The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulations (EU) No. 596/2014 (MAR). Upon the publication of this announcement via Regulatory Information Service (RIS), this inside information is now considered to be in the public domain.

27 February 2024

Orcadian Energy plc

(“Orcadian Energy”, “Orcadian” or the “Company”)

Results for the half year ended 31 December 2023

Orcadian Energy (AIM: ORCA), the North Sea focused oil and gas development company, is pleased to announce its unaudited results for the six months ended 31 December 2023.

Highlights:

- Agreed the terms for a conditional disposal of an 81.25% interest in licence P2244, which includes the Pilot project, to Ping Petroleum UK plc*

- If completed, all costs associated with the remaining 18.75% interest in Pilot to be carried by Ping until first production from Pilot*

- Secured a two-year extension to the P2244 licence, subject to completion of the disposal to Ping

- Completed the seismic inversion of the Catcher North seismic survey with TGS, which covers the Elke field, and conducted quantitative interpretation work to help refine field outline and assist in identification of development well locations

- Raised £350k before expenses on 2 October 2023, and £500k before expenses on 18 December 2023

Post period Highlights:

- Offered two licences in the 33rd Round adding a very large viscous oil discovery, and a series of shallow gas prospects, to our project inventory

Activity Focus:

- To finalise a farm-out deal for the Pilot development project

- To maximise the value of the Company’s satellite discoveries and prospects

- To prepare for awards of new licences in the 33rd Round

Steve Brown, Orcadian’s CEO, commented:

“In the second half of 2023 we struck the deal which we have been seeking since we first signed the Pilot licence. The deal with Ping Petroleum is transformational for us and, whilst completion is still subject to the satisfaction of certain conditions, the board remain confident that these conditions will be satisfied before the end of this quarter.

“We are also delighted to have replenished our inventory of projects with the award of the 292 MMbbl (gross 2C resource) Fynn Beauly discovery. We see opportunities to deploy geothermal heat sources to raise the reservoir temperature and boost production rates sufficiently to enable a polymer flood of the reservoir to be highly successful.

“The 33rd Round awards also included our first gas project and we are very pleased to have been awarded a licence covering nine North Sea blocks with an unrisked P50 prospective resource of over 300 bcf with a P10 upside potential of over 500bcf.”

*see announcement dated 7 December 2023

For further information on the Company please visit the Company’s website: https://orcadian.energy

Contact:

|

Orcadian Energy plc |

+ 44 20 7920 3150 |

|

Steve Brown, CEO Alan Hume, CFO |

|

| WH Ireland (Nomad and Joint Broker) | +44 20 7220 1666 |

|

Katy Mitchell / Andrew de Andrade (Nomad) Harry Ansell / Fraser Marshall (Corporate Broking)

|

|

| Tavistock (PR) | + 44 20 7920 3150 |

| Nick Elwes / Simon Hudson | [email protected] |

About Orcadian Energy

Orcadian is a North Sea focused, low emissions, oil and gas development company. In planning its Pilot development, Orcadian has selected wind power to transform oil production into a cleaner and greener process. The Pilot project is moving towards approval and will be amongst the lowest carbon emitting oil production facilities in the world, despite being a viscous crude. Orcadian may be a small operator, but it is also nimble, and the Directors believe it has grasped opportunities that have eluded some of the much bigger companies. As we strike a balance between Net Zero and a sustainable energy supply, Orcadian intends to play its part to minimise the cost of Net Zero and to deliver reliable energy to the UK.

