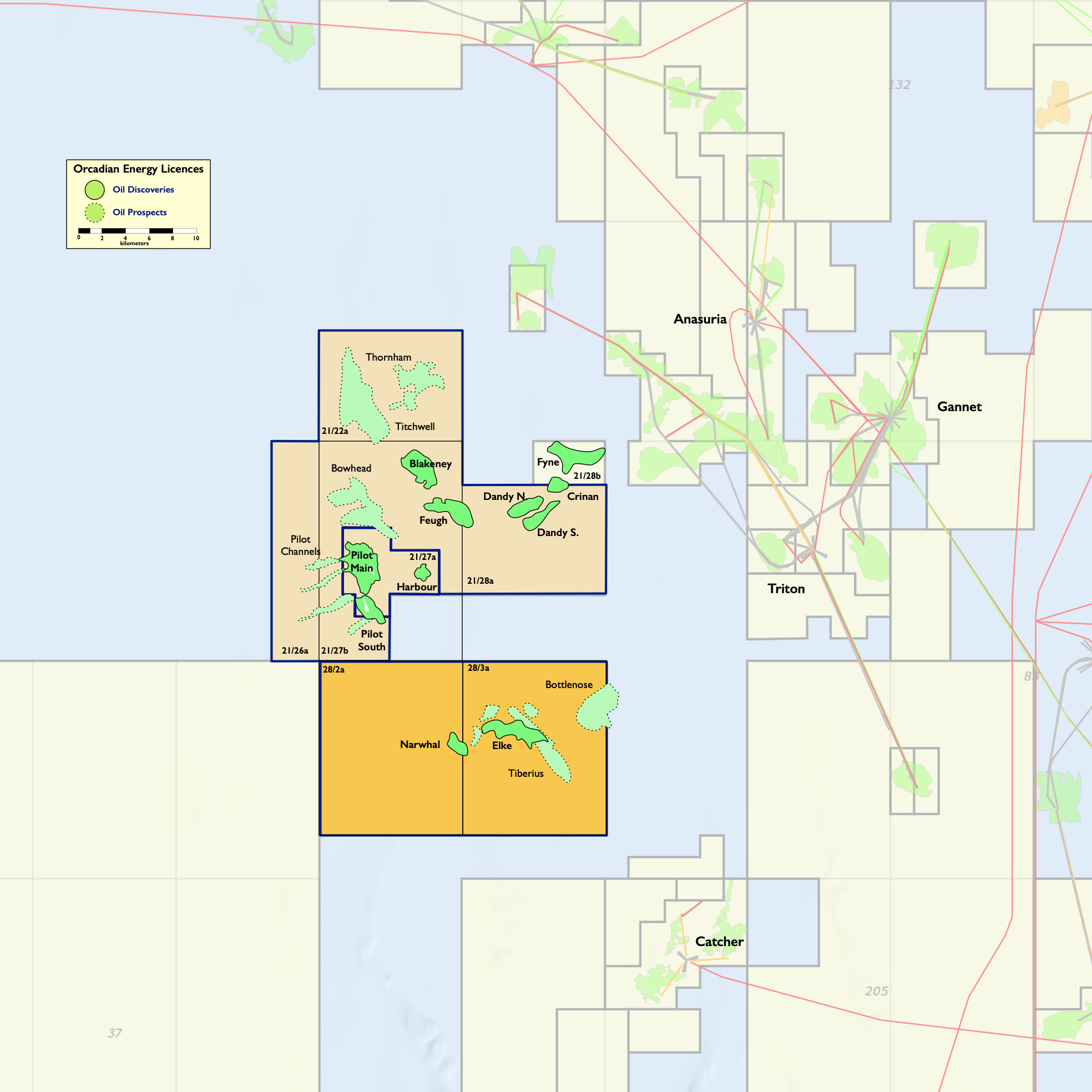

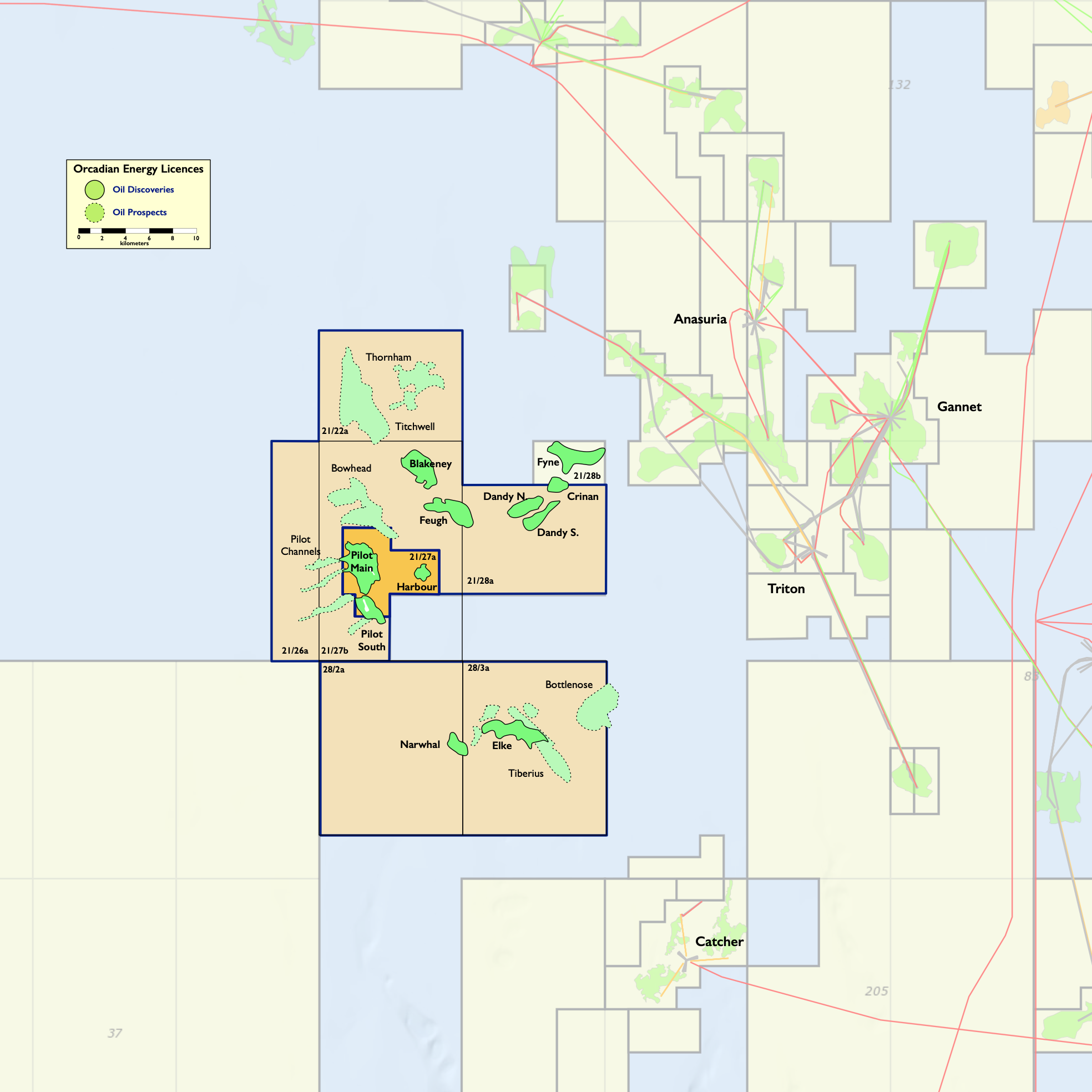

Orcadian Energy (CNS) Ltd, Orcadian’s operating subsidiary, was founded in 2014 and is the sole licensee of P2244, which contains 78.0 MMbbl of 2P Reserves in the Pilot discovery, and of P2482, which contain a further 52.2 MMbbl of 2C Contingent Resources in the Elke and Narwhal discoveries (as audited by Sproule, with both numbers modified to take into account the TGS royalty, see the CPR in the Company’s Admission Document for more details). Within these licences there are also 118 MMbbl of unrisked Prospective Resources (modified for TGS royalty). These licences are in blocks 21/27a, 28/2a and 28/3a, and lie 150 kms due East of Aberdeen.

Pilot, which is the field with the largest reserves in Orcadian’s portfolio, was discovered by PetroFina in 1989 and has been well appraised. In total five wells and two sidetracks were drilled on Pilot, including a relatively short horizontal well which produced over 1,800 bbls/day on test. Orcadian’s proposed low emissions, field development plan for Pilot is based upon a Floating Production Storage and Offloading vessel (FPSO), with over thirty wells to be drilled by a Jack-up rig and provision of power from a floating wind turbine.

Orcadian has entered into a non-binding heads of terms with a North Sea Operator which details the terms under which the Operator will farm-in to the Pilot development project. Upon conclusion of this deal Orcadian would have an 18.75% stake in the Pilot development with all pre-first oil development costs paid by the North Sea Operator.

Emissions per barrel produced are expected to be about a tenth of the 2021 North Sea average, and less than half of the lowest emitting oil facility currently operating on the UKCS. On a global basis this places the Pilot field emissions at the low end of the lowest 5% of global oil production.