THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR NEW ZEALAND OR IN OR INTO ANY OTHER JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A BREACH OF ANY APPLICABLE LAW OR REGULATION.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT ITSELF CONSTITUTE A PROSPECTUS OR OFFERING MEMORANDUM OR AN OFFER FOR SALE OR SUBSCRIPTION IN RESPECT OF ANY SECURITIES IN THE COMPANY. THIS ANNOUNCEMENT DOES NOT CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION, RECOMMENDATION, OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE OR DISPOSE OF ANY SECURITIES OF ORCADIAN ENERGY PLC IN ANY JURISDICTION WHERE TO DO SO WOULD BREACH ANY APPLICABLE LAW OR REGULATION.

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY THE COMPANY TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER THE MARKET ABUSE REGULATION (EU) NO. 596/2014 AS IT FORMS PART OF UK DOMESTIC LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT 2018, AS AMENDED. UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO BE IN THE PUBLIC DOMAIN.

1 February 2023

Orcadian Energy Plc

(“Orcadian”, the “Company” or the “Group”) (AIM: ORCA)

Result of Placing

Orcadian Energy Plc (AIM:ORCA) is pleased to announce that, further to its announcement of 7 a.m. (London time) today, it has successfully completed and closed the Placing. The Placing was oversubscribed.

The Placing has raised, in aggregate, gross proceeds of £0.5m through the placing of 5,000,000 Ordinary Shares (the “Placing Shares”) to certain institutional and other investors at a price of 10 pence per share.

The net proceeds of the Placing will be applied towards:

- Licence Fees;

- On its Pilot Licence by funding progress towards the Field Development Plan; and

- For general working capital purposes.

Commenting on the transaction, Steve Brown, Orcadian’s CEO, said:

“We believe our Pilot project is a key UKCS development project. Not only should it pave the way for the industry to unlock up to 3 billion barrels of viscous oil discoveries on the UKCS, but Pilot is also a potential flagship project demonstrating how to reduce global emissions and make a contribution to a secure transition to net zero. The funds raised, through our oversubscribed fund raise, will enable us to further progress Pilot towards field development plan as well as advance the farm out process that we have commenced, delivering the value that we believe is inherent in the project.

“We believe the year ahead promises to be a very significant year for the Company and look forward to providing updates to all as shareholders in due course.”

Settlement of Invoices

As set out in the announcement of earlier today, the Company has issued 900,000 ordinary shares to Alisanos Geoscience Limited in lieu of unpaid invoices (the “Invoice Shares”)

Admission and Total Voting Rights

Application will be made to the London Stock Exchange for admission of the Placing Shares and the Invoice Shares to trading on AIM (“Admission”). It is expected that Admission will become effective and dealings in the Placing Shares commence on AIM at 8.00 a.m. on 7 February 2023 (or such later date as may be agreed between the Company andthe Joint Bookrunners, but no later than 22 February 2023).

The Placing Shares will be issued fully paid and will rank pari passu in all respects with the Company’s existing Ordinary Shares.

Following Admission, the total number of Ordinary Shares in the capital of the Company in issue will be 72,512,317with voting rights. This figure may be used by shareholders as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in, the Company’s share capital pursuant to the Company’s Articles.

Capitalised terms used but not otherwise defined in this announcement shall have the meanings ascribed to such terms in the Company’s announcement made at 7 a.m. on 1 February 2023, unless the context requires otherwise.

For further information on the Company please visit the Company’s website: https://orcadian.energy

Contact:

|

Orcadian Energy plc |

+ 44 20 7920 3150 |

|

Steve Brown, CEO Alan Hume, CFO |

|

| WH Ireland (Nomad and Joint Broker) | +44 20 7220 1666 |

|

Katy Mitchell / Andrew de Andrade (Nomad) Harry Ansell / Fraser Marshall (Corporate Broking)

|

|

| Tavistock (PR) | + 44 20 7920 3150 |

| Nick Elwes / Simon Hudson | [email protected] |

| Charlesbye (PR) | + 44 7403 050525 |

| Lee Cain / Lucia Hodgson |

About Orcadian Energy

Orcadian is a North Sea focused, low emissions, oil and gas development company. In planning its Pilot development, Orcadian has selected wind power to transform oil production into a cleaner and greener process. The Pilot project is moving towards approval and will be amongst the lowest carbon emitting oil production facilities in the world, despite being a viscous crude. Orcadian may be a small operator, but it is also nimble, and the Directors believe it has grasped opportunities that have eluded some of the much bigger companies. As we strike a balance between Net Zero and a sustainable energy supply, Orcadian intends to play its part to minimise the cost of Net Zero and to deliver reliable organic energy.