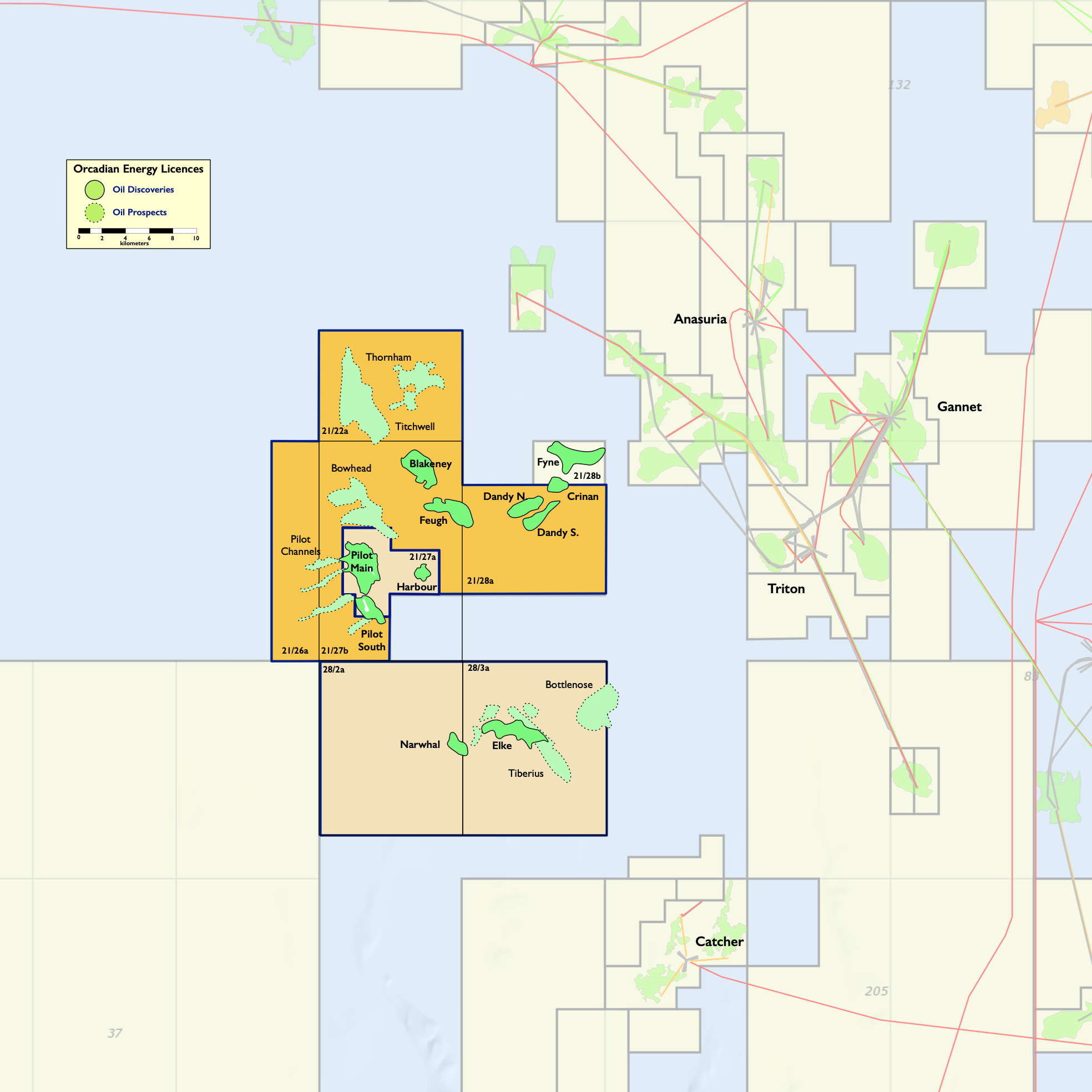

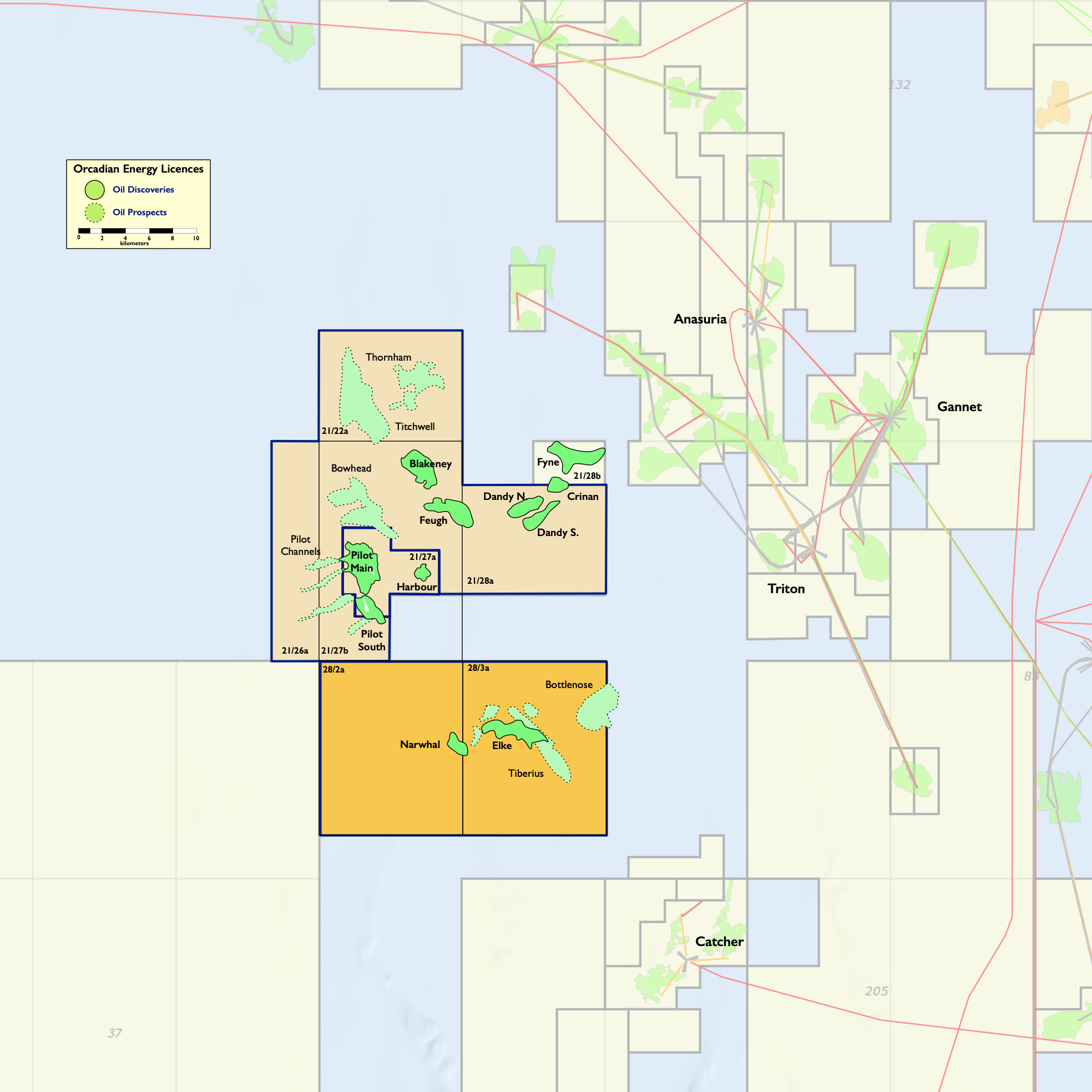

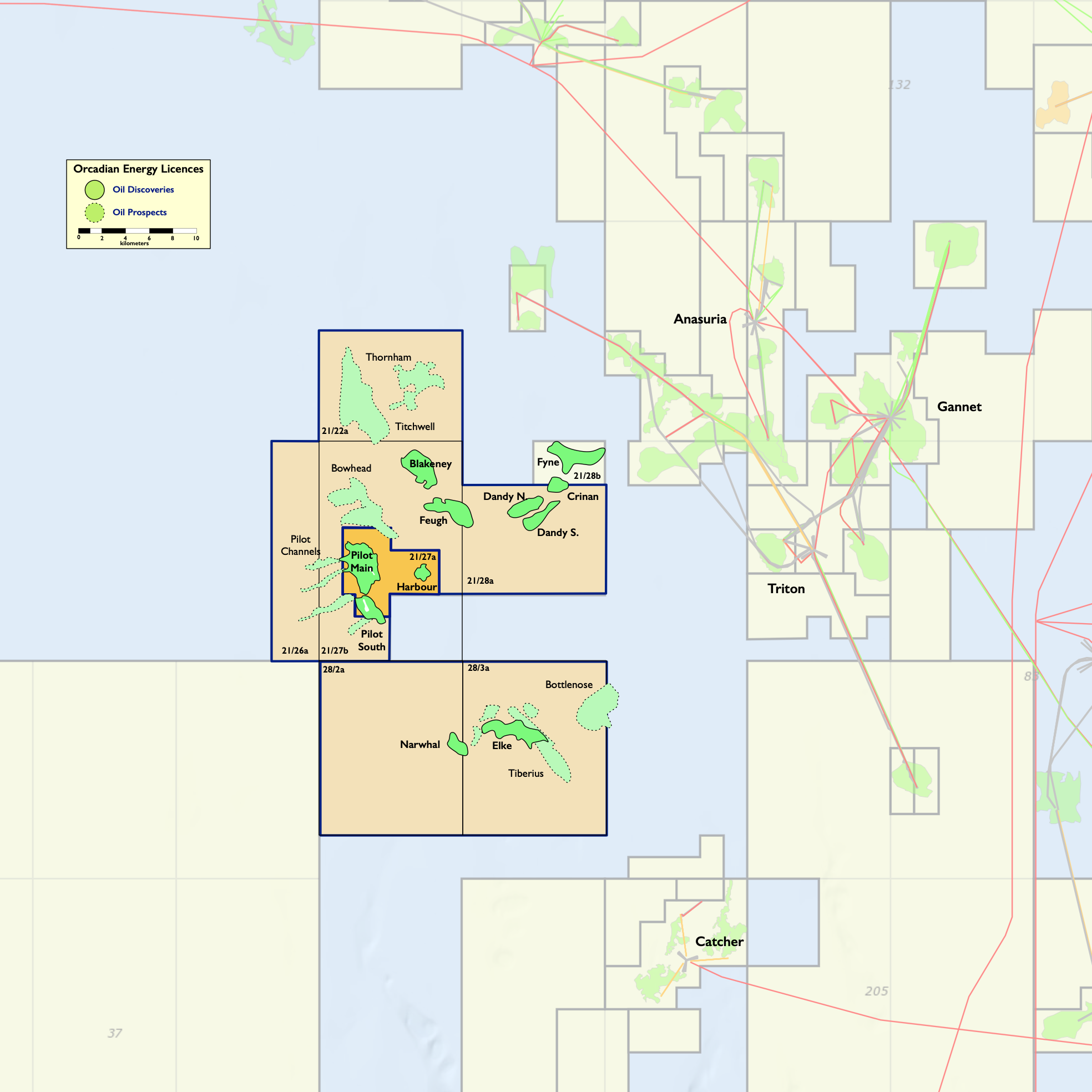

Orcadian Energy (CNS) Ltd, Orcadian’s operating subsidiary, was founded in 2014 and is the sole licensee of P2244, which contains 78.0 MMbbl of 2P Reserves in the Pilot discovery, and of P2482, which contain a further 52.2 MMbbl of 2C Contingent Resources in the Elke and Narwhal discoveries (as audited by Sproule, with both numbers modified to take into account the TGS royalty, see the CPR in the Company’s Admission Document for more details). Within these licences there are also 118 MMbbl of unrisked Prospective Resources (modified for TGS royalty). These licences are in blocks 21/27a, 28/2a and 28/3a, and lie 150 kms due East of Aberdeen.

Pilot, which is the field with the largest reserves in Orcadian’s portfolio, was discovered by PetroFina in 1989 and has been well appraised. In total five wells and two sidetracks were drilled on Pilot, including a relatively short horizontal well which produced over 1,800 bbls/day on test. Orcadian’s proposed low emissions, field development plan for Pilot is based upon a Floating Production Storage and Offloading vessel (FPSO), with over thirty wells to be drilled by a Jack-up rig and provision of power from a floating wind turbine.

Orcadian has entered into a conditional sale and purchase agreement with Ping Petroleum UK plc (“Ping”) which details the terms under which Ping will farm-in to the Pilot development project. Upon conclusion of this deal Orcadian would have an 18.75% stake in the Pilot development with all pre-first oil development costs paid by Ping.

Emissions per barrel produced are expected to be about a tenth of the 2021 North Sea average, and less than half of the lowest emitting oil facility currently operating on the UKCS. On a global basis this places the Pilot field emissions at the low end of the lowest 5% of global oil production.

Chairman & CEO’s Statement

The second half of 2023 has been transformational for Orcadian, on 7 December 2023 we announced the signature of a conditional sale and purchase agreement (the “SPA”), for an 81.25% interest in licence P2244, which contains the Pilot project, with Ping Petroleum UK plc (“Ping”). The deal includes a carry of all costs associated with Pilot until first production from the Pilot field as well as a $3 million payment due on Pilot FDP approval.

