17 March 2022

Orcadian Energy plc

(“Orcadian Energy”, “Orcadian” or the “Company”)

Results for the half year ended 31 December 2021

Orcadian Energy (AIM: ORCA), the North Sea focused oil and gas development company, is delighted to announce its unaudited results for the six months ended 31 December 2021.

Activity Focus:

- To improve the technical and commercial definition of the Pilot development project

- To finance the Pilot development project

- To explore every avenue to maximise the value in our satellite discoveries and prospects

- To propose a practical means to electrify the Central North Sea (“CNS”) and to develop a business model enabling Orcadian to benefit from this work

Highlights:

- Orcadian was admitted to AIM in July 2021 raising gross proceeds of £3 million

- Receipt of Letter of no objection from the Oil and Gas Authority (“OGA”) and entry into the authorisation phase of development planning for the Pilot Field

- Received three expressions of interest for the provision of an Floating Production Storage Offloading (“FPSO”) for the Pilot Development

- Entered into a non-binding Heads of Terms with Carrick Resources Limited (“Carrick”) in respect of a sub-area of Licence P2320 which covers the Carra prospect (“Carra”)

- Selected by the OGA to evaluate an approach to the electrification of North Sea oil and gas platforms which will dramatically cut carbon emissions.

- Cash position as at 31 December 2021 of over £1.5 million

Steve Brown, Orcadian’s CEO, commented:

“Our first half year results have covered a remarkable period for Orcadian as well as the energy industry as a whole. For our own part, we completed our listing on AIM; proposed a transformational approach to new oil and gas developments on the United Kingdom Continental Shelf (“UKCS”) which we believe has the potential to blaze a trail for a slew of new projects with dramatically lower emissions than existing production; the OGA blessed those plans and has also acknowledged the leading role we are seeking to take in enabling electrification of the North Sea basin.

“We also believe that both the Government and society have begun to acknowledge that continuing oil and gas production is an essential part of an energy system in transition and thus ensuring energy security. We believe that new North Sea developments are essential to meet continuing demand for oil and gas, and absent those, we believe that prices will rise, hitting the pockets of the general public, while ensuring that old, high cost, and hence high emissions, production has to stay online.

“Governments should be encouraging investors to back those plans – they will help deliver an energy transition without soaring costs. Having our own oil and gas production is the only viable path to energy security and stability. We need to deal with the reality of energy delivery in the cleanest and most cost effective ways possible. We believe Orcadian can help deliver this.”

For further information on the Company please visit the Company’s website: https://orcadian.energy

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulations (EU) No. 596/2014 (MAR). Upon the publication of this announcement via Regulatory Information Service (RIS), this inside information is now considered to be in the public domain.

Contact:

| Orcadian Energy plc | + 44 20 7920 3150 |

|

Steve Brown, CEO Alan Hume, CFO |

|

| WH Ireland (Nomad and Joint Broker) | +44 20 7220 1666 |

|

Harry Ansell / Fraser Marshall (Corporate Broking) Katy Mitchell / Andrew de Andrade (Nomad) |

|

| Shore Capital (Joint Broker) | +44 20 7408 4090 |

|

Toby Gibbs / James O’Neill (Advisory) |

| Tavistock (PR) | + 44 20 7920 3150 |

|

Nick Elwes Simon Hudson Matthew Taylor |

[email protected] |

| Charlesbye (PR) | + 44 7403 050525 |

|

Lee Cain / Lucia Hodgson |

About Orcadian Energy

Orcadian is a North Sea oil and gas operator with a difference. In planning its Pilot development, Orcadian has selected wind power to transform oil production into a cleaner and greener process. The Pilot project is moving towards approval and will be amongst the lowest carbon emitting oil production facilities in the world, despite being a viscous crude. Orcadian may be a small operator, but it is also nimble, and it has grasped opportunities that have eluded some of the much bigger companies. As we strike a balance between Net Zero and a sustainable energy supply, Orcadian intends to play its part to minimise the cost of Net Zero and deliver reliable organic energy.