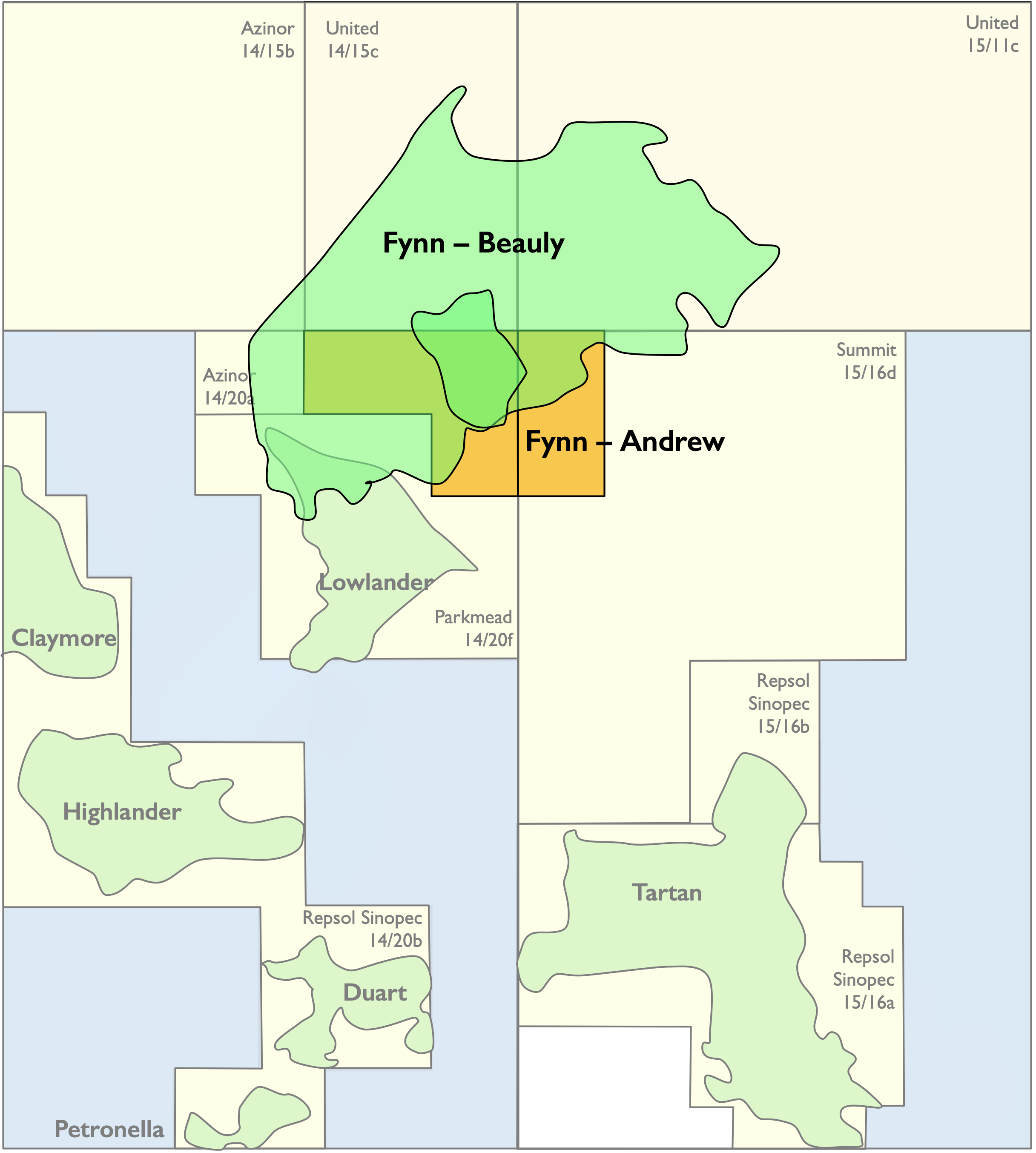

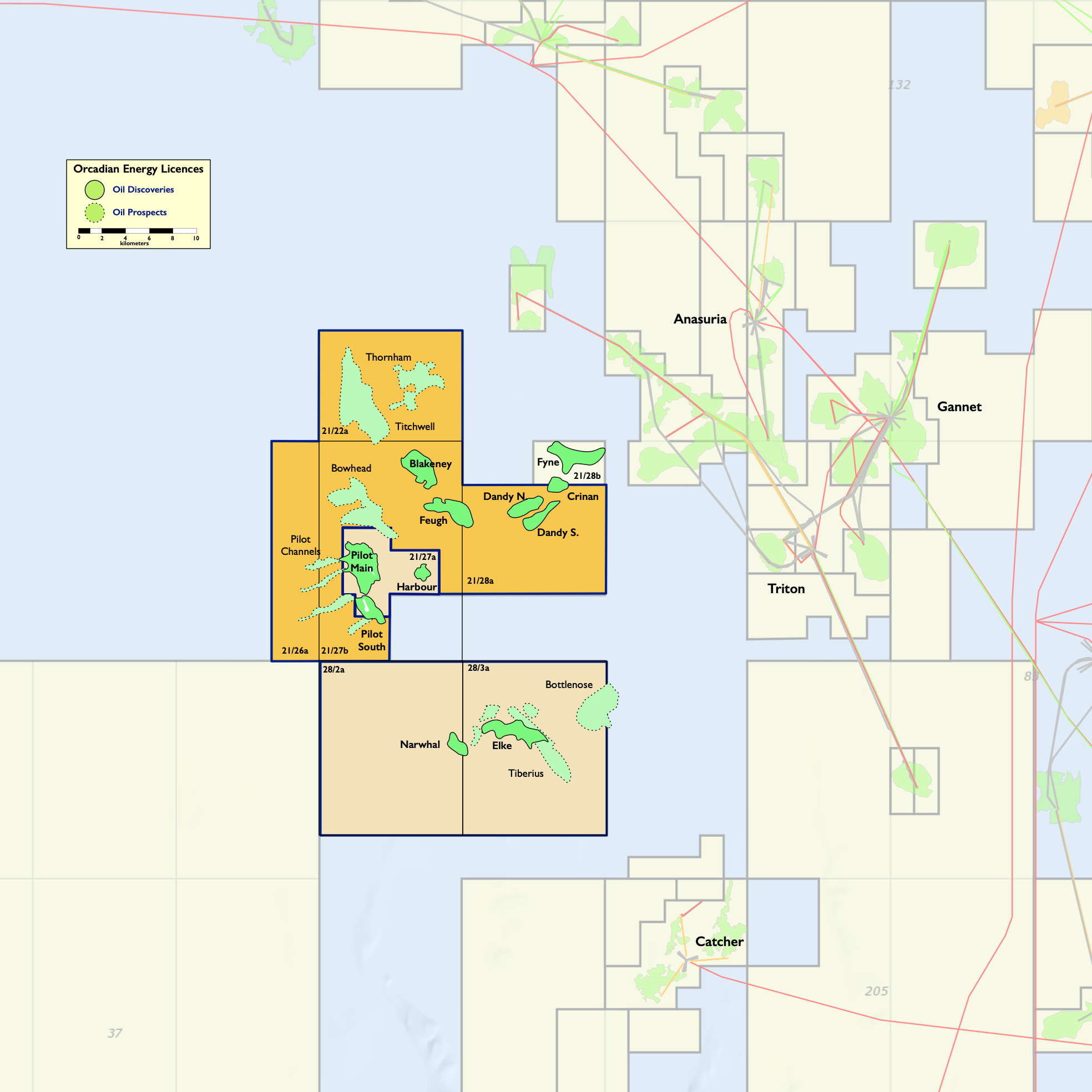

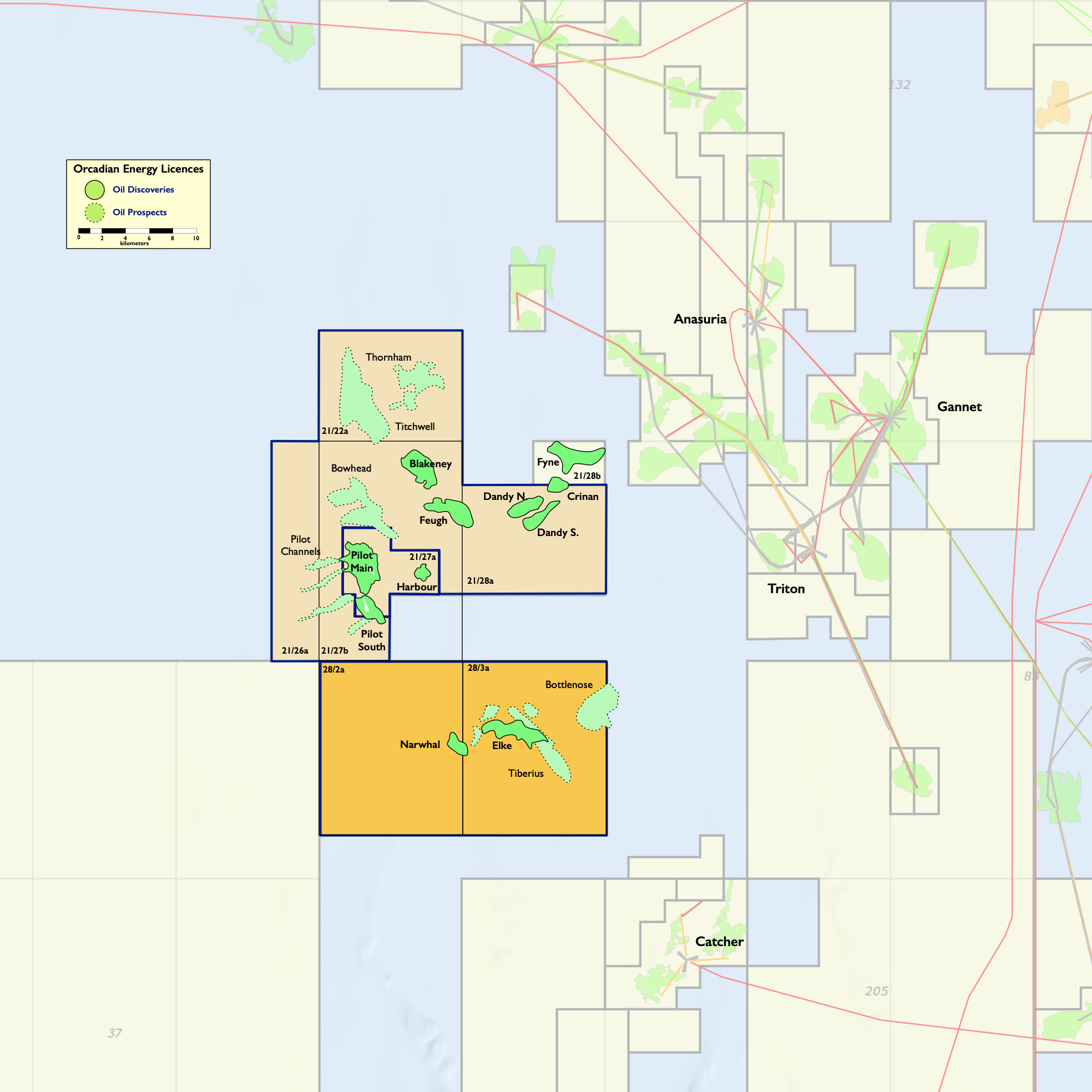

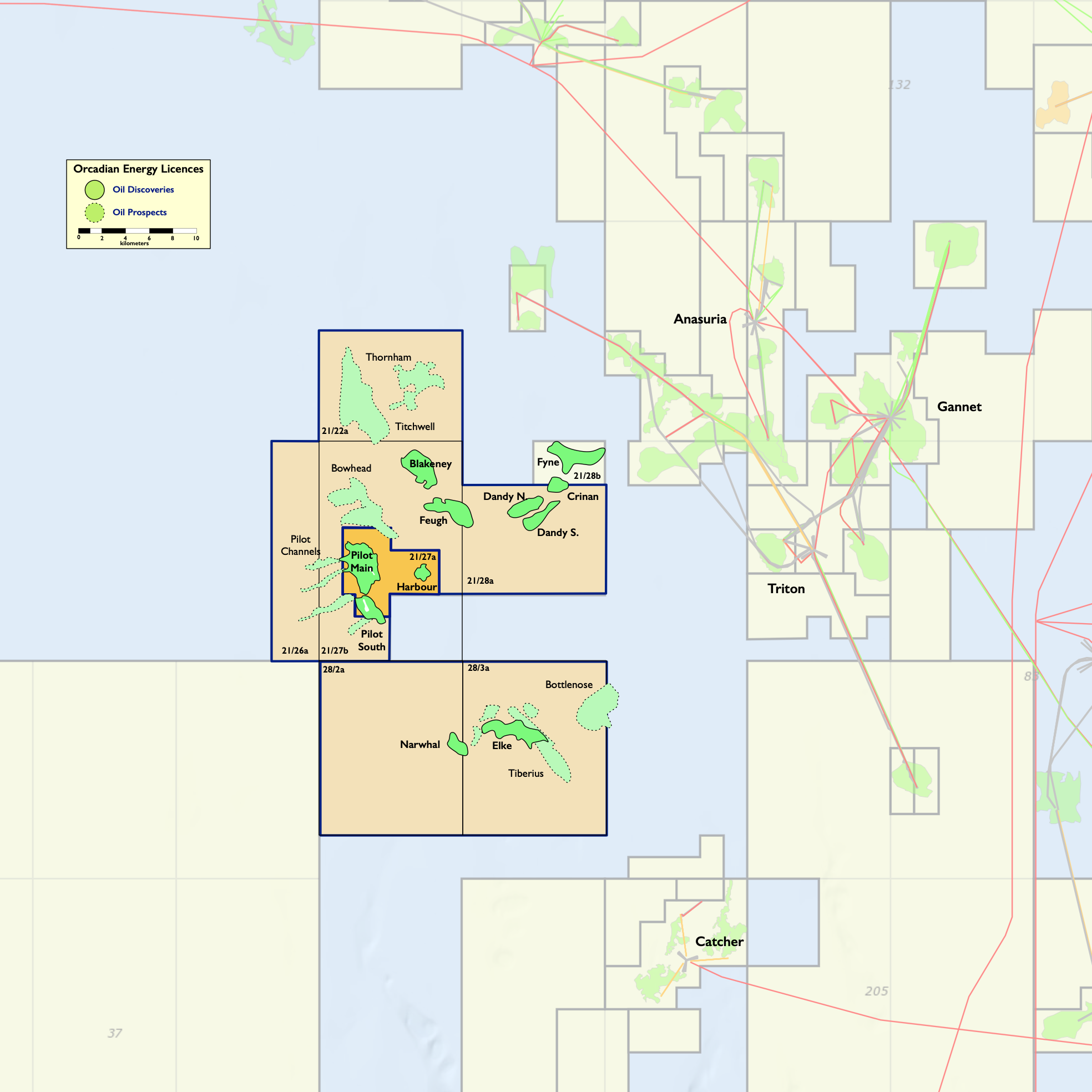

Orcadian Energy (CNS) Ltd (“CNS”), Orcadian’s operating subsidiary, was founded in 2014 and is the sole licensee of P2244, which contains 78.8 MMbbl of 2P Reserves in the Pilot discovery, and of P2320 and P2482, which contain a further 77.8 MMbbl of 2C Contingent Resources in the Elke, Narwhal and Blakeney discoveries (as audited by Sproule, see the CPR in the Company’s Admission Document for more details). Within these licences there are also 191 MMbbl of unrisked Prospective Resources. These licences are in blocks 21/27, 21/28, 28/2 and 28/3, and lie 150 kms due East of