Virtually every company that announces a significant transaction describes it as transformational, but for Orcadian to bring in a partner to develop the material oil resources in the Pilot field, would be truly transformational. Pilot is one of the largest undeveloped fields in the Central North Sea with audited 2P reserves of 79 MMbbl. Our team’s focus has been to find a partner that shares our vision for the project and to strike a deal which minimises the extent of asset and shareholder dilution. That is now accomplished and we can now focus on supporting Ping to satisfy all outstanding conditions to complete the SPA. Once completed, the focus will be on working with Ping to prepare a field development plan which optimises value for every party, and which can deliver first production from Pilot.

Ping is an excellent partner for Orcadian. They are innovative and committed to the UKCS. They may be an unfamiliar name to many, but they have been operating on the UKCS since their first deal with Shell and Exxon in 2015. They, alongside their partners Hibiscus Petroleum, operate the Anasuria cluster which lies about 40km to the northeast of Pilot. They are a subsidiary of a listed Malaysian conglomerate, Dagang NeXchange Berhad, or DNeX, which is a multinational corporation with diverse businesses in Technology, Energy, and Information Technology. DNeX has access to capital from financial markets in the Far East that recognise the value of low-emissions oil and gas assets rather better than our domestic markets do.

The conditions precedent to the SPA include: Orcadian shareholder approval, received on 17 January 2024; completion of commercial and legal due diligence by Ping, which we understand is now complete; finalisation and execution of the Joint Operating Agreement, which is still ongoing; approval of the transaction by the NSTA, received on 4 January 2024; approval of the transaction and variations to the existing agreements in place (where appropriate) from Shell and TGS, still ongoing; and finally approval of the transaction by the Ping board and the board of DNeX, Ping’s parent company, which is expected during March 2024; plus additional standard conditions to a transaction of this nature which are also expected to be satisfied before March 2024.

The licence extension granted by NSTA requires that the assignment of the interest in P2244 completes by the end of March 2024. We remain confident that this will be achieved, and are looking forward to Ping progressing the implementation of the Pilot development scheme.

The second half of 2023 was dominated by negotiating and documenting this deal. We had hoped to have reported a number of licence awards during 2023, but for a multitude of reasons the award of licences by NSTA was delayed, with the first tranche being announced in October 2023. None of the areas we had applied for were awarded in this tranche. So it took until 2024, more than a year after our applications were submitted, for those efforts to bear fruit.

On 31 January 2024 NSTA announced a second tranche of awards in the 33rd Round. Orcadian was successful in both of its applications within the areas awarded. The area of the third application has not yet been awarded and we remain hopeful that we will be awarded a further licence.

These awards open up new possibilities for Orcadian as we have added a gas leg to our viscous oil development strategy. Nevertheless, we still see great potential value in viscous oil opportunities.

The role of gas in displacing coal from power generation and in backing up wind powered grids is well acknowledged. As the transition to net zero proceeds, viscous oils will still be needed for multiple uses beyond combustion: lubricants, asphalt and anode-grade petroleum coke are all significant markets that have a much brighter future than the gasoline market. Viscous oils, especially the relatively low sulphur content oils that Orcadian has under licence, are considered prized pre-cursors of these materials.