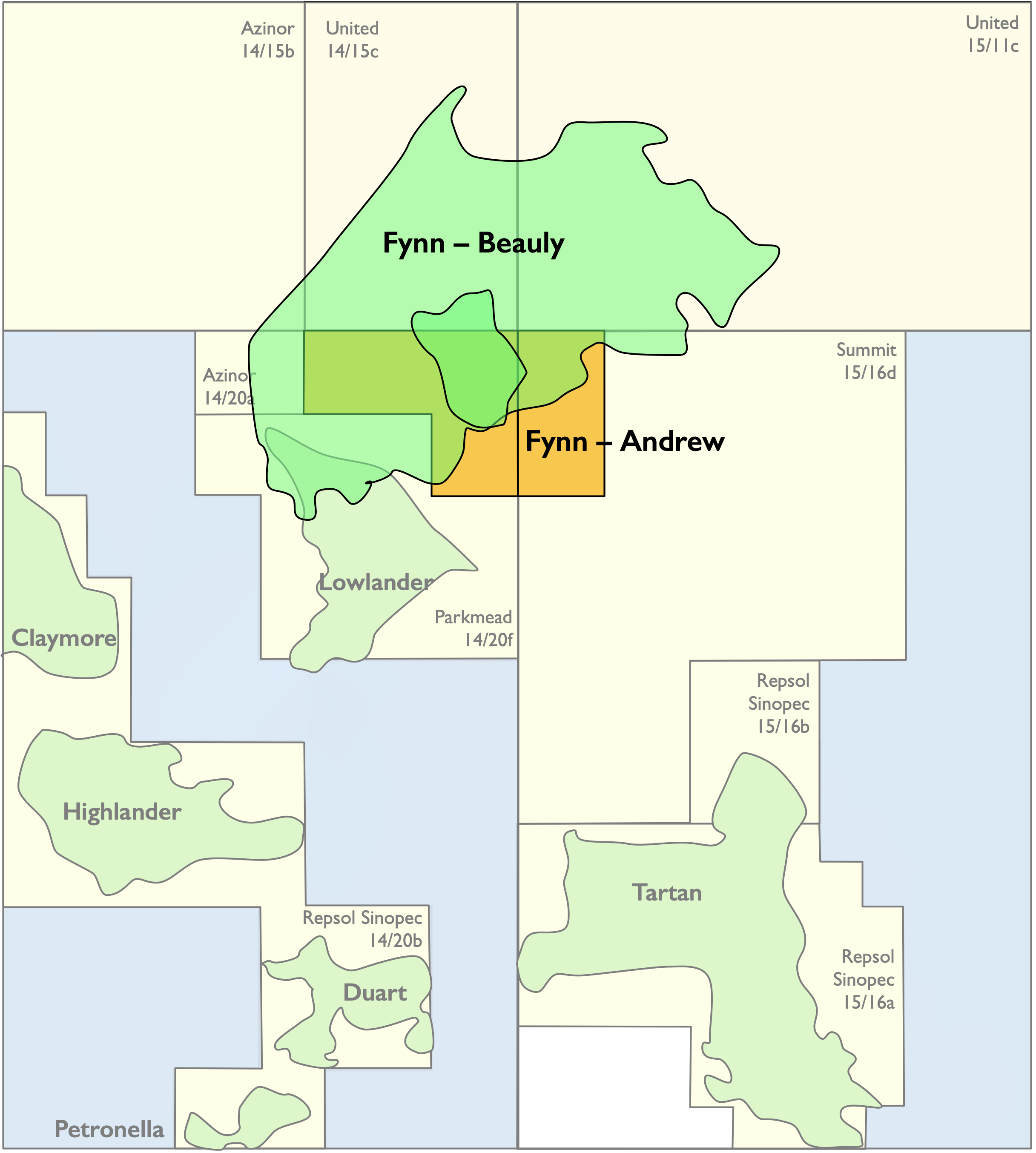

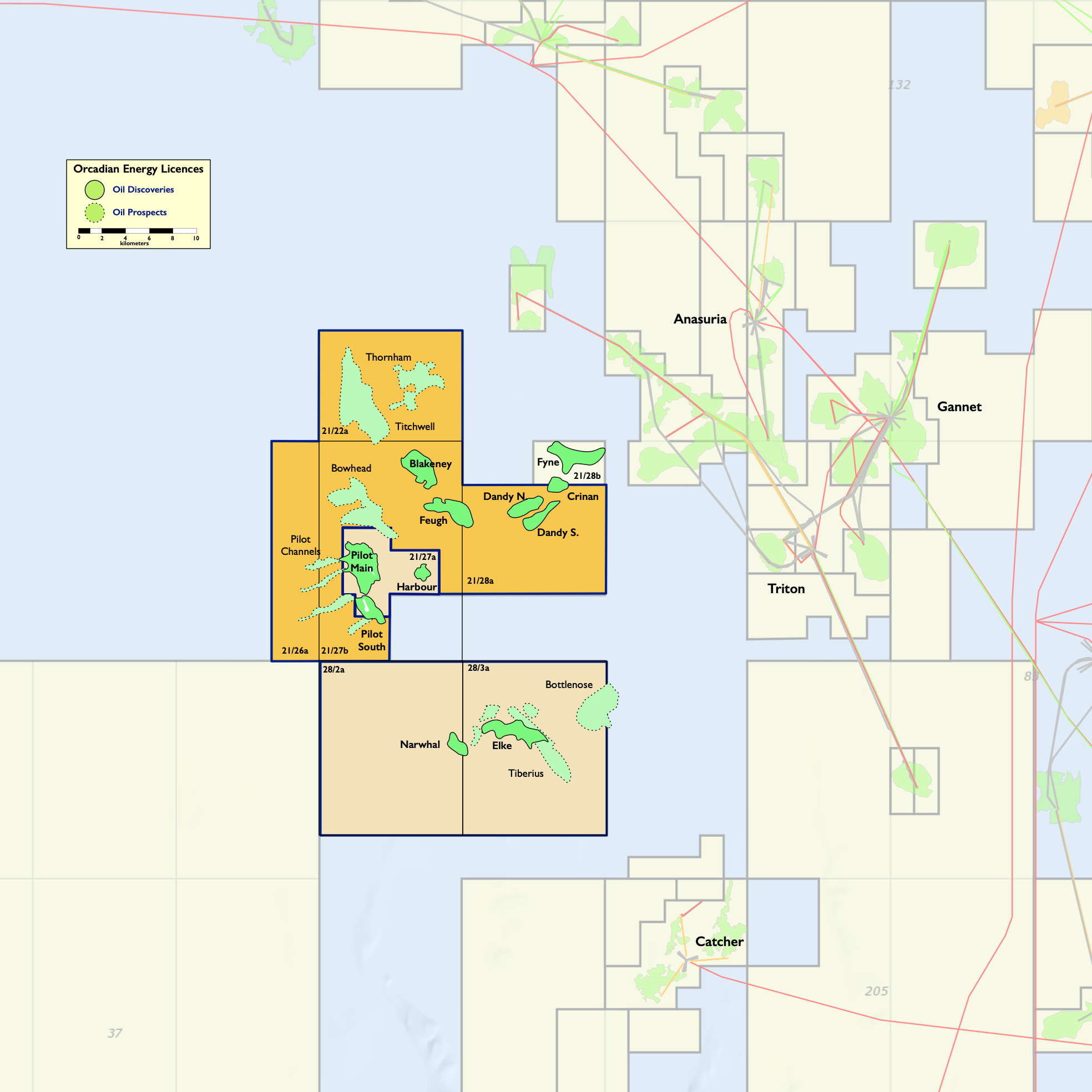

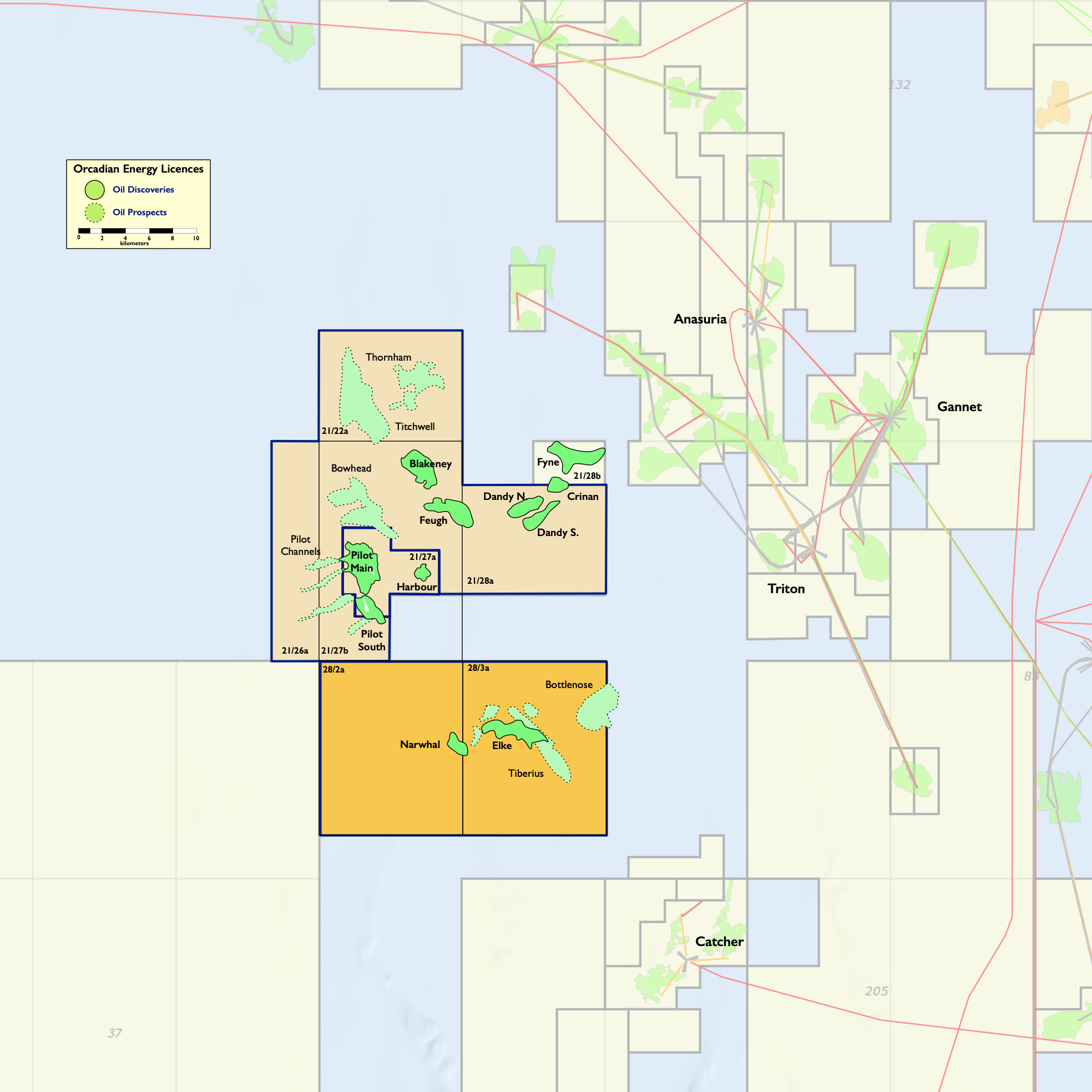

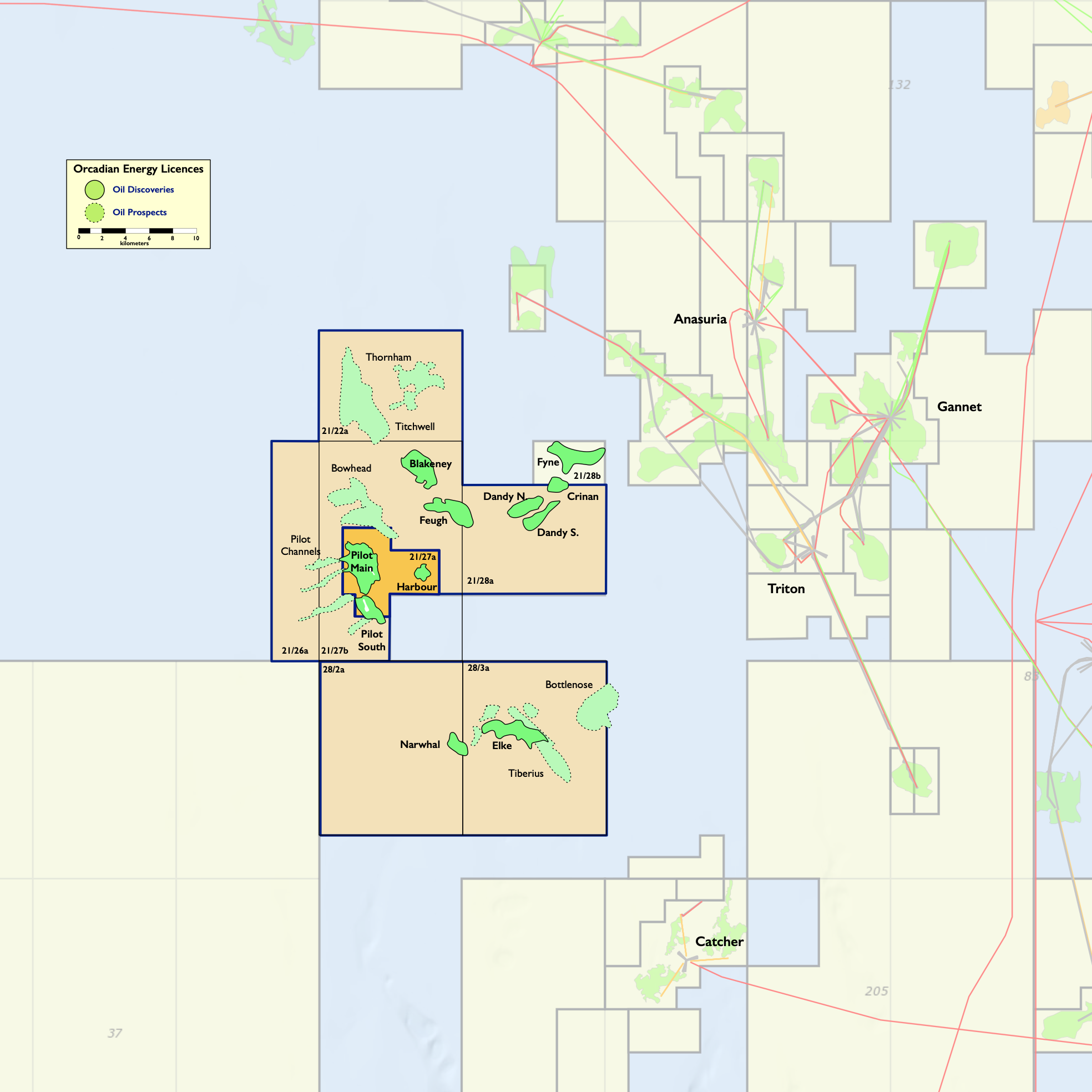

Orcadian Energy (CNS) Ltd (“CNS”), Orcadian’s operating subsidiary, was founded in 2014 and is the sole licensee of P2244, which contains 78.8 MMbbl of 2P Reserves in the Pilot discovery, and of P2320 and P2482, which contain a further 77.8 MMbbl of 2C Contingent Resources in the Elke, Narwhal and Blakeney discoveries (as audited by Sproule, see the CPR in the Company’s Admission Document for more details). Within these licences there are also 191 MMbbl of unrisked Prospective Resources. These licences are in blocks 21/27, 21/28, 28/2 and 28/3, and lie 150 kms due East of Aberdeen. The Company also has a 50% working interest in P2516, which contains the Fynn discoveries. P2516 is administered by the Parkmead Group and covers blocks 14/20g and 15/16g, which lie midway between the Piper and Claymore fields, 180 kms due East of Wick.

Pilot, which is the largest oilfield in Orcadian’s portfolio was discovered by Fina in 1989 and has been well appraised. In total five wells and two sidetracks were drilled on Pilot, including a relatively short horizontal well which produced over 1,800 bbls/day on test. Orcadian’s proposed development plan for Pilot is based upon a Floating Production Storage and Offloading vessel, with over thirty wells to be drilled by a Jack-up rig through a pair of well head platforms and will include a floating wind turbine to provide much of the energy used in the production process. Emissions per barrel produced are expected to be about an eighth of the 2020 North Sea average and to lie in the lowest 5% of global oil production.

Financial Results

Chairman’s Statement

This is the first set of interim financial statements for Orcadian Energy plc. On 15 July 2021, we were admitted to trading on the AIM market of the LSE raising £3m from new investors. These results include the impact of the IPO, which has transformed the Company’s capacity to develop the business.