Aberdeen. The Company also has a 50% working interest in P2516, which contains the Fynn discoveries. P2516 is administered by the Parkmead Group and covers blocks 14/20g and 15/16g, which lie midway between the Piper and Claymore fields, 180 kms due East of Wick.

Pilot, which is the largest oilfield in Orcadian’s portfolio, was discovered by Fina in 1989 and has been well appraised. In total five wells and two sidetracks were drilled on Pilot, including a relatively short horizontal well which produced over 1,800 bbls/day on test. Orcadian’s proposed low emissions, field development plan for Pilot is based upon a Floating Production Storage and Offloading vessel (FPSO), with over thirty wells to be drilled by a Jack-up rig through a pair of well head platforms and provision of power from a floating wind turbine.

Emissions per barrel produced are expected to be about an eighth of the 2020 North Sea average, and less than half of the lowest emitting oil facility currently operating on the UKCS. On a global basis this places the Pilot field emissions at the low end of the lowest 5% of global oil production.

Important Notices

This announcement contains ‘forward-looking statements’ concerning the Company that are subject to risks and uncertainties. Generally, the words ‘will’, ‘may’, ‘should’, ‘continue’, ‘believes’, ‘targets’, ‘plans’, ‘expects’, ‘aims’, ‘intends’, ‘anticipates’ or similar expressions or negatives thereof identify forward-looking statements. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements. Many of these risks and uncertainties relate to factors that are beyond the Company’s ability to control or estimate precisely. The Company cannot give any assurance that such forward-looking statements will prove to have been correct. The reader is cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this announcement. The Company does not undertake any obligation to update or revise publicly any of the forward-looking statements set out herein, whether as a result of new information, future events or otherwise, except to the extent legally required.

Nothing contained herein shall be deemed to be a forecast, projection or estimate of the future financial performance of the Company.