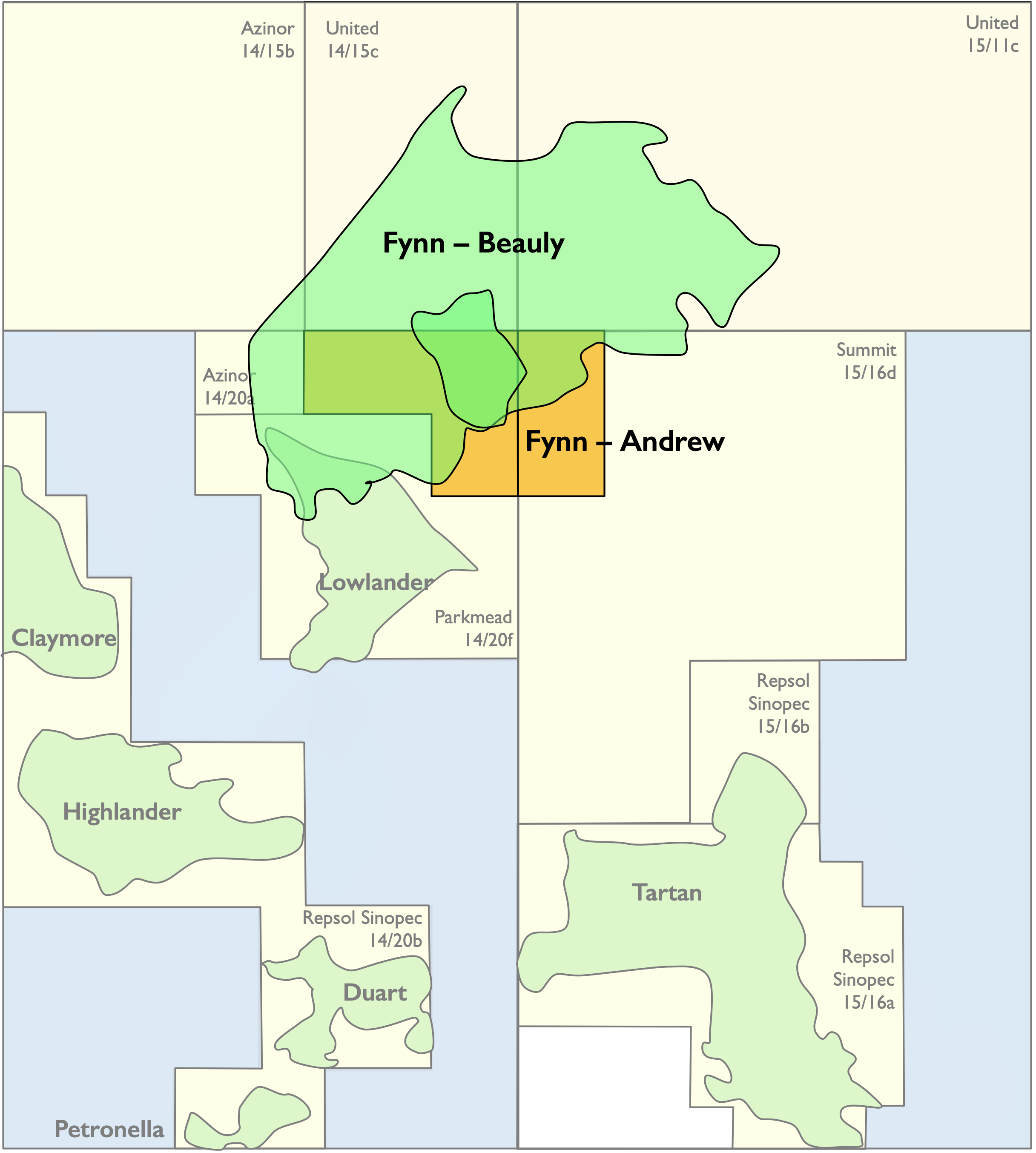

The Fynn award, which lies next to our former P2516 licence, contains a very substantial viscous oil discovery which has a gross P50 contingent recoverable resource of 292 MMbbl, based upon the latest internal estimates as presented to NSTA by Parkmead (E&P) Limited, the proposed operator. About 88% of the resource on a best technical case is estimated to lie within the area of the offered licence, so we estimate we have added some 129 MMbbl of 2C contingent resource to our portfolio. However this is an internal estimate, that has not been audited, and it provided for guidance purposes only.

Orcadian intends to hold a 50% working interest in the Fynn licence which covers blocks 14/15a, 14/20d and 15/11a.

Our joint work on P2516 gave us the confidence to apply for this block and we can do no better than acknowledge our partner Parkmead’s observations on this award which was incorporated in their announcement dated 5 February 2024. As set out above, the estimates contained within it are Parkmead’s own internal estimates and have not been audited, so should not be relied upon and are provided for guidance purposes only:

“This important award consists of a licence covering Blocks 14/15a, 14/20d and 15/11a situated in the Central North Sea. Parkmead will be operator and hold a 50% working interest, alongside its partner Orcadian Energy (CNS) Limited. The new licence contains seven undeveloped oil discoveries within Mesozoic and Palaeozoic reservoirs. The most substantial of these is Fynn Beauly.

“Fynn Beauly is one of the largest undeveloped oil accumulations in the UK, with estimated gross P50 contingent resources of 292 million barrels. This large heavy oil discovery is situated between the prolific Claymore and Piper fields. The field extends across all three awarded blocks and is estimated to contain oil-in-place of between 740 and 1,330 million barrels. This is an important award because the acreage which encapsulates this significant oil field has not previously been licensed to a single partner group, creating an exciting opportunity for Parkmead and Orcadian to advance the development of this substantial, previously untapped resource.

“The current licence commitment requires no major capital outlay. The work programme is focused on assessing the feasibility of reducing Fynn Beauly oil viscosity using enhanced oil recovery techniques. This work will include assessing the potential to utilise geothermal energy as part of the recovery mechanism to avoid the need for injected hot water. This would allow for the delivery of a successful development of this major field which is in line with the NSTA’s Net Zero Strategy.”

We are also excited by our second offer of award which lies to the southeast of Pilot, and consider the area has excellent potential for the discovery of gas. The UK is desperately short of gas and deeply reliant on uninterrupted supplies from Norway, which could, if tensions escalated, easily be targeted by an unfriendly power. As we know from the destruction of the Nordstream pipelines, this type of cross-border infrastructure is vulnerable. The balance of the UK’s gas comes from the LNG market and CO2 emissions associated with that production and transport are many times greater than existing UK gas production. New gas production, developed with an eye to reducing emissions, can also be produced with much lower emissions than the aging UK fields which supply us today.

New gas developments are the only way to mitigate our security of supply concerns, whilst minimising emissions; so to have uncovered, and then won, a significant potential resource on our own doorstep is a matter of great pride.

The Mid North Sea High award contains shallow gas prospects and leads which contain 336 bcf of gross prospective recoverable resource on a P50 basis (this estimate is an Orcadian management estimate, which is provided for guidance only, and was submitted in the licence application). The two largest prospects – Glenlough and Breckagh – are estimated to account for about 80% of the identified resource potential. Orcadian applied in partnership with Triangle Energy, an Australian listed energy company. Orcadian would be licence administrator and would hold 50% of the offered licence.

The Mid North High Sea licence covers blocks 29/16, 29/17, 29/18, 29/19, 29/21, 29/22, 29/23, 29/27 and 29/28.

We have a couple of interesting development concepts for any discoveries here, and we see the potential to use wind power to compress the gas for export as an excellent example of how new developments can be designed to deliver new gas production with emissions far below LNG imports and wholly within our own borders.

We are looking forward to working with both Parkmead and Triangle to bring these projects to fruition as soon as possible.