In July 2021 the Company filed an addendum to the Pilot field Concept Select Report (“CSR”) with the Oil and Gas Authority (“OGA”). This followed the execution of an agreed work programme which included polymer core flood tests and work to reduce the projected carbon dioxide emissions from the development. The selected concept had been revised to include a significant improvement in process heat management and power generation efficiency and included a floating wind turbine to provide energy for the development scheme. This effort means that the Pilot development will have emissions which are about an eighth of the current North Sea average and means that Pilot will lie in the lowest 5% of global oil production.

In August 2021, using some of the proceeds of the fundraise, we licenced a 205 sq km 3D seismic dataset from TGS. which covers the Pilot and Blakeney discoveries as well as the Bowhead prospect. Axis Well Technology Ltd were also engaged to interpret the survey. The work to date has gone very well and is currently drawing to a conclusion. Our maps and static (geological) models of Pilot, Bowhead, Blakeney and Feugh are now based on this recently reprocessed seismic dataset which is the best data available over our acreage.

In October 2021 we entered into a non-binding Heads of Terms with Carrick Resources Ltd (“Carrick”) in respect of a sub-area of Licence P2320 which covers the Carra prospect, we continue to work with Carrick on this opportunity.

Also, in October 2021, we were delighted to receive three expressions of interest for the provision of an FPSO for the Pilot project and, given quality of the responses , the directors are confident that a suitable vessel and FPSO contractor can be chosen. The Company is currently conducting a series of wash tank trials, in conjunction with the wash tank technology supplier Sulzer at TotalEnergies’s facility in Pau, to derive design parameters for the in-hull separation tanks. In parallel, the Company is running a competitive concept definition process with the three FPSO respondents as it moves towards making a final decision on which vessel is best for the project.

In November 2021 the Company received a “Letter of no objection” from the OGA in respect of the development concept for the Pilot field. This letter signalled the finalisation of the “Assessment phase” and the entry into the “Authorisation phase” of development planning for the Pilot Field. In times past, this was a fairly routine marker of progress, but since the OGA’s adoption of a Net Zero central objective, to rank equally with its MER (Maximising Economic Recovery) objective, the directors believe this is actually a very significant stepping-stone towards government approval of the development of Pilot.

In December 2021 the OGA announced that Orcadian had been chosen as one of three winners of the decarbonisation competition for the electrification of offshore oil and gas installations, which had been announced in September 2021. Based upon the knowledge gained from our work on reducing emissions for the Pilot project, we formed what we believe is a powerful consortium and prepared a concept to electrify existing platforms in the CNS. The Company was awarded £466,667 by the OGA and is working with Crondall Energy, Enertechnos, Petrofac, North Sea Midstream Partners and Wärtsilä to deliver a report to the OGA and Central Graben Operators by the end of March 2022. The evaluation will include a commercial proposal for the delivery of electrical power to Central Graben and Central North Sea Operators interested in rapidly implementing electrification of their platforms.

The first half year as a quoted company has been extraordinarily busy and we are working hard focussing on four fronts:

- firstly, to improve the technical and commercial definition of the Pilot development project;

- secondly, to finance the Pilot development project;

- in addition, we are exploring every avenue to maximise the value in our satellite discoveries and prospects; and

- finally, to propose a means to practically electrify the CNS and to develop a business model enabling Orcadian to benefit from this work.

Of these activities, securing finance for Pilot is paramount, and we are exploring multiple avenues and potential opportunities to deliver this. The work to select the FPSO contractor will help define both the project costs and the portion of those costs which the FPSO contractor is willing to shoulder. We are exploring the potential for infrastructure investors to finance facilities costs in return for a tariff (similar to the arrangements Premier entered into for the Tolmount project); and we are testing with potential lenders the project debt capacity, which is determined by the robustness of the proven reserve case.

All these activities will define the equity requirement for the project. This equity can come either from industry, through a farm in, or the markets. The directors, whose interests are closely aligned with shareholders, will choose the most appropriate option which minimises dilution whilst maximising value for all the Company’s shareholders.

The directors believe that the Company is well placed with an excellent project, the development of which is aligned with the interests and strategy of the OGA. Given the feedback that we have already gained from the industry, we believe that we have an exciting year ahead in taking forward not only the Pilot development project, but also our other discoveries and prospects.

Joe Darby

Chairman

CONSOLIDATED STATEMENT OF COMPREHENSIVE LOSS

FOR THE SIX MONTHS ENDED 31 DECEMBER 2021

| Unaudited

6 Month Period Ended 31 December 2021 |

Unaudited

6 Month Period Ended 31 December 2020 |

Audited

12 Month Period Ended 30 June 2021 |

||

| Note | £ | £ | £ | |

| Administrative expenses | (519,650) | (134,396) | (258,909) | |

| Operating Loss | (519,650) | (134,396) | (258,909) | |

| Finance costs | (19,277) | (19,637) | (44,349) | |

| Other income | – | – | 3,000 | |

| Listing costs | (325,449) | – | (76,500) | |

| Loss before tax | (864,376) | (154,033) | (376,758) | |

| Taxation | – | – | 80,420 | |

| Loss for the period | (864,376) | (154,033) | (296,338) | |

| Other comprehensive income: | ||||

| Items that will or may be reclassified to profit or loss: | ||||

| Other comprehensive income | – | – | – | |

| Total comprehensive income | (864,376) | (154,033) | (296,338) | |

| Basic and Diluted Earnings per share | 4 | (1.38p) | (0.89p) | (1.34p) |

All operations are continuing.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2021

| Unaudited

as at 31 December 2021 |

Unaudited

as at 31 December 2020 |

Audited

as at 30 June 2021 |

||

| Note | £ | £ | £ | |

| Non-current assets | ||||

| Property, plant and equipment | 1,842 | 107 | 1,842 | |

| Intangible assets | 5 | 2,694,666 | 1,481,834 | 1,814,615 |

| 2,696,508 | 1,481,942 | 1,816,457 | ||

| Current assets | ||||

| Trade and Other Receivables | 6 | 63,217 | 139,795 | 88,548 |

| Cash and cash equivalents | 1,517,902 | 17,870 | 179,556 | |

| 1,581,119 | 157,665 | 268,104 | ||

| Total assets | 4,277,627 | 1,639,607 | 2,084,561 | |

| Non-current liabilities | ||||

| Borrowings | 7 | (815,185) | (872,430) | (762,686) |

| (815,185) | (872,430) | (762,686) | ||

| Current liabilities | ||||

| Trade and Other Payables | 8 | (516,902) | (401,599) | (328,601) |

| Borrowings | 7 | – | (330,000) | (1,100,000) |

| (516,902) | (731,599) | (1,428,601) | ||

| Total liabilities | (1,332,087) | (1,604,029) | (2,191,287) | |

| Net assets / (liabilities) | 2,945,540 | 35,578 | (106,726) | |

|

Equity Ordinary share capital |

9 | 63,755 | 17,401 | 52,202 |

| Share premium | 9 | 3,890,089 | 563,561 | – |

| Share warrants reserve | 9 | 15,000 | – | – |

| Reverse Acquisition Reserve | 3 | (38,848) | – | (38,848) |

| Retained earnings | (984,456) | (545,384) | (120,080) | |

| Total equity | 2,945,540 | 35,578 | (106,726) |

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTH PERIOD ENDED 31 DECEMBER 2021

| Ordinary Share capital | Share premium | Share warrants reserve | Reverse Acquisition Reserve | Retained earnings | Total | ||

| Note | £ | £ | £ | £ | £ | £ | |

| Balance as at 1 July 2020 (audited) | 17,401 | 563,561 | – | – | (391,350) | 189,612 | |

| Loss for the period and total comprehensive income | – | – |

– |

– |

(154,034) | (154,034) | |

| Balance as at 31 December 2020 (unaudited) | 17,401 | 563,561 | – | – | (545,384) | 35,578 | |

| Loss for the period and total comprehensive income | – | – |

– |

– |

(296,338) | (296,338) | |

| Bonus issue of shares | 9 | 34,801 | (34,801) | – | – | – | – |

| Issue of shares | 9 | 52,202 | – | – | (52,202) | – | – |

| Transfer to Reverse Acquisition Reserve | 3 | (52,202) | (528,760) |

– |

13,354 |

567,608 | – |

| Balance as at 30 June 2021 (audited) | 52,202 | – |

– |

(38,848) |

(120,080) | (106,726) | |

| Loss for the period and total comprehensive income | – | – |

– |

– |

(864,376) | (864,376) | |

| Issue of shares | 9 | 7,625 | 3,042,375 | – | – | – | 3,050,000 |

| Share issue costs | 9 | – | (233,358) | – | – | – | (233,358) |

| Conversion of loans | 9 | 3,928 | 1,096,072 | – | – | – | 1,100,000 |

| Issue of warrants | 9 | – | (15,000) | 15,000 | – | – | – |

| Balance as at 31 December 2021 (unaudited) | 63,755 | 3,890,089 |

15,000 |

(38,848) |

(984,456) | 2,945,540 |

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTH PERIOD ENDED 31 DECEMBER 2021

| Unaudited

6 Month Period Ended 31 December 2021 |

Unaudited

6 Month Period Ended 31 December 2020 |

Audited

12 Month Period Ended 30 June 2021 |

||

| Note | £ | £ | £ | |

| Cash flows from operating activities | ||||

| Loss before tax for the year | (864,376) | (154,034) | (376,758) | |

| Adjustments for: | ||||

| Depreciation | – | – | 217 | |

| Unrealised foreign exchange loss (gain) | 33,222 | – | (129,511) | |

| Decrease / (increase) in trade and other receivables | 6 | 25,331 | (16,155) | (10,409) |

| (Decrease) / Increase in trade and other payables | 8 | (24,928) | 39,128 | 79,504 |

| Finance costs in the period | 19,277 | 19,637 | 44,349 | |

| Cash generated from operations | (811,474) | (111,424) | (392,608) | |

| Income taxes paid | – | – | 80,420 | |

| Net cash flows from operating activities | (811,474) | (111,424) | (312,188) | |

| Investing activities | ||||

| Purchases of property, plant and equipment | – | – | (1,952) | |

| Purchases of exploration and evaluation assets | 5 | (666,822) | (86,165) | (530,818) |

| Net cash used in investing activities | (666,822) | (86,165) | (532,770) | |

| Financing activities | ||||

| Borrowings from Directors and Officers | – | (45,500) | – | |

| Proceeds from issue of convertible loan notes | 7 | – | 230,000 | 1,100,000 |

| Repayment of convertible loan notes | 7 | – | – | (100,000) |

| Interest paid | – | (360) | (6,804) | |

| Proceeds from issue of ordinary share capital | 9 | 2,816,642 | – | – |

| Net cash used in financing activities | 2,816,642 | 184,140 | 993,196 | |

| Net increase in cash and cash equivalents | 1,338,346 | (13,449) | 148,238 | |

| Cash and cash equivalents at beginning of period | 179,556 | 31,318 | 31,318 | |

| Cash and cash equivalents and end of period | 1,517,902 | 17,870 | 179,556 |

Significant non-cash transactions:

On 15 July all Convertible Loan Notes (“CLNs”) were converted in to ordinary shares at a price of 28 pence each. In total 3,928,572 ordinary shares were issued in full discharge of the CLNs.

NOTES TO THE FINANCIAL STATEMENTS

- General Information

Orcadian Energy PLC (the “Company”) is a public limited company which is domiciled and incorporated in England and Wales under the Companies Act 2006 with the registered number 13298968. The Company’s registered office is 6th floor, 60 Gracechurch Street, London, EC3V 0HR, and it ordinary shares are admitted to trading on AIM, a market of the London Stock Exchange.

The principal activity of the Group is managing oil and gas assets and it holds a 100% interest in, and is administrator for, UKCS Seaward Licences P2244, which contains the Pilot and Harbour heavy oil discoveries, and P2320, which contains the Blakeney, Feugh, Dandy & Crinan discoveries.

- Summary of significant accounting policies

The principal accounting principles applied in the preparation of these financial statements are set out below. These principles have been consistently applied to all years presented, unless otherwise stated.

- Basis of preparation

The interim financial information set out above does not constitute statutory accounts within the meaning of the Companies Act 2006. It has been prepared on a going concern basis in accordance with the recognition and measurement criteria of International Financial Reporting Standards (IFRS) as adopted by the European Union. Statutory financial statements for the year ended 30 June 2021 were approved by the Board of Directors on 15 December 2021 and delivered to the Registrar of Companies. The report of the auditors on those financial statements was unqualified.

The interim financial information for the six months ended 31 December 2021 has not been reviewed or audited. The interim financial report has been approved by the Board on 16 March 2022.

- Going concern

The Directors, having made appropriate enquiries, consider that adequate resources exist for the Company to continue in operational existence for the foreseeable future and that, therefore, it is appropriate to adopt the going concern basis in preparing the interim financial statements for the period ended 31 December 2021.

- Risks and uncertainties

The Board continuously assesses and monitors the key risks of the business. The key risks that could affect the Company’s medium term performance and the factors that mitigate those risks have not substantially changed from those set out in the Company’s 2021 Annual Report and Financial Statements, a copy of which is available on the Company’s website: https://orcadian.energy. The key financial risks are securing finance for the Pilot project and an emerging cost inflation risk.

- Critical accounting estimates

The preparation of interim financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the end of the reporting period. Significant items subject to such estimates are set out in note xx of the Company’s 2021 Annual Report and Financial Statements. The nature and amounts of such estimates have not changed significantly during the interim period.

The accounting policies applied are consistent with those of the annual financial statements for the year ended 30 June 2021, as described in those annual financial statements.

- Group reorganisation under common control

The acquisition met the definition of a group reorganisation due to the Company and the subsidiary being under common control at the date of acquisition. As a result, and since Orcadian Energy Plc did not meet the definition of a business per IFRS 3, the acquisition fell outside of the scope of IFRS 3 and the predecessor value method was used to account for the acquisition.

These consolidated financial statements for the period ended 31 December 2020 are of the Company’s wholly owned subsidiary, Orcadian Energy (CNS) Ltd.

On 11 May 2021, the Company issued 52,201,601 shares to acquire the entire issued share capital of Orcadian Energy (CNS) Ltd.

The net assets of Orcadian Energy (CNS) Ltd at the date of acquisition was as follows:

| £ | ||

| Property Plant & Equipment | 1,357 | |

| Intangible Assets | 1,719,292 | |

| Current Assets | 447,425 | |

| Current Liabilities | (284,745) | |

| Non-Current Liabilities | (1,869,975) | |

| Net assets | 13,354 |

The reserve that arose from the acquisition is made up as follows:

| £ | |

| As at 31 December 202 | – |

| Cost of the investment in Orcadian Energy (CNS) Ltd | 52,202 |

| Less: net assets of Orcadian Energy (CNS) Ltd at acqusition | (13,354) |

| As at 30 June 2021 (audited) and as at 31 December 2021 (unaudited) | 38,848 |

- Earnings per share

The calculation of the basic and diluted earnings per share is calculated by dividing the loss for the year for continuing operations for the Company by the weighted average number of ordinary shares in issue during the year.