Finally, I would also like to take this opportunity to thank all our shareholders for their continued support and look forward to providing further updates as appropriate on what we believe will be a key year for the Company and the development of Pilot.

| Joe Darby | Steve Brown |

| Chairman | CEO |

| 26 February 2024 | 26 February 2024 |

CONSOLIDATED STATEMENT OF COMPREHENSIVE LOSS

FOR THE SIX MONTHS ENDED 31 DECEMBER 2023

| Unaudited

6 Month Period Ended 31 December 2023 |

Unaudited

6 Month Period Ended 31 December 2022 |

Audited

12 Month Period Ended 30 June 2023 |

||

| Note | £ | £ | £ | |

| Administrative expenses | (260,180) | (455,196) | (671,327) | |

| Pre-acquisition licence expenses | (2,513) | – | (129,867) | |

| Impairment of intangible assets | 5 | (173,567) | – | (356,532) |

| Operating Loss | (436,260) | (455,196) | (1,157,726) | |

| Finance costs | (51,865) | (36,493) | (77,228) | |

| Other income | – | 2,187 | 50,000 | |

| Loss before tax | (488,125) | (489,503) | (1,184,954) | |

| Taxation | – | – | – | |

| Loss for the period | (488,125) | (489,503) | (1,184,954) | |

| Other comprehensive income: | ||||

| Items that will or may be reclassified to profit or loss: | ||||

| Other comprehensive income | – | – | – | |

| Total comprehensive income | (488,125) | (489,503) | (1,184,954) | |

| Basic and Diluted Earnings per share | 4 | (0.66p) | (0.74p) | (1.72p) |

All operations are continuing.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2023

| Unaudited

as at 31 December 2023 |

Unaudited

as at 31 December 2022 |

Audited

as at 30 June 2023 |

||

| Note | £ | £ | £ | |

| Non-current assets | ||||

| Property, plant and equipment | 1,671 | 3,264 | 2,508 | |

| Intangible assets | 5 | 4,610,093 | 3,768,546 | 3,871,362 |

| 4,611,764 | 3,771,810 | 3,873,870 | ||

| Current assets | ||||

| Trade and Other Receivables | 6 | 535,522 | 58,689 | 48,828 |

| Cash and cash equivalents | 72,934 | 225,446 | 109,705 | |

| 608,456 | 284,135 | 158,533 | ||

| Total assets | 5,220,220 | 4,055,945 | 4,032,403 | |

| Current liabilities | ||||

| Trade and Other Payables | 8 | (1,396,463) | (428,381) | (567,629) |

| Borrowings | 7 | (1,067,947) | (992,678) | (991,339) |

| (2,464,410) | (1,421,059) | (1,558,968) | ||

| Total liabilities | (2,464,410) | (1,421,059) | (1,558,968) | |

| Net assets | 2,755,810 | 2,634,886 | 2,473,435 | |

|

Equity Ordinary share capital |

9 | 75,429 | 66,612 | 72,512 |

| Share premium | 9 | 5,638,615 | 4,788,432 | 5,316,532 |

| Share warrants reserve | 9 | 15,000 | 15,000 | 15,000 |

| Shares to be issued | 10 | 445,500 | – | – |

| Reverse Acquisition Reserve | 3 | (38,848) | (38,848) | (38,848) |

| Retained earnings | (3,379,886) | (2,196,310) | (2,891,761) | |

| Total equity | 2,755,810 | 2,634,886 | 2,473,435 |

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTH PERIOD ENDED 31 DECEMBER 2023

| Ordinary Share capital | Share premium | Share warrants reserve |

Shares to be issued |

Reverse Acquisition Reserve | Retained earnings | Total | ||

| Note | £ | £ | £ | £ | £ | £ | £ | |

| Balance as at 1 July 2022 (audited) | 63,755 | 3,890,089 |

15,000 |

901,200 |

(38,848) |

(1,706,807) | 3,124,389 | |

| Loss for the period and total comprehensive income | – | – | – | – | – | (489,503) | (489,503) | |

| Issue of shares | 9 | 2,857 | 997,143 | – | (1,000,000) | – | – | 1,000,000 |

| Share issue costs | 9 | – | (98,800) | – | 98,800 | – | – | – |

| Balance as at 31 December 2022 (unaudited) | 66,612 | 4,788,432 | 15,000 | – | (38,848) | (2,196,310) | 2,634,886 | |

| Loss for the period and total comprehensive income | – | – |

– |

– |

– |

(695,451) | (695,451) | |

| Issue of shares | 9 | 5,900 | 584,100 | – | – | – | – | 590,000 |

| Share issue costs | 9 | – | (56,000) | – | – | – | – | (56,000) |

| Balance as at 30 June 2023 (audited) | 72,512 | 5,316,532 |

15,000 |

– |

(38,848) |

(2,891,761) | 2,473,435 | |

| Loss for the period and total comprehensive income | – | – | – | – | – | (488,125) | (488,125) | |

| Issue of shares | 9 | 2,917 | 347,083 | – | – | – | – | 350,000 |

| Share issue costs | 9 | – | (25000) | – | – | – | – | (25,000) |

| Shares to be issued – 18 December 2023 placing | 10 | – | – | – | 445,500 | – | – | 445,500 |

| Balance as at 31 December 2023 (unaudited) | 75,429 | 5,638,615 | 15,000 | 445,500 | (38,848) | (3,379,886) | 2,755,810 |

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTH PERIOD ENDED 31 DECEMBER 2023

| Unaudited

6 Month Period Ended 31 December 2023 |

Unaudited

6 Month Period Ended 31 December 2022 |

Audited

12 Month Period Ended 30 June 2023 |

||

| Note | £ | £ | £ | |

| Cash flows from operating activities | ||||

| Loss before tax for the year | (488,125) | (489,503) | (1,184,954) | |

| Adjustments for: | ||||

| Depreciation | 837 | 150 | 1,822 | |

| Unrealised foreign exchange loss (gain) | 24,692 | – | (44,852) | |

| Impairment of intangible assets | 5 | 173,567 | – | 356,532 |

| Interest received | (51) | – | (2,779) | |

| Decrease / (increase) in trade and other receivables | 6 | 13,305 | (2,859) | 7,001 |

| Increase / (decrease) in trade and other payables | 8 | 98,320 | (60,714) | 189,064 |

| Finance costs in the period | 51,916 | 36,493 | 80,007 | |

| Net cash used in operating activities | (125,539) | (516,433) | (598,159) | |

| Investing activities | ||||

| Interest received | 51 | – | 2,779 | |

| Purchases of property, plant and equipment | – | – | (916) | |

| Purchases of exploration and evaluation assets | 5 | (236,283) | (430,760) | (1,000,638) |

| Net cash used in investing activities | (236,232) | (430,760) | (998,775) | |

| Financing activities | ||||

| Proceeds from issue of ordinary share capital | 9 | 350,000 | 1,000,000 | 1,590,000 |

| Share issue costs paid | 9 | (25,000) | (98,800) | (154,800) |

| Net cash used in financing activities | 325,000 | 901,200 | 1,435,200 | |

| Net decrease in cash and cash equivalents | (36,771) | (45,993) | (161,734) | |

| Cash and cash equivalents at beginning of period | 109,705 | 271,439 | 271,439 | |

| Cash and cash equivalents and end of period | 72,934 | 225,446 | 109,705 |

There were no significant non-cash transactions during the period.

NOTES TO THE FINANCIAL STATEMENTS

- General Information

Orcadian Energy PLC (the “Company”) is a public limited company which is domiciled and incorporated in England and Wales under the Companies Act 2006 with the registered number 13298968. The Company’s registered office is 6th floor, 60 Gracechurch Street, London, EC3V 0HR, and it ordinary shares are admitted to trading on AIM, a market of the London Stock Exchange.

The principal activity of the Group is managing oil and gas assets and the Group holds a 100% interest in, and is licence administrator for, UKCS Seaward Licences P2244, which contains the Pilot and Harbour heavy oil discoveries and P2482 which contains the Elke and Narwhal discoveries. The Group has entered into a Sale and Purchase agreement to reduce its working interest in the P2244 licence to 18.75% and to assign operatorship of this licence to Ping Petroleum UK PLC.

The Group also had a 50% working interest in P2516, which contains a small part of the Fynn discoveries. P2516 was administered by the Parkmead Group and covers blocks 14/20g and 15/16g, which lie midway between the Piper and Claymore fields. P2516 expired in November 2023.

- Summary of significant accounting policies

The principal accounting principles applied in the preparation of these financial statements are set out below. These principles have been consistently applied to all years presented, unless otherwise stated.

- Basis of preparation

The interim financial information set out above does not constitute statutory accounts within the meaning of the Companies Act 2006. It has been prepared on a going concern basis in accordance with UK-adopted international accounting standards. Statutory financial statements for the year ended 30 June 2023 were approved by the Board of Directors on 18 December 2023 and delivered to the Registrar of Companies. The report of the auditors on those financial statements was unqualified.

The interim financial information for the six months ended 31 December 2023 has not been reviewed or audited. The interim financial report has been approved by the Board on 26 February 2024.

- Going concern

The Directors, having made appropriate enquiries, consider that adequate resources exist for the Company to continue in operational existence for the foreseeable future and that, therefore, it is appropriate to adopt the going concern basis in preparing the interim financial statements for the period ended 31 December 2023.

- Risks and uncertainties

The Board continuously assesses and monitors the key risks of the business. The key risks that could affect the Company’s medium term performance and the factors that mitigate those risks have not substantially changed from those set out in the Company’s 2023 Annual Report and Financial Statements, a copy of which is available on the Company’s website: https://orcadian.energy. The key financial risks are securing finance for the Pilot project and an emerging cost inflation risk.

- Critical accounting estimates

The preparation of interim financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the end of the reporting period. Significant items subject to such estimates are set out in note 3 of the Company’s 2023 Annual Report and Financial Statements. The nature and amounts of such estimates have not changed significantly during the interim period.

The accounting policies applied are consistent with those of the annual financial statements for the year ended 30 June 2023, as described in those annual financial statements.

- Group reorganisation under common control

The acquisition in the year ended 30 June 2021 met the definition of a group reorganisation due to the Company and the subsidiary being under common control at the date of acquisition. As a result, and since Orcadian Energy Plc did not meet the definition of a business per IFRS 3, the acquisition fell outside of the scope of IFRS 3 and the predecessor value method was used to account for the acquisition.

These consolidated financial statements for the period ended 31 December 2022 are of the Company’s wholly owned subsidiary, Orcadian Energy (CNS) Ltd.

On 11 May 2021, the Company issued 52,201,601 shares to acquire the entire issued share capital of Orcadian Energy (CNS) Ltd.

The net assets of Orcadian Energy (CNS) Ltd at the date of acquisition was as follows:

| £ | ||

| Property Plant & Equipment | 1,357 | |

| Intangible Assets | 1,719,292 | |

| Current Assets | 447,425 | |

| Current Liabilities | (284,745) | |

| Non-Current Liabilities | (1,869,975) | |

| Net assets | 13,354 | |

The reserve that arose from the acquisition is made up as follows:

| £ | |

| As at 31 December 2020 | – |

| Cost of the investment in Orcadian Energy (CNS) Ltd | 52,202 |

| Less: net assets of Orcadian Energy (CNS) Ltd at acquisition | (13,354) |

| As at 30 June 2023 (audited) and as at 31 December 2023 (unaudited) | 38,848 |

- Earnings per share

The calculation of the basic and diluted earnings per share is calculated by dividing the loss for the year for continuing operations for the Company by the weighted average number of ordinary shares in issue during the year.