Dilutive loss per Ordinary Share equals basic loss per Ordinary Share as, due to the losses incurred in all three periods presented, there is no dilutive effect from the subsisting share warrants.

| Unaudited

6 Month Period Ended 31 December 2021 |

Unaudited

6 Month Period Ended 31 December 2020 |

Audited

12 Month Period Ended 30 June 2021 |

|

| £ | £ |

£ |

|

| Loss for the purposes of basic earnings per share being net loss attributable to the owners | (864,376) | (154,034) | (296,338) |

| Weighted average number of Ordinary Shares | 62,809,231 | 17,400,534 | 22,167,804 |

| Loss per share | (1.38p) | (0.89p) | (1.34p) |

The weighted average number of shares is adjusted for the impact of the acquisition as follows:

– Prior to the acquisition, the number of shares is based on Orcadian Energy (CNS) Ltd, adjusted using the share exchange ratio arising on the acquisition; and

– From the date of the acquisition, the number of shares is based on the Company.

- Intangible assets

| Oil and gas exploration assets | |

| £ | |

| Cost | |

| As at 30 June 2020 (audited) | 1,283,797 |

| Additions | 198,037 |

| As at 31 December 2020 (unaudited) | 1,481,834 |

| Additions | 332,781 |

| As at 30 June 1 (audited) | 1,814,615 |

| Additions | 880,051 |

| As at 31 December 2021 (Unaudited) | 2,694,666 |

- Trade and other receivables

| Group | Unaudited

as at 31 December 2021 |

Unaudited

as at 31 December 2020 |

Audited

as at 30 June 2021 |

| £ | £ | £ | |

| VAT receivable | 63,217 | 22,071 | 50,925 |

| Prepayments relating to the issue of equity | – | – | 13,500 |

| Prepayments other | – | – | 24,123 |

| Amounts due from related parties | – | 117,724 | – |

| 63,217 | 139,795 | 88,548 |

- Borrowings

| Unaudited

as at 31 December 2021 |

Unaudited

as at 31 December 2020 |

Audited

as at 30 June 2021 |

|

| £ | £ | £ | |

| STASCO Loan | 815,185 | 872,430 | 762,686 |

| Convertible Loan Note 2020 | – | 330,000 | 380,000 |

| Convertible Loan Note 2021 | – | – | 720,000 |

| 815,185 | 1,202,430 | 1,862,686 |

- Trade and other payables – due within one year

| Unaudited

as at 31 December 2021 |

Unaudited

as at 31 December 2020 |

Audited

as at 30 June 2021 |

|

| £ | £ | £ | |

| Trade payables | 294,918 | 160,357 | 35,443 |

| Accruals | 191,049 | 241,242 | 276,133 |

| Other creditor | 30,935 | – | 17,025 |

| 516,902 | 401,599 | 328,601 |

- Ordinary share capital and share premium

| Group | |||

| Issued | Number of shares | Ordinary share capital

£ |

Share

premium £ |

| As at 30 June 2020 (audited) | 17,400,534 | 17,401 | 563,561 |

| As at 31 December 2020 (unaudited) | 17,400,534 | 17,401 | 563,561 |

| Transfer between reserves | – | 34,801 | (34,801) |

| Issued capital of Company at acquisition | 1 | – | – |

| Issue of shares upon acquisition of subsidiary | 52,201,601 | 52,202 | – |

| Transfer of Ltd paid up capital to reverse acquisition reserve |

(17,400,534) |

(52,202) |

(528,760) |

| As at 30 June 2021(audited) | 52,201,602 | 52,202 | – |

| Issue of shares | 7,625,000 | 7,625 | 3,042,375 |

| Share issue costs | – | – | (233,358) |

| Conversion of loans | 3,928,572 | 3,928 | 1,096,072 |

| As at 31 December 2021 (unaudited) | 63,755,174 | 63,755 | 3,905,089 |

The issued capital of the Group for the period 1 July 2020 to 11 May 2021 was that of Orcadian Energy (CNS) Ltd. Upon completion of the acquisition the share capital of Orcadian Energy (CNS) Ltd was transferred to the Acquisition reserve (Refer to note 4) and the share capital of Orcadian Energy PLC was brought to account.

The ordinary shares confer the right to vote at general meetings of the Company, to a repayment of capital in the event of liquidation or winding up and certain other rights as set out in the Company’s articles of association.

On 15 July 2021 the Company issued 75,000 warrants over ordinary shares of the Company at 40 pence each, exercisable at any time over a three year period from the date of issue. The warrants were valued using the Black-Scholes pricing model. The inputs into the Black-Scholes model are as follows:

| Grant date | 15 July 2021 |

| Exercise price | 40.00 pence |

| Expected life | 3 years |

| Expected volatility | 77.32% |

| Risk free rate of interest | 0.0242% |

| Dividend yield | Nil |

| Fair value of option | 20.00 pence |

Volatility has been estimated based on the historic volatility of a collection of comparable companies over a period equal to the expected term from the grant date.

- Events after the reporting period

Since 31 December 2021, the Company has been focussed on the following activities:

- Progressing, with Sulzer, wash tank trials at the TotalEnergies test facility in Pau, these tests will help provide useful design parameters for the wash tanks to be installed in the FPSO hull;

- Developing the geological and geophysical models for Pilot, Bowhead, Blakeney and Feugh based upon the new seismic data;

- Modelling the expected performance of a polymer flood scheme based upon the results of the polymer core flood work and the new maps;

- Preparing a functional specification and basis of design to be discussed with potential FPSO contractors;

- Executing the agreed work programme for the OGA on the Electrification Competition; and, of course

- Exploring opportunities to finance the Pilot development scheme.