Dilutive loss per Ordinary Share equals basic loss per Ordinary Share as, due to the losses incurred in all three periods presented, there is no dilutive effect from the subsisting share warrants.

| Unaudited

6 Month Period Ended 31 December 2023 |

Unaudited

6 Month Period Ended 31 December 2022 |

Audited

12 Month Period Ended 30 June 2023 |

|

| £ | £ |

£ |

|

| Loss for the purposes of basic earnings per share being net loss attributable to the owners | (488,125) | (489,503) | (1,184,954) |

| Weighted average number of Ordinary Shares | 73,891,393 | 66,519,149 | 68,876,857 |

| Loss per share | (0.66p) | (0.74p) | (1.72p) |

The weighted average number of shares is adjusted for the impact of the acquisition as follows:

- Intangible assets

| Oil and gas exploration assets | |

| £ | |

| Cost | |

| As at 30 June 2022 (audited) | 3,303,400 |

| Additions | 465,146 |

| As at 31 December 2022 (unaudited) | 3,768,546 |

| Additions | 459,348 |

| Impairment | (356,532) |

| As at 30 June 2023 (audited) | 3,871,362 |

| Additions | 912,298 |

| Impairment | (173,567) |

| As at 31 December 2023 (Unaudited) | 4,610,093 |

- Trade and other receivables

| Group | Unaudited

as at 31 December 2023 |

Unaudited

as at 31 December 2022 |

Audited

as at 30 June 2023 |

| £ | £ | £ | |

| VAT receivable | 26,978 | 55,188 | 47,440 |

| Prepayments | 8,544 | – | – |

| Other receivables | 500,000 | 3,500 | 1,388 |

| 535,522 | 58,688 | 48,828 |

- Borrowings

| Unaudited

as at 31 December 2023 |

Unaudited

as at 31 December 2022 |

Audited

as at 30 June 2023 |

|

| £ | £ | £ | |

| STASCO Loan | 1,067,947 | 992,678 | 991,339 |

| 1,067,947 | 992,678 | 991,339 | |

| Current liabilities | 1,067,947 | 992,678 | 991,339 |

| Non-current liabilities | – | – | – |

- Trade and other payables – due within one year

| Unaudited

as at 31 December 2023 |

Unaudited

as at 31 December 2022 |

Audited

as at 30 June 2023 |

|

| £ | £ | £ | |

| Trade payables | 867,941 | 177,849 | 196,354 |

| Accruals | 528,522 | 250,532 | 371,275 |

| 1,396,463 | 428,381 | 567,629 |

- Ordinary share capital and share premium

| Group | |||

| Issued | Number of shares | Ordinary share capital

£ |

Share

premium £ |

| As at 30 June 2022 (audited) | 63,755,174 | 63,755 | 3,890,089 |

| Issue of shares | 2,857,143 | 2,857 | 997,143 |

| Share issue costs | – | – | (98,800) |

| As at 31 December 2022 (unaudited) | 66,612,317 | 66,612 | 4,788,432 |

| Issue of shares | 5,900,000 | 5,900 | 584,100 |

| Share issue costs | – | – | (56,000) |

| As at 30 June 2023 (audited) | 72,512,317 | 72,512 | 5,316,532 |

| Issue of shares | 2,916,666 | 2,917 | 347,083 |

| Share issue costs | – | – | (25,000) |

| As at 31 December 2023 (unaudited) | 75,428,983 | 75,429 | 5,638,615 |

The ordinary shares confer the right to vote at general meetings of the Company, to a repayment of capital in the event of liquidation or winding up and certain other rights as set out in the Company’s articles of association.

On 15 July 2021 the Company issued 75,000 warrants over ordinary shares of the Company at 40 pence each, exercisable at any time over a three year period from the date of issue. The warrants were valued using the Black-Scholes pricing model. The inputs into the Black-Scholes model are as follows:

| Grant date | 15 July 2021 |

| Exercise price | 40.00 pence |

| Expected life | 3 years |

| Expected volatility | 77.32% |

| Risk free rate of interest | 0.0242% |

| Dividend yield | Nil |

| Fair value of option | 20.00 pence |

Volatility has been estimated based on the historic volatility of a collection of comparable companies over a period equal to the expected term from the grant date.

- Shares to be issued

The Shares to be issued represents the issue of 3,571,429 Ordinary shares (“the Shares”) at 14 pence each that completed post-reporting date, on 8 January 2024. The value of the Shares to be issued reserve reflects the gross proceeds of the share placement of £500,000, less £54,500 of share issue costs which have been accrued for at 31 December 2023. Upon completion the value of Shares to be issued will be re-allocated to Share capital and Share premium.

- Events after the reporting period

Since 31 December 2023, the Company has been focussed on the following activities:

- On 8 January 2024 the Company completed a share placement raising £500,000 before costs through the issue of 3,571,429 Ordinary shares at 14 pence per share. Each Ordinary share also has one warrant share entitlement to subscribe at a price of 25p per share for a period of 5 years. Total costs of the share issue were £54,500;

- On 1 February 2024 the Company announced that pursuant to the 33rd licensing round, the NSTA will offer the Company two licences in the Central North Sea (“CNS”) one in partnership with Parkmead Group, and the other in partnership with Triangle Energy. Orcadian anticipates that these licences will be formally issued within the next three months.